World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 24 June 2025

Mutual strikes between Iran and the US have not led to a drop in global stock indices, especially since the parties quickly reached a compromise. Find out more in our analysis and forecast for 24 June 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: the preliminary S&P US Composite PMI was 52.8 in June

- Market impact: moderate PMI growth typically signals stable economic development and is perceived positively

Fundamental analysis

The slower growth rate in PMI may trigger some caution among investors, especially as they await more economic data and Federal Reserve decisions. The slight decline in the services PMI may reflect a cooling in service sector activity, potentially weighing on retail, financial, healthcare, and entertainment stocks.

Some analysts expected that if Iran responded to US strikes on its nuclear infrastructure, indices would come under pressure. However, a closer look shows the strike itself has had no impact on the oil market. Consequences would only arise in two scenarios: an attack on the oil infrastructure of the Persian Gulf monarchies, or a blockade of the Strait of Hormuz. The latter would only have short-term effects. As both scenarios currently seem unlikely, supply and demand balance remains stable – this has encouraged markets and led to a drop in the risk premium.

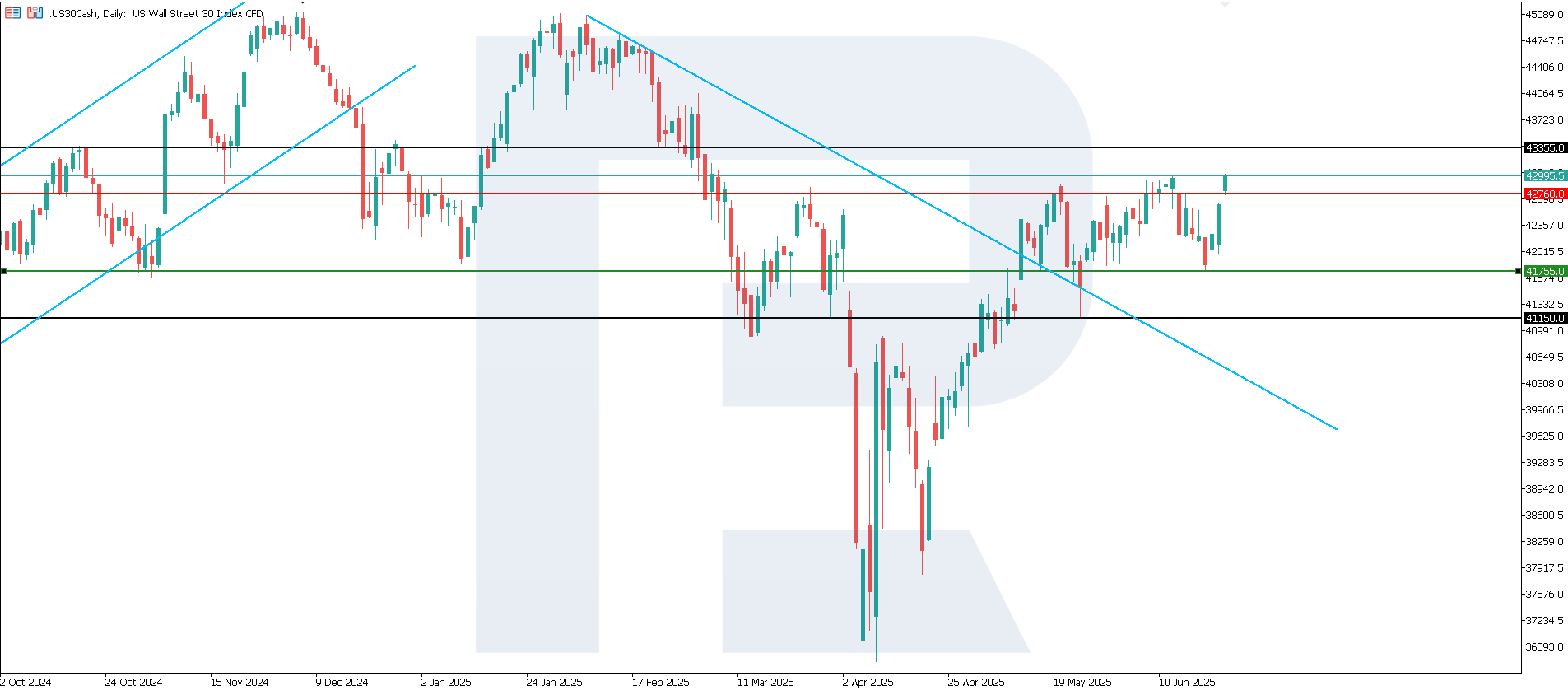

US 30 technical analysis

The US 30 index broke below the previous 42,085.0 support level, with a new one formed at 41,755.0. The resistance level has shifted to 42,760.0. It is worth noting the strong momentum with which the price rebounded from the support level. There is now potential for a trend reversal and a breakout above resistance.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 41,755.0 support level could send the index to 41,150.0

- Optimistic US 30 forecast: a breakout above the 42,760.0 resistance level could boost the index to 43,355.0

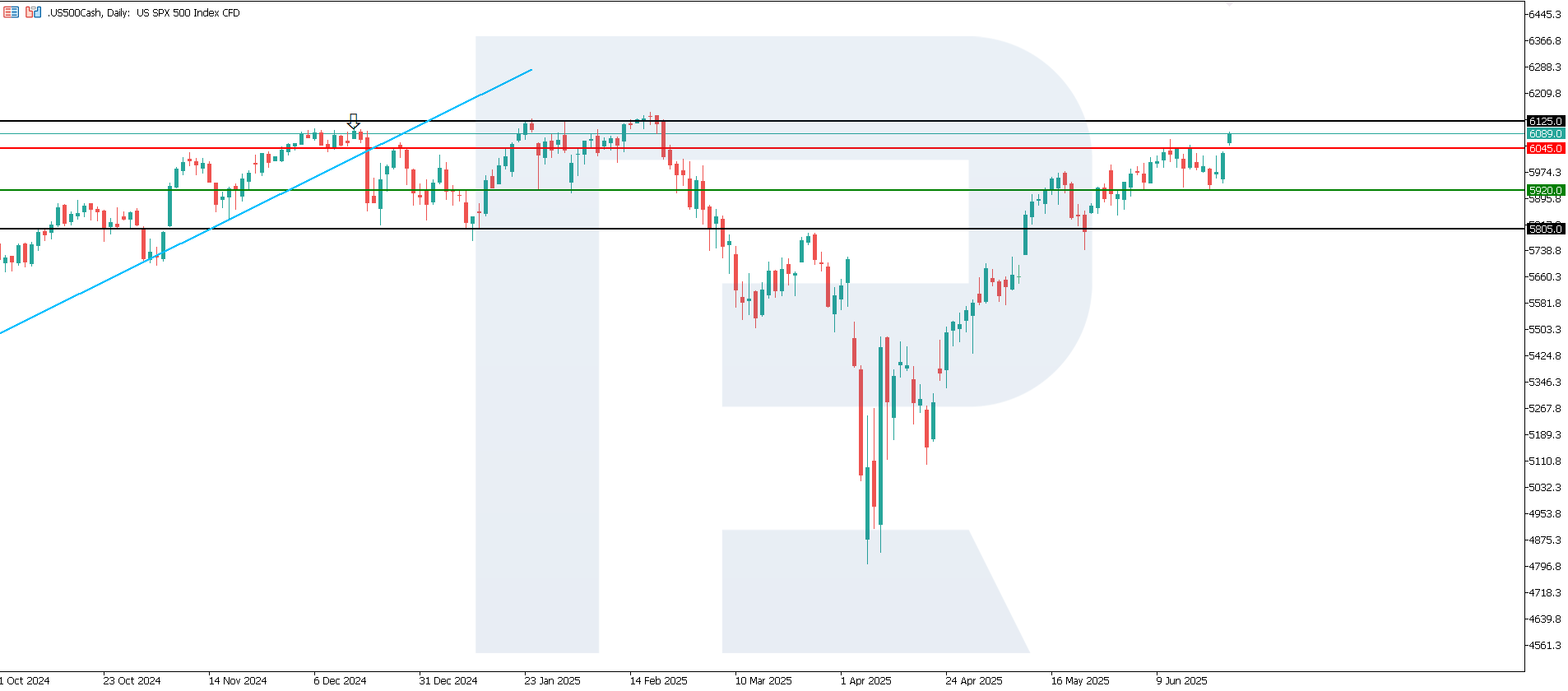

US 500 technical analysis

The US 500 index remained in an uptrend, with the support level shifting to 5,920.0 and resistance forming at 6,045.0. The index tested the support level but failed to break above it. There are still prerequisites for a continuation of the bullish trend.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,920.0 support level could push the index down to 5,745.0

- Optimistic US 500 forecast: a breakout above the 6,045.0 resistance level could propel the index to 6,125.0

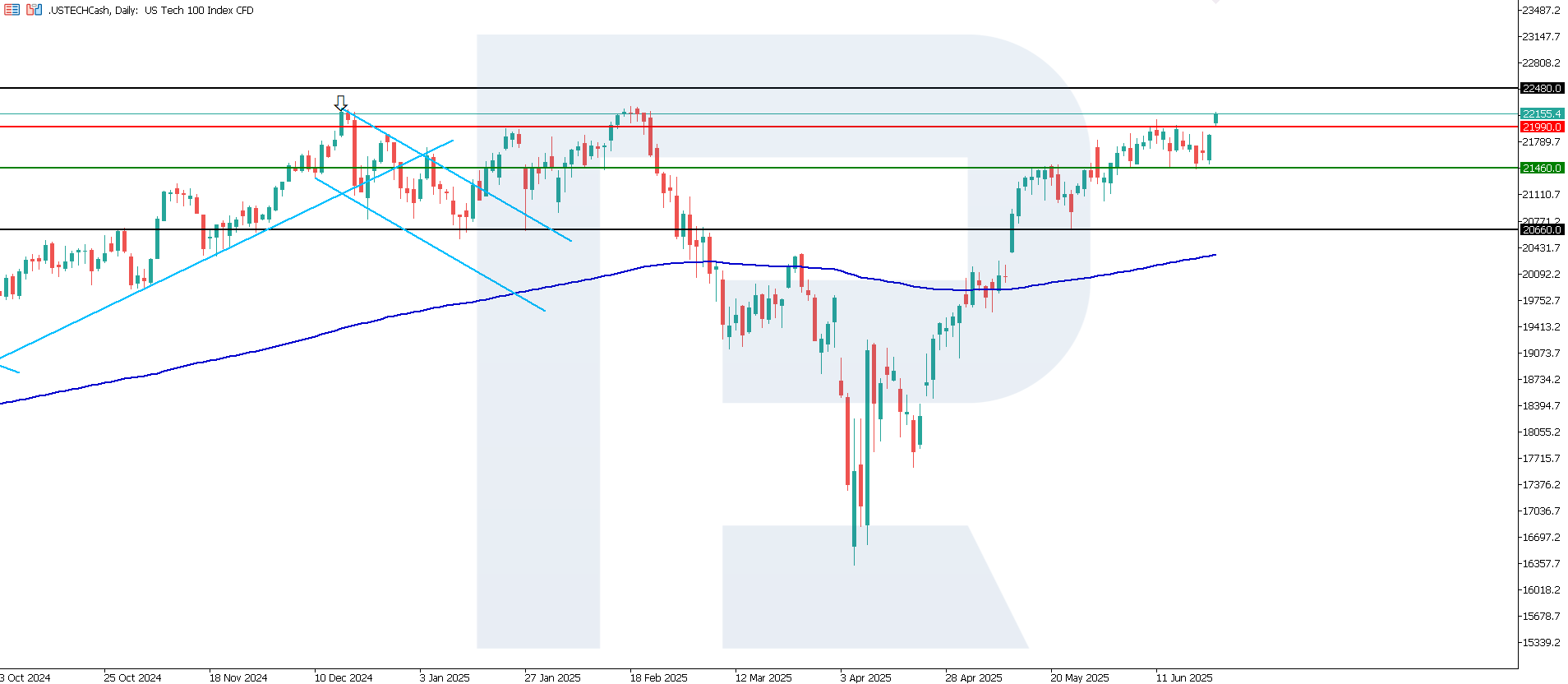

US Tech technical analysis

The US Tech index broke above the 21,780.0 resistance level, with a new one forming at 21,990.0. The support level has shifted to 21,460.0. The index continues to move within an uptrend and shows potential for further growth.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 21,460.0 support level could send the index down to 20,660.0

- Optimistic US Tech forecast: a breakout above the 21,990.0 resistance level could drive the index to 22,480.0

Asian index forecast: JP 225

- Recent data: Japan’s core CPI was 3.7% in May

- Market impact: rising core CPI may lead to expectations of interest rate hikes, which usually affect rate-sensitive sectors negatively

Fundamental analysis

The actual value of 3.7% exceeded the forecast of 3.6% and the previous 3.5%, indicating slightly stronger inflationary pressure. Higher inflation suggests the Bank of Japan may tighten monetary policy, which impacts borrowing costs and overall economic momentum.

Accelerating core inflation in Japan pressures the stock market, triggering expectations of tighter policy. This heightens volatility and affects sectors differently: financials may benefit, while consumer, industrial, and tech sectors may face headwinds.

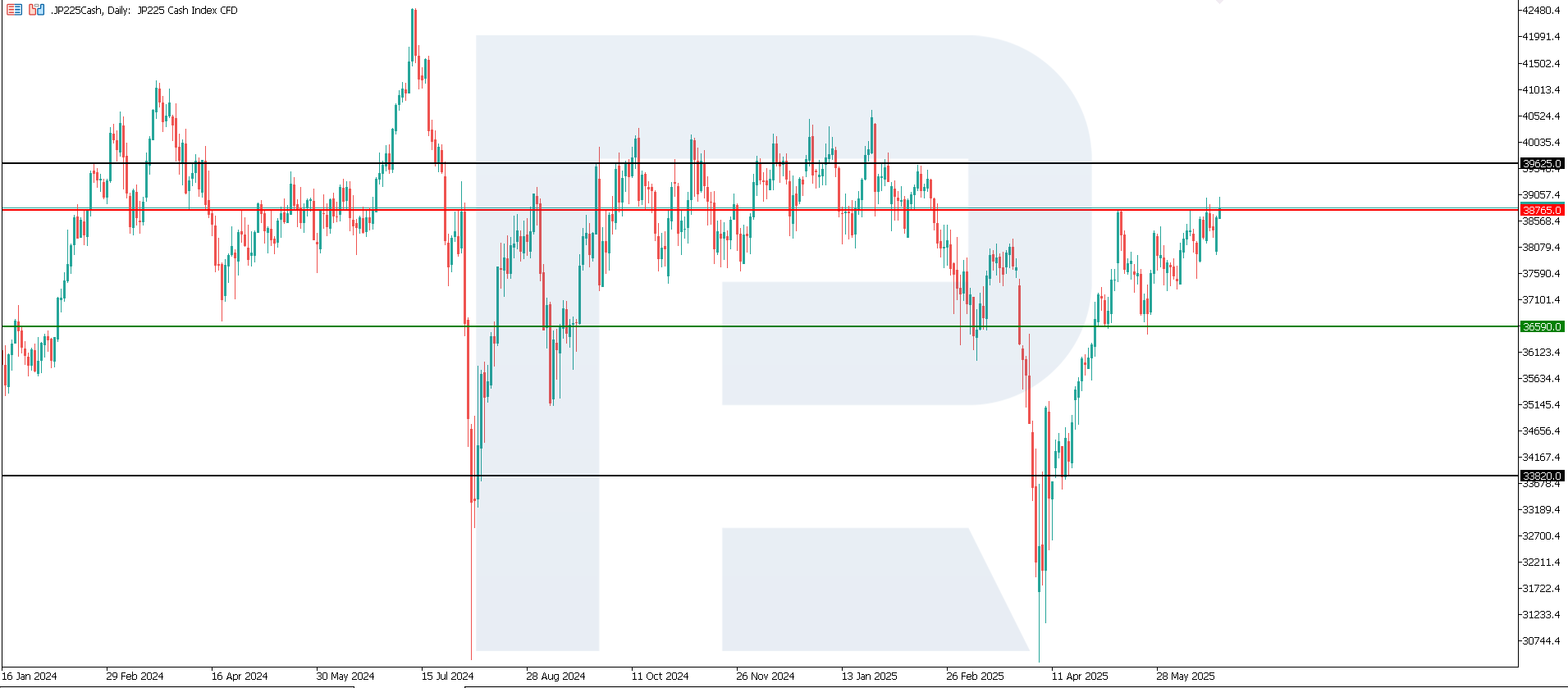

JP 225 technical analysis

The JP 225 index has rebounded from the 36,590.0 support level and is heading towards resistance at 38,765.0. A breakout above this level would confirm the continuation of the medium-term uptrend. There are currently no signs in the market, indicating a trend reversal.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 36,590.0 support level could push the index down to 33,820.0

- Optimistic JP 225 forecast: a breakout above the 38,765.0 resistance level could propel the index to 39,625.0

European index forecast: DE 40

- Recent data: Germany’s Producer Price Index for May came in at -0.2%

- Market impact: this is a neutral or slightly positive signal, pointing to stabilising inflation expectations and potentially lower volatility

Fundamental analysis

The Producer Price Index (PPI) reflects changes in prices of goods sold by manufacturers and serves as an indicator of inflation at the wholesale level. In June, the PPI fell by 0.2%, above the forecast of -0.3% and better than the previous decline of -0.6%. This easing suggests price pressure on producers is stabilising, potentially signalling the start of inflation stabilisation.

Germany’s PPI data shows the decline in producer prices is slowing, suggesting inflation processes may be stabilising. This creates a favourable backdrop for the equity market, encouraging a focus on stability and moderate growth.

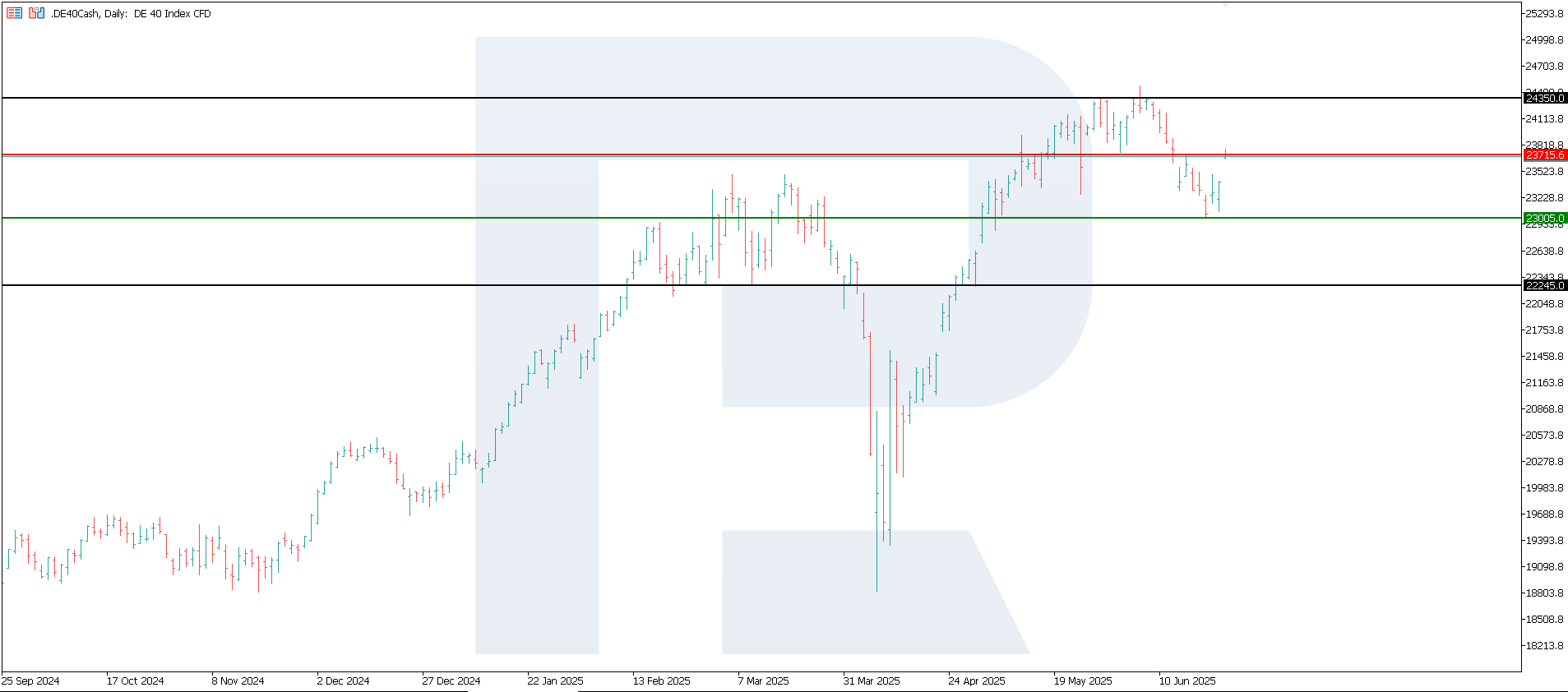

DE 40 technical analysis

The DE 40 index broke below the 23,270.0 support level, marking the end of the medium-term uptrend. The decline will likely be short-term, and growth may resume. A new support level has now formed at 23,005.0.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 23,005.0 support level could send the index down to 22,245.0

- Optimistic DE 40 forecast: a breakout above the 23,270.0 resistance level could push the index higher to 24,855.0

Summary

The US Federal Reserve has kept its benchmark rate unchanged in line with market expectations. The conflict involving the US, Israel, and Iran has not escalated into a global crisis. The nature of actions taken by these actors does not suggest a high risk of broader confrontation. The US 30 index remains volatile, with no strong trend yet formed. The JP 225 index is near its resistance level but has not broken through. The US 500 and US Tech have maintained their upward momentum.

Investor focus will now return to macroeconomic data from the US, EU, and other developed economies. Inflation figures and the impact of new US tariffs will be of particular interest.