During a downward correction, the USDJPY pair received support from buyers at 155.00 and formed an upward reversal. Discover more in our analysis for 20 January 2025.

USDJPY forecast: key trading points

- Japan’s industrial production fell by 2.2% month-on-month in November 2024 and by 2.7% year-on-year

- Today, Donald Trump will officially take office as the US President

- USDJPY forecast for 20 January 2025: 157.00 and 154.50

Fundamental analysis

Japan’s industrial production data for November 2024, released today, recorded a decline of 2.2% month-on-month and 2.7% year-on-year. In contrast, machinery orders statistics showed a 3.4% month-on-month and 10.3% year-on-year increase.

This week’s main event for the USDJPY rate is the Bank of Japan’s monetary policy meeting on Friday. BoJ Governor Kazuo Ueda and Deputy Governor Ryozo Himino have previously stated that an interest rate hike may be on the table at this meeting.

Donald Trump’s inauguration, which happening today, could lead to increased volatility in financial markets. Currency pairs, including the USDJPY pair, might experience significant movements depending on the content of the new US President’s speech.

USDJPY technical analysis

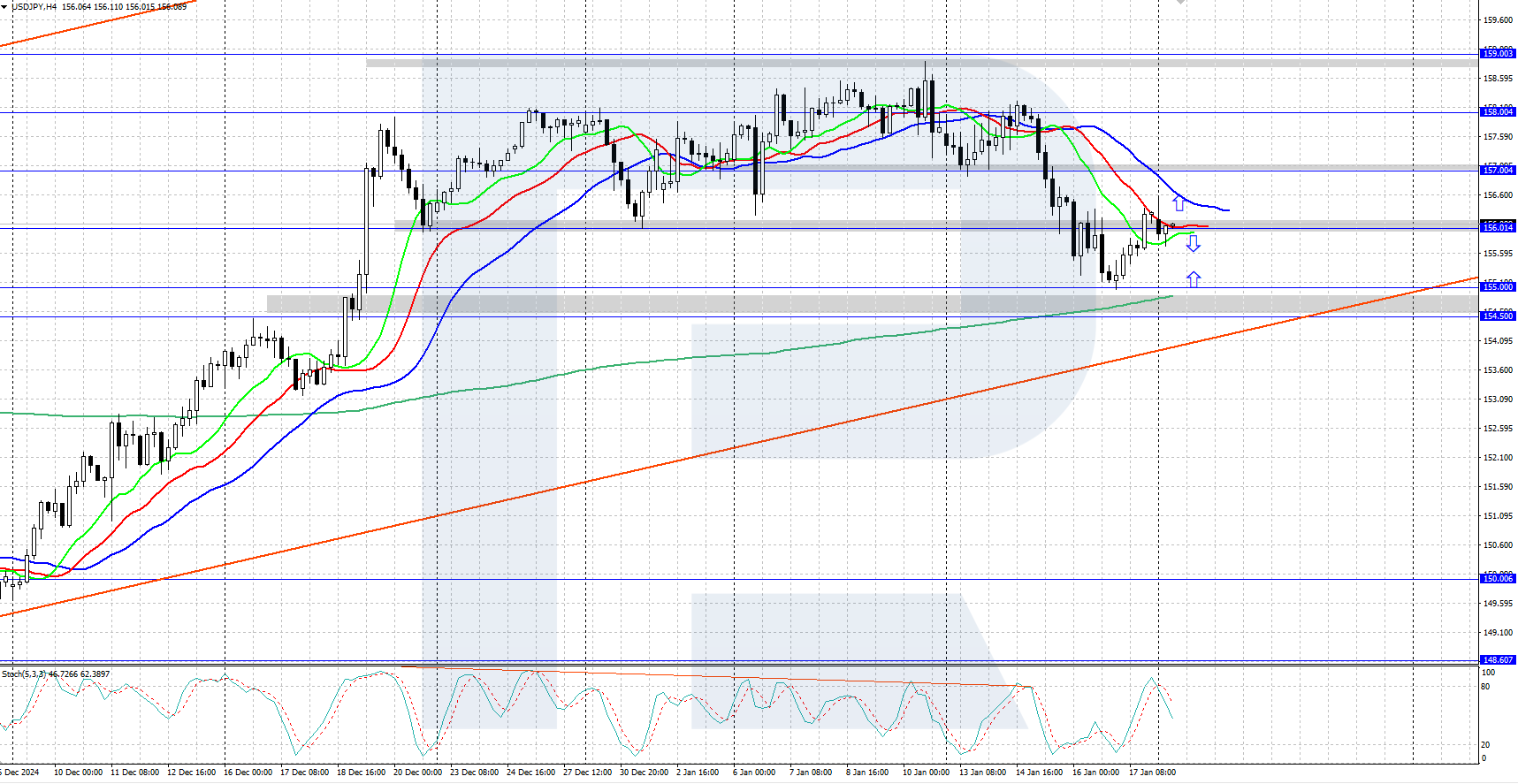

On the H4 chart, the USDJPY pair is undergoing a downward correction after previous growth. The daily trend in the pair remains upward, as confirmed by the Alligator indicator, and growth could resume after the correction. The key support level is currently between 154.50 and 155.00.

Today’s USDJPY forecast suggests potential growth to the 158.88 resistance level and beyond if the bulls hold prices above 156.00. If the bears gain a foothold below 156.00, the price could decline to the 154.50-155.00 support area.

Summary

The USDJPY pair found support at the 154.50-155.00 area and is attempting to continue its ascent. Today, the pair’s volatility could surge sharply during Donald Trump’s inauguration.