Brent price on Tuesday remains around 68.80 USD per barrel. News from Yemen balanced out market pressure. Details – in our analysis for 8 July 2025.

Brent forecast: key trading points

- Brent crude remains near two-week highs despite OPEC+ news

- Tensions in the Red Sea help ease price pressure

- Market follows the US tariff theme

- Brent forecast for 8 July 2025: 69.50

Fundamental analysis

Brent price holds near its two-week peak at around 68.80 USD. However, quotes are retreating from highs amid mixed factors – increased production in OPEC+ countries and rising trade risks from the US.

On Monday, President Donald Trump published initial letters warning of new tariffs against countries that have not concluded trade agreements with Washington. Among them are Japan and South Korea, which face tariffs of 25% from 1 August. Nevertheless, the US administration left a window open for further negotiations.

Additional market pressure came from the OPEC+ decision. From August, the group will increase production by another 548,000 barrels per day. This marks the fourth consecutive increase and exceeds market expectations. Thus, almost 80% of the 2.2 million barrels per day voluntarily cut earlier this year by eight OPEC countries will be restored.

Price declines are partly restrained by geopolitical risks. Houthi rebels from Yemen attacked ships in the Red Sea again, raising concerns over supply disruptions along key maritime routes.

Brent forecast remains mixed.

Brent technical analysis

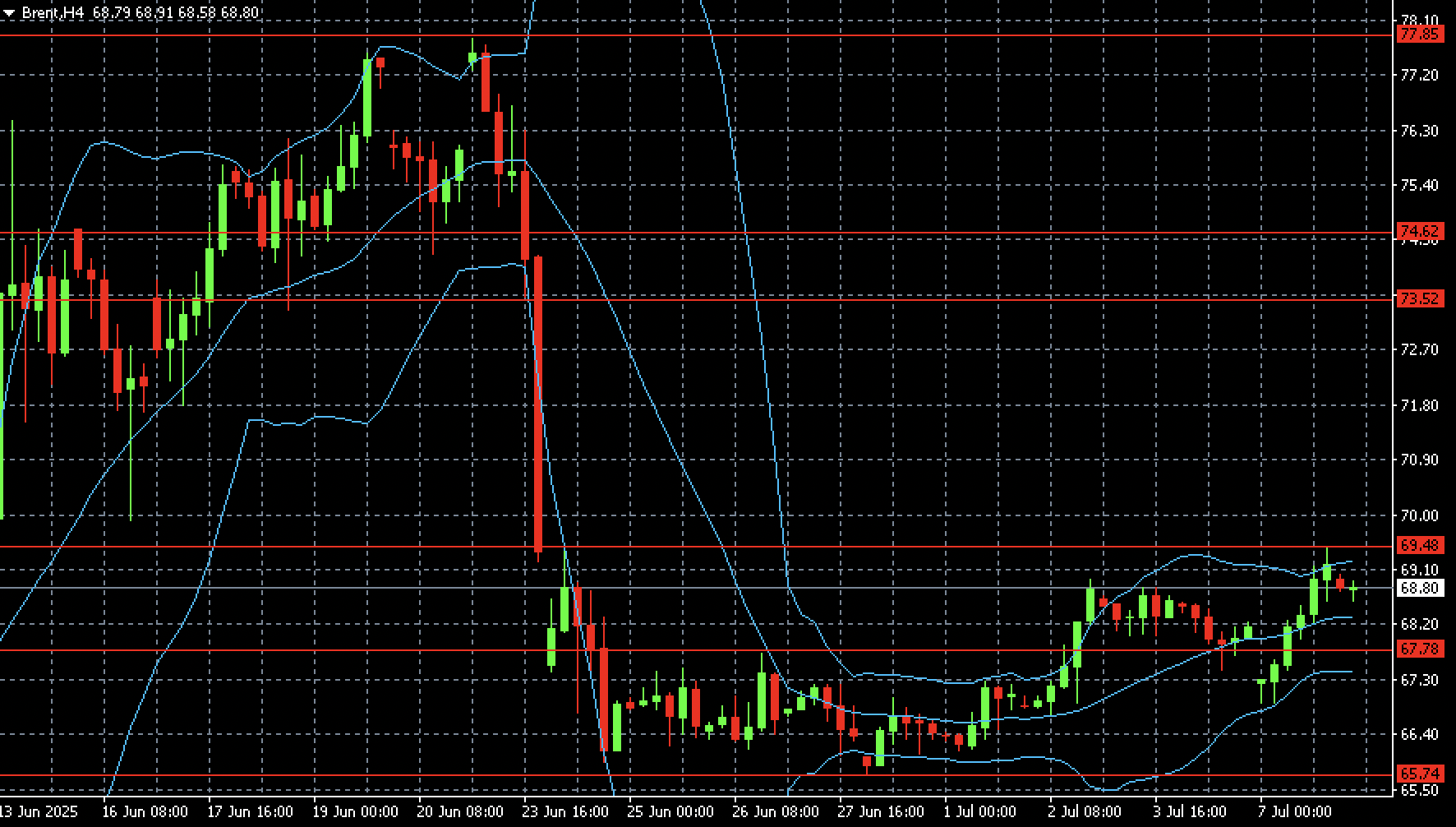

On the H4 chart for Brent, a recovery is visible after the sharp fall between 21–24 June. After the collapse, quotes stabilised within a sideways range with a lower boundary near 65.74 and an upper at 67.78.

Since early July, gradual recovery has been observed. Price has been consistently forming higher lows and highs, breaking through the resistance zone at 67.78 and approaching 69.48. This level currently acts as the nearest resistance.

Trading is taking place within the upper half of Bollinger Bands, indicating a moderately bullish sentiment. A key milestone remains 69.50. If a confident breakout upwards occurs, the next target may be the 73.50 area. Support lies within the 67.80–67.00 zone. Loss of this area could bring prices back under pressure.

Summary

Brent crude oil keeps its eye on the two-week high and remains close by. Brent forecast for today, 8 July 2025, suggests a return to 69.50 if conditions are met.