USDJPY rose: a crucial week begins

The USDJPY pair is undergoing a correction, with the US dollar retreating ahead of the US presidential election. Find out more in our analysis for 4 November 2024.

USDJPY forecast: key trading points

- The USDJPY pair declines

- Safe-haven assets are in demand this week

- USDJPY forecast for 4 November 2024: 151.00 and 150.80

Fundamental analysis

The USDJPY rate fell to 151.75 on Monday.

The Japanese yen has gained an opportunity to strengthen while the US dollar retreats in anticipation of this week’s US presidential election. The next five business days will be tense, with the US presidential campaign nearing its conclusion and the upcoming US Federal Reserve meeting. The market will require strength and safe-haven assets.

The Federal Reserve is expected to lower the interest rate by 25 basis points.

Last week, the Bank of Japan left its interest rate unchanged at 0.25% per annum. The central bank is pausing a series of adjustments in monetary conditions as it assesses the risks of a political imbalance in Japan. This adds to the uncertainty regarding the country’s fiscal policy. The interest rate may change in January, but several key economic indicators will be released by then.

The USDJPY forecast appears concerning.

USDJPY technical analysis

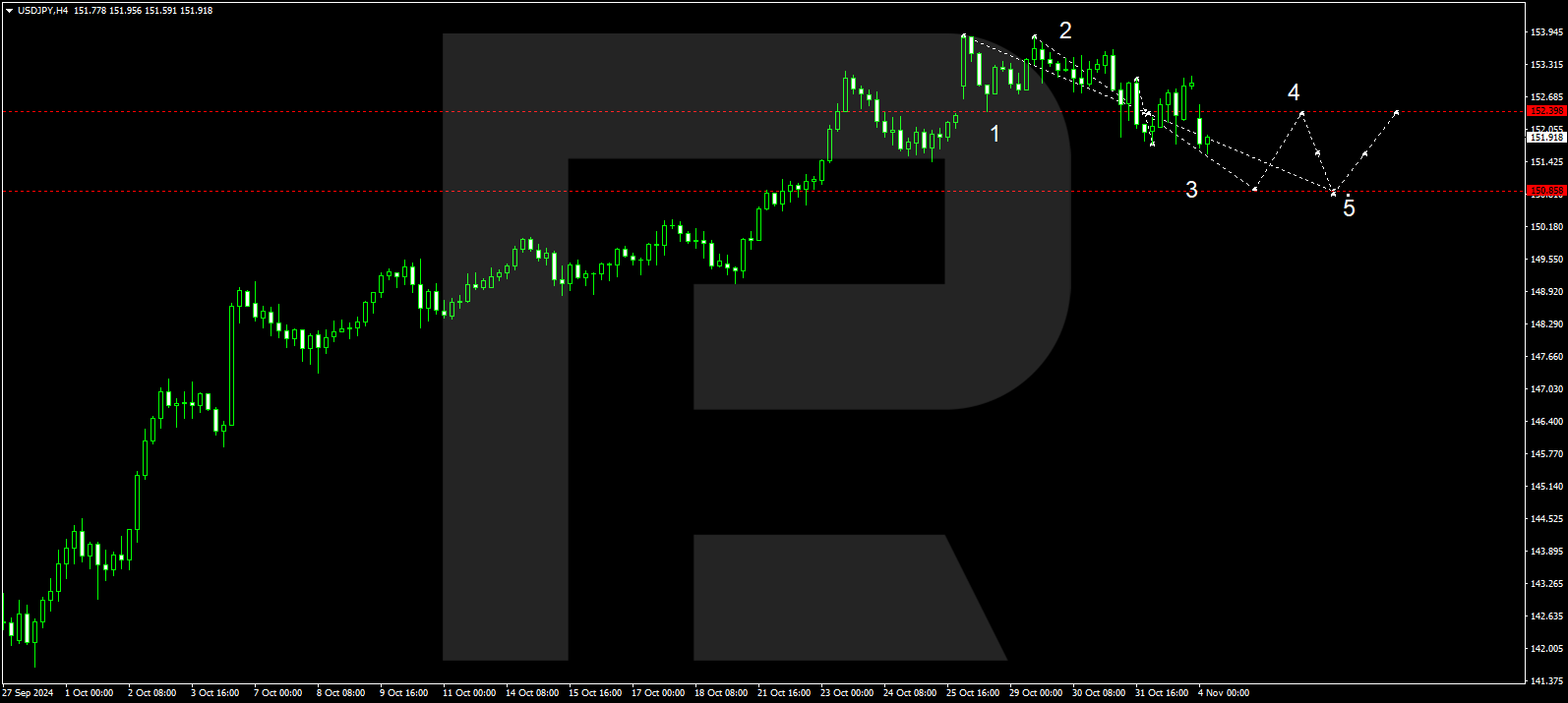

The USDJPY H4 chart shows that the market continues to develop a narrow consolidation range around 152.80 without a clear trend. The price may break below the range today, 4 November 2024, targeting 151.00 and potentially extending to 150.80. A further correction in the USDJPY rate is likely. After reaching this level, the price could rise to 151.80 (testing from below). Another corrective wave could then develop, targeting 149.10.

The Elliott Wave structure and corrective wave matrix, with a pivot point at 152.80, technically support this scenario. A consolidation range is forming around the central line of the price envelope. If there is a breakout below the range, the correction could continue towards the lower boundary of the price envelope.

Summary

The USDJPY pair declined as the weakening US dollar allowed the yen to recover. Technical indicators in today’s USDJPY forecast suggest that the corrective wave could continue towards the 151.00 and 150.80 levels.