World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 28 January 2025

Global stock indices plummeted after the news about the Chinese alternative to ChatGPT. Discover more in our analysis and forecast for global indices for 28 January 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: US preliminary composite PMI came in at 52.4 points in January

- Market impact: the indicator reflects the general economic environment in the US, combining data from the manufacturing and services sectors

Fundamental analysis

A composite PMI reading above 50.0 points indicates economic growth, while the decline from 55.4 to 52.4 points to a slowdown. A decrease in composite and services PMIs signals an economic decline, which may cause concerns among investors about future corporate earnings, potentially sending down stock prices.

Undoubtedly, a new AI-based product from Chinese startup DeepSeek has not gone unnoticed. The company’s app rose to the top of App Store charts, challenging more expensive models such as OpenAI. This has raised questions about the feasibility of planned spending of hundred of billions of dollars on AI technology by companies such as Alphabet Inc., Meta, and Microsoft Corp.

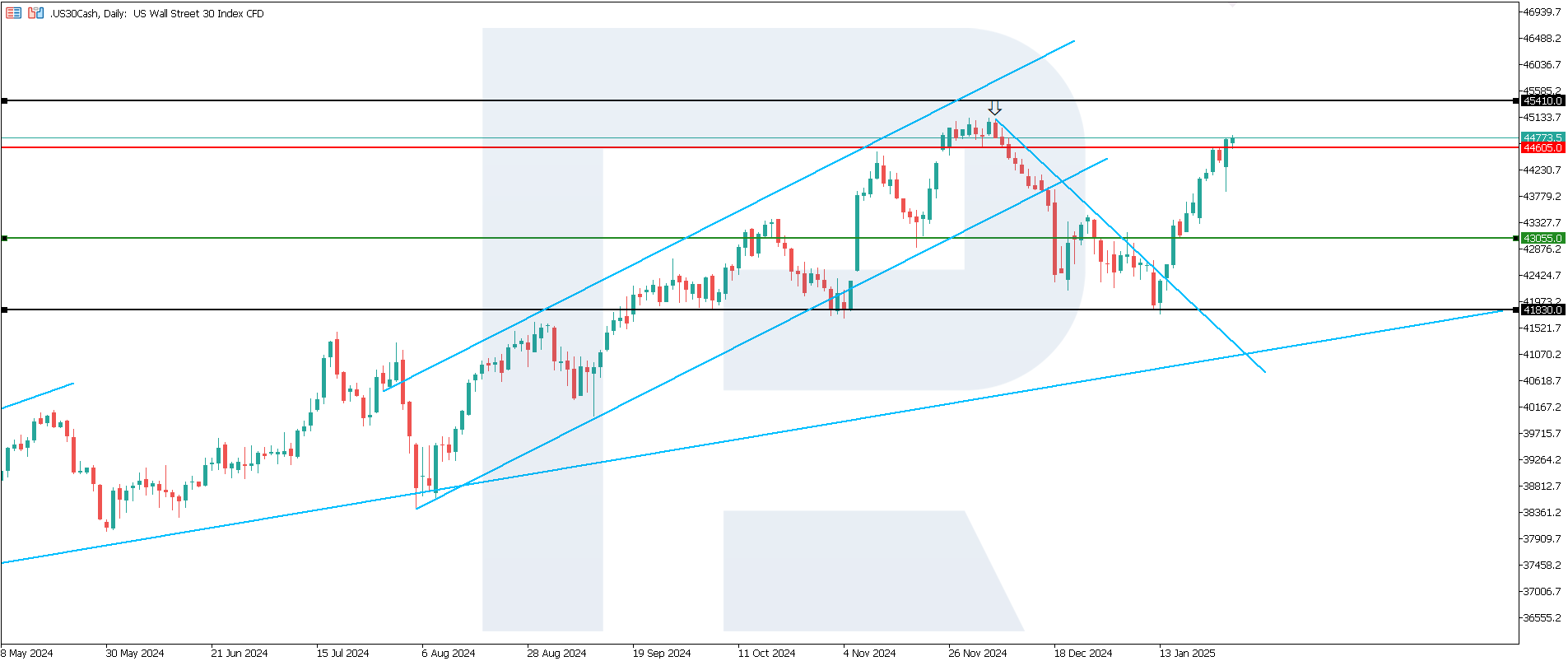

US 30 technical analysis

The US 30 stock index edged higher after yesterday’s market close since the technology sector does not have a significant share in its composition. The uptrend continues, with the price breaking above the 44,605.0 resistance level. According to the US 30 technical analysis, it has the potential to reach a new all-time high.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 43,055.0 support level could push the index down to 41,830.0

- Optimistic US 30 forecast: if the price consolidates above the previously breached resistance level at 44,605.0, it could climb to 45,410.0

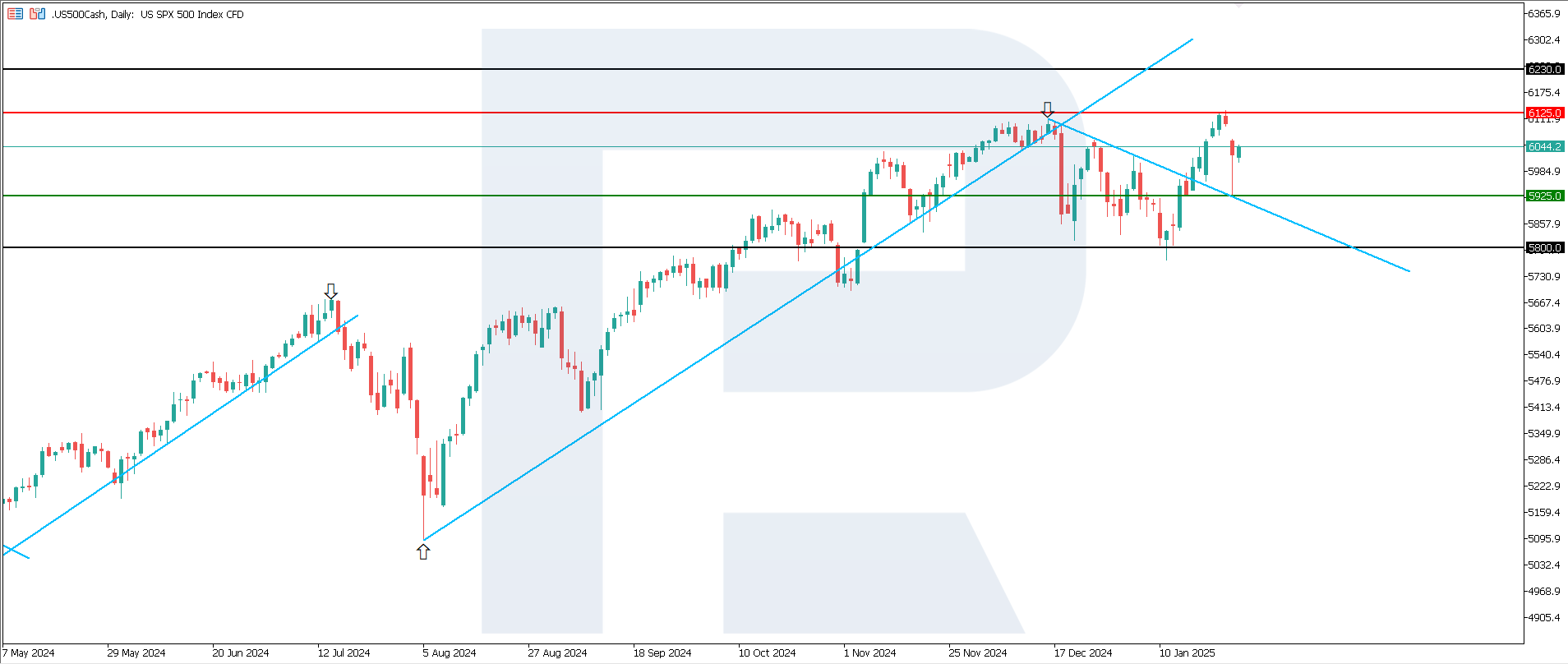

US 500 technical analysis

The US 500 stock index plunged by 2.8%. However, the price failed to break below the 5,925.0 support level. The uptrend will unlikely continue. According to the US 500 technical analysis, a sideways channel could form.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,925.0 support level could send the index down to 5,800.0

- Optimistic US 500 forecast: a breakout above the 6,125.0 resistance level could drive the index to 6,230.0

US Tech technical analysis

The US Tech stock index fell the most by over 5% but could not overcome the 21,030.0 support level. The uptrend will unlikely continue, with the quotes probably entering a sideways channel. According to the US Tech analysis, the price will unlikely reach a new all-time high in the short term.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 21,030.0 support level could push the index down to 20,530.0

- Optimistic US Tech forecast: a breakout above the 21,935.0 resistance level could propel the index to 22,220.0

Asia indices forecast

- Recent data: the Bank of Japan raised the interest rate to 0.50%

- Market impact: the rate hike points to a fight against inflation but also poses risks to economic growth

Fundamental analysis

The rate hike makes borrowing more expensive for companies, which may reduce their earnings and investments. This will negatively impact share prices, especially in rate-sensitive sectors. Investors may start to reallocate capital from stocks to bonds as bond yields rise following rate hikes.

In the short term, this may exert pressure on the stock market, especially for export-oriented companies. The long-term effect will depend on how successfully the Bank of Japan can control inflation and maintain economic growth.

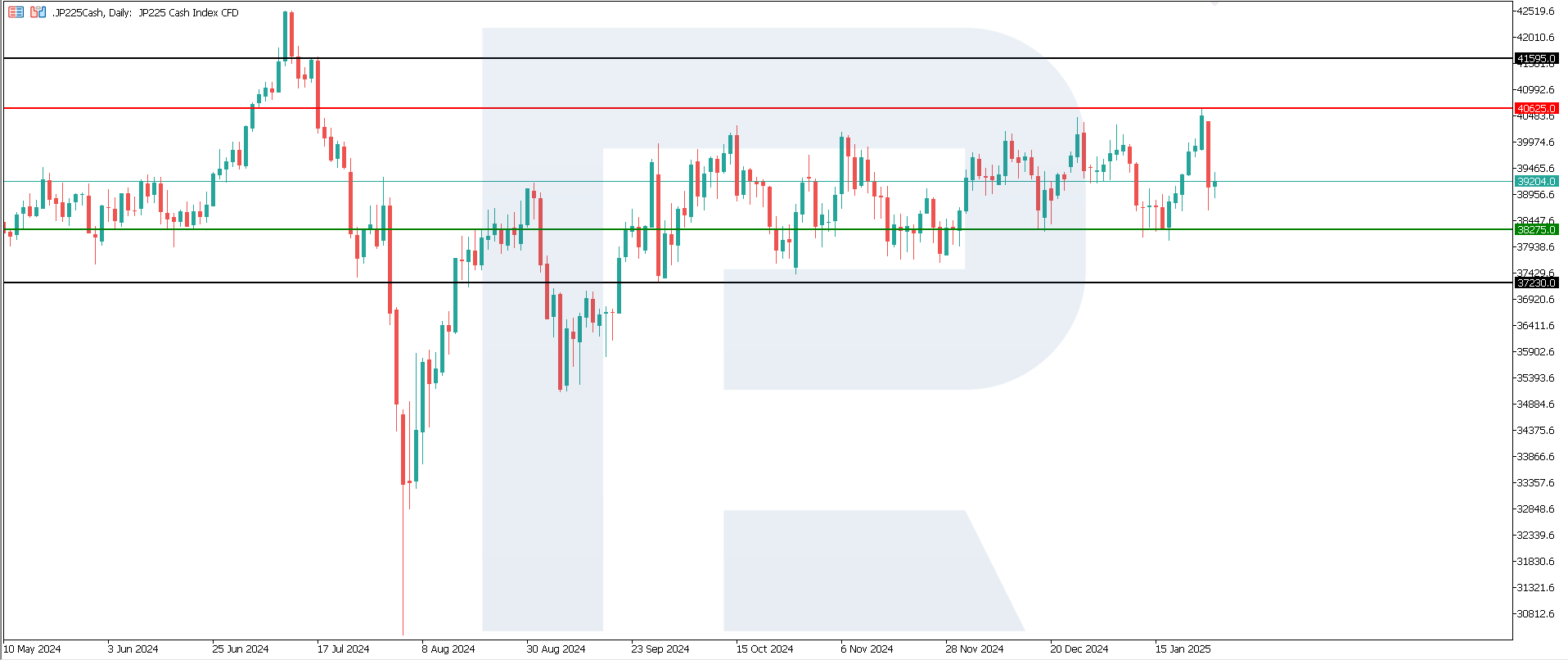

JP 225 technical analysis

The JP 225 stock index briefly exited a sideways range and returned to it, shifting its upper boundary to 40,625.0. According to the JP 225 technical analysis, the uptrend is unlikely, with the price expected to trade within a sideways range but with another upper boundary.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 38,275.0 support level could push the index down to 37,230.0

- Optimistic JP 225 forecast: a breakout above the 40,625.0 resistance level could propel the index to 41,595.0

European index forecast: DE 40

- Recent data: Germany’s preliminary composite PMI came in at 50.1

- Market impact: a reading above 50.0 indicates growth in business activity in the economy

Fundamental analysis

Composite PMI, which returned to the growth area (50.1), may bolster investor sentiment as it indicates a potential improvement in the economic situation. This may positively affect the stock market, especially if investors expect a further recovery. Growth in the services sector and the increase in the index may improve investor sentiment. However, further dynamics of the indicator will depend on global factors such as inflation, ECB policy, and the global economy.

If improved economic data increases inflationary pressures, this will fuel concerns about the ECB monetary policy tightening. This development may adversely affect the stock market, especially companies with a high debt burden. If the manufacturing sector remains weak, its growth potential will be limited.

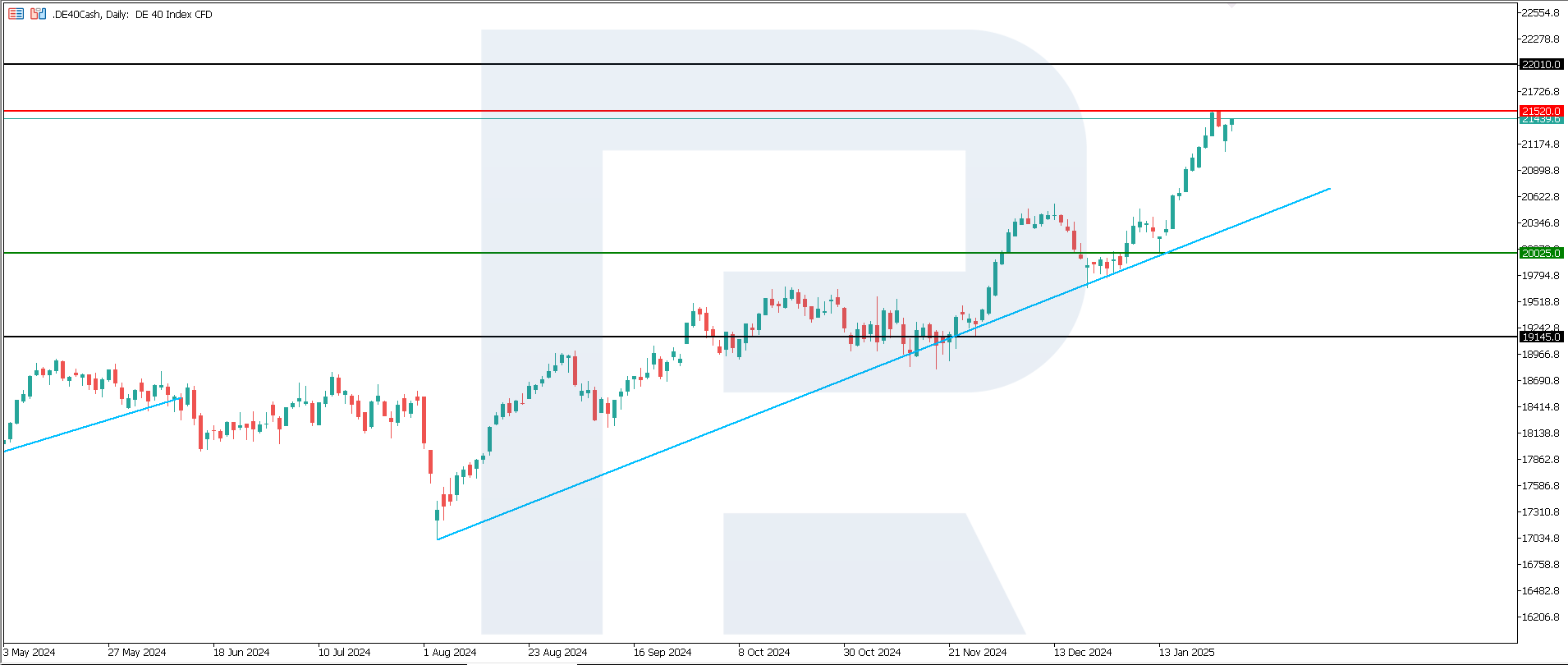

DE 40 technical analysis

The DE 40 stock index remains within an uptrend, with a minor correction observed yesterday within the current trend. The DE 40 index will highly likely continue its ascent and reach a new all-time high in the short term.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 20,025.0 support level could send the index down to 19,145.0

- Optimistic DE 40 forecast: a breakout above the 21,520.0 resistance level could push the index to 22,010.0

Summary

The launch of a Chinese AI-based app from startup DeepSeek challenged US leadership in this sector. Not surprisingly, the US Tech stock index saw the biggest decline, while the industrial US 30 index edged higher after market close. Japan’s JP 225 index continues to trade within a sideways channel. Germany’s DE 40 index is poised for a new all-time high after a correction.