USDJPY strengthens amid political instability in Japan

The USDJPY rate has been rising for the third consecutive trading session. Find out more in our analysis for 23 October 2024.

USDJPY forecast: key trading points

- The Japanese yen has declined to a three-month low due to the strengthening of the US dollar amid robust economic data

- The formation of a Japanese coalition government raises concerns about political instability

- The release of the Fed Beige Book may indicate slower growth in the US, but there is potential for a positive surprise

- USDJPY forecast for 23 October 2024: 152.60 and 153.33

Fundamental analysis

The USDJPY rate is surging after breaking above the 150.35 resistance level. The yen fell to a three-month low as robust US economic data bolstered the dollar.

In Japan, traders are awaiting the general election scheduled for this weekend. The risk of forming a coalition government adds to market concerns about political instability, which may further worsen the Bank of Japan’s monetary policy outlook.

Traders find it challenging to identify reasons to buy the yen in the lead-up to the election, which, as part of today’s USDJPY forecast, indicates the potential for further growth. Any attempt to depreciate the USDJPY rate will likely stem from the BoJ’s actions to raise interest rates rather than from a direct currency intervention.

The Federal Reserve’s publication of economic conditions, known as the Beige Book, will be an important event. The document is expected to reflect the ongoing trend of economic slowdown. However, there is a risk of a positive surprise, as the latest data exceeded forecasts. This may provide additional support for the US dollar.

USDJPY technical analysis

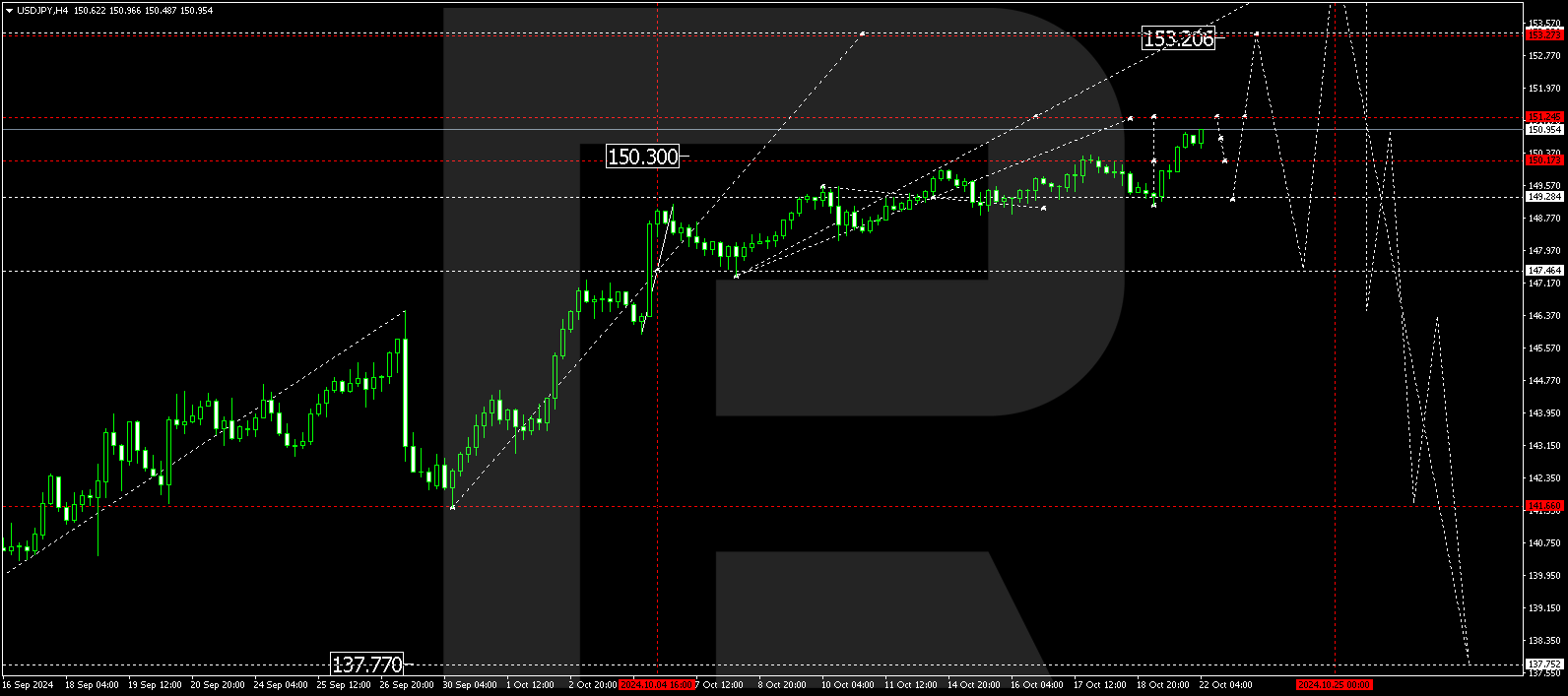

The USDJPY H4 chart shows that the market has formed a compact consolidation range around 150.85 and, breaking above it, maintains upward momentum towards 152.60. The price is expected to reach this target level today, 23 October 2024. Subsequently, a correction in the USDJPY rate could develop, targeting at least 150.85. Afterwards, another growth wave could follow, aiming for 153.33 as the local target. Once the price reaches this level, a more substantial correction towards 147.47 is possible.

Summary

The USDJPY rate continues to rise steadily due to the strong US dollar and political instability in Japan, where the upcoming election only adds to risks for the yen. At the same time, the publication of economic conditions known as the Fed Beige Book may create additional volatility in the market, especially if data exceeds expectations, supporting the US currency. Technical indicators in today’s USDJPY forecast suggest that the growth wave could continue towards 152.60 and potentially further towards 153.33.