World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 13 May 2025

The US Federal Reserve keeps interest rates at 4.5%, allowing for a potential cut only in 2026. China and the US held constructive talks on reducing mutual tariffs. More details in our analysis and forecast for 13 May 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: The US Federal Reserve keeps interest rates at 4.5%

- Market impact: shares of technology companies and other issuers dependent on the discounting of future profits may come under pressure

Fundamental analysis

Maintaining the key rate at the current level along with a resilient economy creates a mixed backdrop. Citing tariffs as a growing inflationary driver increases uncertainty for companies linked to global supply chains (automotive, semiconductors, industrial equipment). Shares of such firms may experience pressure due to potentially higher production costs and lower margins.

A longer period of high rates supports banks’ net interest margins, often leading to relative strength in financial sector stocks, especially those of large universal banks. Investors viewed the progress between the US and China positively. However, relations with the EU have become a new point of tension.

US 30 technical analysis

The US 30 index rose by more than 13% from the April lows, but the overall trend remains downward. As long as support at 37,060.0 holds, prices may get stuck in a sideways corridor; a sustained upward trend is possible only after breaking through the resistance at 42,535.0.

Scenarios for the US 30 index price forecast:

- Pessimistic scenario for US 30: if the support level at 37,060.0 is breached, prices may fall to 35,060.0

- Optimistic scenario for US 30: if the resistance level at 42,535.0 is broken, prices may rise to 43,890.0

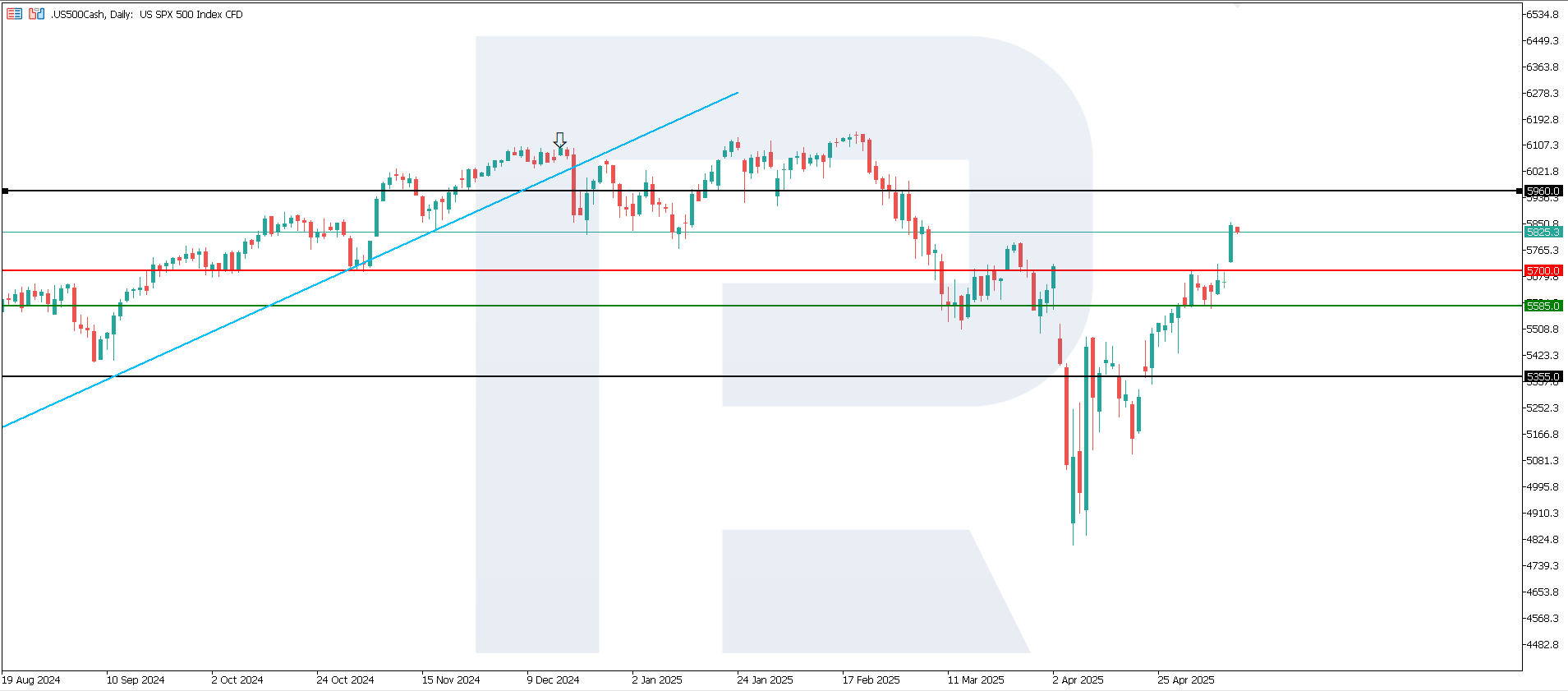

US 500 technical analysis

For the US 500 index, the resistance at 5,700.0 was broken. After the longest series of gains this year, prices are correcting while remaining within an upward trend. The support zone has shifted to the 5,585.0 mark.

Scenarios for the US 500 index price forecast:

- Pessimistic scenario for US 500: if the support level at 5,585.0 is breached, prices may fall to 5,355.0

- Optimistic scenario for US 500: if the price consolidates above the previously broken resistance at 5,700.0, prices may rise to 5,960.0

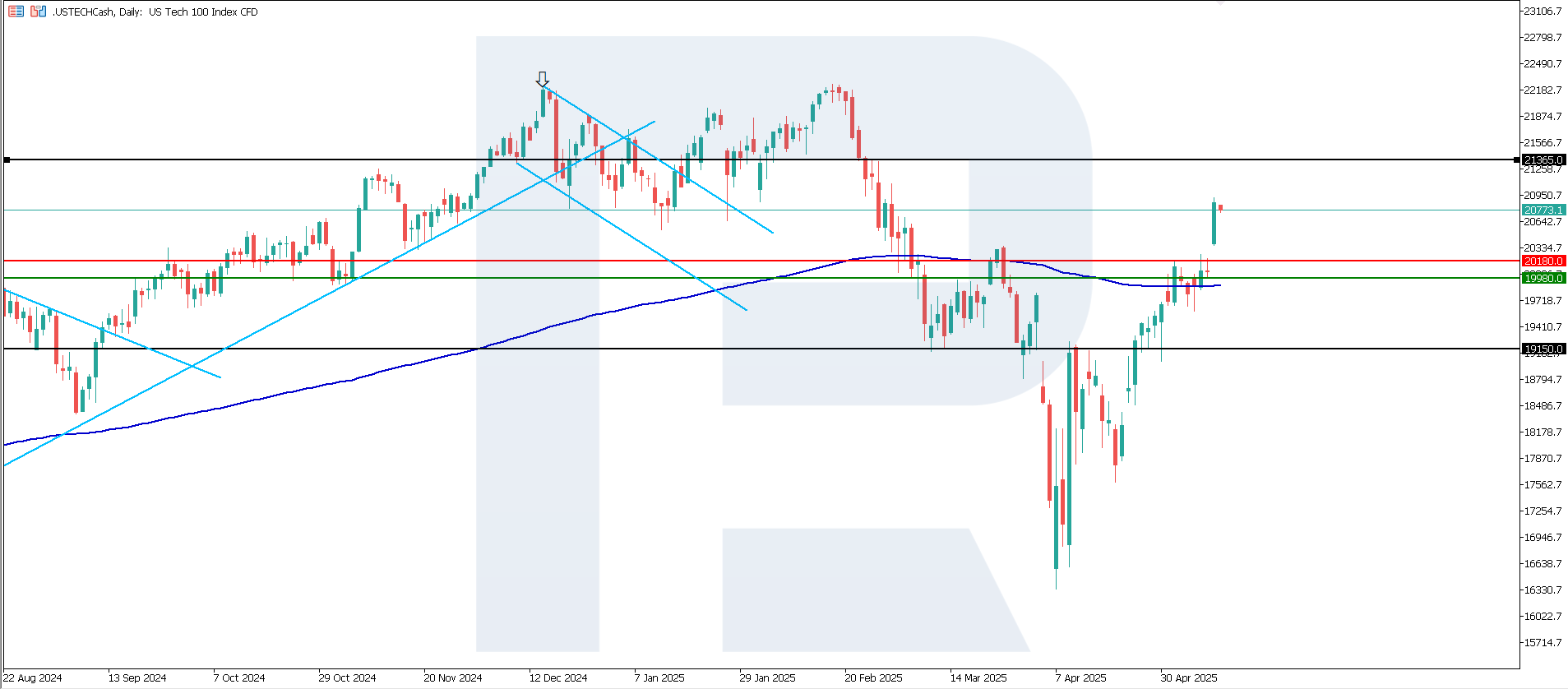

US Tech technical analysis

The US Tech index broke through the resistance level at 20,180.0, while the support zone settled around 19,980.0. Prices managed to rise above the 200-day moving average, which is typically seen as a technical sign of a renewed upward impulse. If prices fall back below the 200-day moving average and remain there, this would confirm weakening buyer strength and could trigger a return to downward movement.

Scenarios for the US Tech index price forecast:

- Pessimistic scenario for US Tech: if the support level at 19,980.0 is breached, prices may fall to 19,150.0

- Optimistic scenario for US Tech: if the price consolidates above the previously broken resistance at 21,180.0, prices may rise to 21,365.0

Asian index forecast: JP 225

- Recent data: Japan’s au Jibun Bank Services PMI for May preliminarily stands at 48.7

- Market impact: a strengthening services sector supports revenue prospects for retail, transportation, tourism, and fintech, which may boost demand for shares of these companies

Fundamental analysis

PMI growth indicates a demand recovery in the economy, which may support the rise of stocks in domestically focused sectors – such as services, tourism, transportation, and consumption. Stronger data may also fuel speculation about possible policy tightening by the Bank of Japan, which in turn strengthens the yen and puts pressure on exporters.

The figure creates a favourable environment for the stock market, especially for domestic industries, but investors may also factor in the effect of yen fluctuations. In addition, Japan is influenced by US trade policy and increasing tariffs.

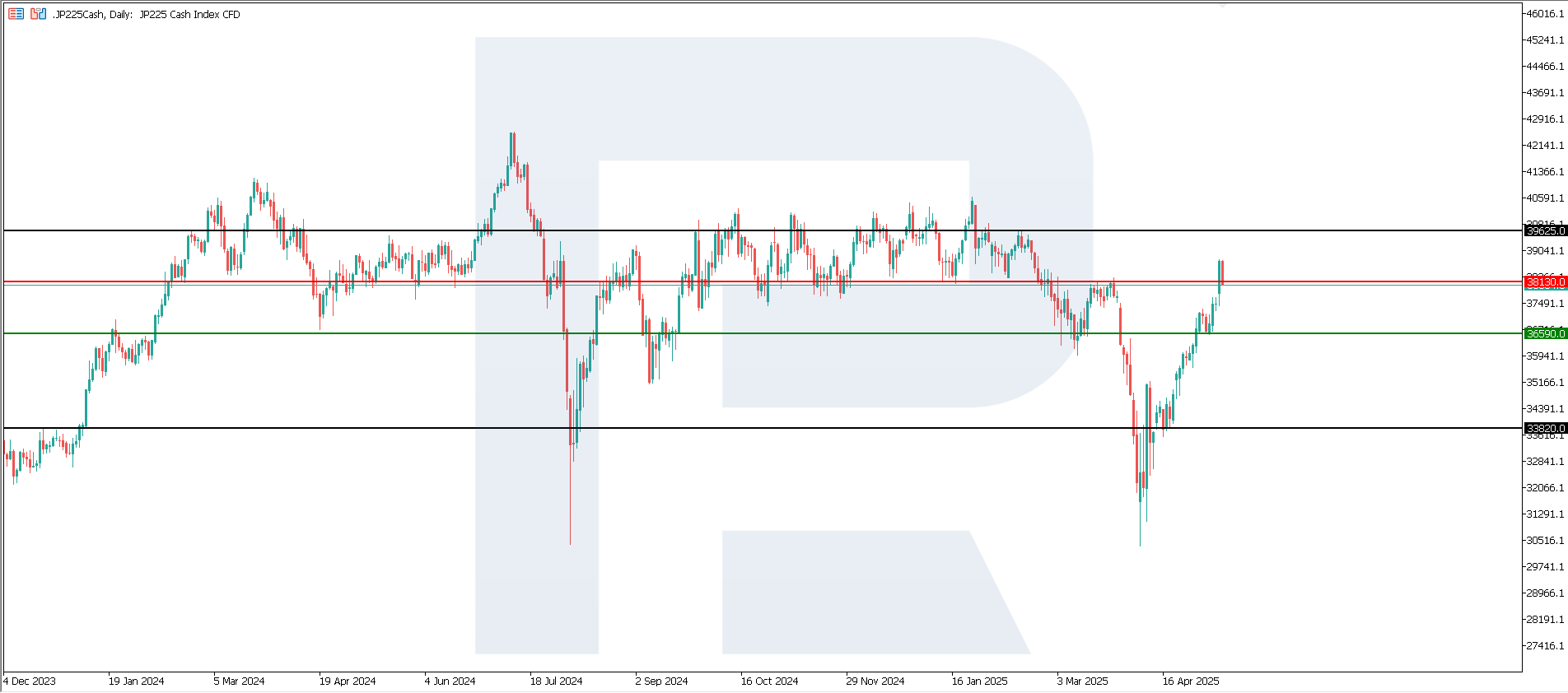

JP 225 technical analysis

The JP 225 index broke through a medium-term sideways channel. Despite a prevailing downtrend, the resistance level at 38,130.0 was broken. This breakout could be false. If so, the downward trend will likely continue; otherwise, one could speak of a possible start of an upward trend.

Scenarios for the JP 225 index price forecast:

- Pessimistic scenario for JP 225: if the support level at 36,590.0 is breached, prices may fall to 33,820.0

- Optimistic scenario for JP 225: if the price consolidates above the previously broken resistance at 38,130.0, prices may rise to 39,625.0

European index forecast: DE 40

- Recent data: Germany’s Industrial Production for March increased by 3%

- Market impact: such strong data indicates a strengthening economy and may boost market participants’ confidence

Fundamental analysis

A 3% rise in March (against a forecast of +0.9% and a previous reading of -1.3%) points to a sharp recovery in manufacturing activity after the February downturn. This may result from improved external demand, supply chain normalisation, or domestic stimulus (e.g. investments in the defence industry).

Manufacturing, engineering, and automotive companies (such as Siemens, BMW, Volkswagen) may receive additional support. Improvements in macroeconomic indicators increase the likelihood that German firms will post strong quarterly results, potentially pushing DE 40 higher.

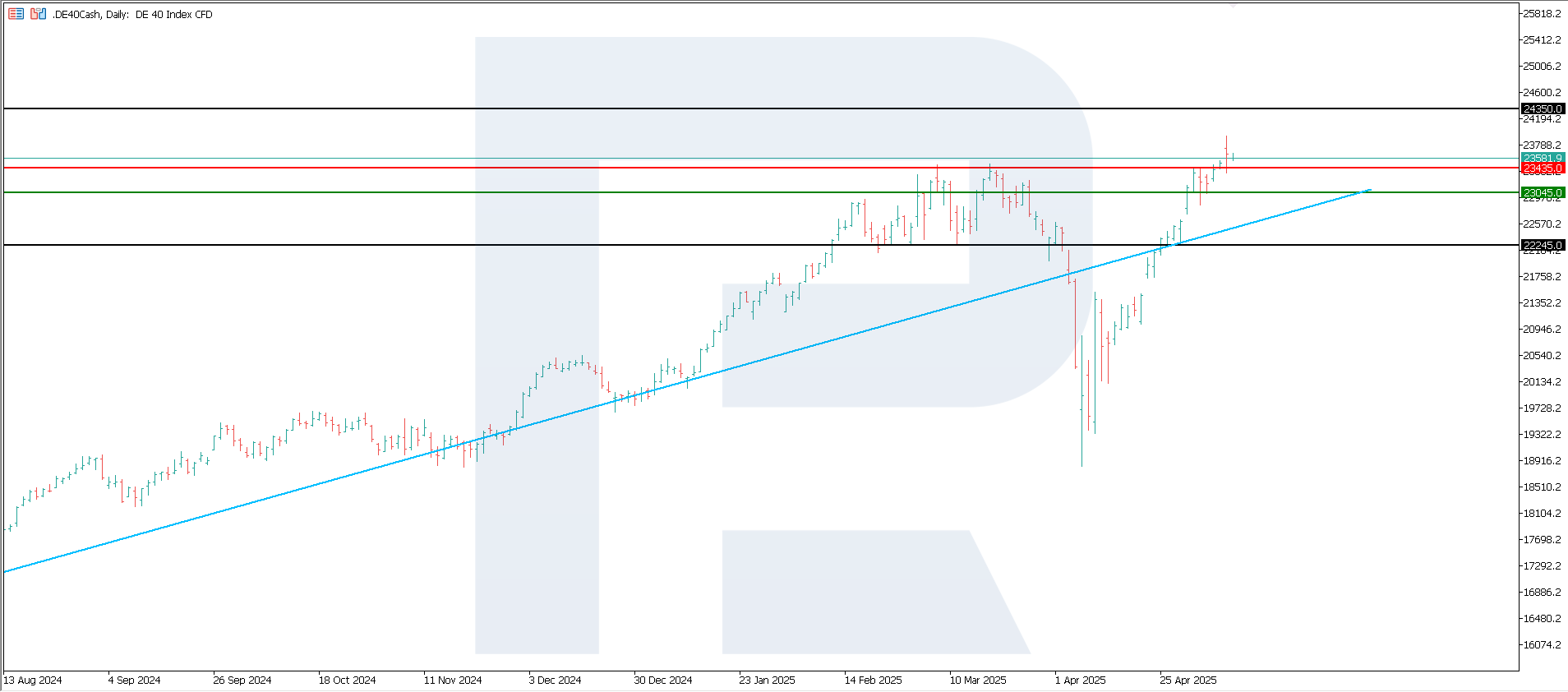

DE 40 technical analysis

The DE 40 stock index broke through the resistance at 23,435.0, while the support zone shifted to 23,045.0. Prices reached a new all-time high and still hold potential for further growth. However, to confirm the sustainability of the uptrend, a new resistance level must form.

Scenarios for the DE 40 index price forecast:

- Pessimistic scenario for DE 40: if the support level at 23,045.0 is breached, prices may fall to 22,245.0

- Optimistic scenario for DE 40: if the price consolidates above the previously broken resistance at 23,435.0, prices may rise to 24,345.0

Summary

Most global stock indices show upward movement, but a confirmed trend reversal has yet to appear in the US 30. Market optimism largely stems from the easing of trade relations between the US and China. At the same time, after the Federal Reserve maintained the key rate at 4.5% and signalled it may hold it there until 2026, investors will focus on future regulatory cues about the central bank's monetary policy direction.