USDJPY: the yen is strong again, regaining ground

A decline in the manufacturing index and an increase in US initial jobless claims could push the USDJPY rate further down to the 149.50 support level. Discover more in our analysis for 20 February 2025.

USDJPY forecast: key trading points

- US initial jobless claims: previously at 213 thousand, projected at 215 thousand

- Philadelphia Fed Manufacturing Index: previously at 44.3, projected at 19.4

- USDJPY forecast for 20 February 2025: 151.50 and 149.50

Fundamental analysis

US initial jobless claims represent the number of people who claimed unemployment benefits for the first time during the previous week. This indicator measures the labour market climate, with an increase in initial jobless claims indicating rising unemployment.

The previous reading was 213 thousand; the forecast for 20 February 2025 does not appear very optimistic as initial jobless claims are expected to increase to 215 thousand. While the expected growth is insignificant, it may differ considerably from the actual data, with this discrepancy able to have a strong impact on the USDJPY rate.

The Philadelphia Fed Manufacturing Index is an economic indicator showing the state of industry in the region. It is based on a survey of manufacturers about new orders, employment, inventories, and prices. A reading above zero signals growth in the sector, while a reading below zero indicates a downturn. The index affects market expectations for the Federal Reserve interest rates and gives early signals about the state of the US economy.

The Philadelphia Fed Manufacturing Index is calculated based on a monthly survey of the region’s manufacturers: Eastern Pennsylvania, Southern New Jersey, and Delaware. Respondents specify whether their performance improved, worsened, or remained unchanged from the previous month. Subsequently, a net percentage balance is calculated by subtracting the proportion of negative responses from the proportion of positive responses.

Fundamental analysis for 20 February 2025 takes into account that the manufacturing index could fall to 19.4 from the previous 44.3. Although it may remain above zero, this will be a significant decline compared to the previous period.

USDJPY technical analysis

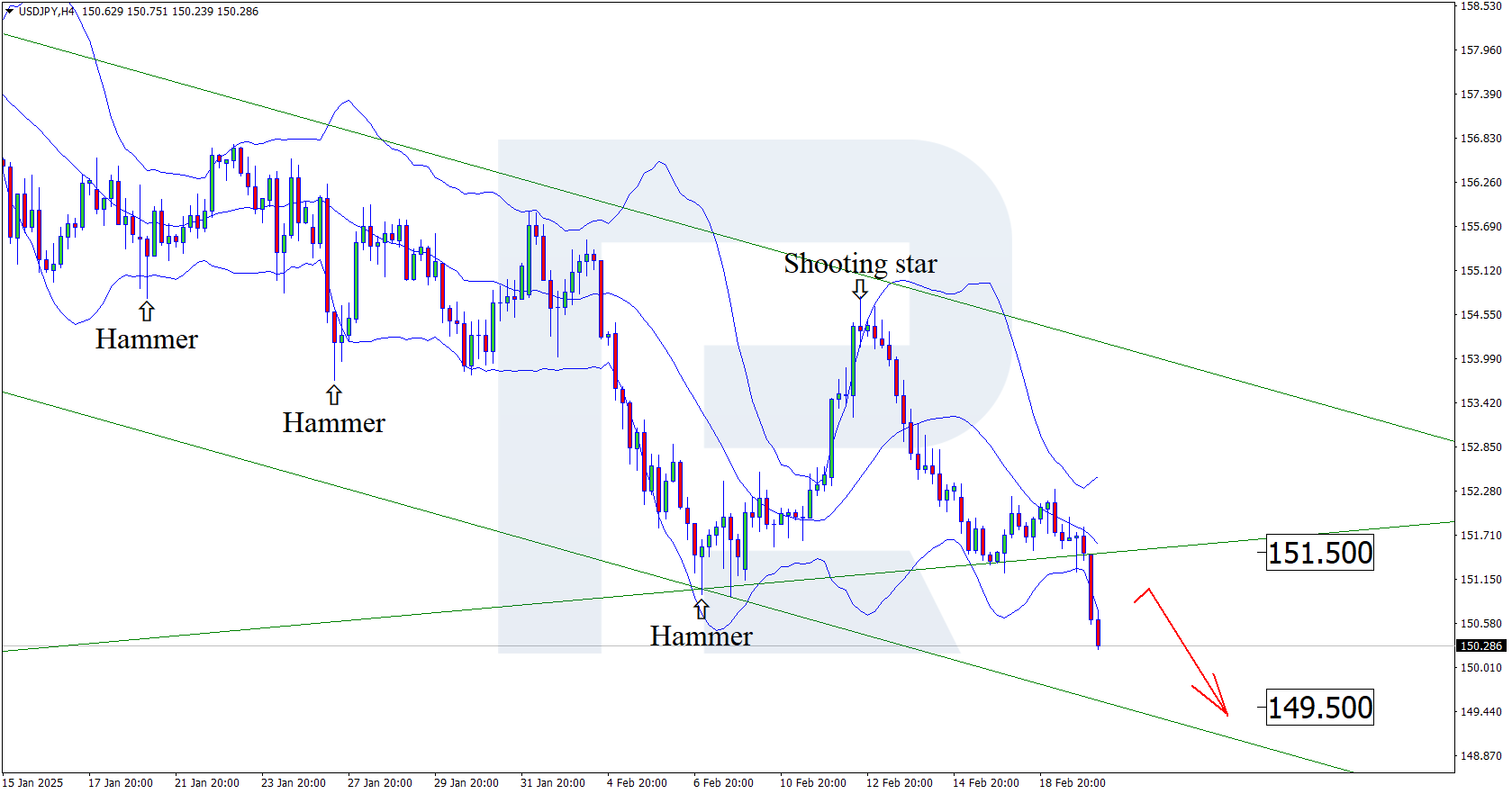

Having tested the upper Bollinger band, the USDJPY price has formed a Shooting Star reversal pattern on the H4 chart. At this stage, it continues its downward momentum following the pattern signal. Since the quotes have rebounded from the resistance level and continue to move within a descending channel, they could drop further to the support level.

The downside target is 149.50. A breakout below this level could pave the way for a more substantial downward movement.

However, today’s USDJPY forecast also takes into account an alternative scenario, where the price corrects towards 151.50

before a decline.

Summary

Coupled with the USDJPY technical analysis, the decrease in US economic indicators suggests a further decline to the 149.50 USD support level.