Brent crude prices are declining amid a combination of geopolitical and economic factors, currently standing at 63.93 USD. Find more details in our analysis for 30 October 2025.

Brent forecast: key trading points

- US President Donald Trump reported successful talks with Chinese President Xi Jinping

- The parties reached agreements on key issues, with a trade deal expected to be signed soon

- Brent forecast for 30 October 2025: 66.65

Fundamental analysis

Brent crude prices moved lower on Thursday, reacting to the outcome of talks between US President Donald Trump and Chinese President Xi Jinping. According to Trump, the discussions were productive, and both leaders reached a consensus on several key trade issues. The signing of a US-China trade agreement is now anticipated in the coming days.

Additional pressure on oil prices came from the Federal Reserve’s recent decision to cut interest rates by 25 basis points.

Earlier this week, oil prices were supported by data from the US Department of Energy, which showed a 6.858 million barrel decline in crude inventories, the sharpest drawdown in over six weeks.

Brent technical analysis

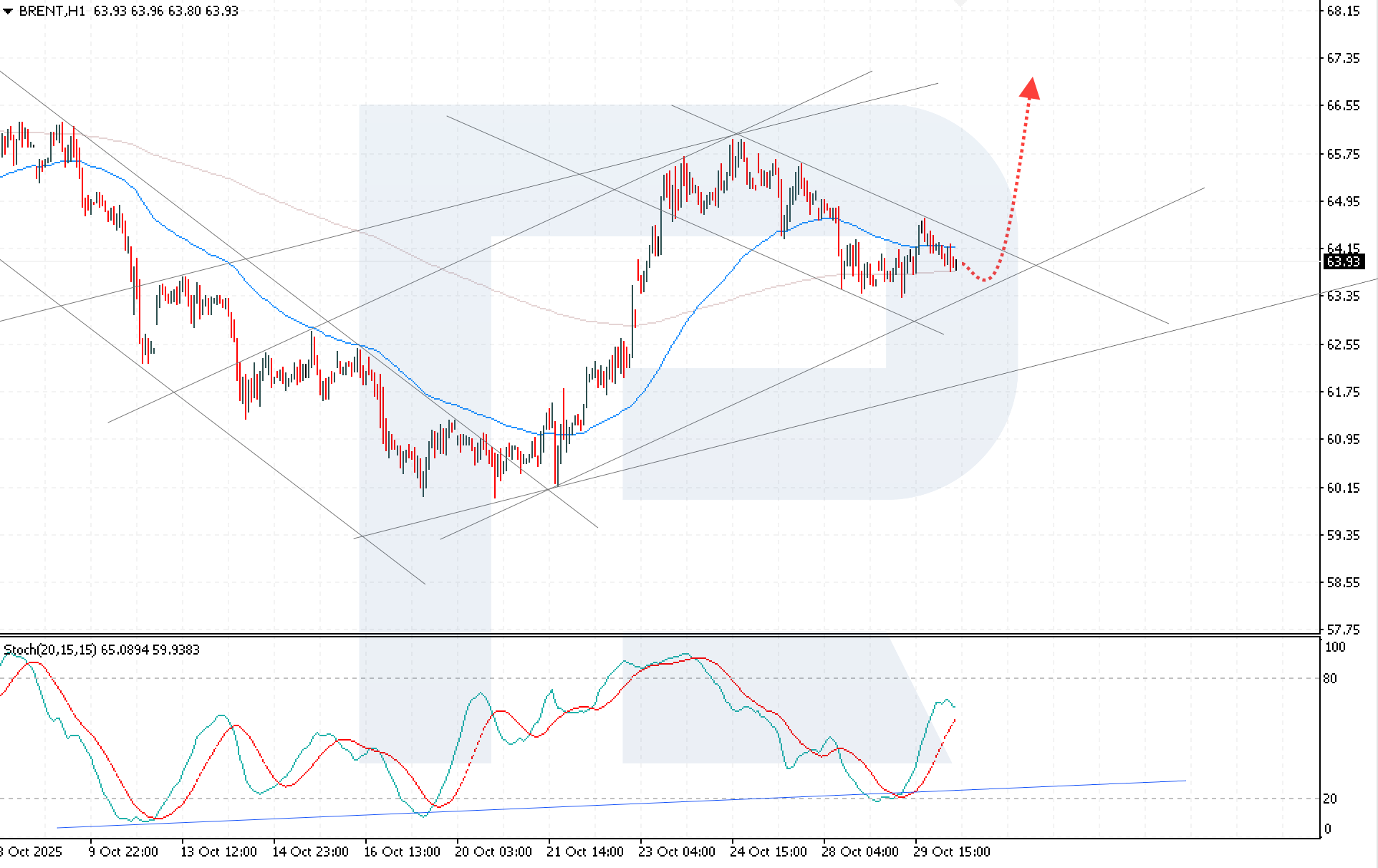

Brent prices remain within a downward corrective channel, consolidating near Moving Averages, indicating market indecision and a temporary pause in direction.

The short-term Brent price forecast suggests a potential rebound towards 66.65 USD. The Stochastic Oscillator supports this scenario, as it is bouncing off the support line and turning higher, signalling renewed bullish activity.

A consolidation above 65.05 USD would reinforce the bullish case, signalling an exit from the downward corrective channel and the start of a new upward impulse.

Summary

Oil prices remain under pressure amid a combination of positive US-China trade developments and the Fed’s monetary easing, even as US oil inventories decline. Today’s Brent analysis indicates bullish momentum, with growing chances of a breakout from the current descending channel and a potential move towards 66.65 USD.

Open Account