Brent price retreated to 66.50 USD per barrel. The market is pondering what OPEC+ will do next. Details – in our analysis for 1 July 2025.

Brent forecast: key trading points

- Brent oil price declines for the second consecutive day, market assesses future OPEC+ actions

- Global supply together with August quotas may rise by 1.5% of total demand

- Brent forecast for 1 July 2025: 67.78

Fundamental analysis

Brent prices fell to 66.50 USD on Tuesday, marking the second straight session of losses. Pressure on quotes increased amid concerns about an oversupply as OPEC+ countries prepare for another production increase.

There is a possibility that in August production volume will rise by 411 thousand barrels per day. Similar decisions were made for May, June, and July. If confirmed, this step will lead to a total production increase of 1.78 million barrels since the beginning of the year, equivalent to more than 1.5% of global demand.

The production growth is seen as a sanction against countries exceeding quotas and as a strategic move by the group’s leader – Saudi Arabia.

The key OPEC+ player aims to regain market share lost to US shale producers and other competitors.

Additional pressure on prices comes from reduced geopolitical tension. The ceasefire between Israel and Iran remains in place. Furthermore, weak business activity in China’s industrial sector, the world’s largest oil importer, has heightened concerns about slowing demand.

The Brent forecast remains cautious.

Brent technical analysis

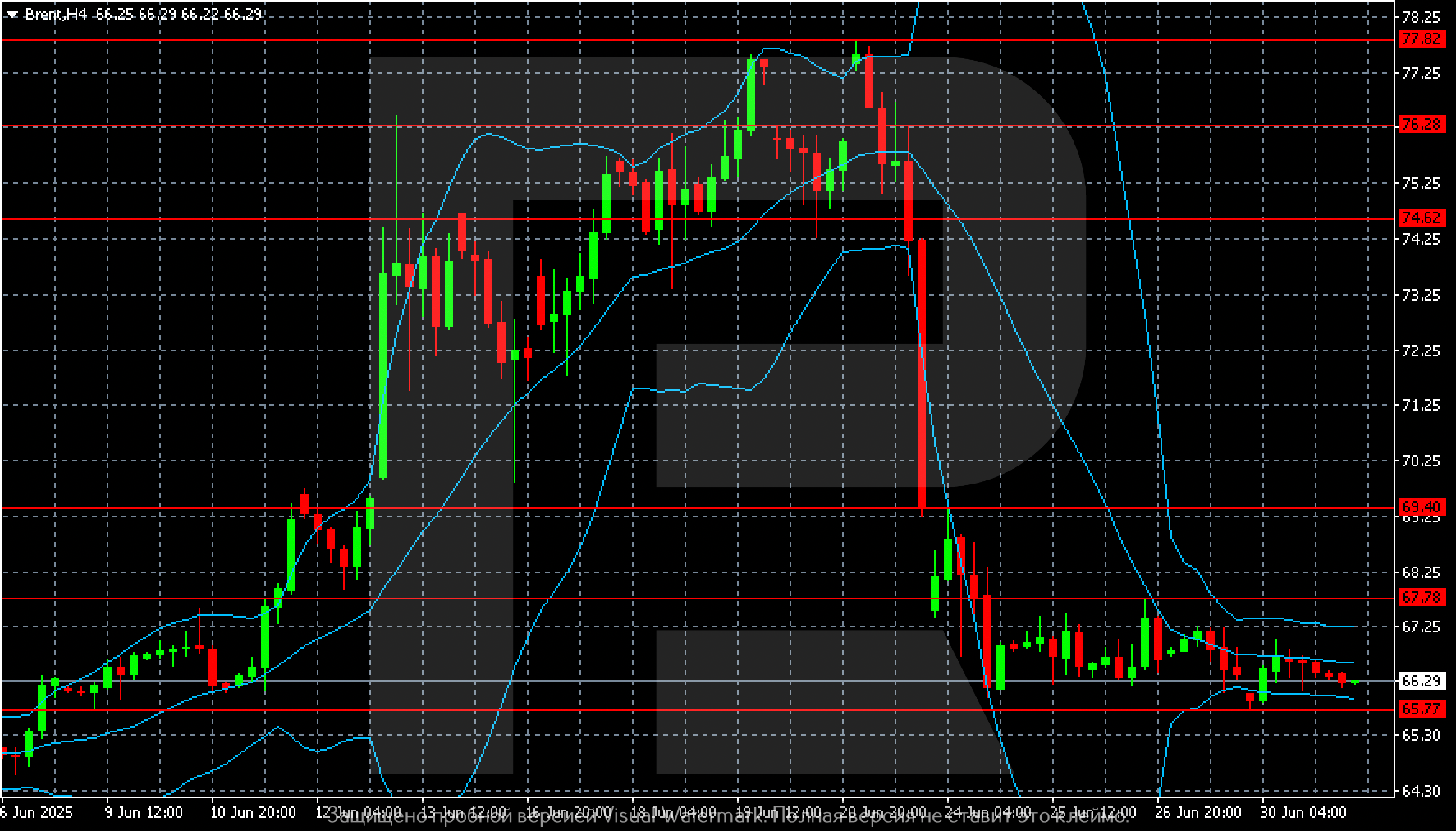

On the H4 chart for Brent, stabilisation in a sideways corridor is visible. This became possible after the sharp fall from 77.82 USD to the minimum of 65.77. A narrow range of 65.77–67.78 has formed on the chart, where the price has remained for several consecutive sessions. Bollinger Bands have narrowed, indicating reduced volatility and temporary equilibrium between sellers and buyers.

The market needs an impulse to exit consolidation. A breakout above 67.78 USD will open the way for a positive correction towards 69.40 USD.

A decline below 65.77 will increase pressure and may lead to a test of the 64.00–64.50 zone.

Summary

Brent oil has entered a fairly narrow price range and clearly needs an impulse. The Brent forecast for today, 1 July 2025, does not rule out testing the corridor boundaries with the formation of a short-term trend.