World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 29 May 2025

The court ruling that repealed tariffs imposed by the current US administration boosted investor optimism and global stock indices. Find out more in our analysis and forecast for global indices for 29 May 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: a federal trade court blocks Trump’s global reciprocal tariffs and orders the administration to rescind them

- Market impact: global indices resume growth as demand for stocks from investors increases

Fundamental analysis

The court ruling permanently blocks the tariffs unless an appellate court allows President Donald Trump to reinstate them during further legal proceedings. The Department of Justice has already filed a notice of appeal. This decision significantly undermines his economic agenda, and global markets responded positively.

In its ruling, the three-judge panel of the US Court of International Trade stated that the International Emergency Economic Powers Act (IEEPA), which Trump used to justify the tariffs, does not grant the president authority to impose universal import duties. The US administration has filed an appeal.

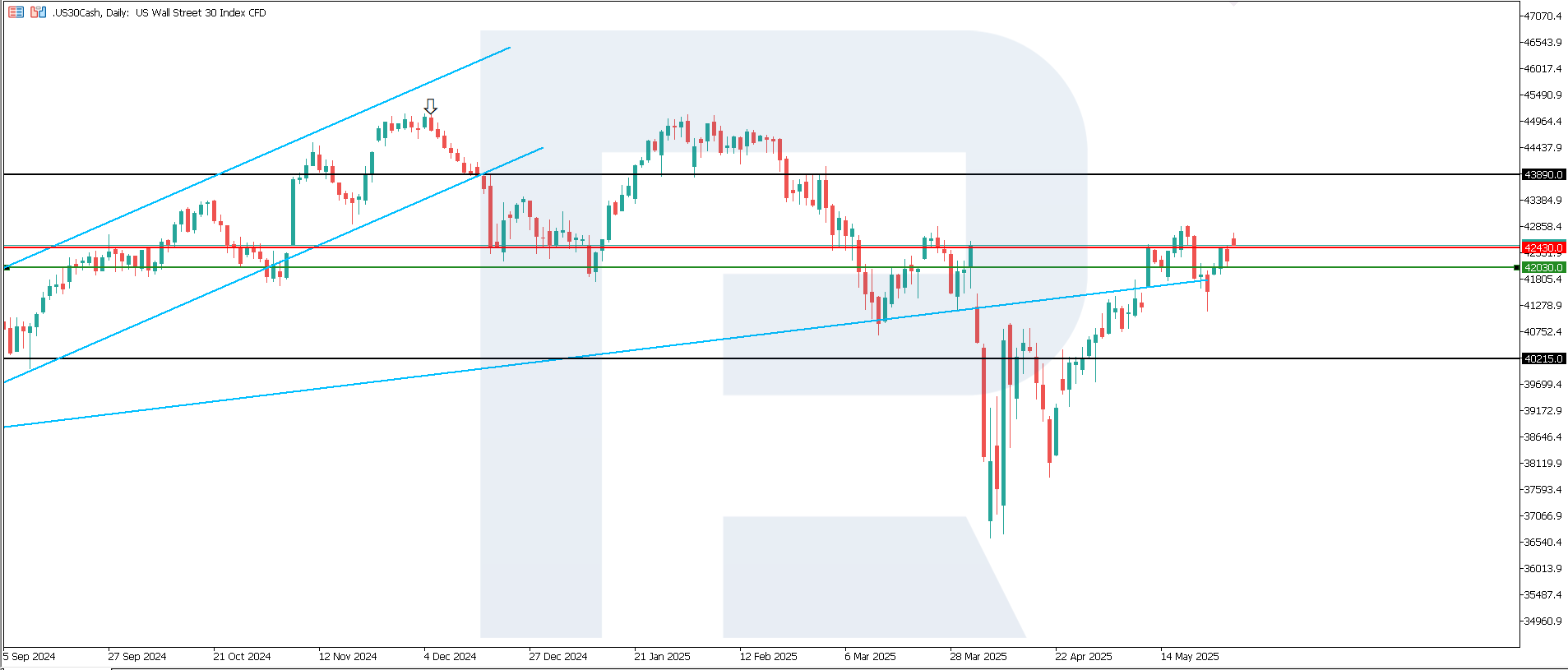

US 30 technical analysis

The US 30 index broke above the recently formed resistance level at 42,430.0, with the support level shifting to 42,030.0. A new level has yet to form. The situation in the US 30 continues to change – this marks the third trend reversal. Technically, the conditions for an uptrend have emerged, but the formation of a sideways channel is also possible. The boundaries of this range may be breached, but without a trend continuation.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 42,030.0 support level could push the index to 40,215.0

- Optimistic US 30 forecast: a breakout above the 42,430.0 resistance level could drive the index to 43,890.0

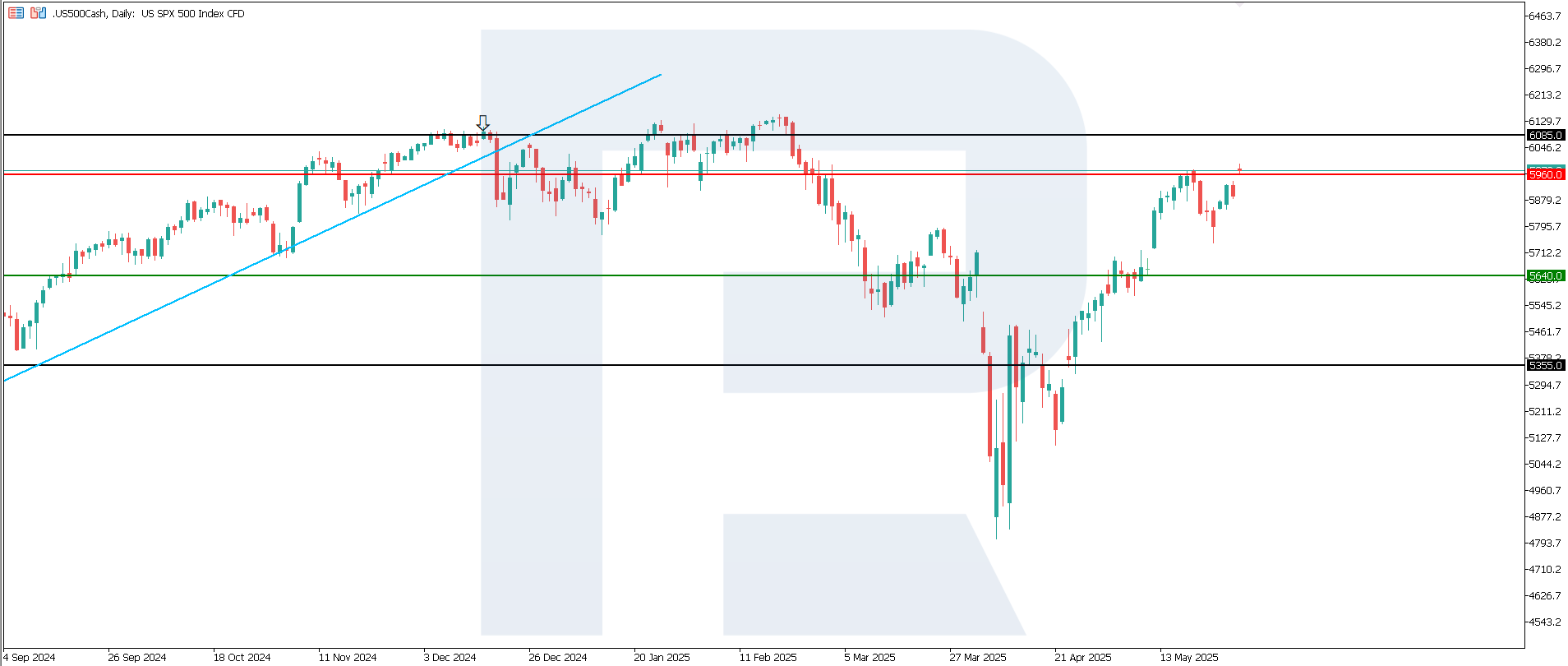

US 500 technical analysis

The US 500 index has entered a corrective phase, with the support area shifting down to 5,640.0 and new resistance forming at 5,960.0. There is a growth impulse, which may lead to a breakout above the current resistance level. The index maintains its upward trajectory, with the potential to evolve into a stable medium-term uptrend.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,640.0 support level could send the index down to 5,355.0

- Optimistic US 500 forecast: a breakout above the 5,960.0 resistance level could propel the index to 6,085.0

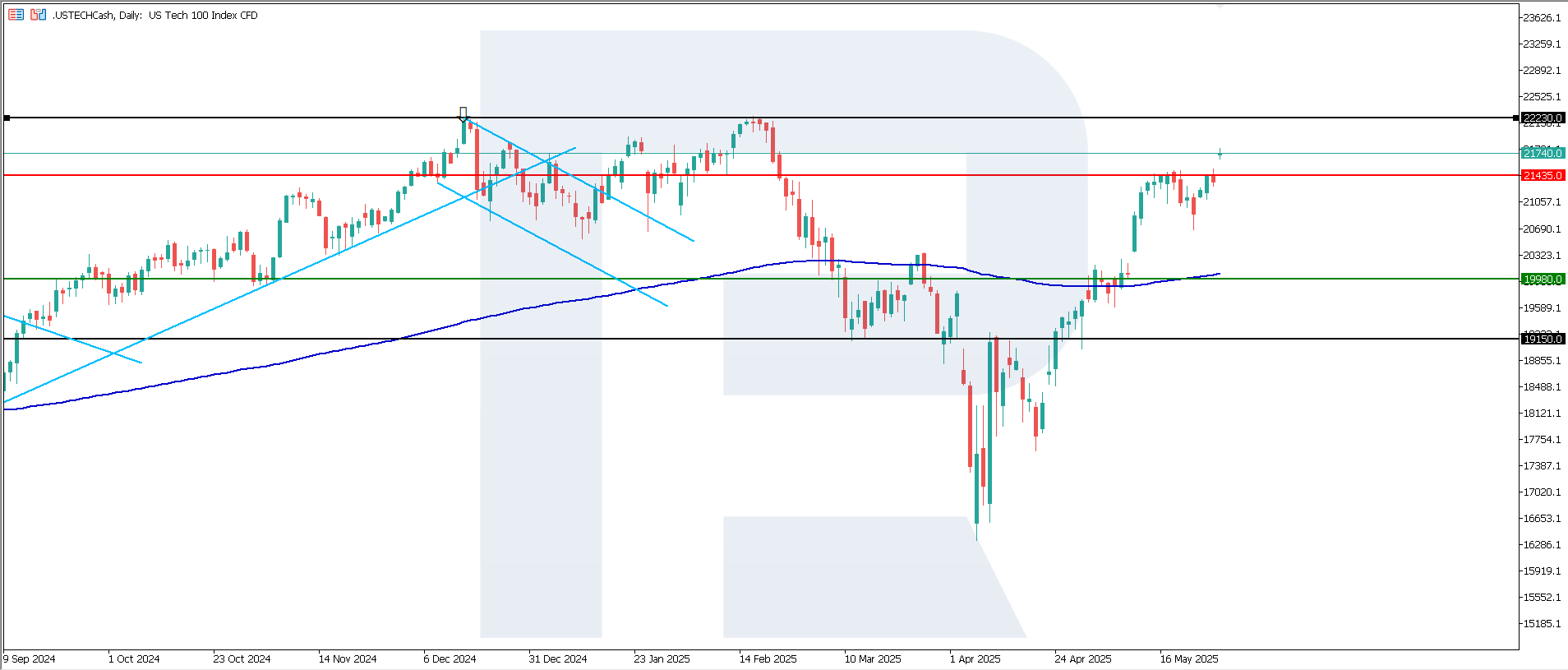

US Tech technical analysis

The US Tech index has consolidated above the 200-day Moving Average, indicating persistent upward momentum. The support line has shifted to 19,980.0, and the resistance level is marked at 21,435.0. Given the current dynamics, the likelihood of a medium-term uptrend remains high if the price consolidates above the 21,435.0 level after breaking above it.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 19,980.0 support level could push the index down to 19,150.0

- Optimistic US Tech forecast: if the price consolidates above the previously breached resistance level at 21,435.0, the index could climb to 22,230.0

Asian index forecast: JP 225

- Recent data: Bank of Japan’s core CPI for May (preliminary) came in at 2.4%

- Market impact: if inflation continues to rise, the Bank of Japan may adopt tighter measures – traditionally perceived as a bearish signal for the stock market

Fundamental analysis

The Bank of Japan’s core Consumer Price Index (CPI) reflects the year-over-year price change for goods and services, excluding fresh food. In May 2025, the figure stood at 2.4%, higher than the forecast of 2.3% and the previous reading of 2.2%, indicating that inflation in Japan remains persistent and may be intensifying.

Higher-than-expected inflation increases pressure on the Bank of Japan to tighten monetary policy (e.g., raising interest rates). This could boost bond yields and make equities less attractive. Traders and analysts will now closely monitor BoJ statements and further macroeconomic data to assess the likelihood of a policy shift.

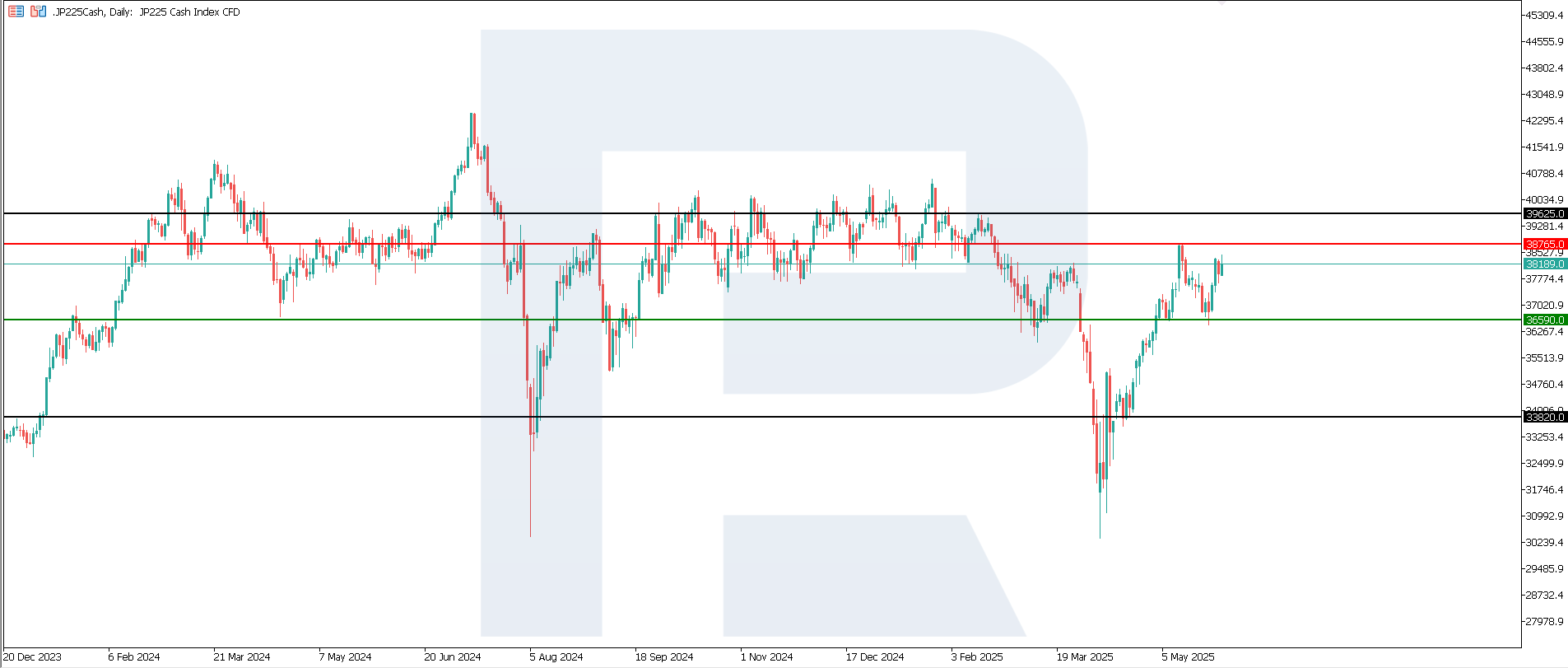

JP 225 technical analysis

The JP 225 index rebounded from the 36,590.0 support level and headed towards resistance at 38,765.0. If this level is breached, the previously formed medium-term uptrend will continue. At the moment, there are no signs of a trend reversal.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 36,590.0 support level could push the index down to 33,820.0

- Optimistic JP 225 forecast: a breakout above the 38,765.0 resistance level could drive the index to 39,625.0

European index forecast: DE 40

- Recent data: Germany’s unemployment rate for May (preliminary) was 6.3%

- Market impact: since the actual figure matched the forecast and remained unchanged from the previous period, investors are unlikely to revise their strategies significantly

Fundamental analysis

Germany’s unemployment rate (6.3% for May 2025) reflects the proportion of the working-age population actively seeking employment. This figure matched both the forecast and the previous month, indicating stability in the labour market. It shows neither improvement nor deterioration.

The absence of negative surprises may help maintain the current market sentiment. Given the stagnant labour market, investors may shift focus to upcoming data on wage growth, inflation, and PMI to gain a clearer picture of economic conditions. This report has a moderate impact on the German stock market and is interpreted as a neutral signal.

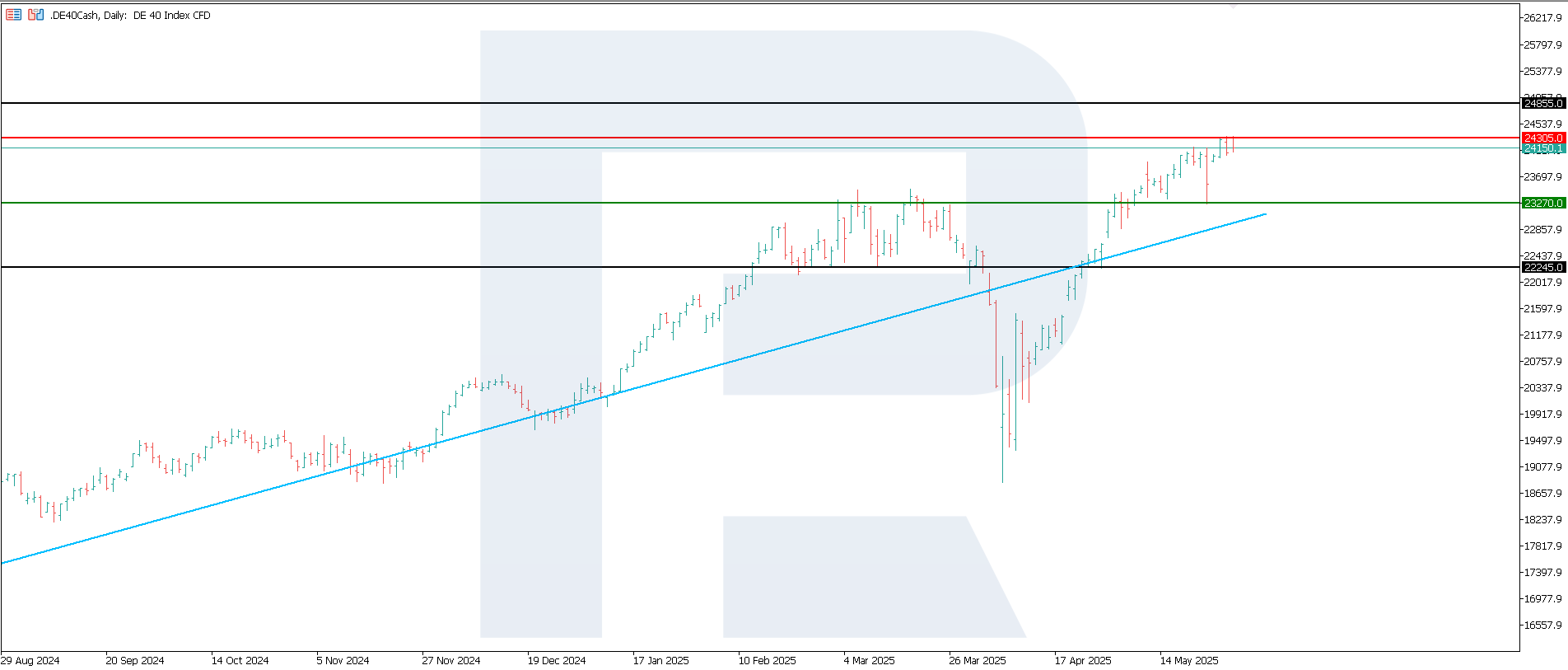

DE 40 technical analysis

The DE 40 index has established key levels: resistance at 24,305.0 and support at 23,270.0. The current trend shows strengthening upward momentum. The index retains the potential to reach a new all-time high.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 23,270.0 support level could send the index down to 22,245.0

- Optimistic DE 40 forecast: a breakout above the 24,305.0 resistance level could propel the index to 24,855.0

Summary

The US court decision to repeal imposed tariffs generated positive sentiment among investors. Several existing tariffs on specific goods, such as aluminium and steel, remain unaffected by Wednesday’s ruling as the president did not invoke IEEPA to justify them. The US 30 index once again broke above the resistance level, reversing the early signs of a downtrend. Japan’s JP 225 is advancing towards its current resistance level. The US 500 and US Tech indices continue to trade in an uptrend, with Germany’s DE 40 aiming for another all-time high.