The USDJPY rate fell to the 154.50 support level after the Federal Reserve decided to keep the interest rate steady at 4.5%. Find out more in our analysis for 30 January 2025.

USDJPY forecast: key trading points

- The US Federal Reserve left the interest rate unchanged at 4.5%

- Current trend: a downward correction is developing

- USDJPY forecast for 30 January 2025: 153.70 and 156.00

Fundamental analysis

At the meeting that ended yesterday, the US Federal Reserve decided to keep the benchmark interest rate unchanged at 4.5%. The regulator halted its rate-cutting cycle after three consecutive cuts in 2024, which totalled 1.0%.

This decision was expected by market participants, so there was no strong reaction in the currency market. In an accompanying statement, Federal Reserve Chairman Jerome Powell noted that the Fed would not rush to lower interest rates until it sees further progress in fighting inflation.

USDJPY technical analysis

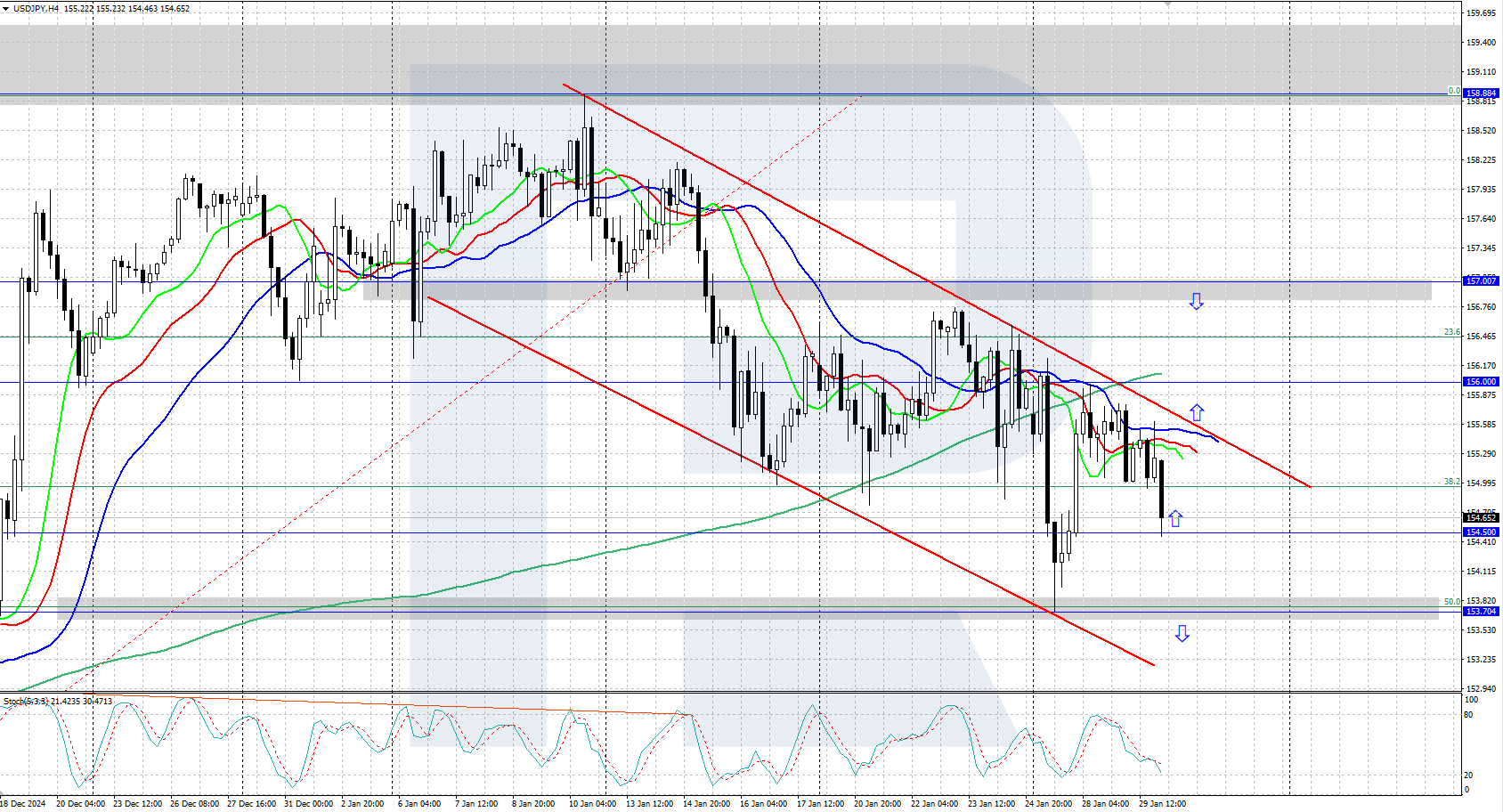

On the H4 chart, the USDJPY pair is undergoing a downward correction after the previous growth. Since the daily trend remains upward and the price is hovering above the 200-day Moving Average, growth may continue once the correction is complete. The key support area is between 154.50 and 153.70.

Today’s USDJPY forecast suggests that the pair has the potential for growth to the 158.88 resistance level and higher if the bulls manage to hold the quotes above 153.70. Conversely, if the bears find a foothold below 153.70, the price could decline to 152.50.

Summary

The USDJPY pair tumbled to the 154.50 support level after the Federal Reserve decided to leave the interest rate unchanged at 4.5%. The pair is now undergoing a downward correction before potentially continuing its upward trajectory.