Daily technical analysis and forecast for 18 September 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 18 September 2025.

EURUSD forecast

On the H4 chart of EURUSD, the market extended its growth wave to 1.1917 on the news and then fell sharply to 1.1819. Today, 18 September 2025, a consolidation range is expected to form around this level. A downside breakout would open potential for a continued decline to 1.1720. Later, a correction to 1.1819 (testing from below) is not excluded. Practically, a consolidation range is expected around 1.1819, with a further downside move possible towards 1.1600 and 1.1500 as the next targets.

Technically, the Elliott wave structure and the growth wave matrix with a pivot at 1.1630 confirm this scenario for EURUSD. At the moment, the market completed a growth wave to the upper boundary of the Price Envelope at 1.1917 and is expected to decline towards the lower boundary at 1.1720.

Technical indicators for today’s EURUSD forecast suggest a decline to 1.1720.

USDJPY forecast

On the H4 chart of USDJPY, the market completed a decline to 145.50 and then executed an impulse growth to 146.95. Today, 18 September 2025, a consolidation range is expected around this level. An upside breakout would open potential for growth to 148.40, while a downside breakout could extend the decline to 144.67.

Technically, the Elliott wave structure and the downward wave matrix with a pivot at 147.30 confirm this scenario for USDJPY. At the moment, the market completed a decline to the lower boundary of the Price Envelope at 145.50. A correction towards its upper boundary at 148.30 is possible today.

Technical indicators for today’s USDJPY forecast suggest an upward move to 148.30.

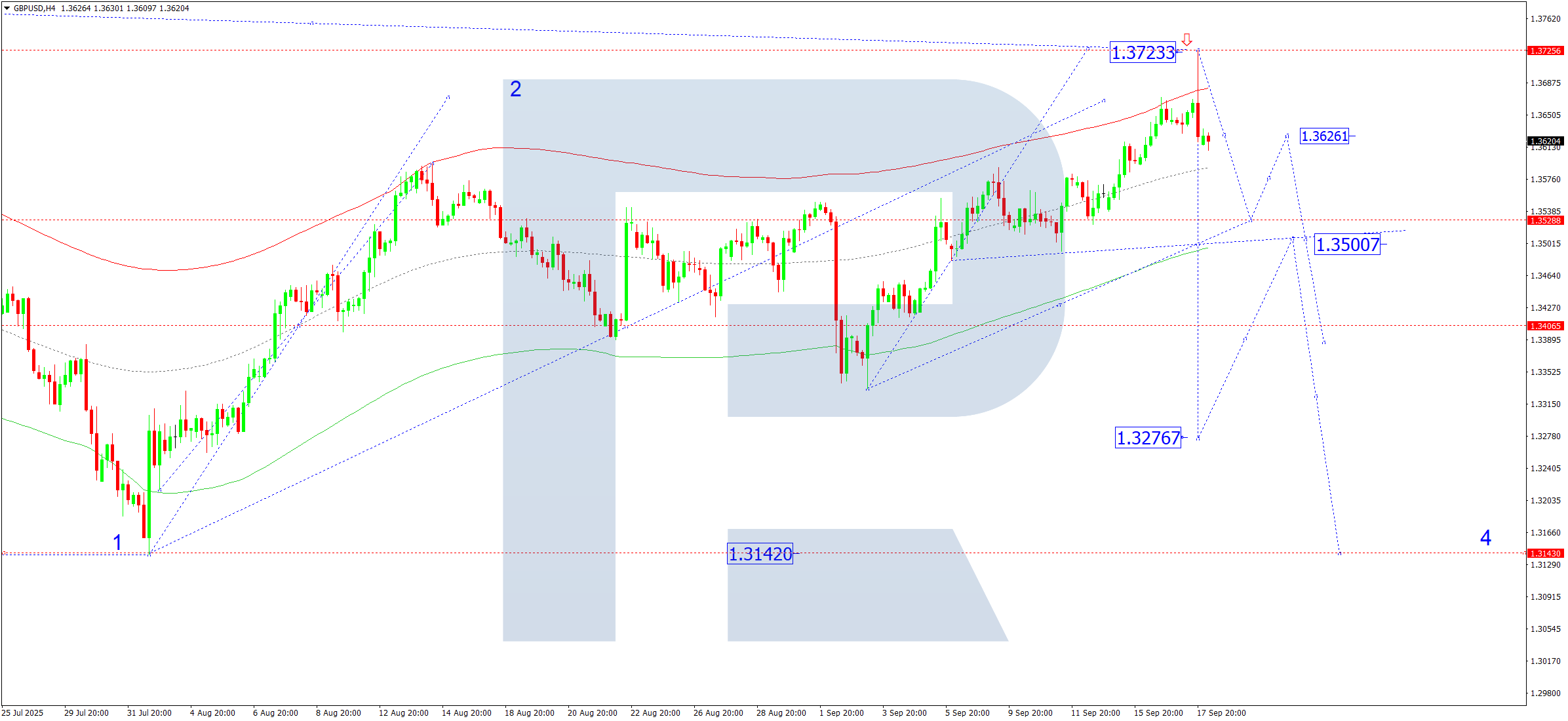

GBPUSD forecast

On the H4 chart of GBPUSD, the market completed a growth wave to 1.3723 and then an impulse decline to 1.3626. Today, 18 September 2025, a consolidation range is expected around this level. A downside breakout would open potential for a decline to 1.3525. Afterwards, a correction to 1.3626 is possible before continuing the downward wave to 1.3277.

Technically, the Elliott wave structure and the growth wave matrix with a pivot at 1.3400 confirm this scenario for GBPUSD. At the moment, the market completed a growth wave to the upper boundary of the Price Envelope at 1.3723. A move down to its lower boundary at 1.3525 is expected today.

Technical indicators for today’s GBPUSD forecast suggest a decline to 1.3525.

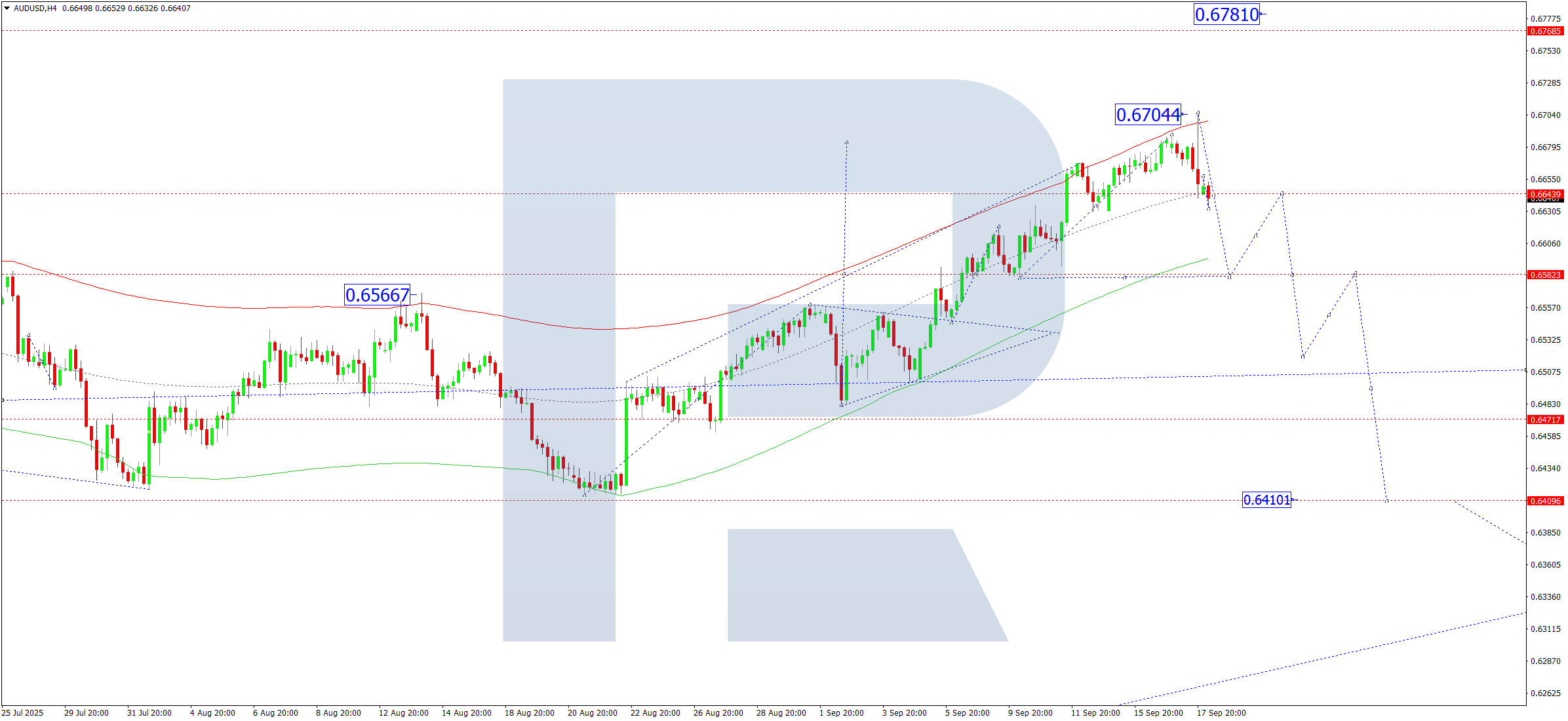

AUDUSD forecast

On the H4 chart of AUDUSD, the market extended its growth wave to 0.6704 and then formed a decline to 0.6644. Today, 18 September 2025, a consolidation range is expected to form around this level. A downward breakout would open potential for a continued decline to 0.6580, followed by a correction back to 0.6640.

Technically, the Elliott wave structure and the growth wave matrix with a pivot at 0.6511 confirm this scenario for AUDUSD. At the moment, the market completed a growth wave to the upper boundary of the Price Envelope at 0.6704. A decline towards its lower boundary at 0.6580 is possible today.

Technical indicators for today’s AUDUSD forecast suggest a decline to 0.6580.

USDCAD forecast

On the H4 chart of USDCAD, the market completed a decline to 1.3727 before rising to 1.3777. Today, 18 September 2025, a consolidation range is expected to form around this level. An upside breakout would open potential for further growth to 1.3826.

Technically, the Elliott wave structure and the downward wave matrix with a pivot at 1.3777 confirm this scenario for USDCAD. At the moment, the market completed a decline to the lower boundary of the Price Envelope at 1.3727. A growth move to its central line at 1.3826 (testing from below) is possible, followed by a correction back to the lower boundary at 1.3770.

Technical indicators for today’s USDCAD forecast suggest a growth move to 1.3826.

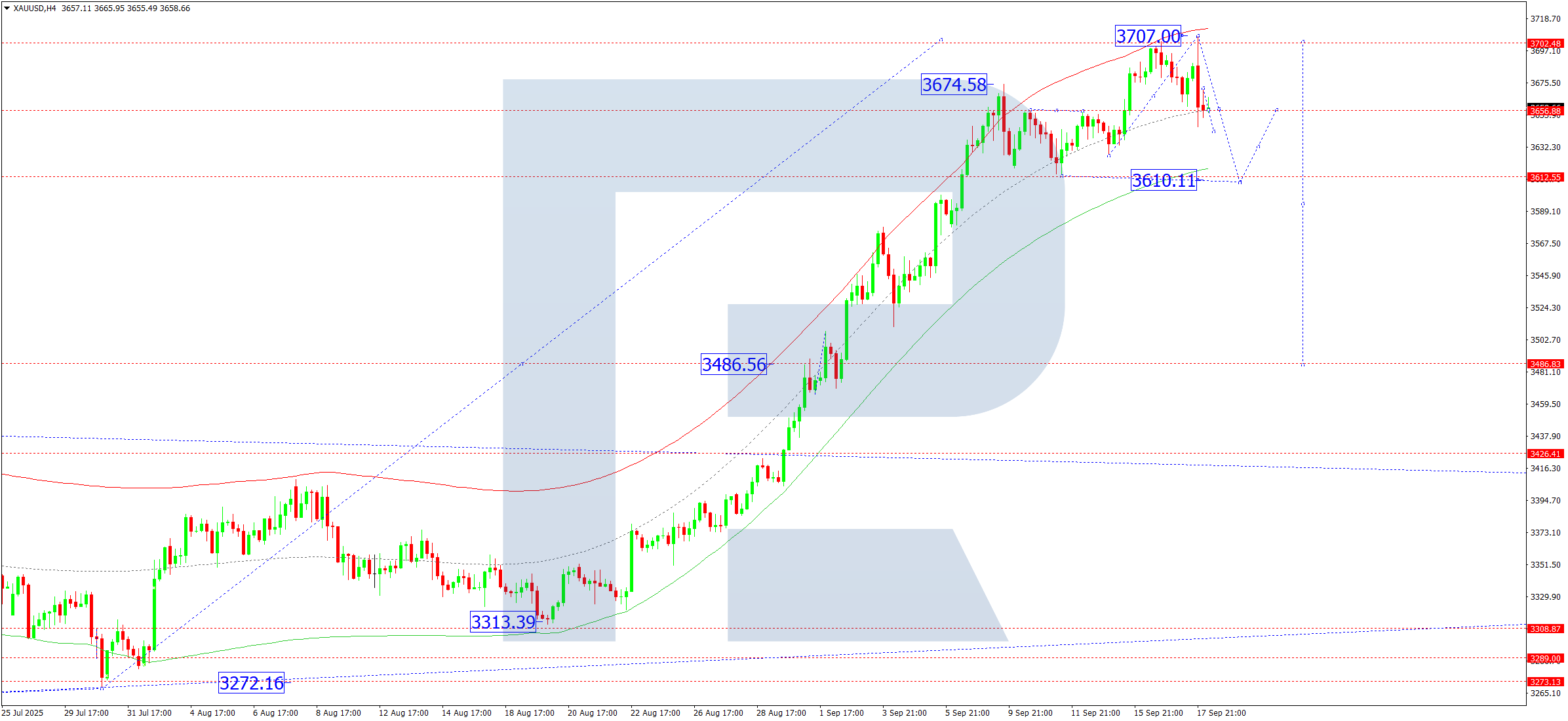

XAUUSD forecast

On the H4 chart of XAUUSD, the market completed a growth wave to 3,707 and then an impulse decline to 3,656. Today, 18 September 2025, a consolidation range is expected around this level. A downward breakout would open potential for a further drop to 3,610, followed by a correction to 3,656. A broader consolidation range may form, with a further downward breakout potentially extending the decline to 3,486.

Technically, the Elliott wave structure and the growth wave matrix with a pivot at 3,486 confirm this scenario for XAUUSD. At the moment, the market completed a growth wave to the upper boundary of the Price Envelope at 3,707. A decline to its lower boundary at 3,610 is expected, with a potential continuation towards 3,486 if broken.

Technical indicators for today’s XAUUSD forecast suggest a downward move to 3,610.

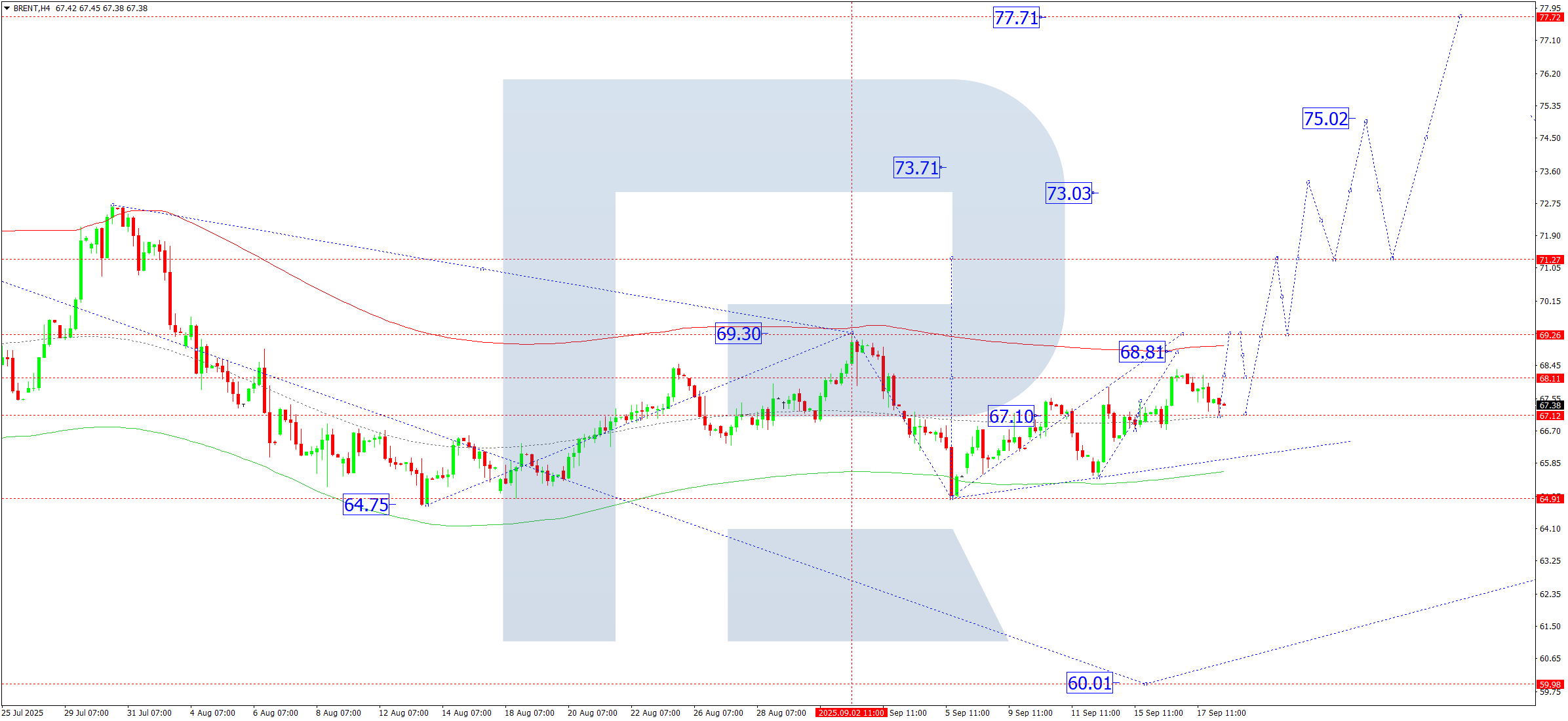

Brent forecast

On the H4 chart of Brent, the market completed a correction wave, reaching 67.10. Today, 18 September 2025, a growth wave is expected to continue to 68.80, with further potential to 69.30. Afterwards, a correction towards 67.20 may follow, before another growth wave to 71.30 with continuation to 75.00 as the local target.

Technically, the Elliott wave structure and the growth wave matrix with a pivot at 67.10 confirm this scenario for Brent. At the moment, the market continues its growth wave to the upper boundary of the Price Envelope at 69.30. Later, a correction to its central line at 67.20 is possible.

Technical indicators for today’s Brent forecast suggest a growth wave to 69.30.