The AUDUSD rate is trading around 0.6550 amid moderately rising inflation in Australia. Find more details in our analysis for 31 October 2025.

AUDUSD forecast: key trading points

- Market focus: Australian producer prices rose 1.0% in Q3

- Current trend: trading sideways

- AUDUSD forecast for 31 October 2025: 0.6450 or 0.6630

Fundamental analysis

The Australian dollar remains relatively firm against the US dollar as strengthening inflationary pressures have increased expectations that the Reserve Bank of Australia will keep rates unchanged at next week’s meeting.

Recent data showed that producer prices in Australia rose 1.0% in Q3, marking the fastest pace in a year, up from 0.7% and exceeding market forecasts. This increased overall inflationary pressure in the economy, prompting investors to sharply reduce expectations of an RBA interest rate cut at the 4 November policy meeting.

AUDUSD technical analysis

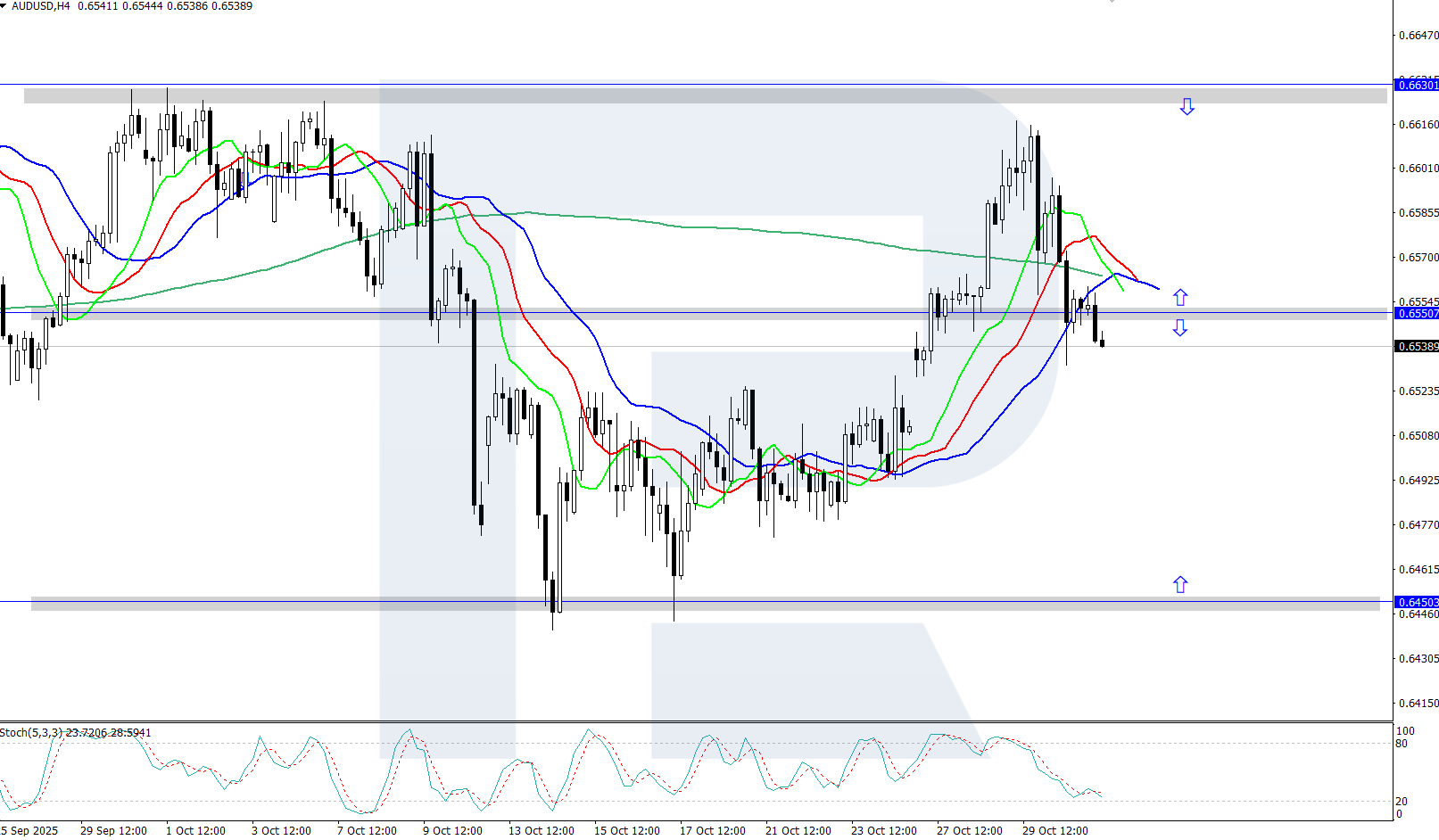

The AUDUSD pair is trading within a limited price range between 0.6450 and 0.6630 following a period of strong upward momentum. The direction of the next breakout will determine the future trajectory of the pair.

The short-term AUDUSD forecast suggests a rally towards the resistance level near 0.6630 if bulls maintain control. Conversely, if bears gain a foothold below 0.6550, the pair could decline towards the lower boundary near 0.6450.

Summary

The AUDUSD pair is consolidating within a price range between 0.6450 and 0.6630. Traders are now focused on next week’s RBA policy decision.

Open Account