World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 5 June 2025

The US administration increased tariffs on steel and aluminium from 25% to 50%. At the same time, investment in AI reached record highs. Find out more in our analysis and forecast for 5 June 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: the S&P US composite PMI came out at 53 in May

- Market impact: rising PMI may indicate stable economic growth, supporting corporate profits

Fundamental analysis

Robust S&P composite PMI data could reinforce the view that the Federal Reserve will not rush to cut rates, which may restrain stock growth in the short term, especially in rate-sensitive tech stocks. As the economy recovers, industrials, financials, and energy shares could gain.

With AI sector expansion and technology adoption, spending on computer equipment in Q1 2025 made the largest-ever contribution to US GDP on record. The decision to increase tariffs on steel and aluminium also boosted metals sector stocks.

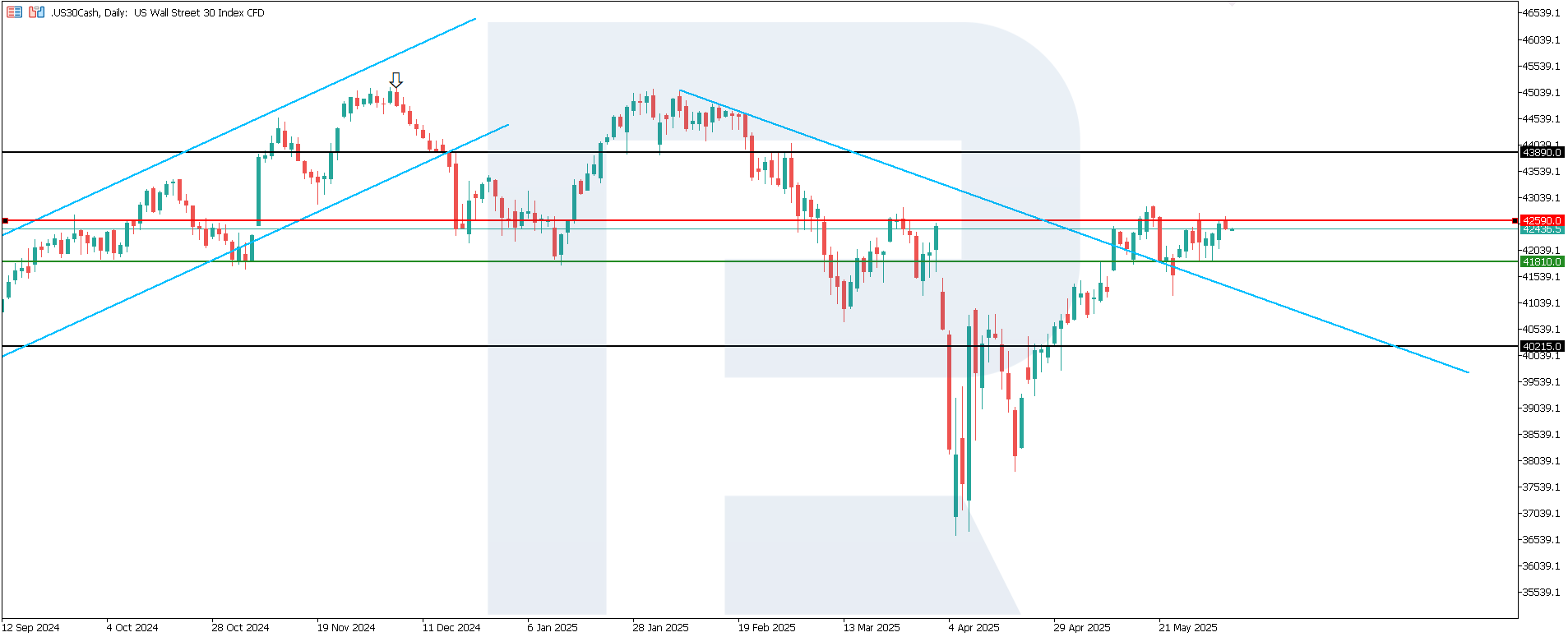

US 30 technical analysis

The US 30 index broke above the 42,590.0 resistance level, with the support line shifting to 41,810.0. The US 30 outlook remains unstable, marking the third directional shift. Despite technical signs of an emerging uptrend, the likelihood of moving into a sideways consolidation phase remains high.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 41,810.0 support level could push the index to 40,215.0

- Optimistic US 30 forecast: a breakout above the 42,590.0 resistance level could drive the index to 43,890.0

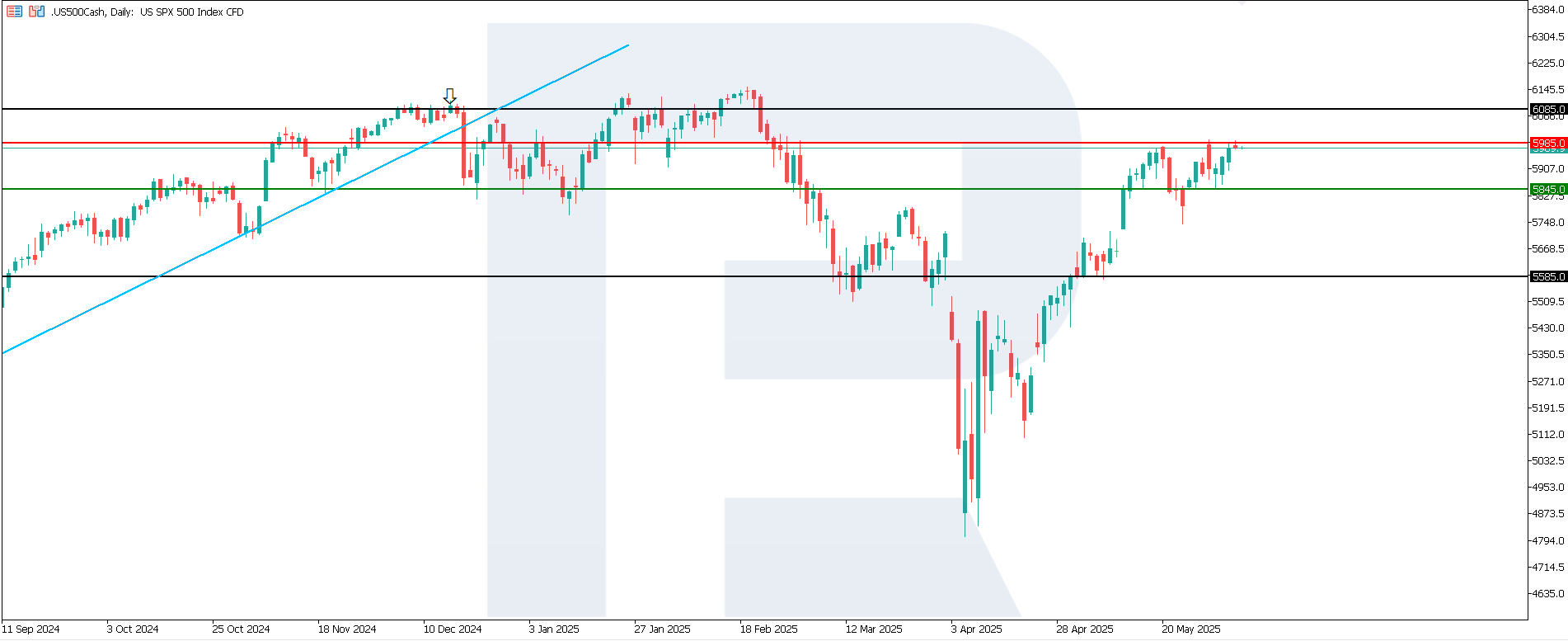

US 500 technical analysis

The US 500 index continues to rise, with the support level shifting to 5,845.0 and resistance at 5,985.0. The price is attempting to break above the current resistance level.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,845.0 support level could send the index down to 5,585.0

- Optimistic US 500 forecast: a breakout above the 5,985.0 resistance level could propel the index to 6,085.0

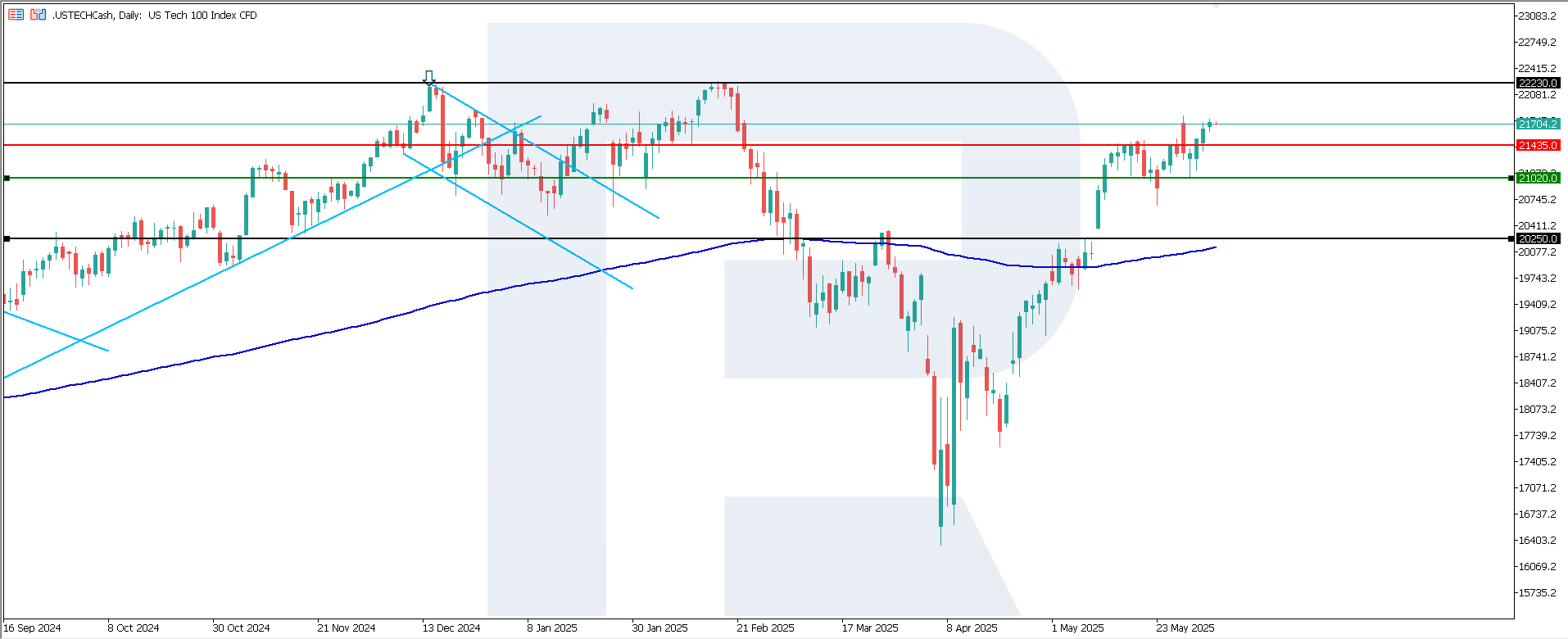

US Tech technical analysis

The US Tech index broke above the 21,435.0 resistance level, with a new one yet to form. The support level has shifted to 21,020.0, while the resistance line is located at 21,435.0. If prices consolidate above this level, a stable medium-term uptrend will likely form.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 21,020.0 support level could push the index down to 20,250.0

- Optimistic US Tech forecast: if the price consolidates above the previously breached resistance level at 21,435.0, the index could climb to 22,230.0

Asian index forecast: JP 225

- Recent data: au Jibun Bank Japan PMI for May came in at 51.0

- Market impact: investors may react moderately positively, especially in sectors focused on domestic demand and services

Fundamental analysis

Despite a slowdown in PMI growth compared to the previous month, activity remains above the 50 threshold, indicating continued economic recovery. Slower growth may raise expectations that the Bank of Japan will take additional stimulus measures, which could support the equity market.

However, the lack of growth acceleration may dampen investor optimism. If the slowdown continues, it could trigger a correction in shares of companies sensitive to domestic consumer demand and economic activity.

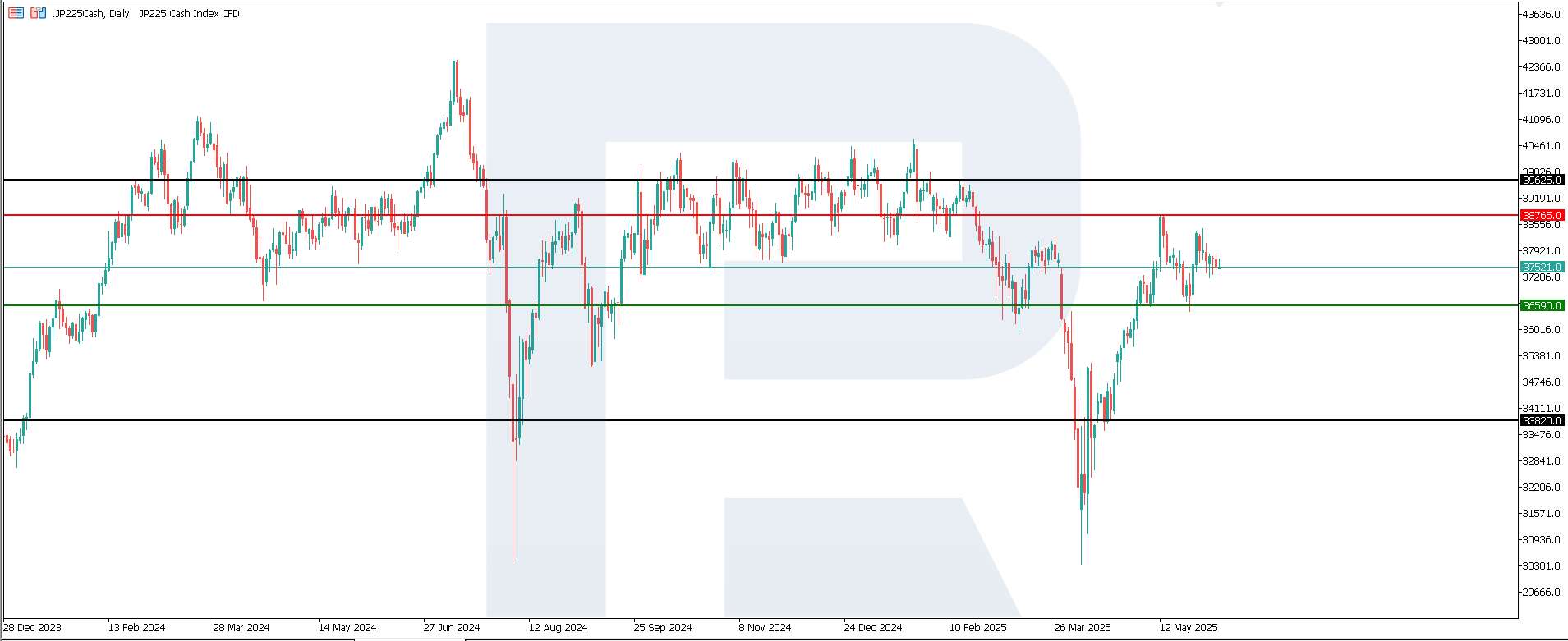

JP 225 technical analysis

The JP 225 index is rebounding from the 36,590.0 support level, heading towards resistance at 38,765.0. A breakout above this level will confirm the continuation of the medium-term uptrend. Currently, there are no signs of a trend reversal.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 36,590.0 support level could push the index down to 33,820.0

- Optimistic JP 225 forecast: a breakout above the 38,765.0 resistance level could drive the index to 39,625.0

European index forecast: DE 40

- Recent data: Germany’s manufacturing PMI for May was 48.3

- Market impact: this is a negative factor for the stock market, particularly for engineering, automotive, and export companies

Fundamental analysis

Germany’s manufacturing PMI for May 2025 came in at 48.3, below the forecast of 48.8 and the previous reading of 48.4. This increases investor concerns as the index has long remained below the critical 50 level that separates expansion from contraction in business activity.

The updated PMI data confirms a slowdown in Germany’s manufacturing sector. Investors should exercise caution as pressure on the German equity market may continue, especially in traditional sectors like heavy industry, exporters, and automotive.

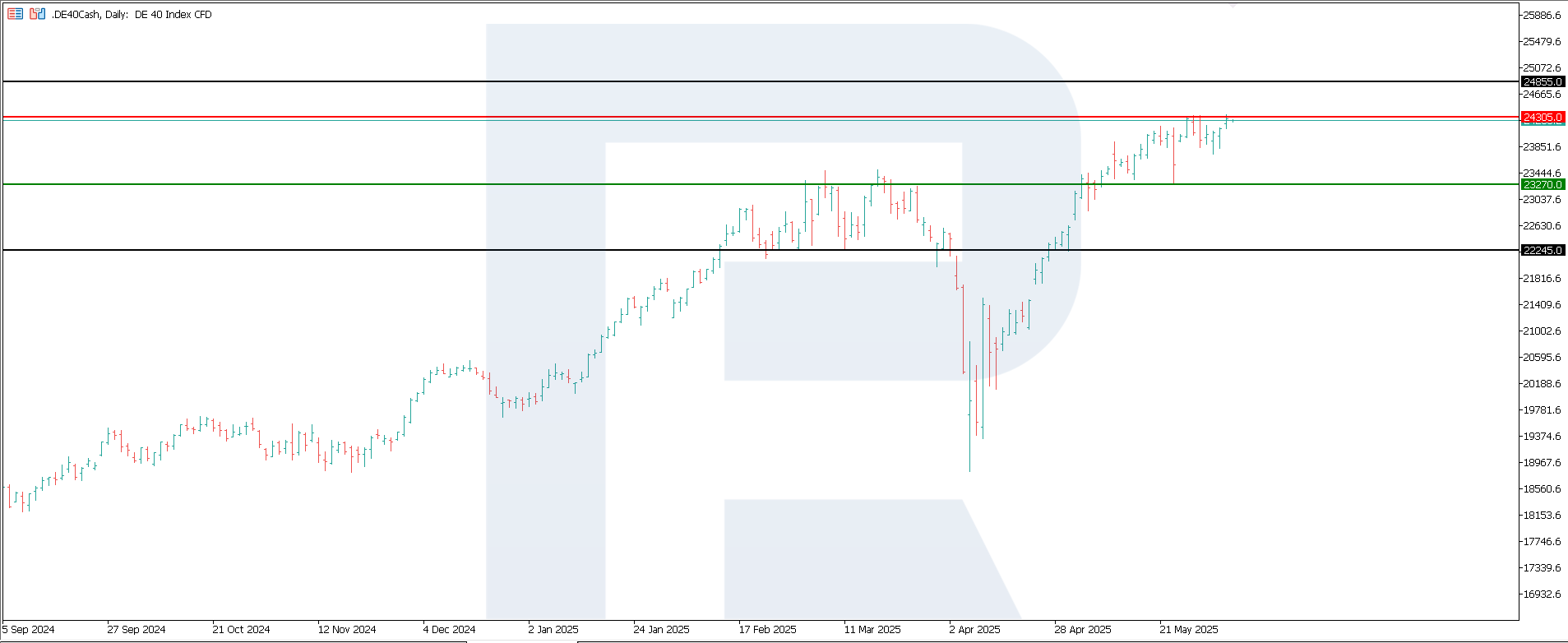

DE 40 technical analysis

The DE 40 index has formed key levels, with resistance at 24,305.0 and support around 23,270.0. The current market dynamics indicate a stable uptrend, increasing the likelihood of new all-time highs.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 23,270.0 support level could send the index down to 22,245.0

- Optimistic DE 40 forecast: a breakout above the 24,305.0 resistance level could propel the index to 24,855.0

Summary

The US 30 broke above the resistance level and reversed the emerging downtrend. Japan’s JP 225 is advancing towards its current resistance level. The US 500 and US Tech indices continue to trade in an uptrend, with Germany’s DE 40 aiming for another all-time high. Investor focus will turn to upcoming US labour market data, which will serve as the main economic indicator following the recent GDP report. In case of mixed results, the interpretation by the Federal Reserve will regain importance.