The Australian dollar is awaiting the speech of the Reserve Bank of Australia Governor. More details in our analysis for 28 November 2024.

AUDUSD forecast: key trading points

- Thanksgiving Day in the US

- A speech by Reserve Bank of Australia Governor Michele Bullock

- Australia’s building capital expenditure in Q3: previously at -3.8%, currently at 1.1%

- Australia’s plant machinery capital expenditure in Q3: previously at -1.0%, currently at 1.1%

- AUDUSD forecast for 28 November 2024: 0.6424

Fundamental analysis

Today marks Thanksgiving Day in the US, with stock exchanges closed and no news expected.

The fundamental analysis for 28 November 2024 takes into account that Reserve Bank of Australia Governor Bullock will deliver a speech today. Her speeches often provide information into potential directions for the future development of Australia’s monetary policy.

Actual investments in Australia’s construction industry increased to 1.1% from -3.8%. This positive result may suggest some stabilisation in the country’s economy, with the potential for future growth in economic indicators.

The forecast for 28 November 2024 anticipated a rise in investments in plant machinery to 0.2%, but the actual data exceeded expectations, coming in at 1.1%. This shift into positive territory supports the Australian dollar in the near term.

AUDUSD technical analysis

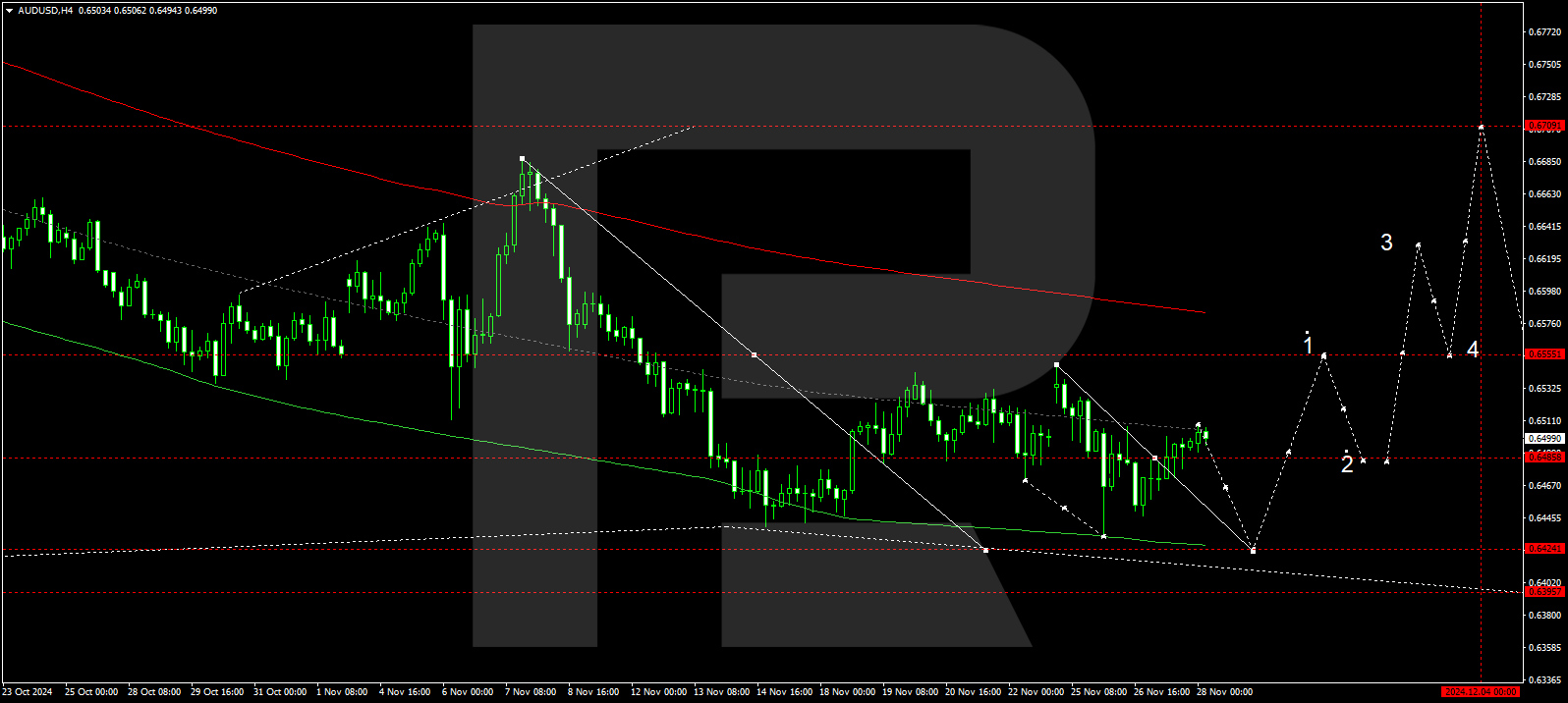

The AUDUSD H4 chart shows that the market has formed a consolidation range around 0.6485, extending it to 0.6548 upwards and 0.6433 downwards. Another decline to 0.6424 is possible today, 28 November 2024. Once the price reaches this level, a growth wave towards 0.6555 will follow. A breakout above the range will open the potential for an upward movement towards 0.6700. If the range breaks downward, the trend could continue towards 0.6400.

The Elliott Wave structure and downward wave matrix, with a pivot point at 0.6555, technically support this scenario for the AUDUSD rate. The market has declined to the lower boundary of a price envelope at 0.6433 before rising to its central line at 0.6485. Another downward wave could develop, targeting the envelope’s lower boundary at 0.6424.

Summary

Bullock’s speech and the technical analysis for today’s AUDUSD forecast suggest that the downward wave could continue towards the 0.6424 level.