USDJPY: the pair is correcting before falling

A rise in Japan’s business survey index of large manufacturing firms above zero and a hawkish speech by the BoJ Policy Board member may cause the USD to lose ground against the JPY. Find out more in our analysis for 12 September 2024.

USDJPY forecast: key trading points

- Japan’s business survey index of large manufacturing firms: previously at -1.0%, currently at 4.5%

- Japan’s corporate goods price index (CGPI) (y/y): previously at 3.0%, currently at 2.5%

- A speech by Bank of Japan Policy Board member Tamura Naoki

- USDJPY forecast for 12 September 2024: 142.00 and 139.70

Fundamental analysis

The business survey index of large manufacturing firms (BSI) reflects the sentiment in the industry. Data is based on surveys of large companies, assessing business conditions. The indicator is considered a significant gauge of the state of the Japanese economy, where the manufacturing sector plays a leading role. A positive index reading indicates improving business conditions while a value below zero shows a deterioration.

The BSI was in negative territory in the previous quarter; the actual data for the current period shows an increase in the reading to 4.5%. Fundamental analysis for 12 September 2024 shows an improvement in business sentiment among large Japanese manufacturers.

Japan’s corporate goods price index (CGPI) shows the difference in prices for products purchased by national corporations. The previous reading was 3.0%; analytical forecasts for 12 September 2024 suggested a decrease to 2.8%. The actual reading came in at 2.5%, which did not sit well with investors. In this context, the USDJPY pair is forming a correction.

A speech by a Bank of Japan Policy Board member brought more turmoil to the market. Tamura Naoki is more inclined to tighten the yen monetary policy than other BoJ Board members.

USDJPY technical analysis

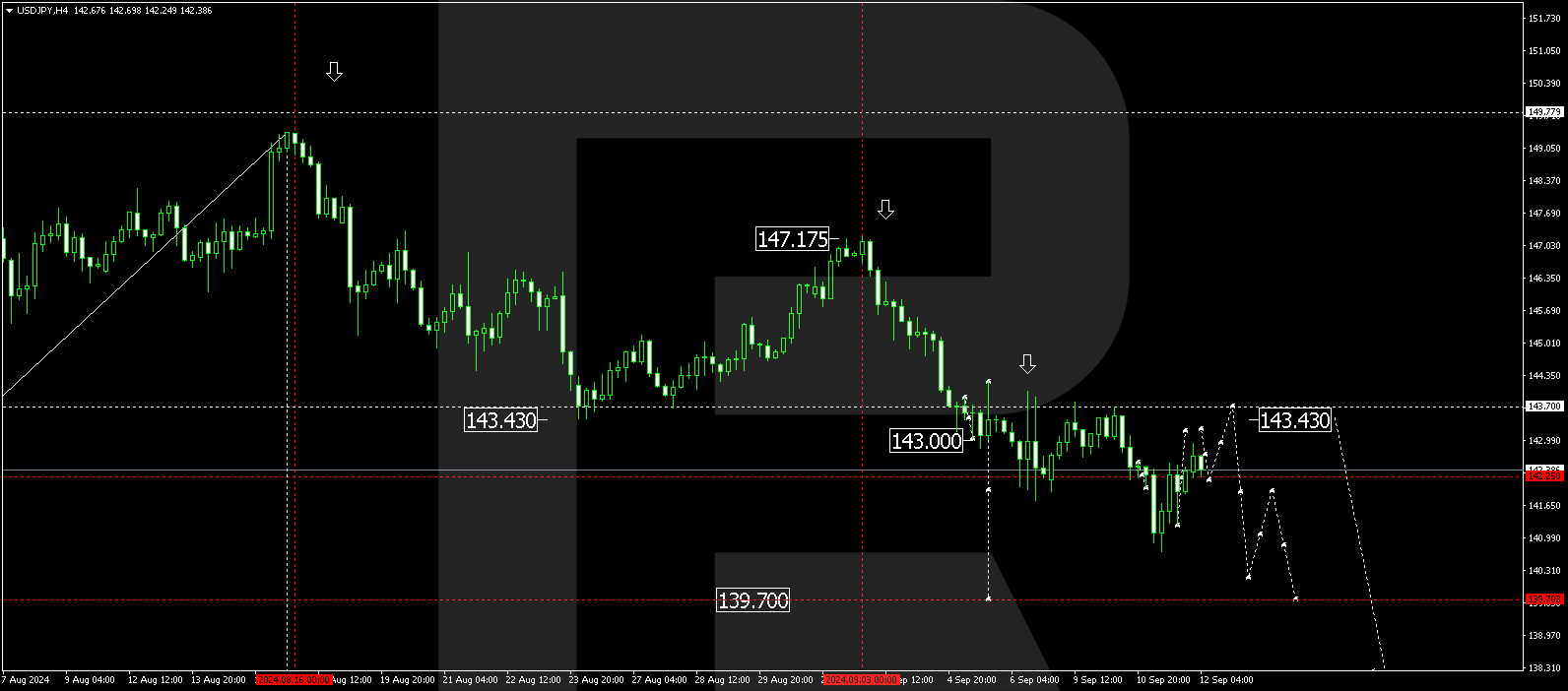

The USDJPY H4 chart shows that the market has completed a downward wave, reaching 140.70. An upward impulse towards 142.25 is complete today, 12 September 2024. A consolidation range is currently forming around this level. The price could break above the range, aiming for 143.70 (testing from below). Subsequently, the USDJPY rate could decline to 142.00. A breakout below this level could signal a further downward movement to the local target of 139.70, forming the third downward wave structure.

Summary

The future interest rate change by the Bank of Japan and the USDJPY technical analysis in today’s USDJPY forecast suggest a potential decline to the 142.00 and 139.70 levels.