The USDJPY rate dropped to 147.00 amid lower-than-expected inflation in the US. Read the full details in our analysis for 14 May 2025.

USDJPY forecast: key trading points

- Market focus: US inflation eases – April Consumer Price Index (CPI) at 2.3% vs forecast of 2.4%

- Current trend: downward correction underway

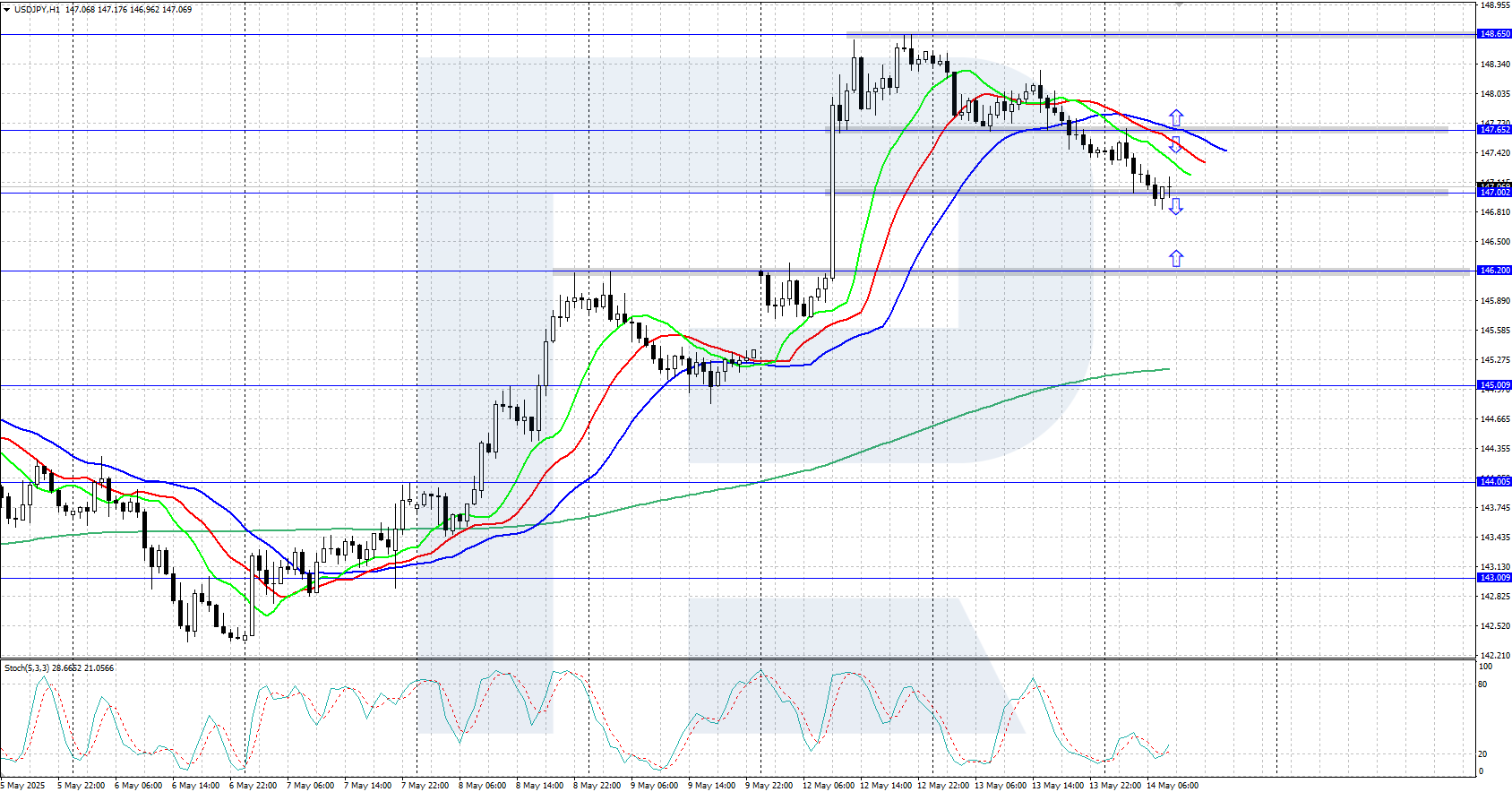

- USDJPY forecast for 14 May 2025: 146.20 and 147.65

Fundamental analysis

The Japanese yen strengthened to 147 yen per dollar on Wednesday, as the dollar weakened following softer-than-anticipated US inflation data. Investors are also evaluating current global trade developments after the US and China agreed to reduce tariffs for a 90-day period. However, uncertainty remains about the direction of trade policy once the agreement expires.

Japanese Prime Minister Shigeru Ishiba stated that Japan will not accept the initial trade deal with the US that excludes provisions on automobiles, urging Washington to lift its 25% tariff on Japanese cars.

According to statistics published today, Japan’s producer prices rose by 4.0% year-on-year in April, following a 4.2% increase in March. The Bank of Japan maintains a cautious policy stance for now and is in no rush to raise its key interest rate.

USDJPY technical analysis

The USDJPY pair shows signs of a potential reversal downwards on the H4 chart after forming a local daily high at 148.65. The Alligator indicator still points upwards, so it's too early to call a full trend reversal. The key support level lies at 146.20.

Today’s USDJPY forecast suggests the pair may continue falling towards the 146.20 support level if bears manage to maintain control. A break above 147.65 would indicate the end of the downward correction and the potential resumption of upward movement.

Summary

USDJPY dropped to the 147.00 level amid cooling US consumer inflation. On Thursday, market participants await the US April Producer Price Index (PPI) data.