USDJPY: the rate may continue its upward momentum after a correction

If US unemployment figures improve, the US dollar will strengthen its position, and the USDJPY rate could move towards the 152.50 level. Discover more in our analysis for 5 December 2024.

USDJPY forecast: key trading points

- A speech by Bank of Japan Policy Board member Toyoaki Nakamura

- Continuing US jobless claims: previously at 1,907 thousand, projected at 1,910 thousand

- Initial US jobless claims: previously at 213k, projected at 215k

- USDJPY forecast for 5 December 2024: 152.50

Fundamental analysis

Today, 5 December 2024, Toyoaki Nakamura, a member of the Bank of Japan’s Policy Board, made an important statement about the current economic situation and the central bank’s policy. The key topic was the inflation outlook, which, he said, is unlikely to reach the 2.0% target by 2025. He also emphasised that a crucial condition for a change in the current monetary policy is steady inflation growth, which has yet to be seen.

Nakamura noted that despite efforts to stimulate the economy, wage growth rates and other factors are insufficient to reach the desired level of price stability. The Bank of Japan is poised to maintain its loose monetary policy until there are more precise signals of accelerating inflation and improving economic performance.

According to the forecast for 5 December 2024, the total number of people receiving US employment benefits could increase to 1,910 thousand. While growth is insignificant at this stage, US unemployment has steadily risen over the past two months.

US initial jobless claims represent the number of people who claimed unemployment benefits for the first time during the previous week. This indicator measures the employment market climate, with an increase in initial jobless claims indicating rising unemployment.

The previous reading was 213k; the fundamental analysis for 5 December 2024 does not appear overly optimistic, suggesting an increase in the claims to 215k. Expectations may differ significantly from the actual data, and the final reading may impact the USDJPY rate markedly.

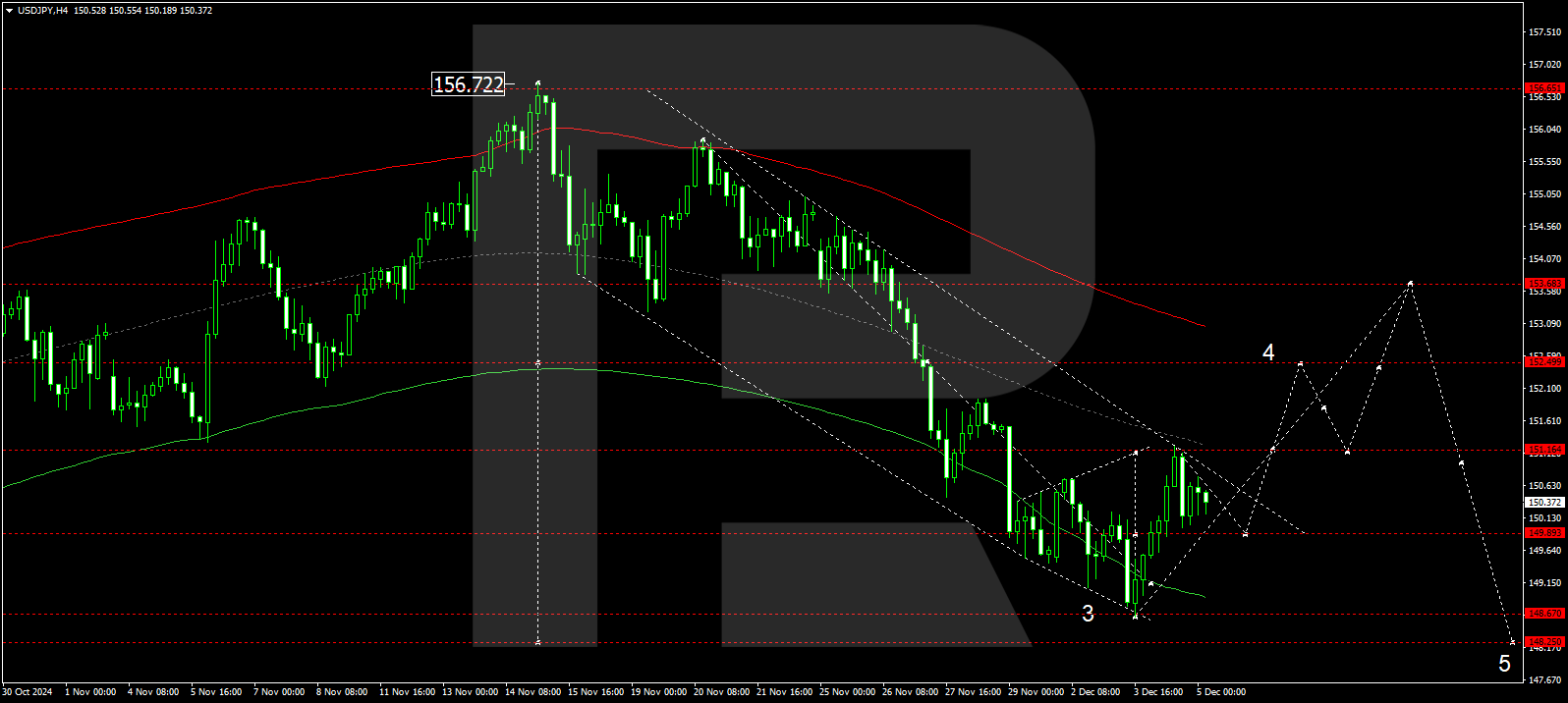

USDJPY technical analysis

The USDJPY H4 chart indicates that the market has completed a growth wave, reaching 151.20. Today, 5 December 2024, the market may return to 149.90, forming a broad consolidation range around this level. An upward breakout would open the potential for a growth wave targeting 152.50, potentially extending further to 153.70. A breakout below the range would drive a downward movement towards 148.25.

The Elliott Wave structure and growth wave matrix, with a pivot at 151.20, technically support this scenario for the USDJPY rate. The market has reached the estimated target for the first impulse of growth to the central line of a price envelope – 151.20. The price may decline to 149.90 today before rising to the envelope’s upper boundary at 152.50 and potentially further to 153.70.

Summary

Combined with technical analysis for today’s USDJPY forecast, the probability of stabilisation of the US unemployment figures suggests a potential rise to the 152.50 level.