World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 8 April 2025

New US tariff policies led to the sharpest decline in global stock indices since the coronavirus pandemic. Find out more in our analysis and forecast for global indices for 8 April 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: US unemployment rose to 4.2% in March

- Market impact: this may negatively impact technology and consumer stocks

Fundamental analysis

Strong NFP data, especially combined with a simultaneous increase in unemployment, creates a challenging environment for the stock market. It shows that the economy remains resilient but may push back expectations of a rate cut, creating risks of a prolonged correction in the near term, especially for rate-sensitive sectors.

BlackRock Inc. CEO Laurence Fink believes the US is in a recession. He warned that stock markets may fall lower as US trade policies destabilise the global economy. The US Federal Reserve’s emergency meeting is scheduled for today, where the regulator may decide to revise monetary policy.

US 30 technical analysis

The US 30 stock index broke below the 40,670.0 support level, with resistance shifting to 42,535.0. A new support level is yet to form; quotes are in free fall. The downtrend will likely continue to the target of 35,060.0.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: if the price consolidates below the previously breached support level at 40,670.0, the index could dip to 35,060.0

- Optimistic US 30 forecast: a breakout above the 42,535.0 resistance level could drive the index to 43,890.0

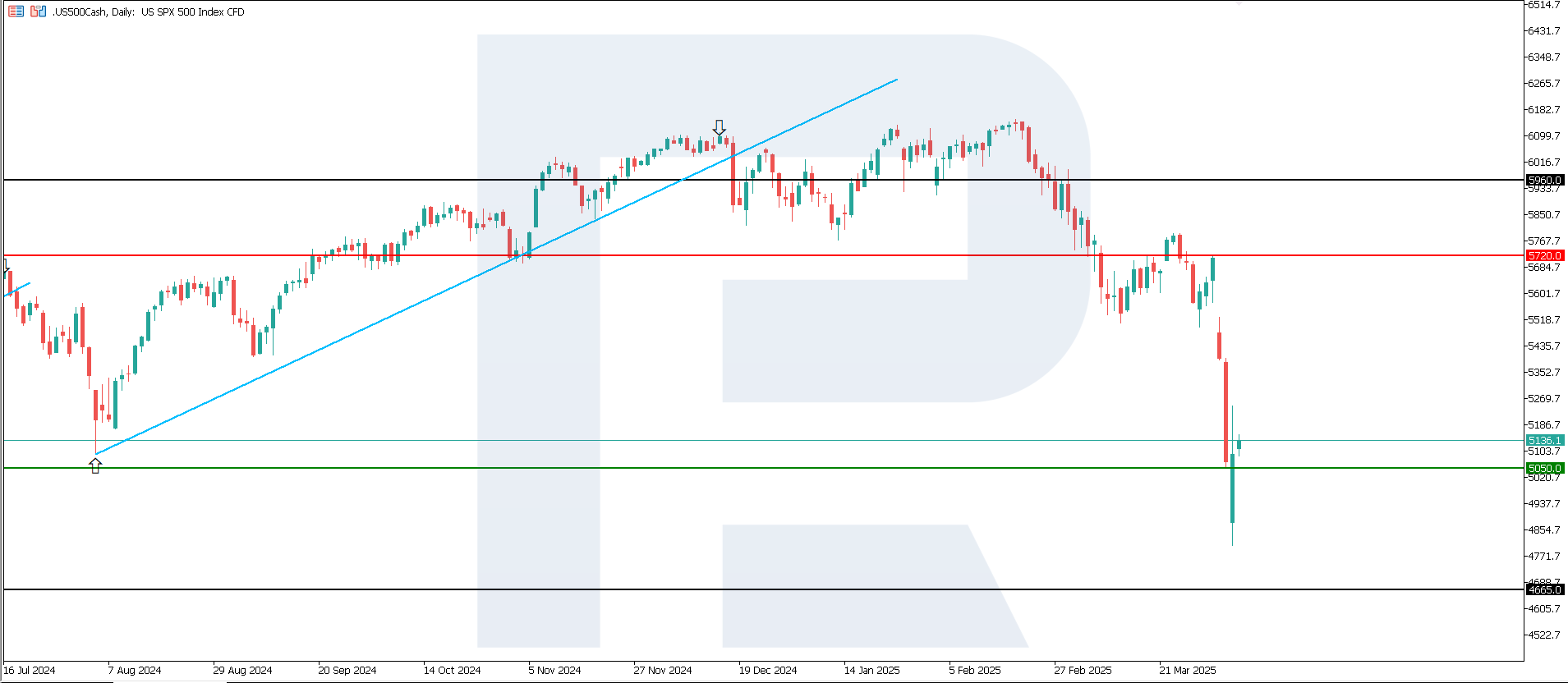

US 500 technical analysis

The US 500 stock index managed to stay above 5,000.0. The support level formed at 5,050.0, with resistance at 5,720.0. The downtrend remains in force, with the nearest potential downside target at 4,665.0.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,050.0 support level could send the index down to 4,665.0

- Optimistic US 500 forecast: a breakout above the 5,720.0 resistance level could propel the index to 5,960.0

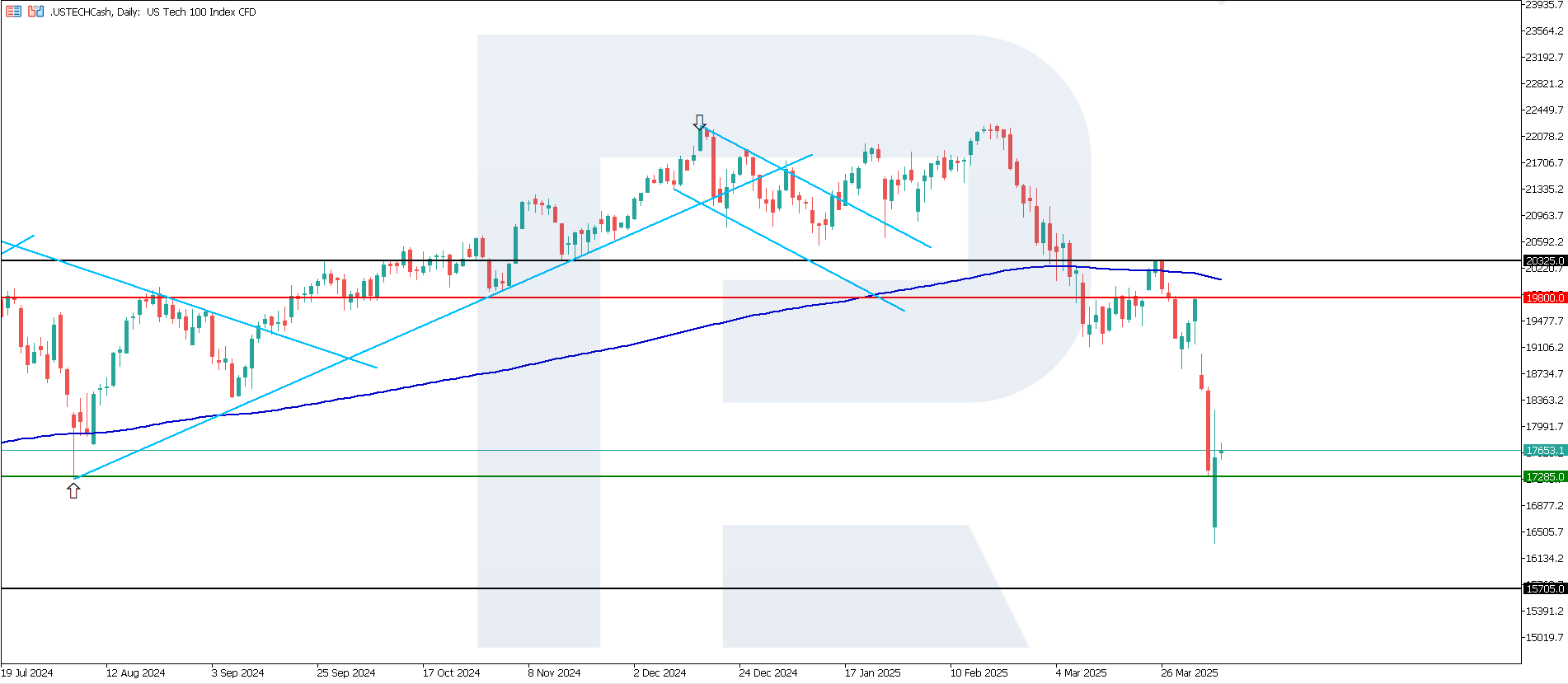

US Tech technical analysis

The bearish trend in the US Tech index continues, with the support level at 17,285.0 and the resistance level at 19,800.0. The nearest downside target could be 15,705.0.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 17,285.0 support level could push the index down to 15,705.0

- Optimistic US Tech forecast: a breakout above the 19,800.0 resistance level could propel the index to 20,325.0

Asian index forecast: JP 225

- Recent data: the damage from the imposed US tariffs for Japan may reach 86 billion USD

- Market impact: stocks of automakers may come under pressure

Fundamental analysis

Japan may lose 86 billion USD or 2% of GDP due to US tariffs on car imports. If there is no consensus on the issue, auto stocks may enter a strong downtrend.

China, Japan, and South Korea have agreed to reactly jointly to US tariffs. Japan’s Prime Minister Shigeru Ishiba held phone talks with US President Donald Trump and agreed to proceed with negotiations.

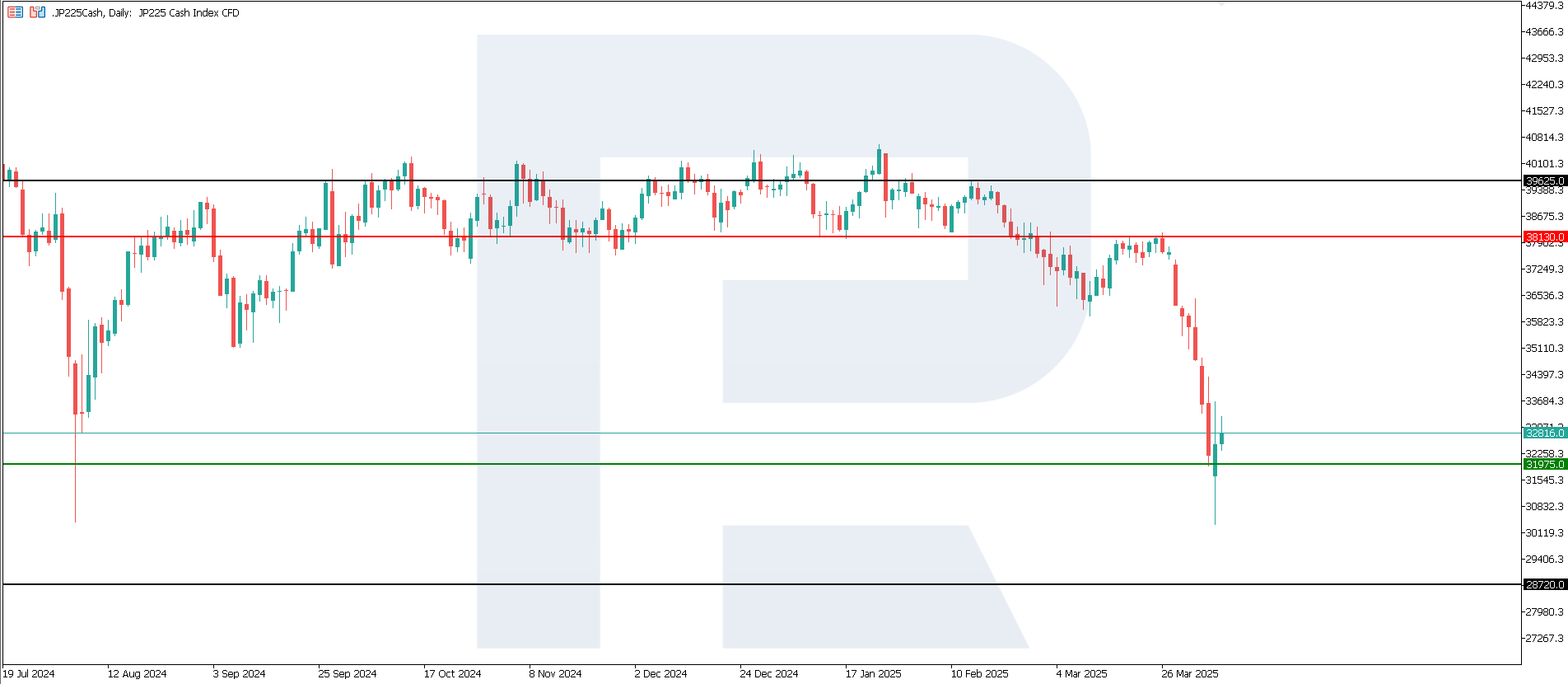

JP 225 technical analysis

The JP 225 stock index tumbled to the lows seen in August 2024. The support level formed at 31,975.0, with resistance at 38,130.0. The price will most likely decline further to 28,720.0.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 31,975.0 support level could send the index down to 28,720.0

- Optimistic JP 225 forecast: a breakout above the 38,130.0 resistance level could propel the index to 39,635.0

European index forecast: DE 40

- Recent data: German CPI came in at 2.2% in March

- Market impact: data in line with forecasts reduces market uncertainty

Fundamental analysis

As the CPI is not spiking, investors have less reason for panic, and expectations of changes from the European Central Bank (ECB) remain more predictable. With inflation close to (or slightly above) target levels, the ECB may not need to raise interest rates urgently or, conversely, ease policy. This predictability may have a moderately positive impact on the stock market.

The US imposed tariffs on EU goods. The European Commission proposes 25% retaliatory measures on some goods imported from the US in response to US duties on steel. The tariffs will take effect on 16 May.

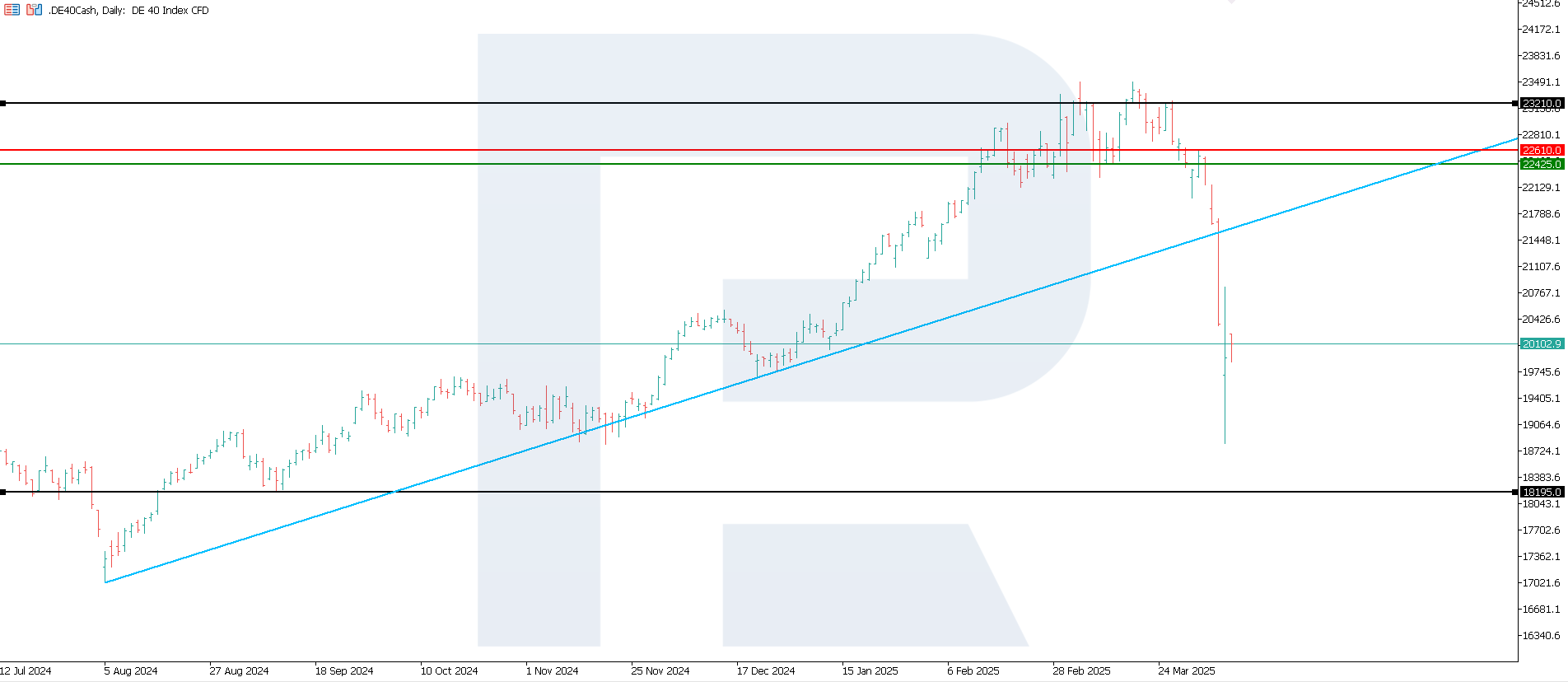

DE 40 technical analysis

The DE 40 stock index entered a downtrend after breaking below the 22,425.0 support level. The resistance level shifted to 22,610.0, with the next downside target at 18,195.0.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: if the price consolidates below the previously breached support level at 22,425.0, the index could plunge to 18,195.0

- Optimistic DE 40 forecast: a breakout above the 22,610.0 resistance level could drive the index to 23,210.0

Summary

All global stock indices are in a downtrend following the US decision to impose new trade tariffs. The US 30 stock index and the German DE 40 index are yet to form support levels, with prices continuing to fall freely. The general negative background may change only if the US Federal Reserve decides to urgently lower the key rate or the US authorities cancel trade tariffs. Otherwise, the bearish trend in stock markets may become long-term.