World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 16 April 2025

The correction stopped, and even the easing of tariff restrictions could not reignite the growth of global indices. Find out more in our analysis and forecast for global indices for 15 April 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: preliminary US Michigan consumer sentiment came in at 50.8 in April

- Market impact: declining consumer activity may negatively impact companies’ revenues, especially in the consumer staples sector

Fundamental analysis

The reading of 50.8 was below the forecast and the previous reading, indicating increased pessimism among consumers. Overall, lower consumer sentiment points to a possible slowdown in demand. While this may put pressure on the US stock market, the strength and duration of this impact also depends on other macroeconomic factors and the regulator’s reaction.

The US Customs and Border Protection has issued a document with 20 product classification codes related to various types of electronics that will be exempt from tariffs when imported from China. According to the list, the exemptions from reciprocal import tariffs include laptops, tablets, smartphones, modems, external hard drives, memory cards, monitors, transistors, converters, and other semiconductor devices. However, the US authorities have stated that these goods may be subject to special tariffs.

US 30 technical analysis

The US 30 stock index soared by 7.87% at the end of last week, marking the biggest gain since 2020. The support level formed at 37,060.0. Despite the general optimism, the global trend remains downward. If the support level does not break, a sideways movement could follow.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 37,060.0 support level could send the index down to 35,060.0

- Optimistic US 30 forecast: a breakout above the 42,535.0 resistance level could drive the index to 43,890.0

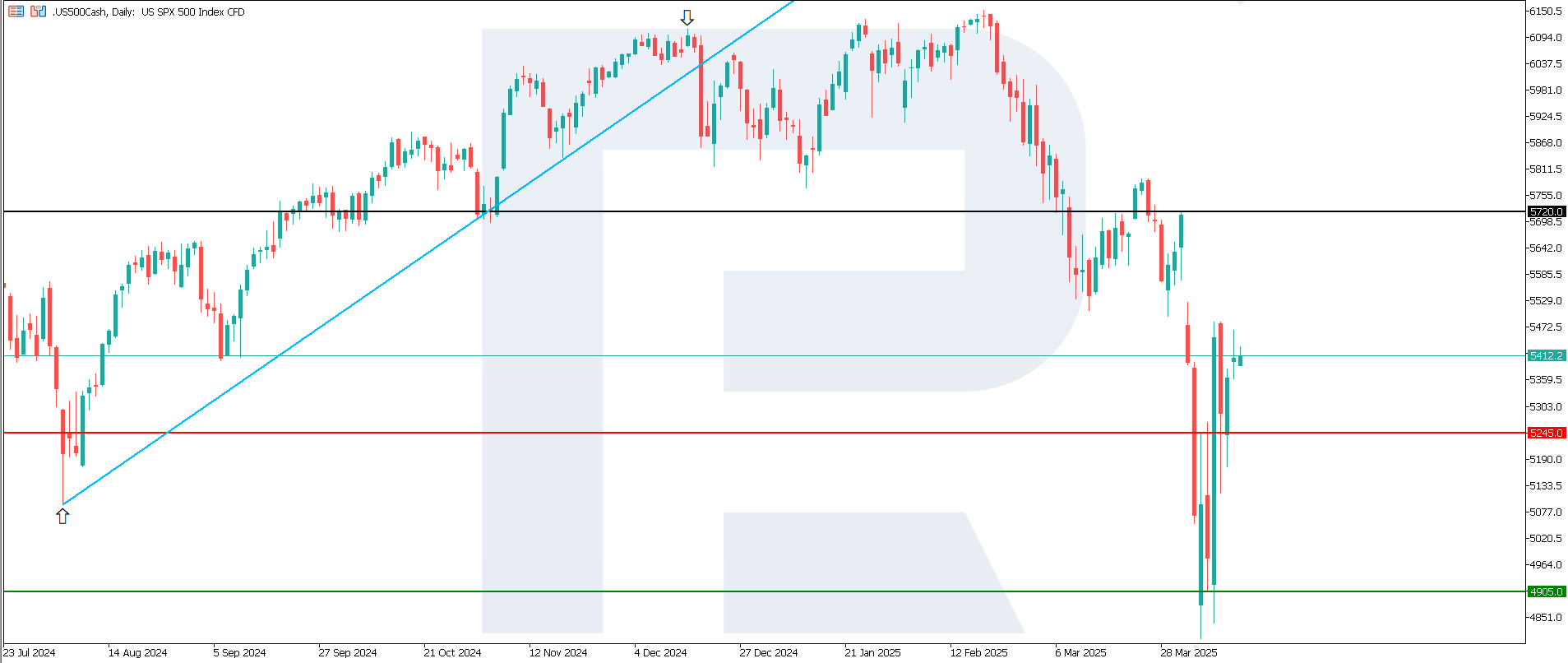

US 500 technical analysis

The US 500 stock index has seen record growth since 2008, adding 9.51%. The support level shifted to 4,905.0, with resistance at 5,245.0. The latter was breached when the price corrected upwards, indicating the beginning of an uptrend.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 4,905.0 support level could send the index down to 4,665.0

- Optimistic US 500 forecast: if the price consolidates above the previously breached resistance level at 5,245.0, the index could climb to 5,720.0

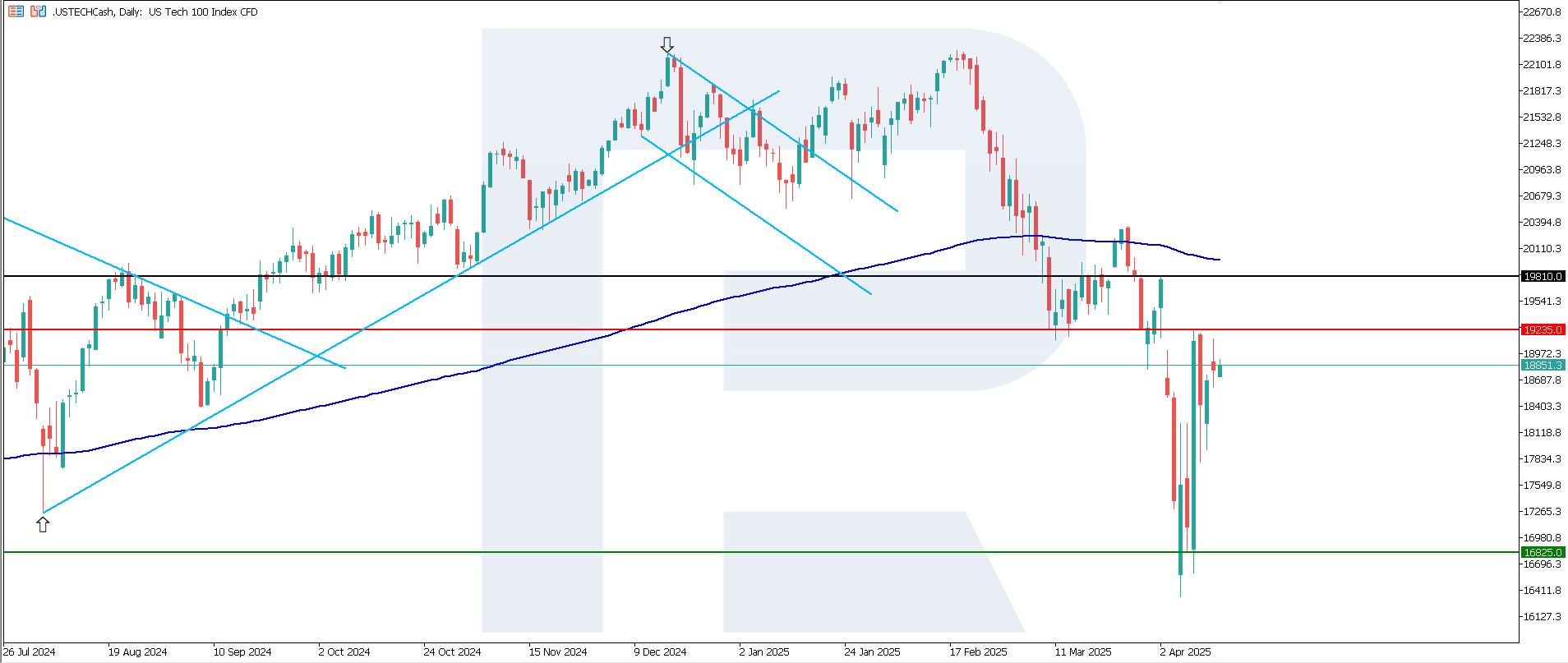

US Tech technical analysis

The US Tech index formed a resistance level at 19,235.0, with support at 16,825.0. The index is still trading below the 200-day Moving Average, indicating the unsustainability of the current uptrend.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 16,825.0 support level could push the index down to 15,705.0

- Optimistic US Tech forecast: a breakout above the 19,235.0 resistance level could propel the index to 19,810.0

Asian index forecast: JP 225

- Recent data: Japan’s industrial production in February was up 2.3% from January 2025

- Market impact: companies dependent on the economic cycle may see an influx of stock buyers on expectations of further growth in output and profits

Fundamental analysis

The final data came in at 2.3%, slightly below the forecast of 2.5%, marking a significant improvement from a 1.1% decline the previous month. Figures above the previous reading are typically considered a moderately positive factor for the Japanese stock market. However, a weaker-than-expected reading may dampen excessive optimism somewhat.

Bank of Japan Governor Kazuo Ueda told parliament that US tariffs have heightened uncertainty in the global and Japanese economies, putting downward pressure on them. The BoJ will likely pause rate hikes due to US tariffs, which may significantly harm the country’s economy. This will have a positive impact on the Japanese stock market.

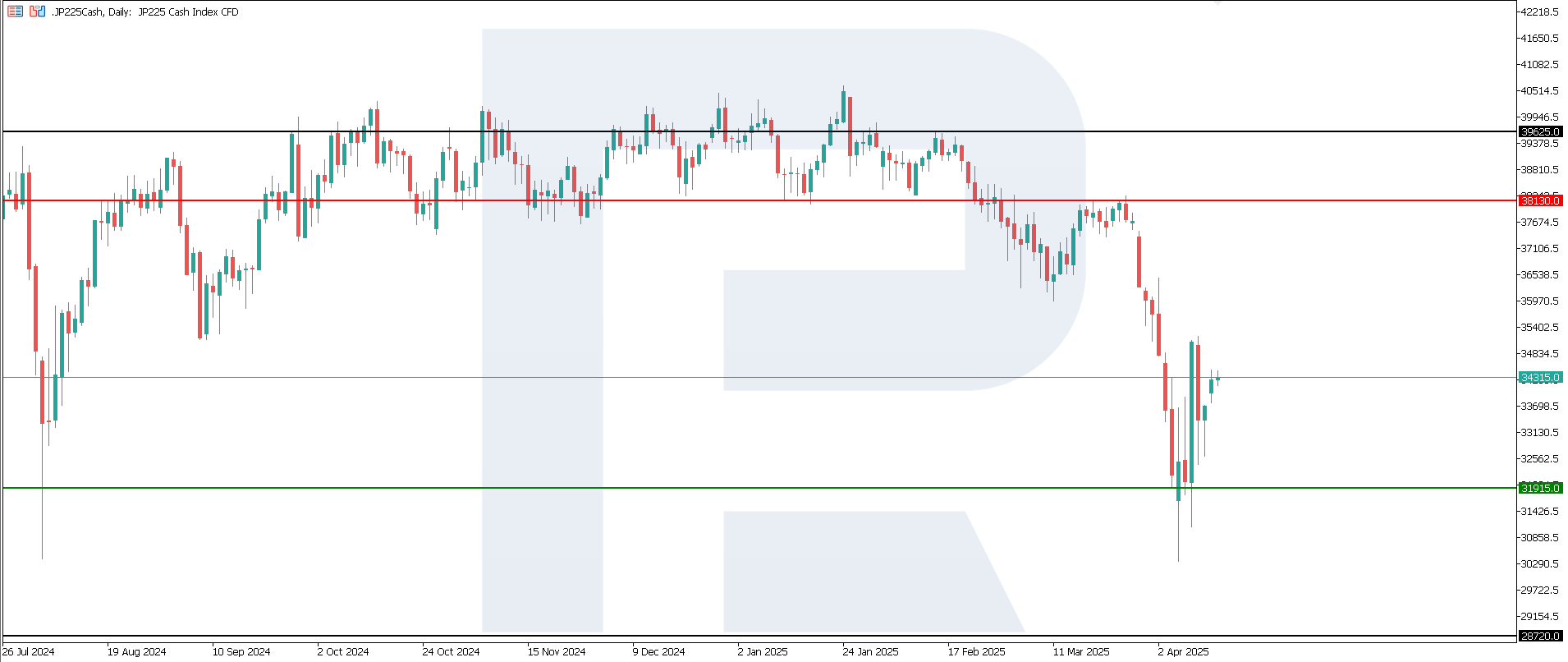

JP 225 technical analysis

The JP 225 stock index has formed a large channel between the current support and resistance levels. Overall, the trend remains negative. However, a false breakout below the 31,915.0 support level is possible, followed by an upward reversal of the trend.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 31,915.0 support level could send the index down to 28,720.0

- Optimistic JP 225 forecast: a breakout above the 38,130.0 resistance level could propel the index to 39,635.0

European index forecast: DE 40

- Recent data: the German CPI rose by 2.2% in March

- Market impact: data in line with expectations often causes a neutral or moderately positive reaction on the stock market

Fundamental analysis

Investors are receiving a signal that the ECB’s regulatory policy is more likely to remain predictable. Stable inflation is typically favourable for consumer demand, which may support stocks of retailers, consumer goods producers and service sectors.

Figures close to targets commonly reduce the likelihood of the ECB’s aggressive measures such as sharp rate hikes or cuts. This creates a predictable business environment and may positively affect stock performance in the medium term. Inflation data in line with expectations and moderate price growth create relatively stable conditions for the German stock market, reducing the risk of sharp fluctuations.

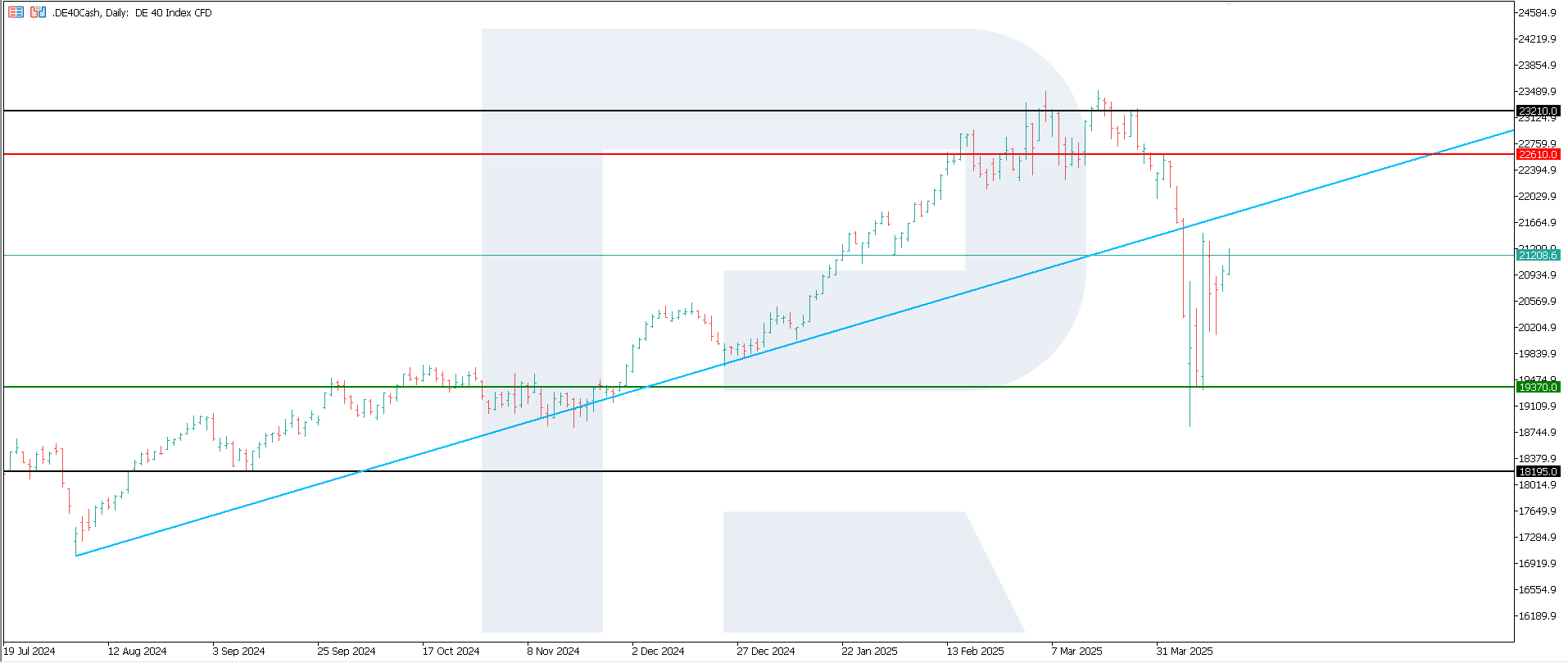

DE 40 technical analysis

Despite growing by more than 11%, the DE 40 stock index remains in a downtrend. A sideways channel is possible. The support level formed at 19,370.0 after a correction.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 19,370.0 support level could push the index down to 18,195.0

- Optimistic DE 40 forecast: a breakout above the 22,610.0 resistance level could drive the index to 23,210.0

Summary

The reversal of tariffs on some goods instilled hopes for a compromise. However, not all indices have entered a stable uptrend. Amid uncertainty caused by the tariff pause, sideways channels without a clear trend could form. The US 500 and US Tech indices are now the only ones to see sustained growth.