USDJPY: the yen has the potential to strengthen after a correction

Japan’s PMI improved significantly, while US retail sales may decline. Find out more in our analysis for 17 September 2024.

USDJPY forecast: key trading points

- Japan’s services PMI (m/m): previously at -1.2%, currently at 1.4%

- US core retail sales index (m/m): previously at 0.4%, projected at 0.2%

- US retail sales (m/m): previously at 1.0%, projected at -0.2%

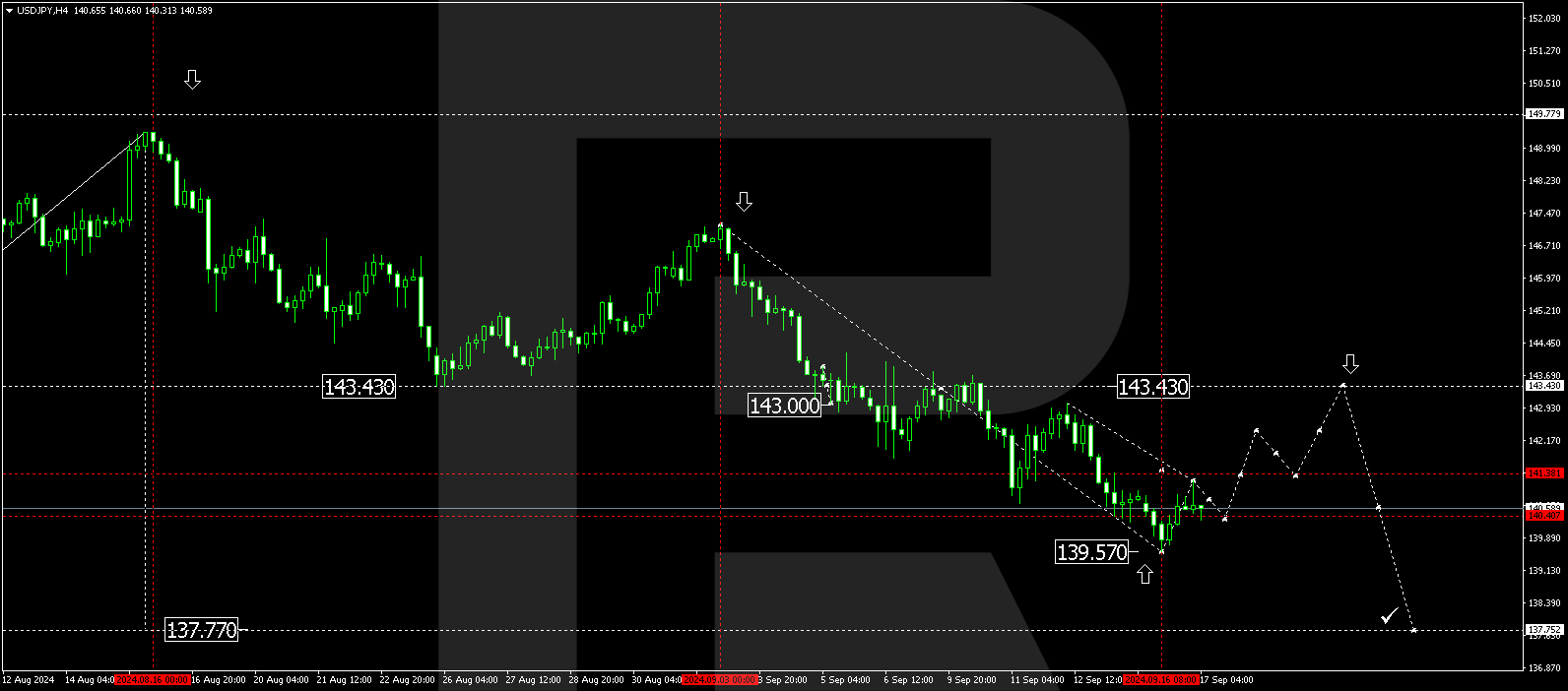

- USDJPY forecast for 17 September 2024: 141.38 and 143.43

Fundamental analysis

Japan’s services PMI shows consumer spending on all types of services other than industrial production. The index is a gauge of domestic consumer activity and financial well-being. The previous reading was -1.2%, while in the current period, the indicator shifted to positive territory, reaching 1.4%. Analysis for 17 September 2024 shows that the PMI fluctuates from negative to positive territory almost every month. This cannot have a strong impact on the USDJPY rate as the Japanese economy is export-oriented.

The US core retail sales index shows the change in retail sales over the previous month (excluding autos). The previous reading was 0.4%; according to the forecast for 17 September 2024, the index is projected to decline to 0.2%. A decrease in the indicator shows lower consumer spending and the US economic slowdown.

US retail sales show the difference in sales of all goods by retailers. The projected reading of -0.2% may indicate slowing economic growth. A slump in sales will add more negativity to the US dollar.

USDJPY technical analysis

The USDJPY H4 chart shows that the market has completed a downward wave, reaching 139.57. The price rose to 141.23 and corrected towards 140.31 today, 17 October 2024, with the market outlining the boundaries of a consolidation range. With a breakout above the range, a correction could begin, aiming for 141.38. Breaking above this level may be considered a signal for a further corrective movement towards 143.43 (testing from below). With a breakout below the range, the downward wave could continue towards 137.77.

Summary

The increase in Japan’s PMI supports the yen, with the USDJPY technical analysis in today’s USDJPY forecast suggesting a potential correction towards the 141.38 and 143.43 levels.