What to expect from AMD stock in 2025 and potential development scenarios

On 29 October, Advanced Micro Devices, Inc. (NASDAQ: AMD) released its Q3 2024 report, posting higher-than-forecast revenue and income. However, following the announcement of the results, the company’s share price declined as investors grew concerned about the Q4 forecast, which suggested revenue growth may slow more than expected. This could signal a deceleration in the growth rate of the artificial intelligence (AI) market.

This article discusses AMD, covering its revenue sources and product offerings within the AI market. It provides a fundamental analysis of AMD and a technical analysis of Advanced Micro Devices stock, which form the basis for AMD’s stock forecast.

About Advanced Micro Devices, Inc.

Advanced Micro Devices, Inc. (AMD) is a US-based company founded in 1969 by Jerry Sanders and a group of fellow engineers. It designs and manufactures semiconductor devices, including processors, graphics chips, and server solutions. The company went public with an IPO on the NYSE in 1972 under the ticker AMD.

The following AMD products are represented in the emerging AI market:

- Graphics processing units (GPU) for data centres: AMD produces Radeon Instinct microprocessors and has recently introduced new developments in the MI series, designed for high-performance computing and AI workloads. For example, the MI300 is a powerful processor for deep data analysis and large AI models.

- Radeon Open Compute (ROCm) software: AMD has developed an open software platform, ROCm, that provides tools for AI development and high-performance computing on the company’s GPUs

- Field programmable gate arrays (FPGAs): following the acquisition of Xilinx, AMD also became a supplier of FPGAs, which are widely used for AI tasks, including signal processing and adaptive computing

- Central processing units (CPUs): AMD also optimises its EPYC series processors to support AI computing in server solutions

- Products for end devices: in addition to server solutions, AMD also develops specialised GPUs and FPGAs for AI-driven end devices, such as autonomous vehicles, smart cameras, and medical equipment

AMD’s revenue is generated from four main segments:

- Data Centre: this includes EPYC server processors, AMD Instinct graphics accelerators for AI and scientific computing and Xilinx FPGA solutions for specialised tasks in data centres.

- Client segment: this segment includes Ryzen and Athlon processors for desktop PCs and laptops, which provide high performance for general users and enthusiasts, and integrated graphics solutions for hybrid devices.

- Gaming segment: this includes Radeon GPUs for gaming PCs, integrated solutions for gaming laptops, and specialised processors for gaming consoles, such as PlayStation and Xbox.

- Embedded segment: this comprises high-performance processors and graphics solutions for embedded systems in automotive electronics, industrial automation, medical devices, and telecommunications.

Advantages of Advanced Micro Devices, Inc. in the semiconductor market

AMD has several strengths that enable it to compete effectively with companies such as Intel Corp. (NASDAQ: INTC) and NVIDIA Corp. (NASDAQ: NVDA). The main advantages are outlined below:

- Processor architecture: AMD introduced the Zen architecture, which significantly enhanced performance and energy efficiency. The Ryzen (consumer) and EPYC (server) series have gained popularity thanks to their excellent performance-to-price ratio. In recent years, AMD has outpaced Intel in terms of core and thread counts in processors

- Multi-core and multi-threaded solutions: AMD typically offers more cores and threads at the same price point, making its processors appealing to users requiring multitasking and high-performance computing (e.g., graphics work, video editing, data streaming, etc.)

- Innovations in graphics technology: In the GPU segment, while AMD lags behind NVIDIA in certain high-performance GPU features, it remains well-positioned due to its processors with high data processing speeds, offering a competitive price-to-performance ratio. With the RDNA and RDNA 2 series, AMD has significantly improved the energy efficiency and performance of its graphics cards

- EPYC server solutions: AMD’s EPYC offers an impressive performance-to-price ratio in the server segment, capturing the attention of large corporations and data centres. These processors support more cores per socket, reducing scaling costs for server infrastructure

- CPU and GPU integration: AMD manufactures both processors and graphics chips, enabling the development of integrated solutions for laptops and gaming consoles. For example, AMD supplies processors for PlayStation and Xbox consoles, which provides a stable revenue stream and reinforces its position in the market

- Competitive pricing: AMD frequently offers more affordable prices than Intel and NVIDIA, making its products more attractive to a diverse range of users, from enthusiasts to corporate clients

- Rapid adaptation of new technological processes: AMD actively cooperates with TSMC, enabling it to swiftly adopt new process technology advancements (such as 7 and 5 nm), which enhances the energy efficiency and performance of its processors and graphics chips

Advanced Micro Devices, Inc.’s Q3 2024 report

On 29 October, AMD released its Q3 2024 report, showing continued revenue and net income growth. Below are the report’s key figures:

- Revenue: 6.82 billion USD (+18%)

- Net income: 0.77 billion USD (+158%)

- Earnings per share: 0.47 USD (+161%)

- Operating profit: 0.72 billion USD (+223%)

Revenue by segment:

- Data Centre: 3.55 billion USD (+122%)

- Client segment: 1.88 billion USD (+29%)

- Gaming segment: 462 million USD (-69%)

- Embedded segment: 927 million USD (-25%)

AI development significantly impacts the company, as reflected in the data centre segment, in which revenue surged by 122% and now accounts for 52% of total revenue. The gaming segment recorded the most marked decline (69%) and now ranks lowest in revenue.

For Q4 2024, AMD forecasts revenue to be between 7.2 and 7.8 billion USD, with an average estimate of 7.5 billion. This projection suggests a 22% increase compared to last year’s corresponding period and a 10% rise from Q3 2024. However, the forecast fell slightly short of analysts’ expectations, raising concerns among investors, particularly given the intensifying competition in the AI market and the broader slowdown in growth for this sector.

Experts’ forecasts for Advanced Micro Devices, Inc.’s stock

- Barchart: 30 of 37 analysts rated the stock as a Strong Buy, one as a Moderate Buy, and six as a Hold, with an average price target of 191.41 USD

- MarketBeat: 29 of 32 specialists assigned a Buy rating to the shares, while three gave a Hold recommendation, with an average price target of 192.79 USD

- TipRanks: 26 of 32 professionals recommended the stock as a Buy, while six designated a Hold rating for the shares, with an average stock price target of 188.22 USD

- Stock Analysis: 16 of 31 experts rated the stock as a Strong Buy, 11 as Buy, and four as Hold, with an average stock price target of 195.77 USD

None of the experts recommended selling AMD shares.

Technical analysis and Q4 2024 forecast for Advanced Micro Devices, Inc.’s stock

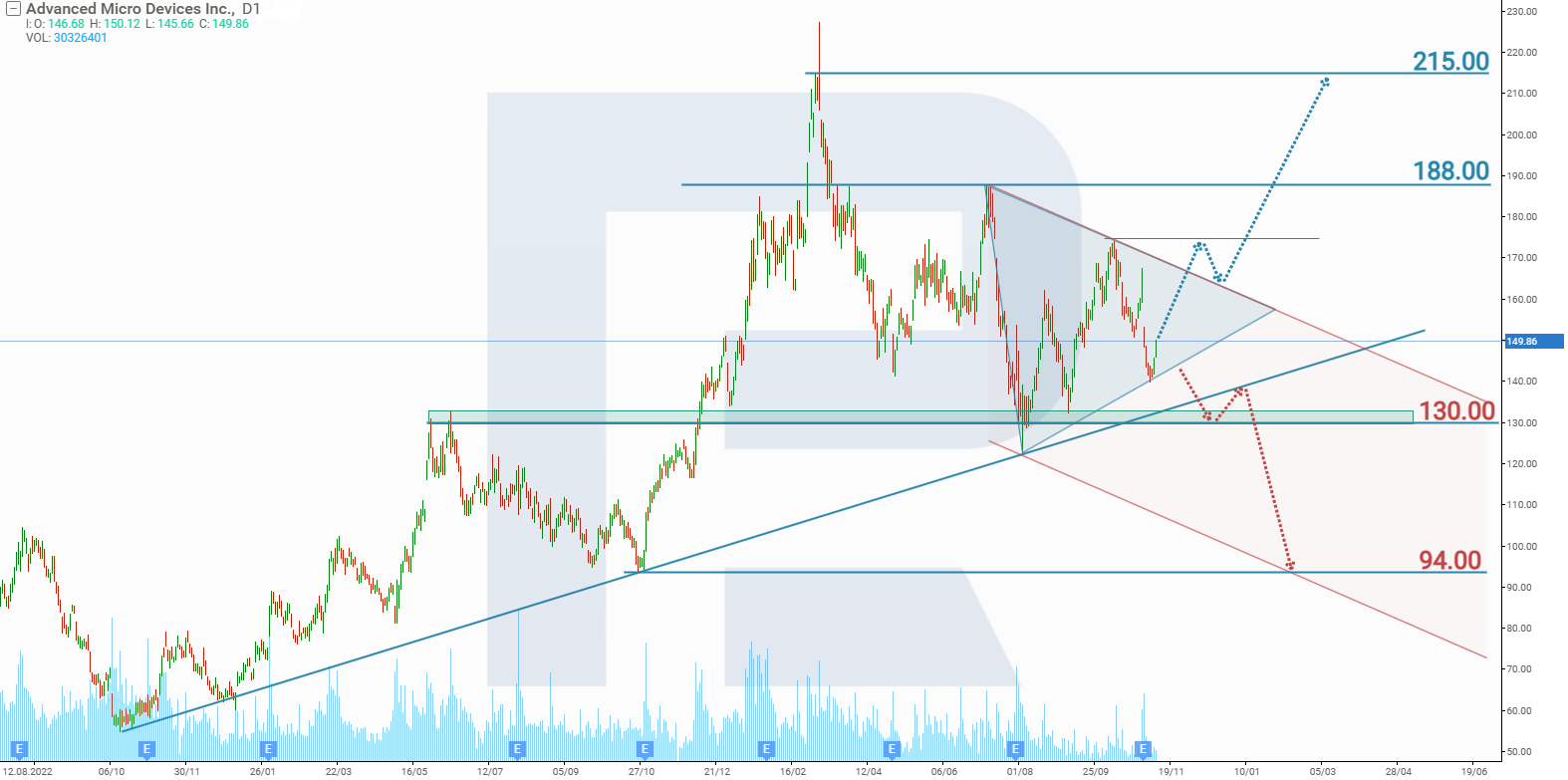

A triangle pattern has formed on the daily timeframe of AMD’s stock chart. Additionally, the shares have been trading in an uptrend since October 2022. Based on Advanced Micro Devices’ stock performance over the past two years, the following scenarios are possible:

An optimistic Q4 2024 forecast for Advanced Micro Devices stock suggests a breakout above the triangle’s upper boundary, with the price rising to an initial target of 188 USD. A breakout above this resistance level could drive the stock price to 215 USD. This forecast is the priority scenario, supported by the expert opinions above.

A negative Q4 2024 forecast for Advanced Micro Devices’ shares suggests a breakout of the ascending trendline, which could push the price down to the 130 USD support level. Breaking below this level could drive the price down to 94 USD.

Analysis and forecast for Advanced Micro Devices, Inc.’s stock for Q4 2024Technical analysis and 2025 forecast for Advanced Micro Devices, Inc.’s stock

AMD shares are trading within an ascending channel on the weekly timeframe. In February 2024, a false breakout of the channel’s upper line was followed by a corrective decline. Based on Advanced Micro Devices’ stock performance, two AMD stock forecasts for 2025 can be considered:

The baseline 2025 forecast for Advanced Micro Devices stock anticipates a rise to the channel’s upper boundary at 200 USD, followed by a correction towards 175 USD. If the price rebounds from this support level, the shares could resume growth and reach an all-time high of 227 USD.

The negative 2025 forecast for Advanced Micro Devices stock predicts a breakout below the 130 USD support level, followed by a further decline to 94 USD as part of the correction. This scenario would indicate potential problems for the company (e.g., decreased competitiveness of its products) or an overall slowdown in the AI market, which could adversely affect all semiconductor manufacturers.

Analysis and forecast for Advanced Micro Devices, Inc.’s stock for 2025Risks of investing in AMD stock

When investing in AMD shares, it is essential to consider the following risks:

- Intense competition: AMD faces tough competition from Intel Corp. (NASDAQ: INTC) and NVIDIA, which may lower prices or accelerate the introduction of new technologies, potentially impacting AMD’s market share negatively

- Reliance on TSMC: AMD relies on TSMC to manufacture its chips. Any supply disruptions or delays in the introduction of new technology processes at TSMC (NYSE: TSM) could affect AMD’s market position

- Demand fluctuations: the PC and server market is cyclical and depends on macroeconomic conditions. A decrease in demand for devices may reduce AMD’s revenue

- Development of proprietary AI chips by consumers: large tech companies like Amazon, Google, and Microsoft are investing in the development of their own semiconductors for data centres and specialised tasks. This reduces their reliance on external suppliers, including AMD. If these corporations continue to increase spending on developing their own chips, it could constrain AMD’s overall market and diminish its share in the data centre segment, thereby impeding its revenue growth over the long term

- Integration of acquisitions: following the acquisitions of Xilinx and Pensando, AMD must integrate these assets into its structure effectively. Failures in this process could lead to increased costs and reduced profitability

Summary

The sharp increase in data centre revenues and their significant share of AMD’s total revenue highlight the company’s growing reliance on AI technology development. The company is currently reporting strong financial results. However, if the AI market begins to slow, this will adversely affect AMD. So far, major tech companies do not plan to cut AI spending, which suggests that AMD has a strong chance of maintaining steady revenue growth in the near future.