Brent quotes are attempting to stabilise after falling to around 65.00 USD due to a possible increase in oil output by OPEC+ countries. Discover more in our analysis for 24 April 2025.

Brent forecast: key trading points

- Market focus: US crude oil inventories rose by 0.24 million barrels according to the EIA data, while a decline of 0.7 million barrels had been expected

- Current trend: correcting downwards

- Brent forecast for 24 April 2025: 64.00-65.75 USD

Fundamental analysis

Brent prices fell to the 65.00 USD area after reports emerged that some OPEC+ countries with additional voluntary production cuts may propose an increase in output starting in June. Reuters cited three sources familiar with the matter.

Eight OPEC+ members – Russia, Saudi Arabia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman – who had agreed to extra voluntary cuts, decided in April to meet monthly to discuss their next steps. The next meeting is scheduled for 5 May, when production levels for June will be determined.

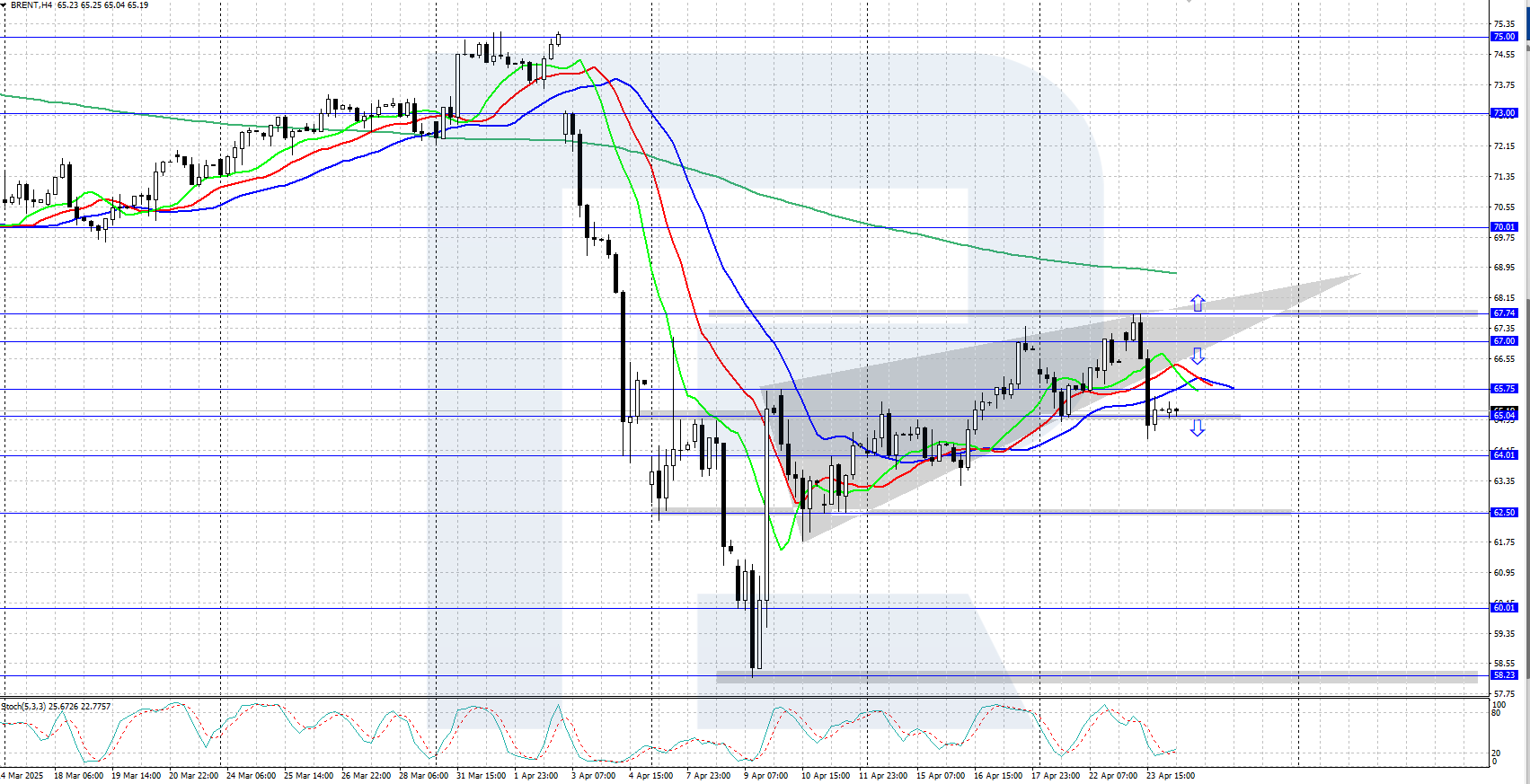

Brent technical analysis

On the H4 chart, Brent shows a downward correction following recent gains. The Alligator indicator has reversed downwards, confirming the potential for further decline. The key support level is currently at 62.50 USD.

The short-term Brent price forecast suggests that prices could revisit the 65.75 USD level and move higher if bulls hold prices above 65.00 USD. Conversely, if bears succeed in pushing quotes confidently below 65.00 USD, the downward movement may extend towards 64.00 USD and lower.

Summary

Brent prices quickly dropped to the 65.00 USD area following Reuters’ report on a possible OPEC+ output increase. The oil cartel’s next meeting is scheduled for 5 May.