Brent crude prices are recovering after a decline, with quotes testing the 65.40 USD level. Discover more in our analysis for 7 October 2025.

Brent forecast: key trading points

- China is building new oil storage facilities

- OPEC+ agreed on a moderate production increase of 137 thousand barrels per day in November

- Brent forecast for 7 October 2025: 63.55

Fundamental analysis

Brent fundamental analysis for 7 October 2025 takes into account that after a decline, prices are forming an upward wave, trading around 65.40 USD per barrel.

OPEC+ agreed on a moderate output increase of 137 thousand barrels per day in November, which was significantly below market expectations. Traders interpreted this move as moderate and supportive for Brent prices.

China is also playing a key role in shaping Brent’s price dynamics. The country is accelerating the construction of new strategic oil storage facilities to strengthen its energy security and absorb excess supply. Plans include the construction of 11 new storage sites, with a total capacity roughly equivalent to two weeks of oil imports. The expansion of China’s reserves will help mitigate potential price spikes and ease pressure on Brent prices.

The Brent forecast suggests that higher output could lead to increased global inventories if demand fails to keep pace, which in turn could put downward pressure on oil prices.

Brent technical analysis

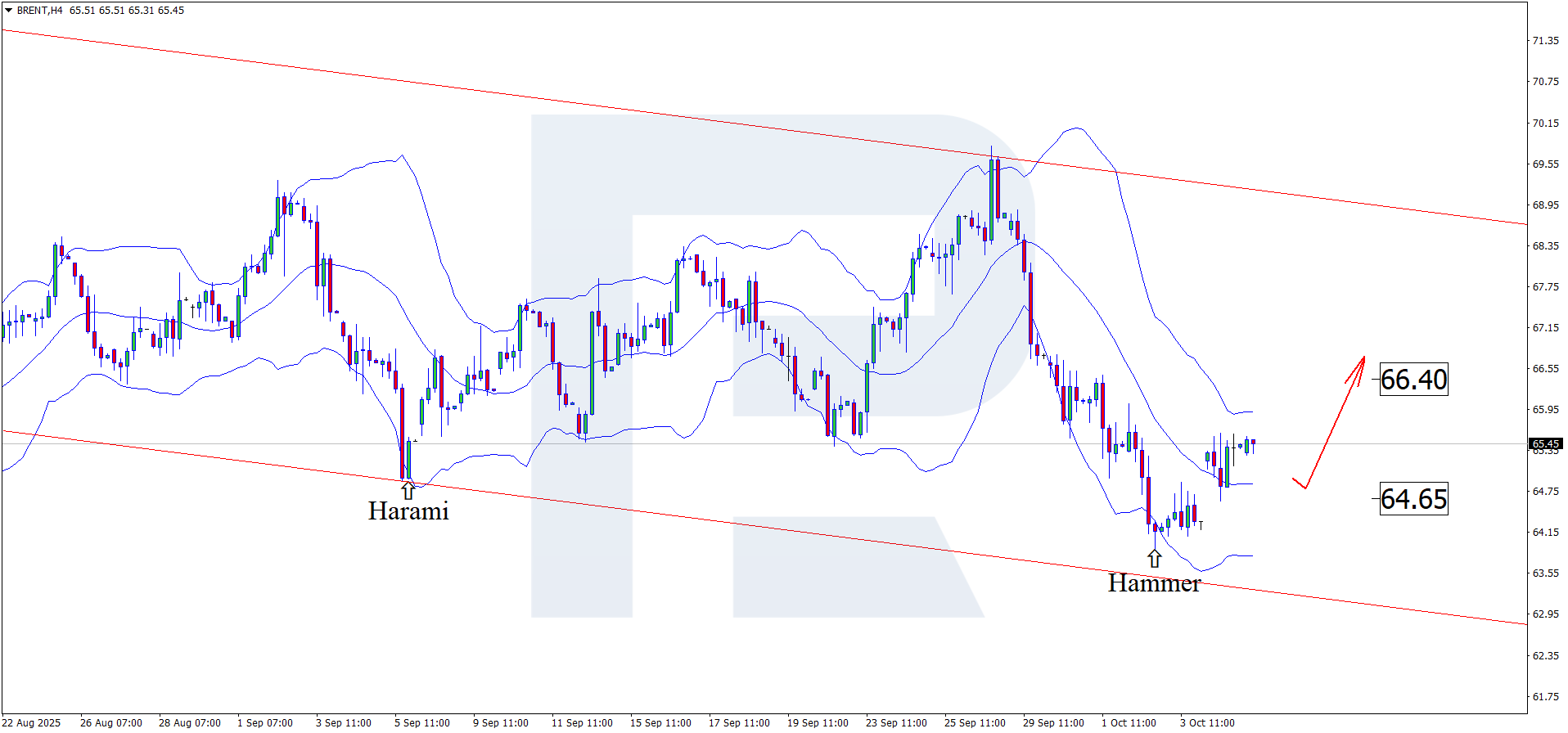

Having tested the lower Bollinger Band, Brent prices formed a Hammer reversal pattern on the H4 chart. At this stage, the market is developing a growth wave following this signal.

The Brent price forecast for 7 October 2025 considers the 66.40 USD level as the next upside target. A breakout above this resistance would open the way for further bullish momentum.

At the same time, an alternative scenario cannot be ruled out, where Brent quotes may form a correction towards 64.65 USD before growth.

Summary

Overall, Brent crude dynamics on 7 October 2025 remain moderately positive. Despite the production increase by OPEC+ and China’s buildup of reserves, the market continues to show steady buying interest amid limited supply growth and sustained demand.

Open Account