USDJPY surprises again: FOMC minutes may set a new trend

The USDJPY pair continues to surprise by reaching new price highs. At this stage, the pair is forming a correction and trading near 152.30. Find more details in our analysis for 8 October 2025.

USDJPY forecast: key trading points

- Publication of FOMC minutes

- The yen tested the 152.60 level

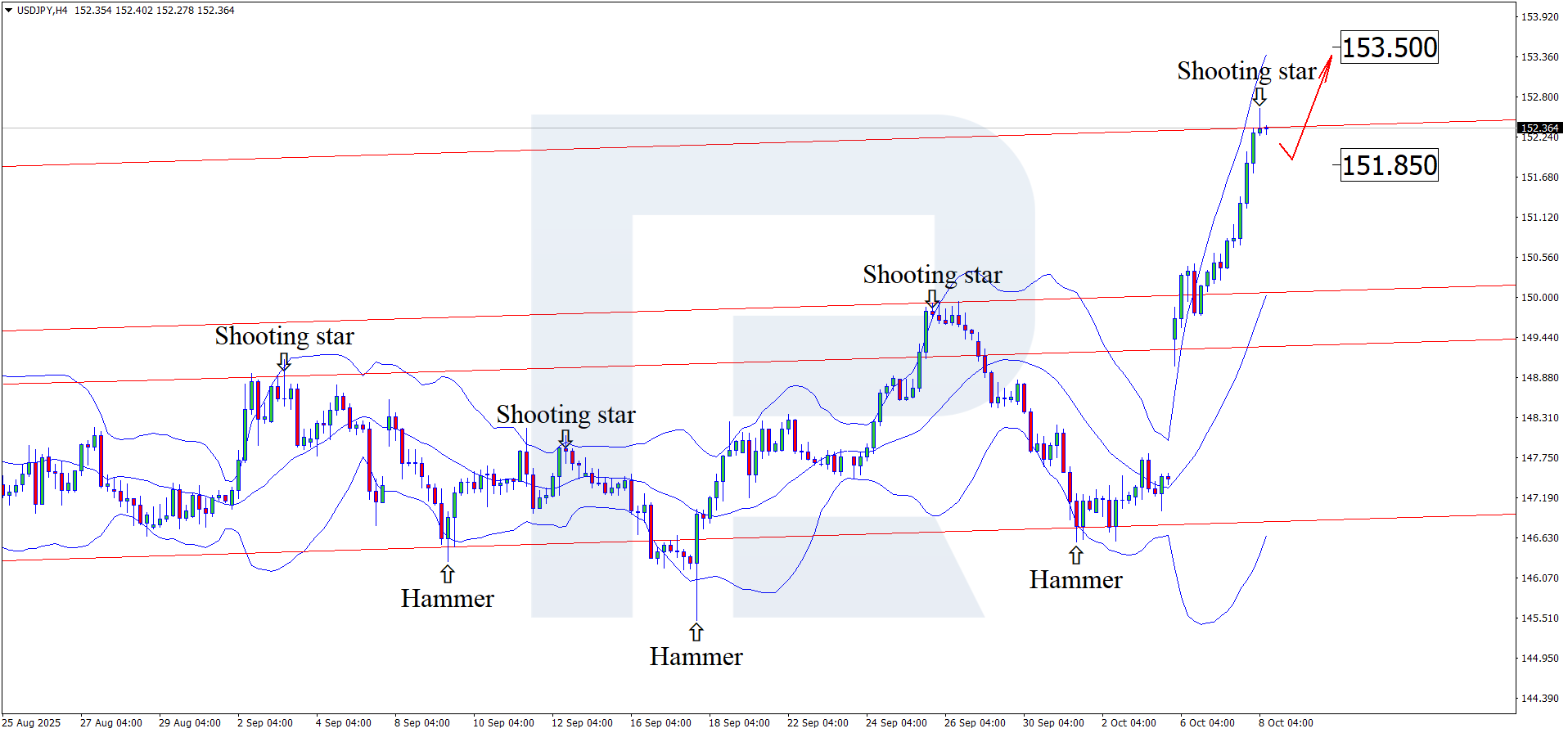

- USDJPY forecast for 8 October 2025: 153.50 and 151.85

Fundamental analysis

The forecast for 8 October 2025 takes into account that, ahead of the FOMC minutes release, the USDJPY pair has set another price record and is trading near 152.30.

Today, market attention is focused on the publication of the FOMC minutes, which may provide key clues regarding the future direction of US monetary policy. The minutes are expected to clarify the motives and goals behind the recent rate cut to 4.25%, as well as offer hints on whether the Fed plans to continue the easing cycle before the end of the year.

Particular attention will be given to the tone of the discussion:

- Notes in the minutes expressing rising concern about inflation could support the dollar and lead markets to reassess expectations for further easing

- If the minutes reveal that most members favour additional rate cuts, this could increase pressure on the USD and push the USDJPY rate lower

- Equally important will be the Fed’s assessment of the labour market and consumer demand, as these topics determine how confident policymakers feel amid slowing economic growth

The USDJPY forecast for today considers that further price movement will depend less on the facts themselves and more on the underlying tone – how determined the Fed appears to continue its easing cycle. The more cautious the tone, the higher the chances for short-term dollar strength and a move to new highs in the pair.

USDJPY technical analysis

On the H4 chart, the USDJPY price tested the upper Bollinger Band and formed a Shooting Star reversal pattern, currently trading around 152.30. At this stage, a correctional wave may develop as the pattern plays out, with a target near 151.85.

At the same time, the USDJPY forecast also considers an alternative scenario, where the pair is testing the upper boundary of the ascending channel, suggesting the possibility of a breakout above the resistance level and a rally towards 153.50 without a correction to support.

Summary

Amid economic and political developments in the US and Japan, the USDJPY rate continues to climb. The USDJPY technical analysis suggests that the uptrend may continue once the current correction is complete.