World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 27 February 2025

US plans to impose 25% tariffs on goods from the EU led to a decline in global indices again. Find out more in our analysis and forecast for global indices for 27 February 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: US new home sales fell by 10.5% in January

- Market impact: stocks of construction companies, manufacturers of building materials and related services may dip amid expectations of weaker revenues

Fundamental analysis

When the real estate market cools down due to high rates, investors may have increased expectations of a softer Federal Reserve stance (a slowdown or pause in rate hikes). It sometimes supports the stock market as a whole although the effect may be limited if other economic data points to sustainable inflation growth and high demand.

The main news was that US President Donald Trump reiterated his plans to impose 25% tariffs on the EU. These measures will boost inflation, jeopardising the US Federal Reserve’s plans to lower interest rates further.

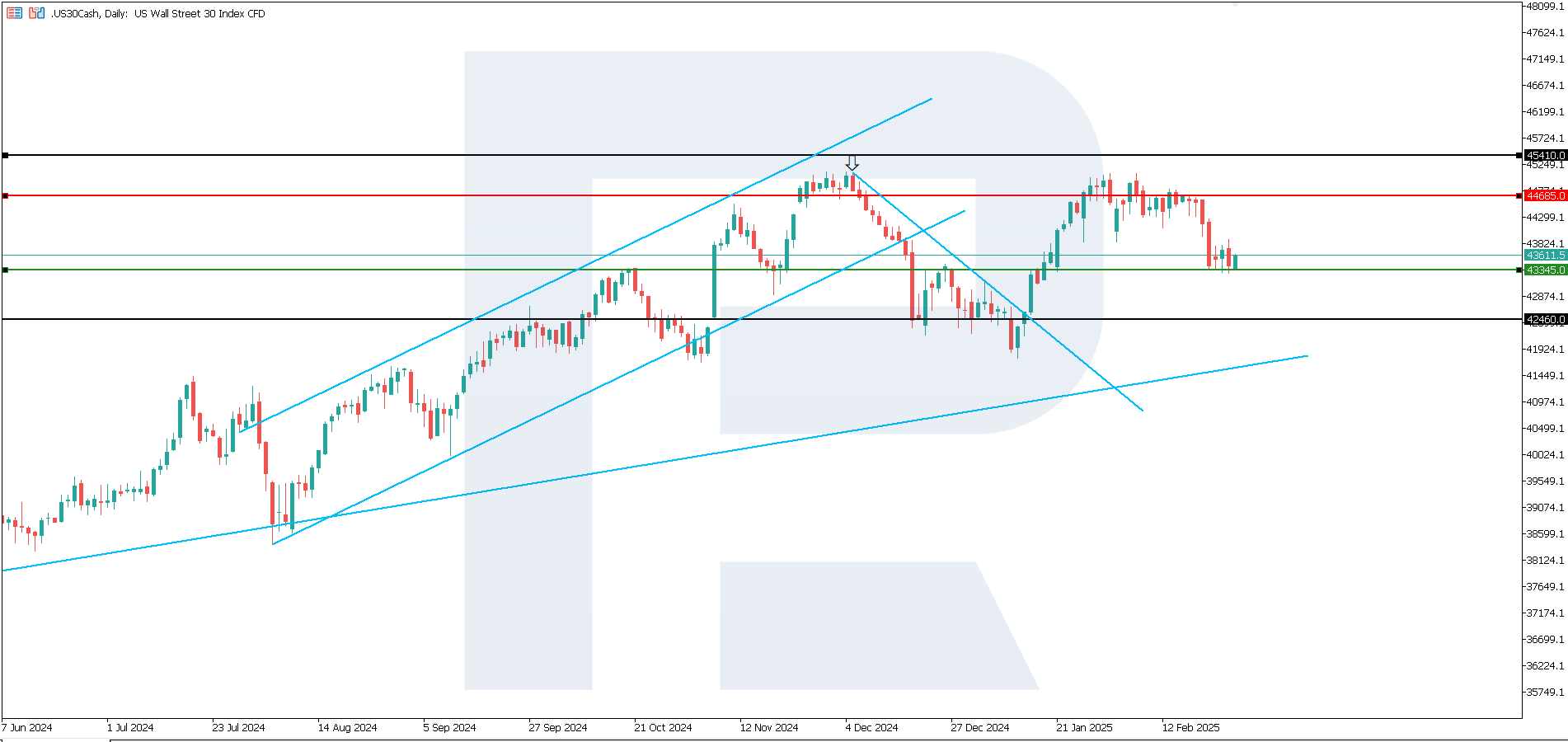

US 30 technical analysis

The US 30 stock index is forming a downtrend. Bulls and bears are fighting for the 43,345.0 support level, which will highly likely be breached, with the price targeting 42,460.0.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 43,345.0 support level could push the index down to 42,460.0

- Optimistic US 30 forecast: a breakout above the 44,685.0 resistance level could drive the index to 45,410.0

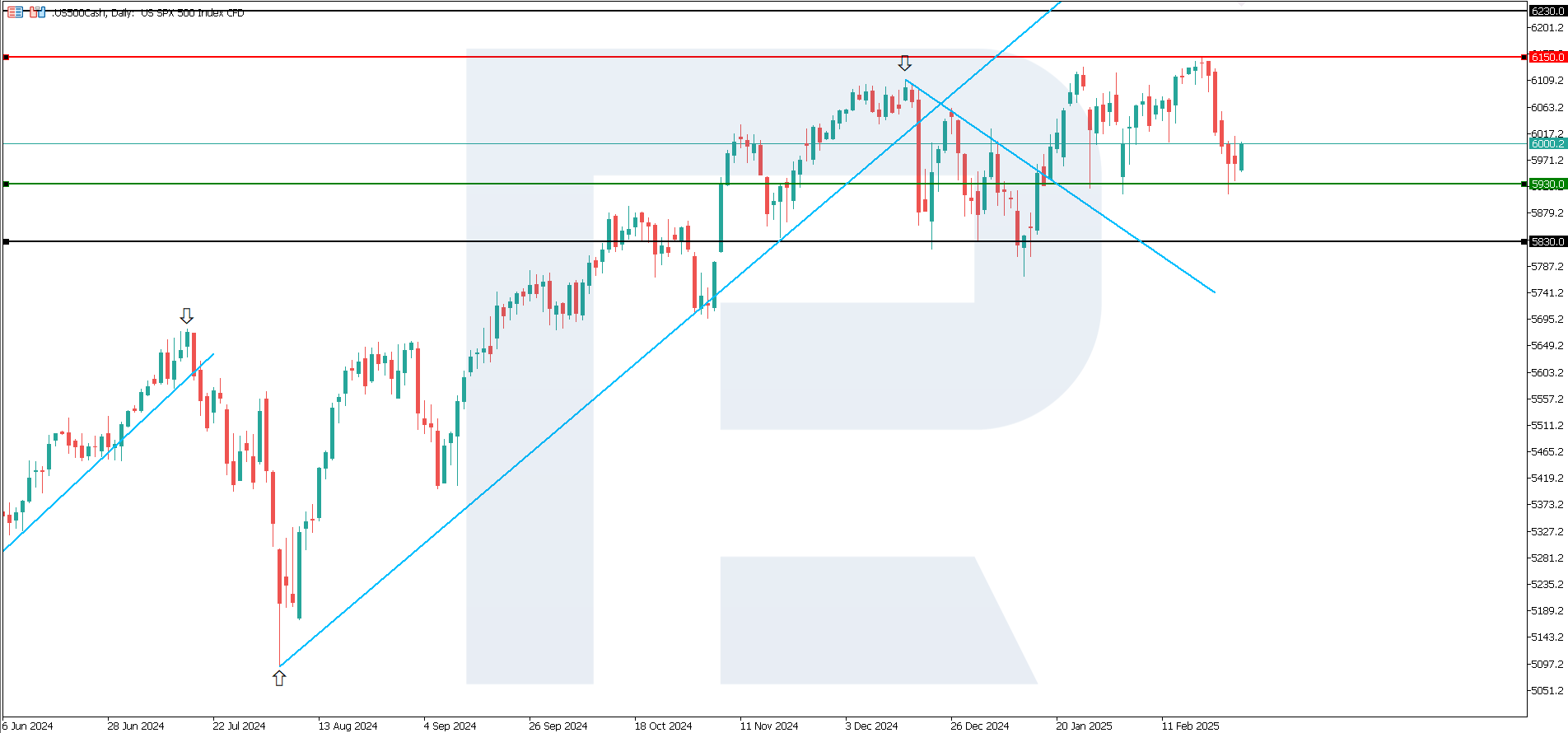

US 500 technical analysis

The US 500 stock index continues to correct. A downtrend will likely begin, with a downside target at 5,830.0. The US 500 technical analysis does not rule out the formation of a sideways channel.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,930.0 support level could send the index down to 5,830.0

- Optimistic US 500 forecast: a breakout above the 6,150.0 resistance level could propel the index to 6,230.0

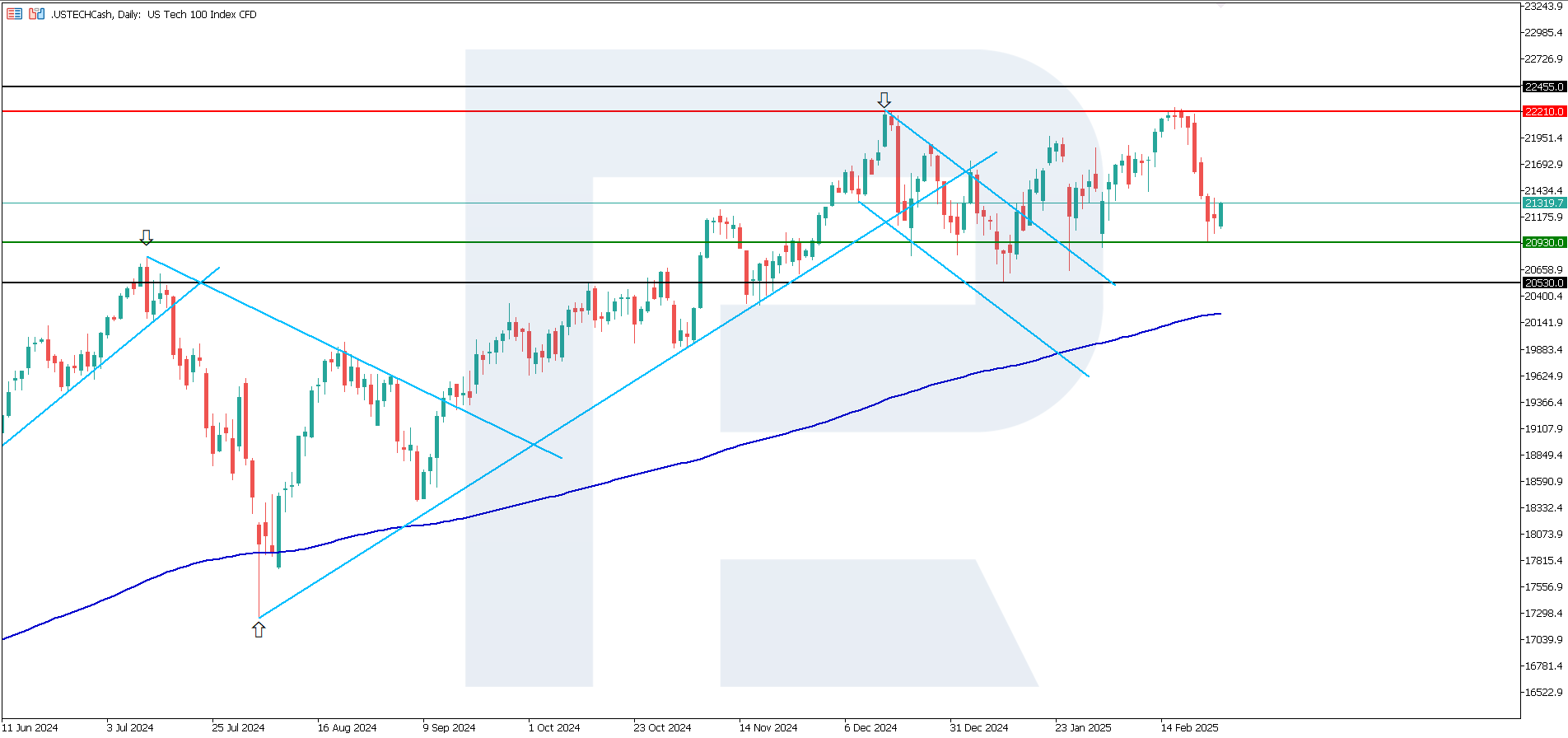

US Tech technical analysis

The US Tech stock index dipped by nearly 6% in a massive decline. Subsequently, a support level formed at 20,930.0, with resistance at 22,210.0. The next downside target could be 20,530.0.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 20,930.0 support level could push the index down to 20,530.0

- Optimistic US Tech forecast: a breakout above the 22,210.0 resistance level could boost the index to 22,455.0

Asian index forecast: JP 225

- Recent data: Japan’s core CPI was 3.2% year-on-year in January

- Market impact: if inflation is higher than expected, investors may fear the regulator’s more decisive moves and reduce their positions in stocks.

Fundamental analysis

Japan’s core CPI measures changes in prices of goods and services, excluding the most volatile components. The indicator is considered a more accurate gauge of long-term inflation dynamics than the overall CPI. The indicator came out above expectations of 3.1% and the previous reading of 3.0%.

For Japan, where inflation has been low for many years, such readings indicate larger-than-usual inflation processes in the economy. The current data may confirm the Bank of Japan’s plans to raise the key rate further, which may have a temporary chilling effect on stock market players.

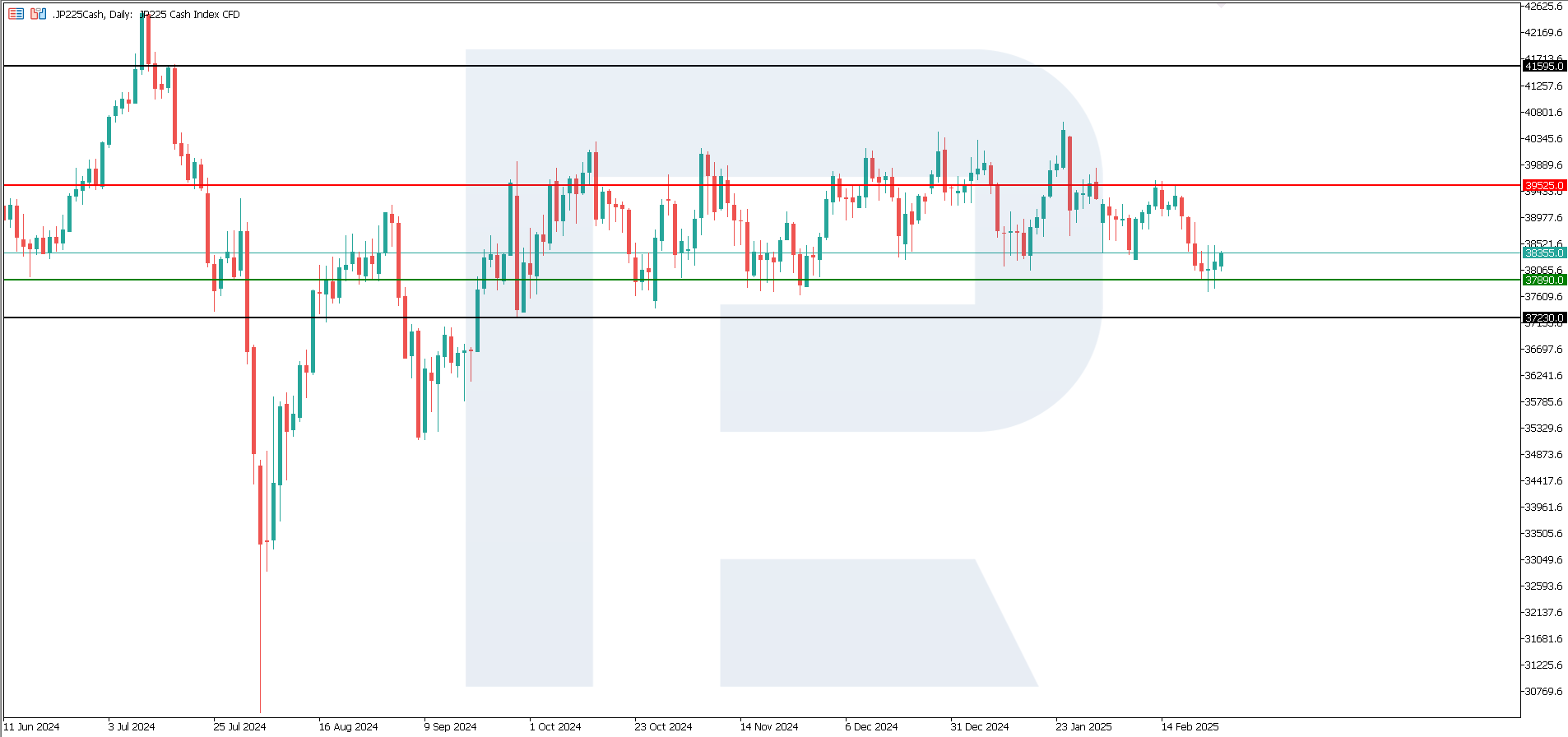

JP 225 technical analysis

After exiting a months-long sideways channel, the JP 225 stock index will highly likely form a new one. According to the JP 225 technical analysis, the downtrend will unlikely begin until the quotes breach the 37,230.0 level and consolidate below it.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 37,890.0 support level could send the index down to 37,230.0

- Optimistic JP 225 forecast: a breakout above the 39,525.0 resistance level could propel the index to 41,595.0

European index forecast: DE 40

- Recent data: based on preliminary data, Germany’s composite PMI was 51.0 in February

- Market impact: the increase in composite PMI may drive up quotes as investors expect companies to have higher earnings amid stronger business activity

Fundamental analysis

The manufacturing sector is contracting but is already showing signs of improvement. The service sector remains the growth driver. This may lead to different dynamics in the stocks of specific companies, with manufacturing companies recovering more slowly than service ones.

Overall, the released PMI data shows some improvement in the outlook compared to the previous month and may bolster the German stock market, especially if investors expect further economic recovery.

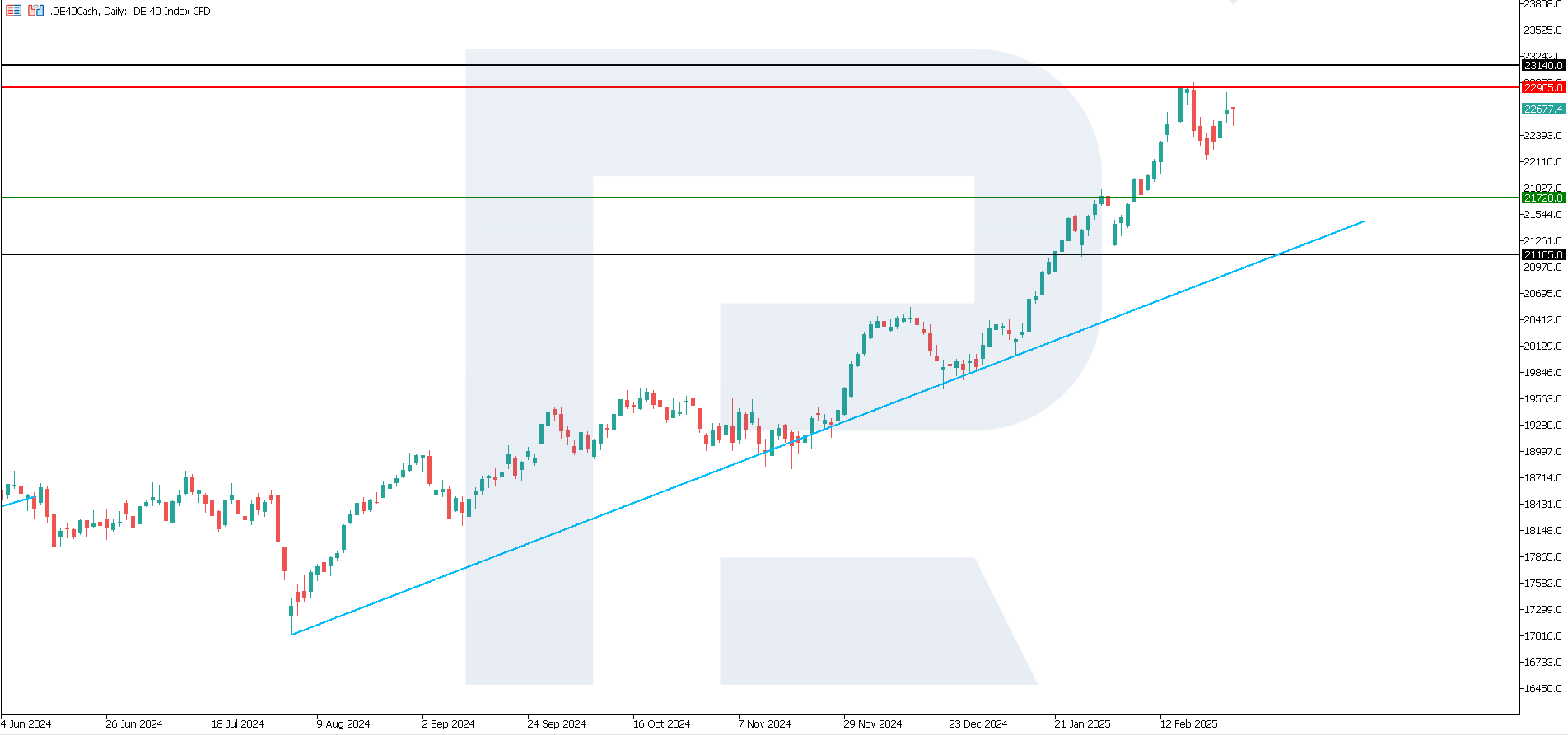

DE 40 technical analysis

Following a 3.52% decline, the DE 40 stock index maintains an upward trajectory. The quotes are expected to consolidate between the current resistance and support levels in the short term. Technical analysis shows that there are still prerequisites for further growth of the DE 40 index.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 21,720.0 support level could send the index down to 21,105.0

- Optimistic DE 40 forecast: a breakout above the 22,905.0 resistance level could boost the index to 23,140.0

Summary

US stock indices are in a downtrend, the duration of which is too early to determine. The Japanese JP 225 appears to form another sideways channel with new boundaries. After a correction, the German DE 40 rushed to break the resistance level and then to a new all-time high.