The oil market remains under pressure, with Brent quotes edging lower amid expectations of weaker demand and geopolitical factors, currently standing at 66.76 USD. Find more details in our analysis for 28 August 2025.

Brent forecast: key trading points

- Investors expect fuel demand in the US to decline with the end of the summer season

- Analysts believe oil consumption has already peaked

- US crude oil inventories fell by 2.39 million barrels to 418.3 million

- Brent forecast for 28 August 2025: 63.90

Fundamental analysis

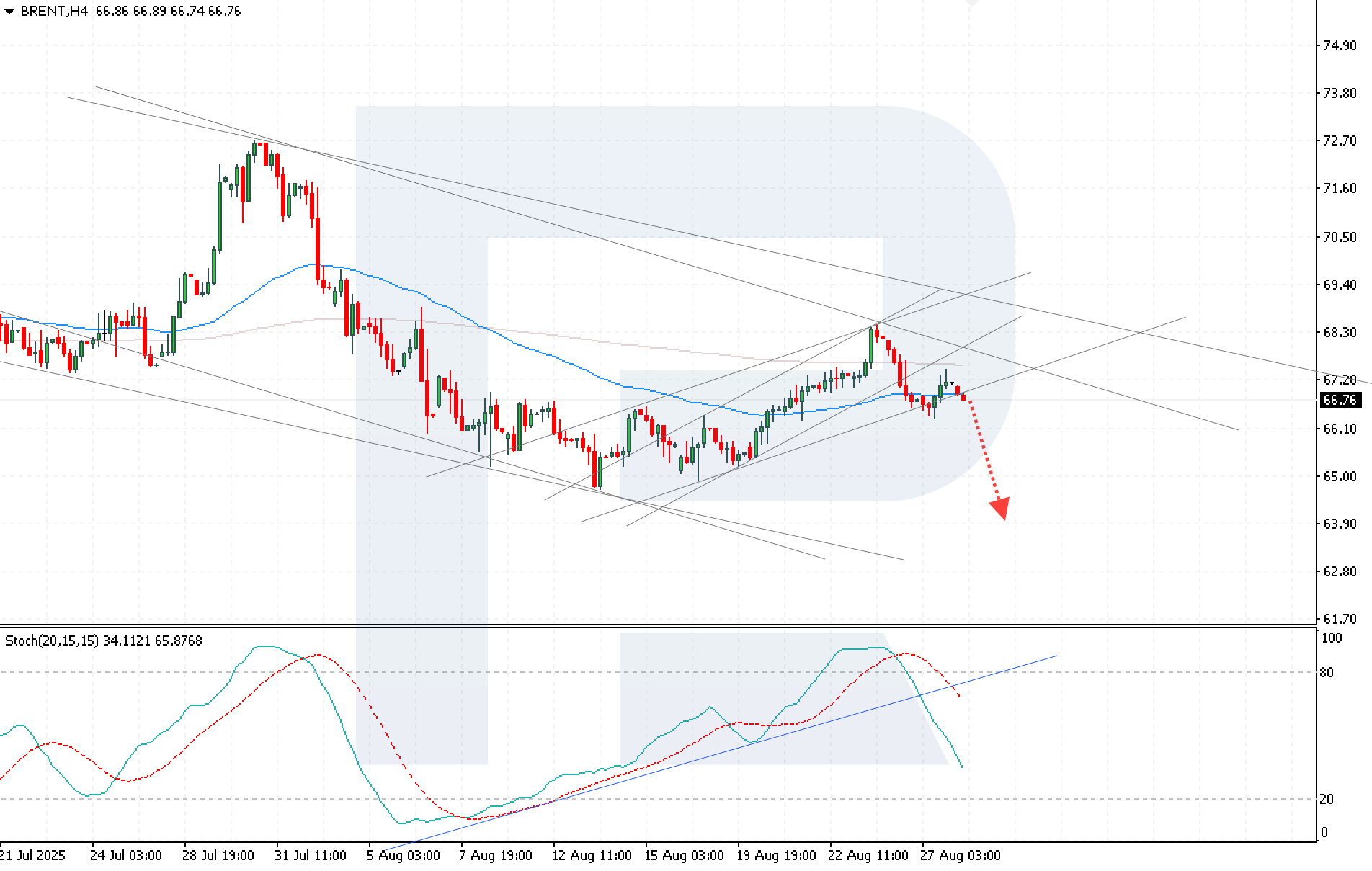

Brent prices are falling after rebounding from the key resistance level at 68.50 USD. Investors factor in the anticipated drop in US fuel demand as the summer season ends, while also assessing potential supply shifts amid US high tariffs on India. Analysts note that consumption has peaked, projecting a gradual demand slowdown. According to the Brent price forecast, such expectations point to growing bearish sentiment in the market.

US commercial crude inventories dropped by 2.39 million barrels last week to 418.3 million, according to the Energy Department’s weekly report. Analysts had forecast a decline of 2 million barrels.

Traders are also watching India’s stance in response to US pressure aimed at curbing Russian oil imports after the tariff hikes. However, analysts expect India to continue to buy in the near term, limiting this factor’s impact on the global market.

Brent technical analysis

Brent quotes are retreating after rebounding from the 68.50 resistance level, remaining within a descending channel. The current dynamics suggest a strong likelihood of a bearish impulse towards 63.90 USD.

Today’s Brent outlook points to further downside after breaking below the short-term support level at 66.00 USD and consolidating below the EMA-65. The Stochastic Oscillator gives a bearish signal: its lines have turned downwards, confirming the probability of continued decline.

Another factor adding to pressure is the potential breakout below the lower boundary of the corrective channel, which would reinforce the bearish trend.

Summary

Brent quotes continue to face pressure, with expectations of declining US demand and uncertainty over India’s oil imports increasing the risk of bearish dynamics. Today’s Brent analysis signals that the downward impulse remains intact with a target at 63.90 USD.

Open Account