Daily technical analysis and forecast for 2 July 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 2 July 2025.

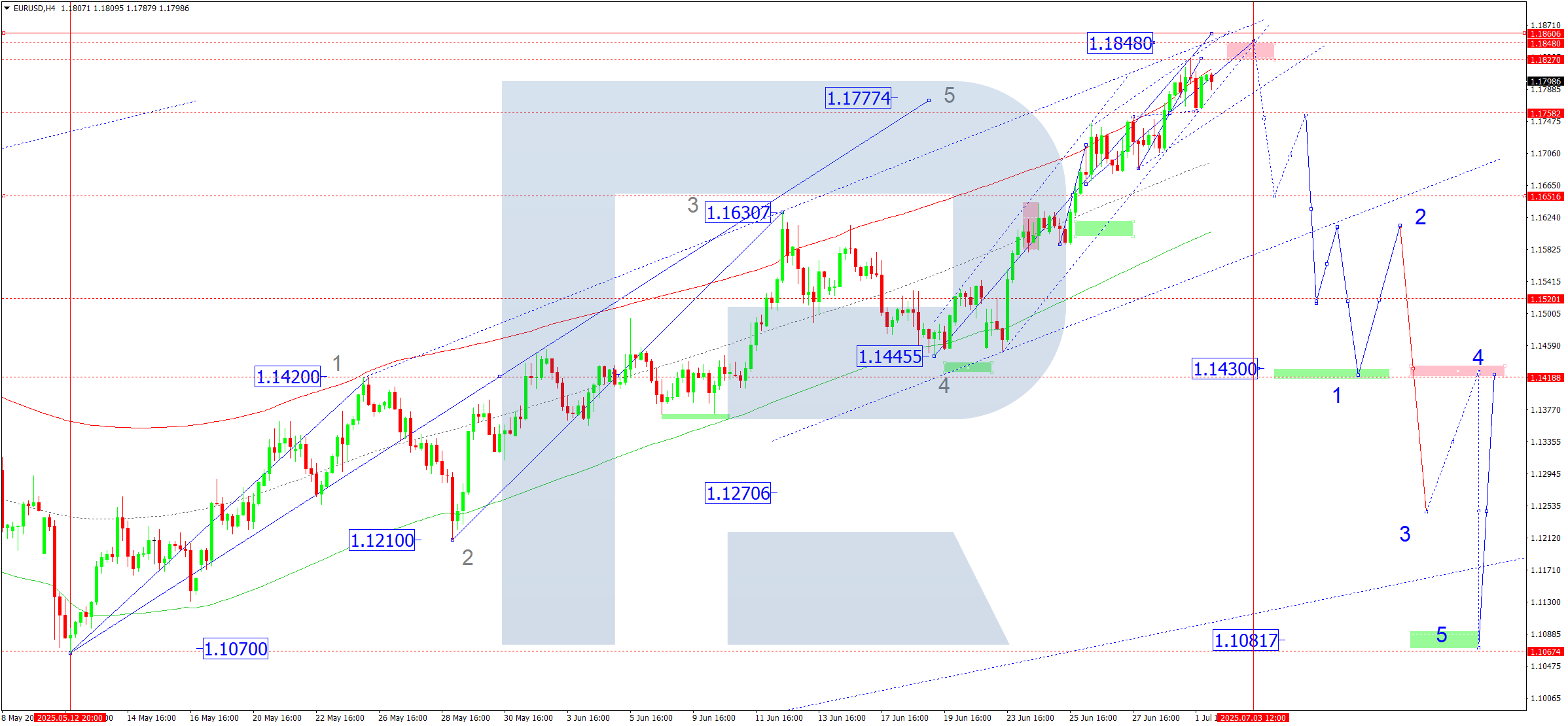

EURUSD forecast

On the H4 chart of EURUSD, the market found support at 1.1758 and is forming a growth structure towards 1.1848. Today, 2 July 2025, we consider the possibility of reaching this target level. At this point, the potential extension of this growth wave will be exhausted. Afterwards, a downward wave towards 1.1660 is anticipated.

Technically, this scenario is confirmed by the Elliott wave structure and the growth wave matrix with a rotation centre at 1.1430. This remains key within the wave structure for EURUSD. At the moment, the market has broken the upper boundary of the consolidation range and continues its rise towards the Price Envelope’s upper boundary at 1.1848. Today, we expect it to reach this target level and begin a downward move to its central line at 1.1660.

Technical indicators for today’s EURUSD forecast suggest considering a growth wave towards 1.1848.

USDJPY forecast

On the H4 chart of USDJPY, the market is forming a consolidation range around 143.33. Currently, the range has expanded down to 142.70 and up to 143.79. Today, 2 July 2025, we will consider the possibility of an extension upwards to 143.93 (testing from below). Afterwards, we expect the continuation of the downward wave to 142.70. Breaking below this level opens potential for further trend continuation to 141.70.

Technically, this scenario for USDJPY is confirmed by the Elliott wave structure and the downward wave matrix with a rotation centre at 144.84. This remains key within this wave structure. At the moment, the market is forming the fifth wave of decline. The market has completed half of this wave and is correcting the latest decline. The correction target is at 143.93. After this correction completes, we expect continuation of the decline to 142.70, with potential trend continuation to the Price Envelope’s lower boundary at 141.70.

Technical indicators for today’s USDJPY forecast suggest considering continuation of the downward wave towards 141.70.

GBPUSD forecast

On the H4 chart of GBPUSD, the market continues to form a consolidation range around 1.3722. Today, 2 July 2025, we expect a breakout upwards towards 1.3870. After reaching this level, a corrective move down to 1.3618 (testing from above) is possible. If it breaks upwards out of this range, potential for a trend continuation towards 1.4000 will open. A breakout downwards from this range could lead to continued correction towards 1.3400.

Technically, this scenario for GBPUSD is confirmed by the Elliott wave structure and the growth wave matrix with a rotation centre at 1.3400. This remains key within this wave structure. At the moment, the market has formed a consolidation range around the Price Envelope’s central line at 1.3620 and broke upwards towards its upper boundary at 1.3780. Today, it is relevant to consider the possibility of a decline back to its central line at 1.3680, followed by further growth towards its upper boundary at 1.3870.

Technical indicators for today’s GBPUSD forecast suggest considering growth towards 1.3870.

AUDUSD forecast

On the H4 chart of AUDUSD, the market is forming a growth wave towards 0.6595. Today, 2 July 2025, we expect it to reach this level, followed by a corrective move down to 0.6555 (testing from above). Afterwards, another growth wave towards 0.6616 is possible.

Technically, this scenario is confirmed by the Elliott wave structure and the growth wave matrix with a rotation centre at 0.6500. This remains key within this wave structure. At the moment, the market broke above 0.6555 and continues its upward move towards the Price Envelope’s upper boundary at 0.6595. Afterwards, a correction back to its central line at 0.6555 is not excluded, followed by growth towards its upper boundary at 0.6616.

Technical indicators for today’s AUDUSD forecast suggest considering another growth wave towards 0.6595.

USDCAD forecast

On the H4 chart of USDCAD, the market is forming a consolidation range around 1.3686. Today, 2 July 2025, we expect a decline to 1.3575. After reaching this level, a growth move back to 1.3686 (testing from below) is possible. Afterwards, another downward wave towards 1.3466 is anticipated, with potential trend continuation to 1.3380.

Technically, this scenario is confirmed by the Elliott wave structure and the downward wave matrix with a rotation centre at 1.3680. This remains key for USDCAD within this wave structure. At the moment, the market continues its consolidation around the Price Envelope’s central line at 1.3680. Today, it is relevant to consider a decline to its lower boundary at 1.3575, followed by growth back to its central line at 1.3680.

Technical indicators for today’s USDCAD forecast suggest considering decline towards 1.3575.

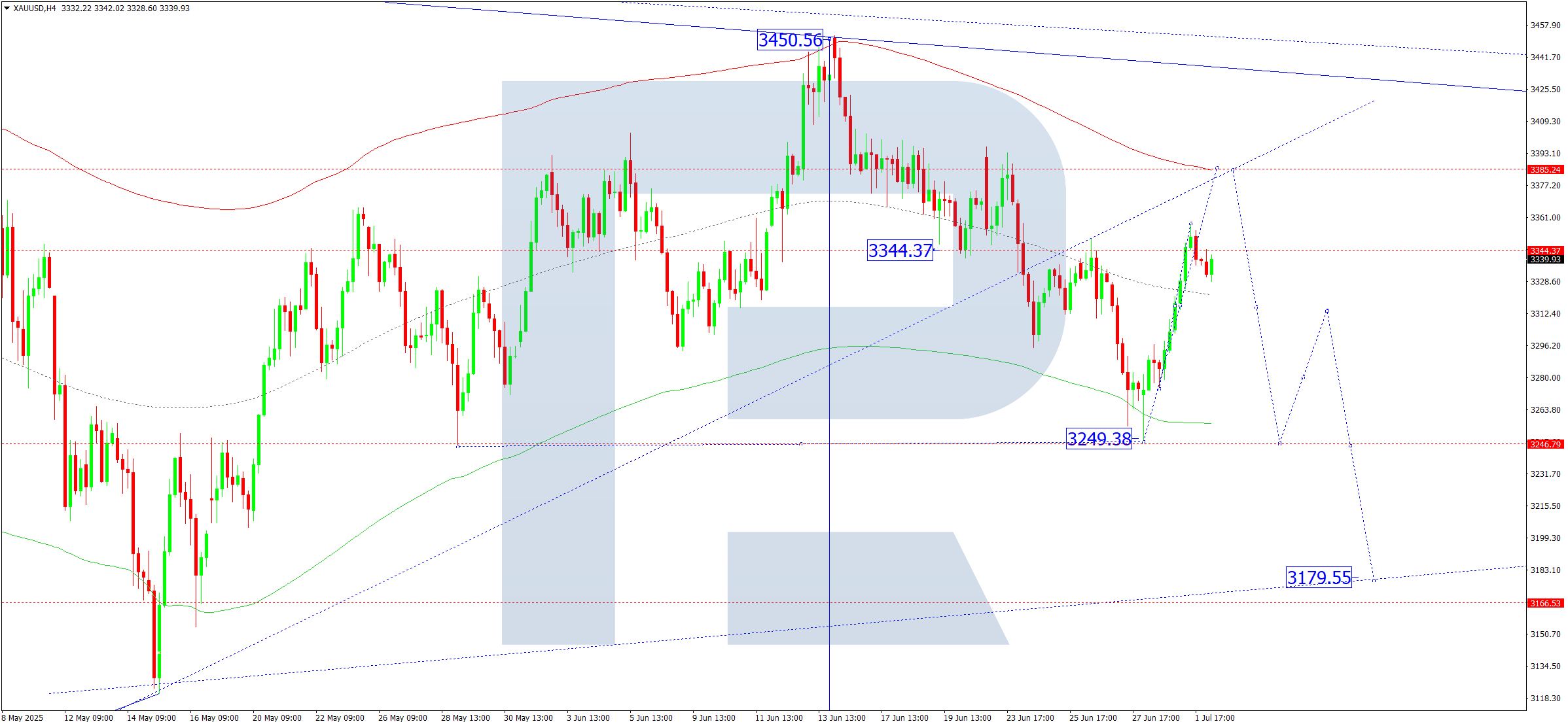

XAUUSD forecast

On the H4 chart of XAUUSD, the market completed a correction to 3344. Today, 2 July 2025, a consolidation range is forming around this level. If it breaks upwards, a further correction to 3385 is possible. Afterwards, a downward wave towards 3250 is anticipated. A broad consolidation structure is forming around 3344.

Technically, this scenario is confirmed by the Elliott wave structure and the downward wave matrix with a rotation centre at 3344. This remains key within this wave structure. Currently, the market completed a downward wave to the Price Envelope’s lower boundary at 3249 and a correction up to its central line at 3344. Today, it is relevant to expect growth towards its upper boundary at 3385, followed by a decline towards its lower boundary at 3250.

Technical indicators for today’s XAUUSD forecast indicate a possible growth wave towards 3385 and the beginning of a decline to 3250.

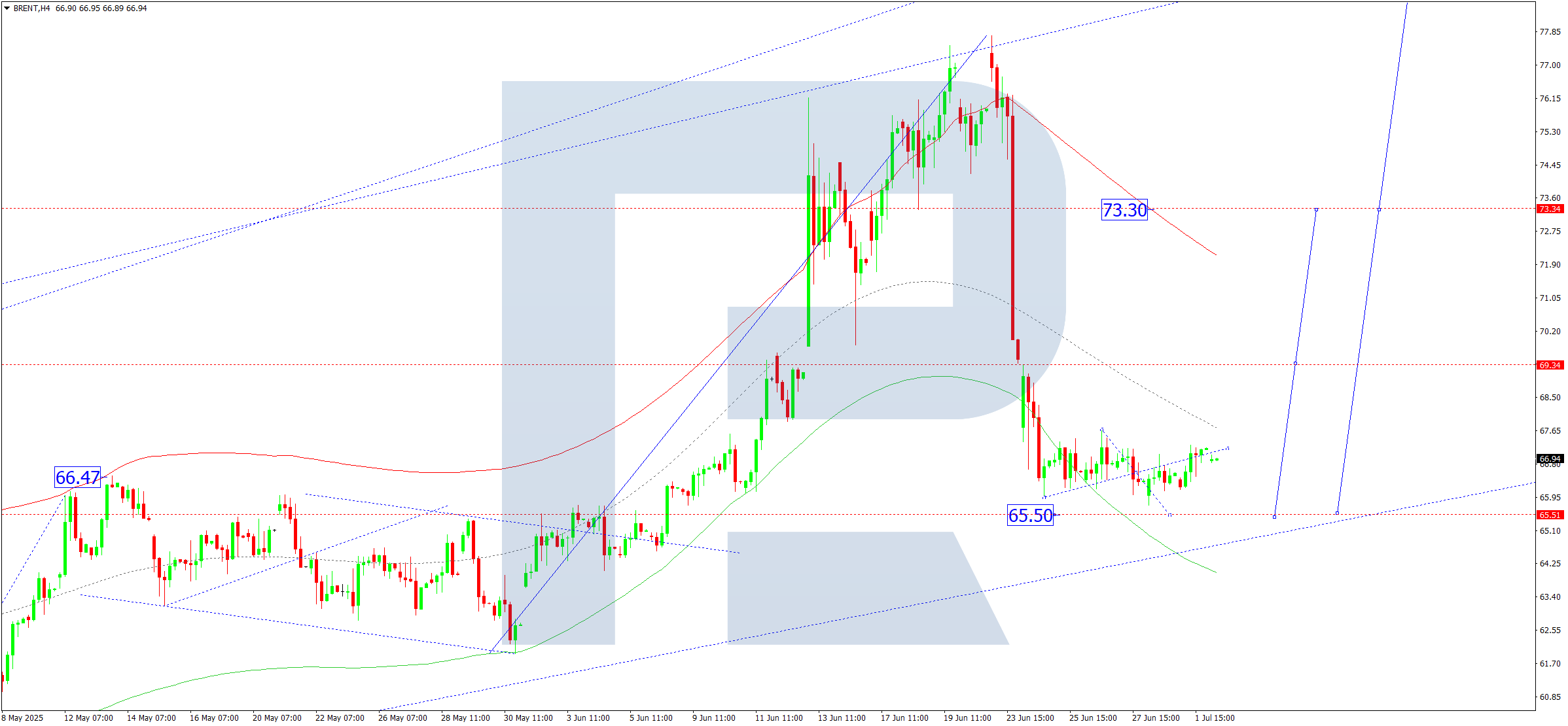

Brent forecast

On the H4 chart of Brent crude, the market continues to form a consolidation range around 66.66 without a clear trend. Today, 2 July 2025, a decline towards 65.50 is possible. Afterwards, a growth wave towards 69.35 may begin. Breaking above this level opens potential for a trend continuation towards 73.30. This is the first target within the growth wave structure towards 81.00.

Technically, this scenario is confirmed by the Elliott wave structure and the growth wave matrix with a rotation centre at 70.00. This remains key within Brent’s wave structure. Currently, the market is completing a corrective structure towards the Price Envelope’s lower boundary at 65.50. Afterwards, growth towards its central line at 69.50 is possible. Breaking above this level opens potential for continuation towards its upper boundary at 81.00.

Technical indicators suggest today’s Brent forecast considers a possible growth wave towards 69.50.