Brent prices may surge towards the 81.50 resistance level, having completed a corrective wave. Find out more in our analysis for 21 January 2025.

Brent forecast: key trading points

- Brent prices are attempting to regain their position after a decline

- Brent forecast for 21 January 2025: 78.00 and 81.50

Fundamental analysis

Brent's fundamental analysis for today, 21 January 2025, considers that oil prices are experiencing significant volatility. In October 2024, prices fell below 77.00 USD per barrel due to the lack of new incentives for the Chinese economy and escalating conflict in the Middle East. However, already in January 2025, Brent quotes surpassed 81.00 USD per barrel on news of expanded sanctions against Russia and Iran and the weakening of the US dollar.

This price behaviour is caused by a combination of geopolitical factors and large-scale changes in the global economy.

Amid the US presidential inauguration, Brent prices plunged below 80.00 USD after a surge.

Brent technical analysis

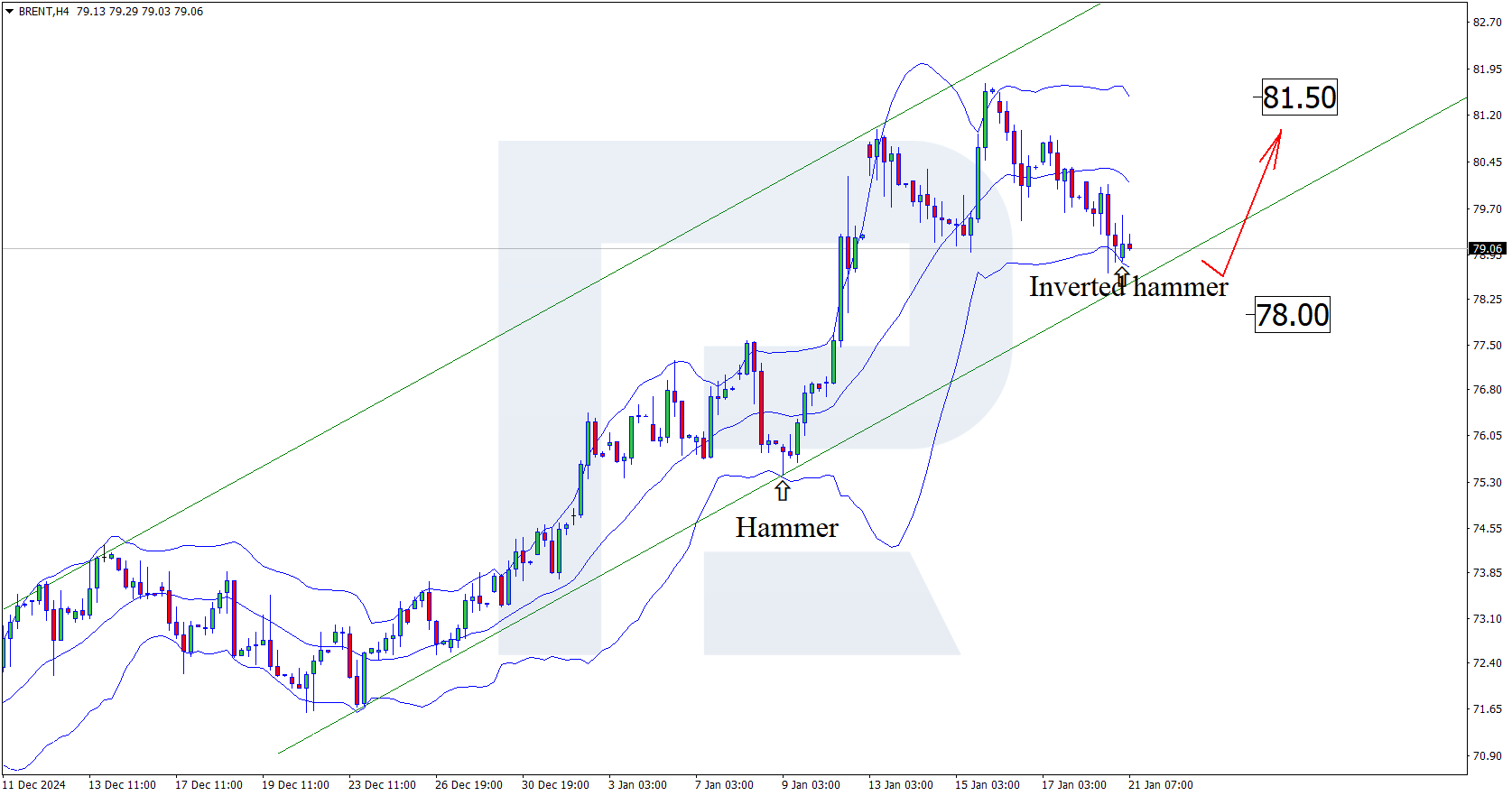

Having tested the lower Bollinger band, Brent prices have formed an Inverted Hammer reversal pattern on the H4 chart. At this stage, they could rise following the pattern signal. Since the quotes are testing the lower boundary of an ascending channel after a pullback, they could rebound from the support level and continue the uptrend.

The Brent forecast for today, 21 January 2025, is somewhat optimistic and points to the next resistance level at 81.50 USD as a growth target. A breakout above this level will open the potential for a more substantial upward movement.

However, an alternative scenario is possible: Brent prices may break below the support level and tumble to 78.00 before a rise.

Summary

Brent technical analysis for 21 January 2025 suggests price growth to the 81.50 USD resistance level.