USDJPY: the US dollar may continue to strengthen against the yen

The IMF meeting and Neel Kashkari’s speech may further bolster the US dollar. Discover more in our analysis for 21 October 2024.

USDJPY forecast: key trading points

- A speech by FOMC member Neel Kashkari

- The International Monetary Fund meeting

- The US Leading Economic Index, m/m: previously at -0.2%, projected at -0.3%

- USDJPY forecast for 21 October 2024: 153.20

Fundamental analysis

The analysis for 21 October 2024 suggests that Federal Reserve Bank of Minneapolis President Neel Kashkari’s speech will include comments on the current economic situation in the US, the inflation rate, and the outlook for interest rates. In his previous statements, Kashkari underscored that inflation demonstrates an upward trend. Still, the Federal Reserve is in no hurry to implement measures to tighten monetary policy until it is confident that inflation will steadily decline to the 2% target.

Kashkari may also discuss the impact of elevated interest rates on the economy and the labour market. One key issue could be the uncertainty about a neutral interest rate, which, he believes, could have temporarily increased due to the post-pandemic economic recovery. His comments are likely to be cautious, as markets may respond strongly to even a hint of rate cuts.

Every autumn, the Boards of Governors of the World Bank and the International Monetary Fund meet to discuss a wide range of issues. These meetings benefit international cooperation and enable various organisations to exchange views effectively.

The agenda of Annual Meetings of the Boards of Governors of the World Bank Group and the International Monetary Fund includes the following issues:

- Poverty reduction: strategies and measures to reduce poverty in various countries

- International economic development: issues related to global economic growth and sustainable development

- Financial operations: coordinating financial policies, regulation, and governance

- International cooperation: strengthening cooperation among countries to address global challenges

- Relevant economic challenges: discussing and assessing the current economic conditions

The US Leading Economic Index includes several indicators reflecting the current state of the economy. Its calculation formula considers ten factors ranging from consumer expectations to the construction sector statistics. Since the data on these indicators is already available when the index is published, its release typically does not cause significant changes in the market.

The previous reading was negative, at -0.2%. The forecast for 21 October 2024 suggests that the index could have declined to -0.3%. Given the fundamental data, the report’s release will unlikely significantly influence the USDJPY rate.

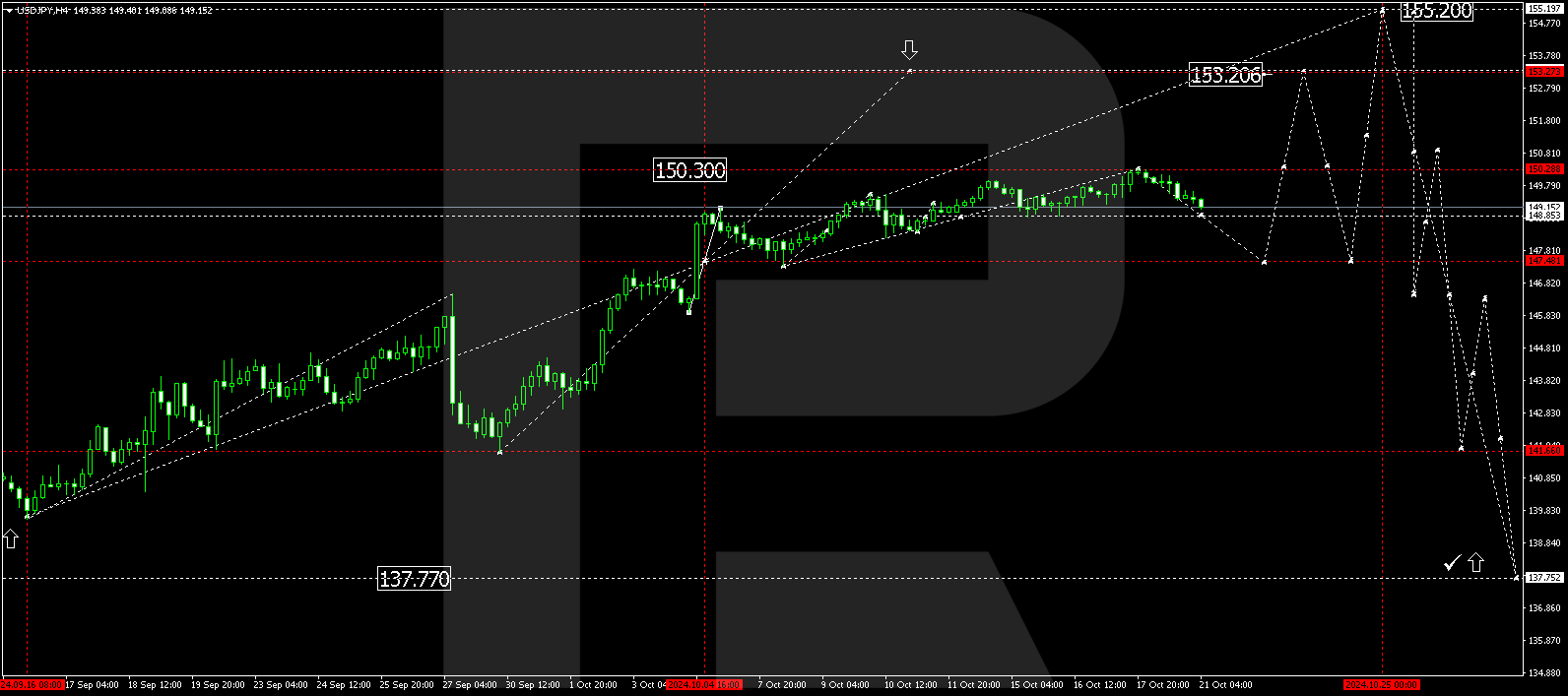

USDJPY technical analysis

The USDJPY H4 chart shows that the market continues to develop a broad consolidation range around 148.85. The price is expected to test the 148.85 level from above today, 21 October 2024. This decline is considered a correction. With a breakout below this level, the correction could continue towards 147.50 (testing from above). Subsequently, a growth wave in the USDJPY rate could develop, aiming for 150.30 and potentially continuing the trend towards 153.20, the local target.

Summary

Coupled with the USDJPY technical analysis for today’s USDJPY forecast, fundamental indicators and the speech by FOMC official Kashkari suggest that the correction could be complete at 148.85, followed by another growth wave, aiming for 153.20.