USDJPY: rising expectations of aggressive Fed interest rate cuts support the Japanese yen

The USDJPY rate fell below the annual low following the BoJ official’s speech. Find out more in our analysis for 11 September 2024.

USDJPY forecast: key trading points

- BoJ Policy Board member Junko Nakagawa announced further interest rate hikes if inflation remains at the projected level

- The expected US consumer price index report may show a fall in annual inflation from 2.9% to 2.6%

- CME FedWatch estimates the likelihood of a 25-basis-point Federal Reserve interest rate cut at 65% and a 50-basis-point rate cut at 35%

- USDJPY forecast for 11 September 2024: 139.70

Fundamental analysis

BoJ Policy Board member Junko Nakagawa stated that the regulator will continue to raise interest rates if inflation is in line with expectations. She noted that the weak employment market and continued rise in import prices create risks for a further rise in inflation. In addition, Nakagawa emphasised that real interest rates remain deeply negative despite the July hike. These comments exerted pressure on the USDJPY rate, with market participants noting that a price drop below 140.00 would not be unexpected.

While the BoJ remains on a tightening course, the Federal Reserve will likely lower interest rates as early as this month. Federal Reserve officials continue to warn of growing risks to the employment market. According to CME FedWatch, the likelihood of a 25-basis-point Federal Reserve interest rate cut is currently estimated at 65%, down from 71% yesterday. Conversely, the odds of a more significant 50-basis-point rate cut increased from 29% to 35%. Traders’ growing expectations of a more aggressive Federal Reserve interest rate reduction are helping to strengthen the Japanese yen as part of today’s USDJPY forecast.

Market participants focus on the upcoming US consumer price index report today. Annual inflation is expected to come in at 2.6% in August, down from 2.9% in July. Markets are looking for confirmation that inflation is under control, giving the Federal Reserve room for a 50-basis-point interest rate cut.

USDJPY technical analysis

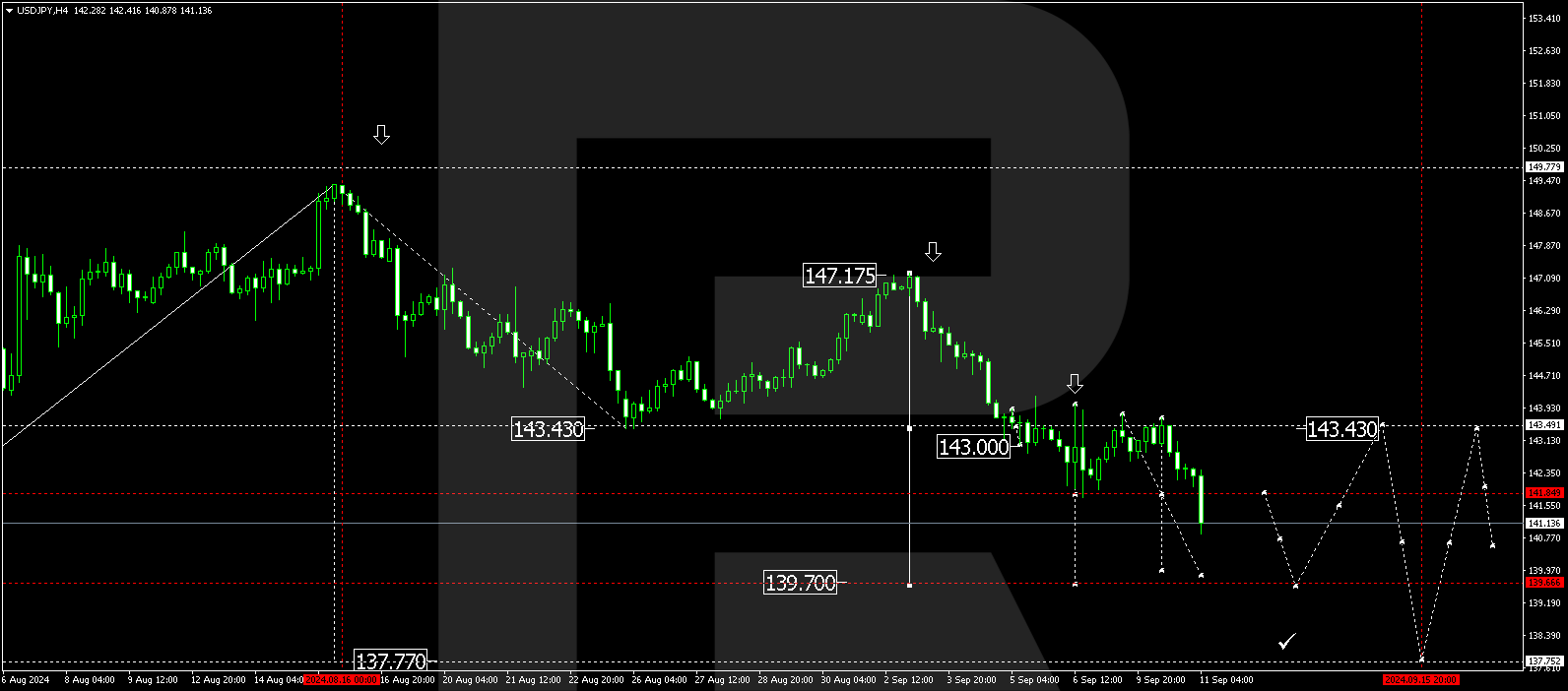

The USDJPY H4 chart shows that the market has broken below the 143.85 level, signalling a further movement towards 139.70. The price is expected to dip to 139.90 today, 11 September 2024, before potentially rising to 141.85 (testing from below). Once the price hits this level, another decline structure is expected to develop, aiming for 139.70 as the local target. The third downward wave structure will be formed. Subsequently, a new consolidation range is expected to develop above the 139.70 level. With an upward breakout, a correction could start, targeting 143.43. A downward breakout will open the potential for a downward wave to 137.77.

Summary

The USDJPY rate remains under pressure amid significant differences between Japanese and US monetary policies. Investors will be focused on US inflation data due today, which will help assess the Federal Reserve’s future actions. Technical indicators in today’s USDJPY forecast suggest a potential decline to 139.70.