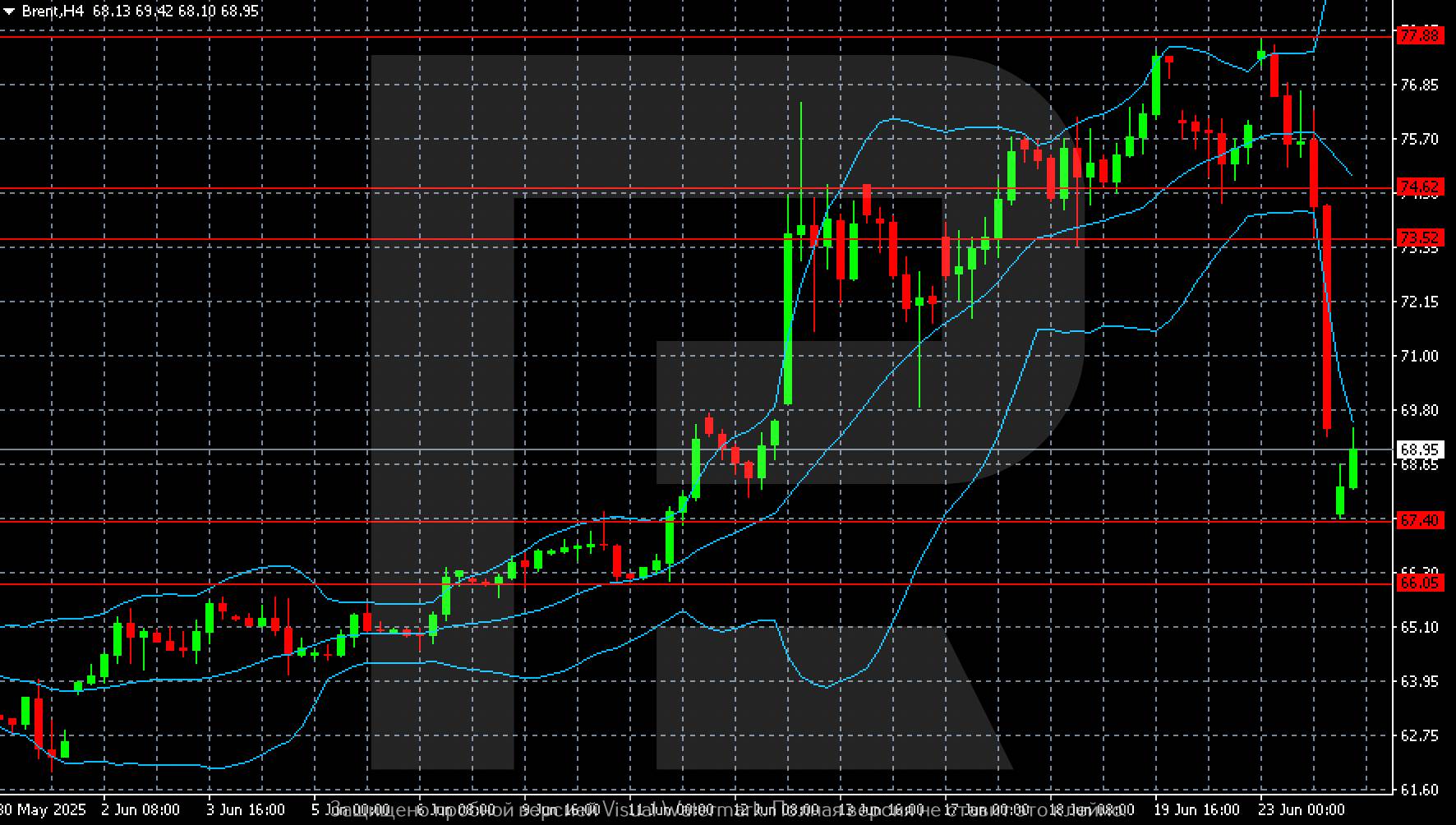

Brent quotes fell to 68.95 USD per barrel, with the Middle East still steering market sentiment. Discover more in our analysis for 24 June 2025.

Brent forecast: key trading points

- Brent crude erased all gains following the Middle East ceasefire

- The market is correcting and monitoring external developments

- Brent forecast for 24 June 2025: 67.40

Fundamental analysis

Brent prices plunged to 68.95 USD on Tuesday morning, marking a two-week low.

The drop followed Donald Trump’s announcement of a ceasefire between Israel and Iran, which eased concerns over potential oil supply disruptions from the Middle East. According to Trump, the ceasefire was to begin on Monday evening, with Iran halting strikes first, followed by Israel.

If both sides hold the truce, the conflict will officially end within 24 hours, concluding a 12-day confrontation.

The announcement came just hours after Iran fired missiles at a US base in Qatar in response to US strikes on its nuclear sites. US air defence systems intercepted the rockets, and there were no casualties. This development triggered a drop of over 7% in oil prices on Monday.

The easing of tensions also reduced fears that Iran might attempt to block the Strait of Hormuz, a critical route through which around 20% of global oil supplies flow.

The Brent forecast is negative.

Brent technical analysis

On the H4 chart, Brent shows signs of consolidating around 68.80. However, if the market weakens further, sellers will likely aim for a retest of the morning low at 67.40, with a possible dip to 66.05.

Summary

Brent prices fell to two-week lows following the ceasefire announcement in the Middle East. There are no immediate threats to oil supplies through the Strait of Hormuz. The Brent forecast for today, 24 June 2025, suggests a further decline towards 67.40.