Daily technical analysis and forecast for 24 June 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 24 June 2025.

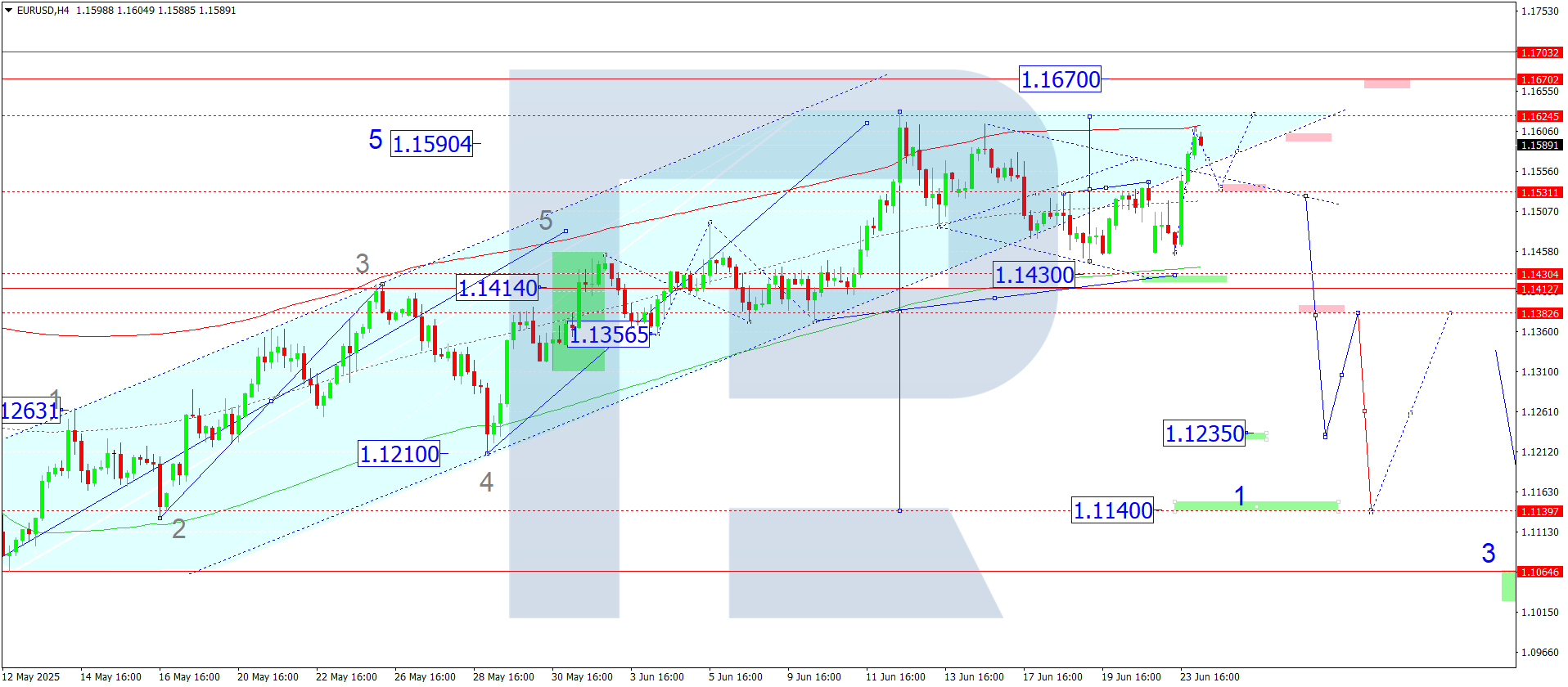

EURUSD forecast

On the H4 chart of EURUSD, the market continues to form a consolidation range around 1.1550. The range has currently expanded down to 1.1453 and up to 1.1608. Today, 24 June 2025, a decline to 1.1550 (testing from above) is expected. Afterwards, a rise to 1.1625 remains possible. If the market breaks this range upwards, the trend could continue to 1.1670. If the breakout occurs downwards, the wave may extend to 1.1235 and potentially continue to 1.1140 as the estimated target.

The Elliott wave structure and the growth matrix with a pivot at 1.1550 support this scenario, marking it as key in the EURUSD wave structure. The market is currently forming a consolidation range around the central line of the price Envelope at 1.1550. Today, a downward move to this central line is expected, followed by a possible upward wave towards the upper boundary at 1.1625.

Technical indicators for today’s EURUSD forecast suggest a wave down to 1.1550 and a possible rise to 1.1625.

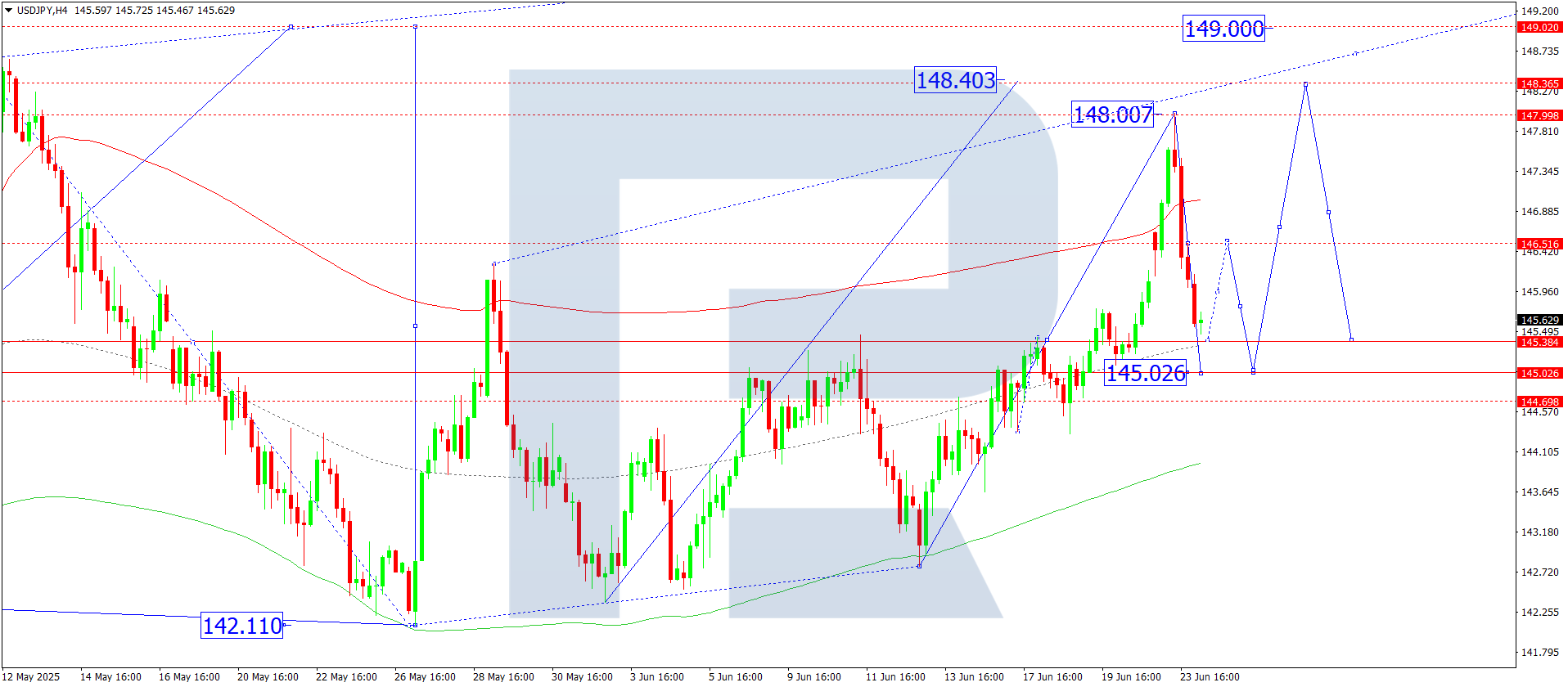

USDJPY forecast

On the H4 chart of USDJPY, the market reached the local growth wave target at 148.00. Today, 24 June 2025, a correction to 145.38 is likely. Then, a rise to 146.50 may follow, after which the price could decline to 145.03. This is a correction to the previous upward wave. Once the correction ends, another growth wave towards 148.40 may start, potentially stretching to 149.00.

The Elliott wave structure and growth matrix with a pivot at 144.00 confirm this outlook and define it as key in the USDJPY structure. The market has recently formed a consolidation range around the central line of the price Envelope at 144.40 and broken upwards, reaching the local target near the upper boundary at 148.00. Today, a correction down to the central line at 145.03 is relevant. After the correction, growth may resume without significant pullbacks towards 149.00.

Technical indicators for today’s USDJPY forecast suggest a continuation of the growth wave to 149.00.

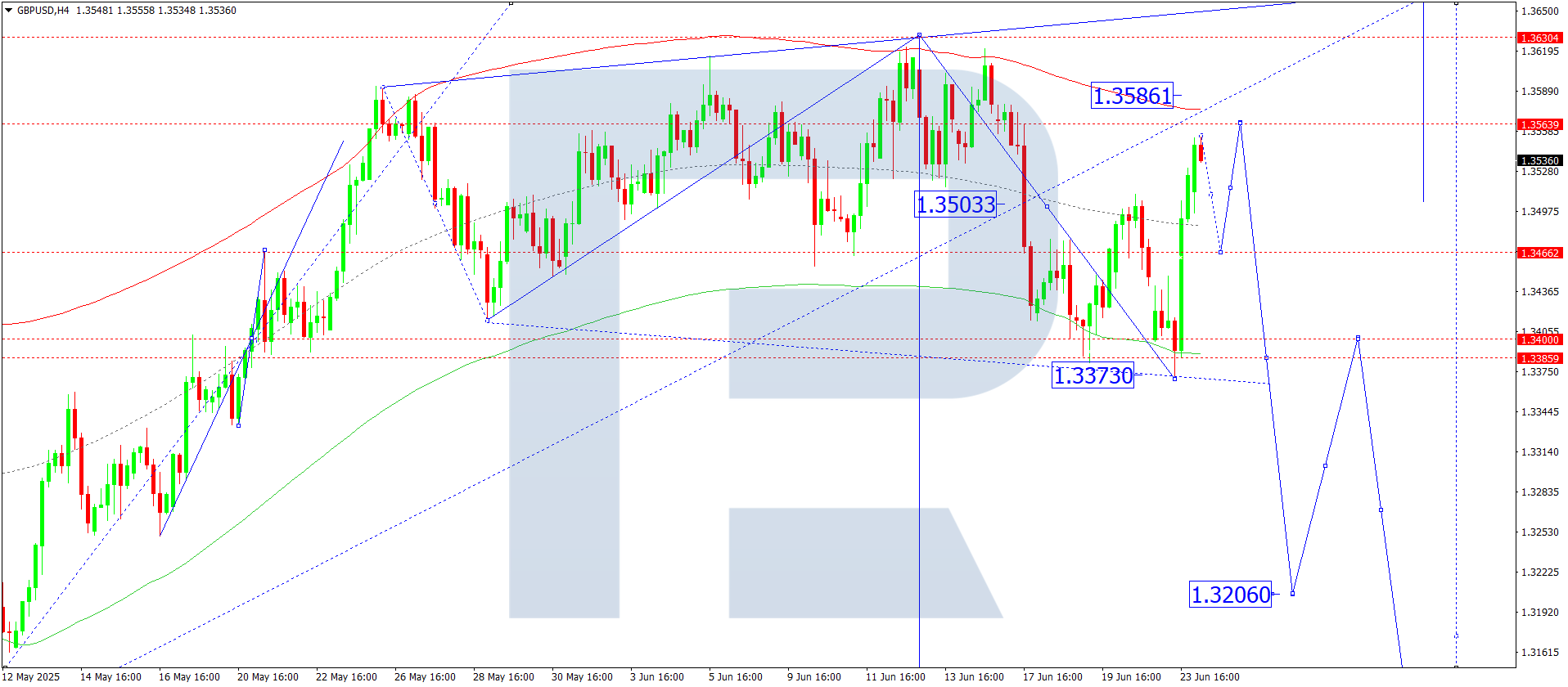

GBPUSD forecast

On the H4 chart of GBPUSD, the market completed a corrective wave to 1.3564. Today, 24 June 2025, a decline to 1.3466 is possible, followed by a rise to 1.3586. Once that level is reached, a new decline to 1.3466 may unfold. A broad consolidation range is forming around 1.3466. If the market breaks down, the wave may extend to 1.3370 and 1.3200. If the breakout is upwards, the range could expand to 1.3650 before a likely decline to 1.3200.

The Elliott wave structure and decline matrix with a pivot at 1.3466 support this outlook, identifying it as key in the current GBPUSD wave. The market is currently forming a wave towards the upper boundary of the price Envelope at 1.3586. A downward move to the lower boundary at 1.3370 is anticipated afterwards.

Technical indicators for today’s GBPUSD forecast suggest a decline to 1.3370.

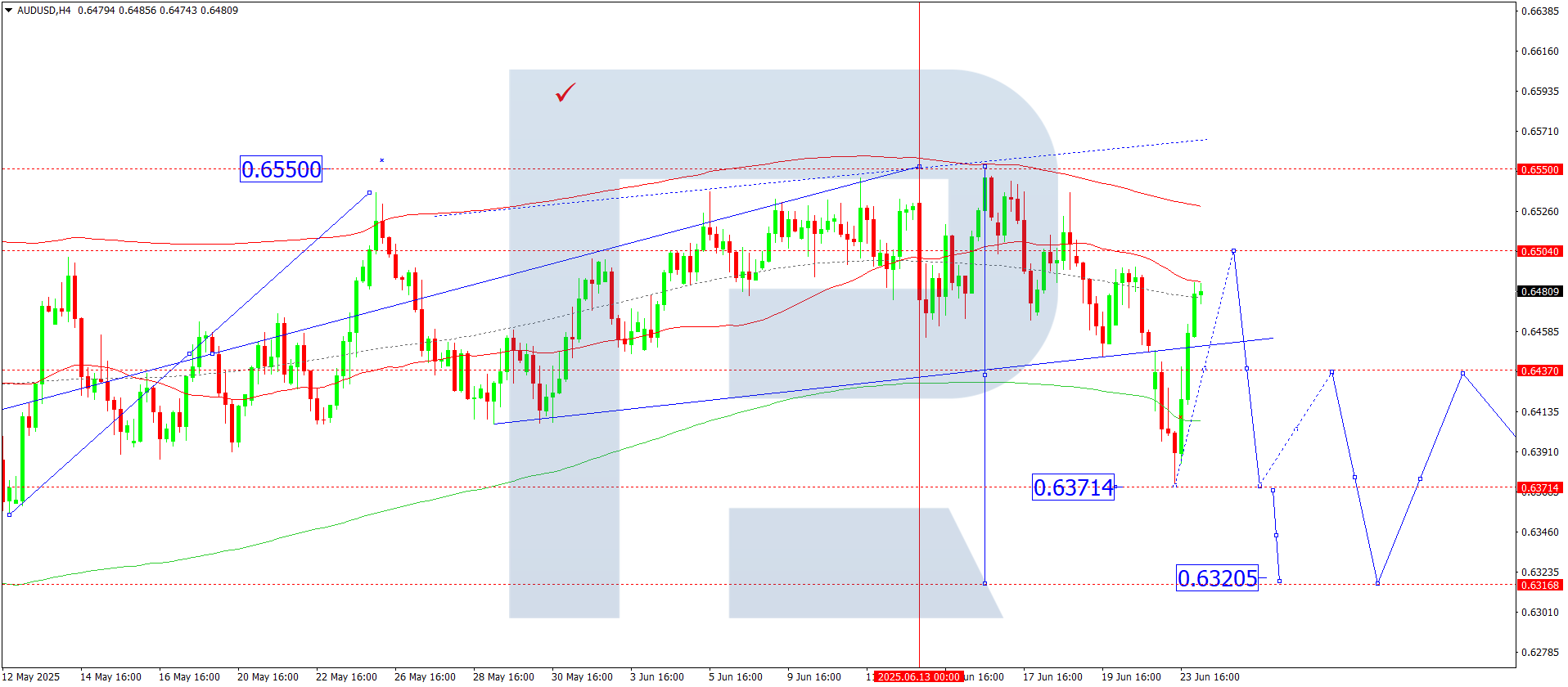

AUDUSD forecast

On the H4 chart of AUDUSD, the market is currently forming a corrective wave to 0.6500. Today, 24 June 2025, the correction is expected to end, and a new downward wave to the local target of 0.6370 may begin. Afterwards, a rebound to 0.6444 is possible, followed by a decline to 0.6320 as the main target.

The Elliott wave structure and the decline matrix with a pivot at 0.6500 support this outlook and define it as key in the AUDUSD structure. The market is currently heading towards the central line of the price Envelope at 0.6500. Once this level is reached, a decline to the lower boundary at 0.6370 may follow.

Technical indicators for today’s AUDUSD forecast suggest a likely development of another downward wave to 0.6370.

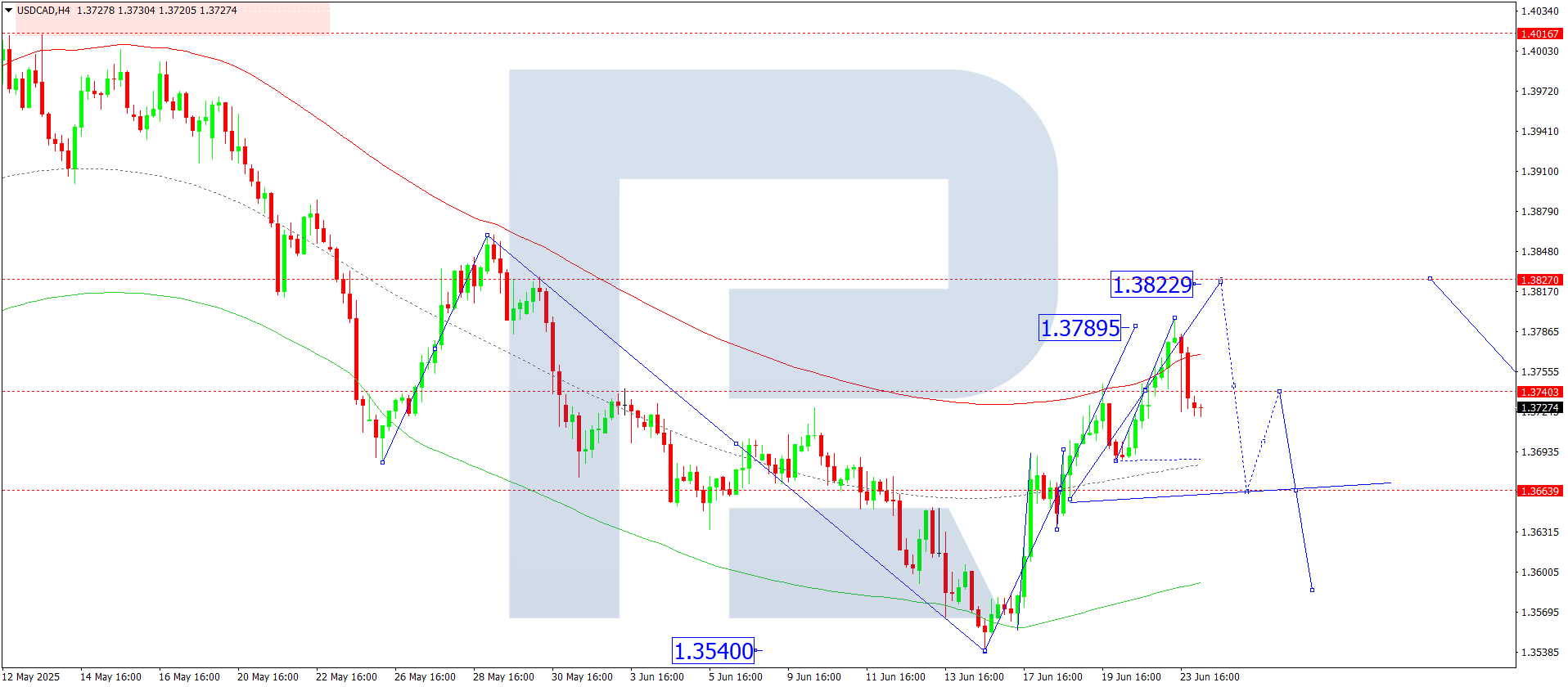

USDCAD forecast

On the H4 chart of USDCAD, the market completed a growth wave to 1.3790 as a local target. Today, 24 June 2025, a correction to 1.3666 is possible. Once this correction ends, a rise to 1.3822 is anticipated as the first target.

The Elliott wave structure and growth matrix with a pivot at 1.3666 confirm this outlook and mark it as key in the current USDCAD wave structure. The market has reached the upper boundary of the price Envelope at 1.3790. Today, a correction to the central line at 1.3666 remains relevant. Afterwards, a rise to the upper boundary at 1.3822 is expected.

Technical indicators for today’s USDCAD forecast suggest a decline to 1.3666.

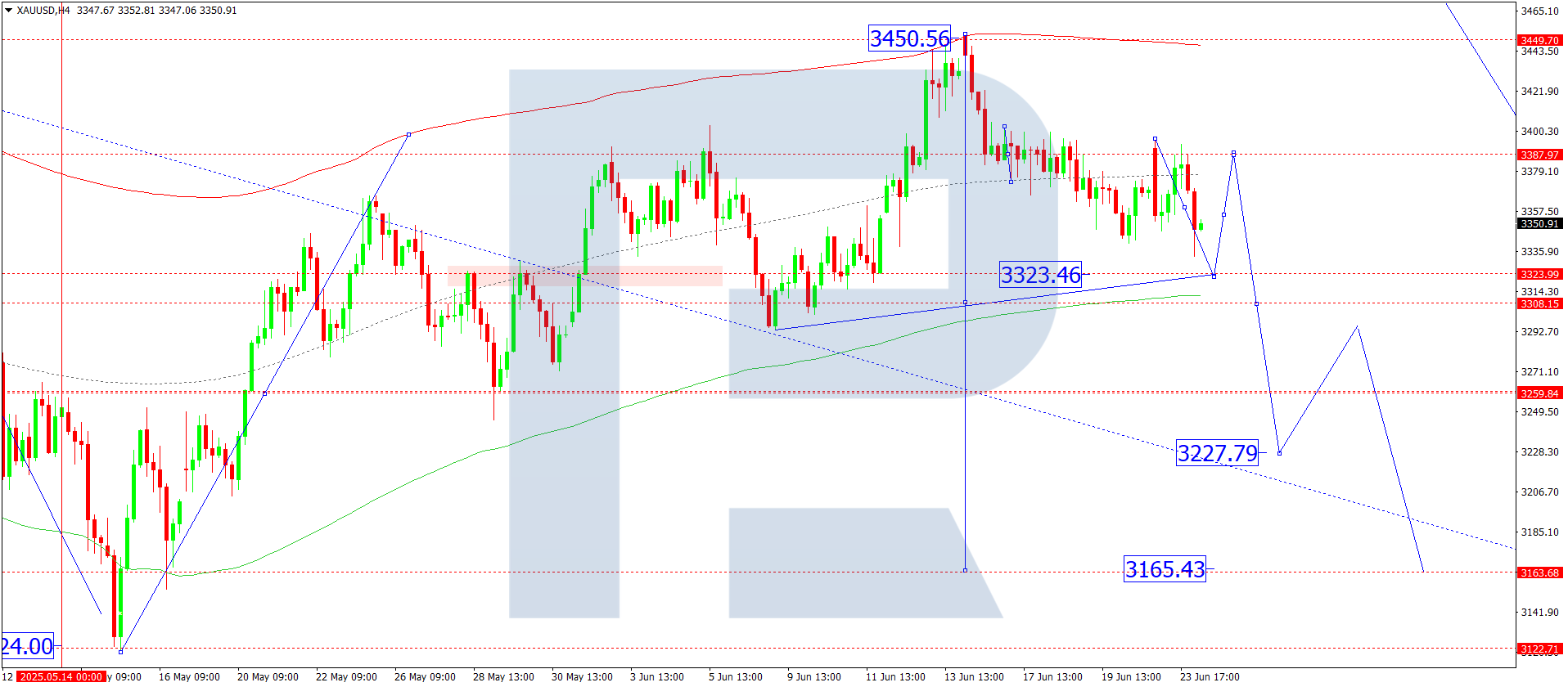

XAUUSD forecast

On the H4 chart of XAUUSD, the market bounced down from 3,388 and continues the decline to 3,323. Today, 24 June 2025, the market is expected to reach this target level. Afterwards, a rise towards 3,388 may follow. A broad consolidation range is developing around 3,388.

The Elliott wave structure and the decline matrix with a pivot at 3,388 support this scenario and define it as key in the current XAUUSD wave. The market formed a consolidation range around the central line of the price Envelope at 3,388 and broke lower. Today, a continued decline towards the lower boundary at 3,323 is possible.

Technical indicators for today’s XAUUSD forecast suggest a further decline to 3,323.

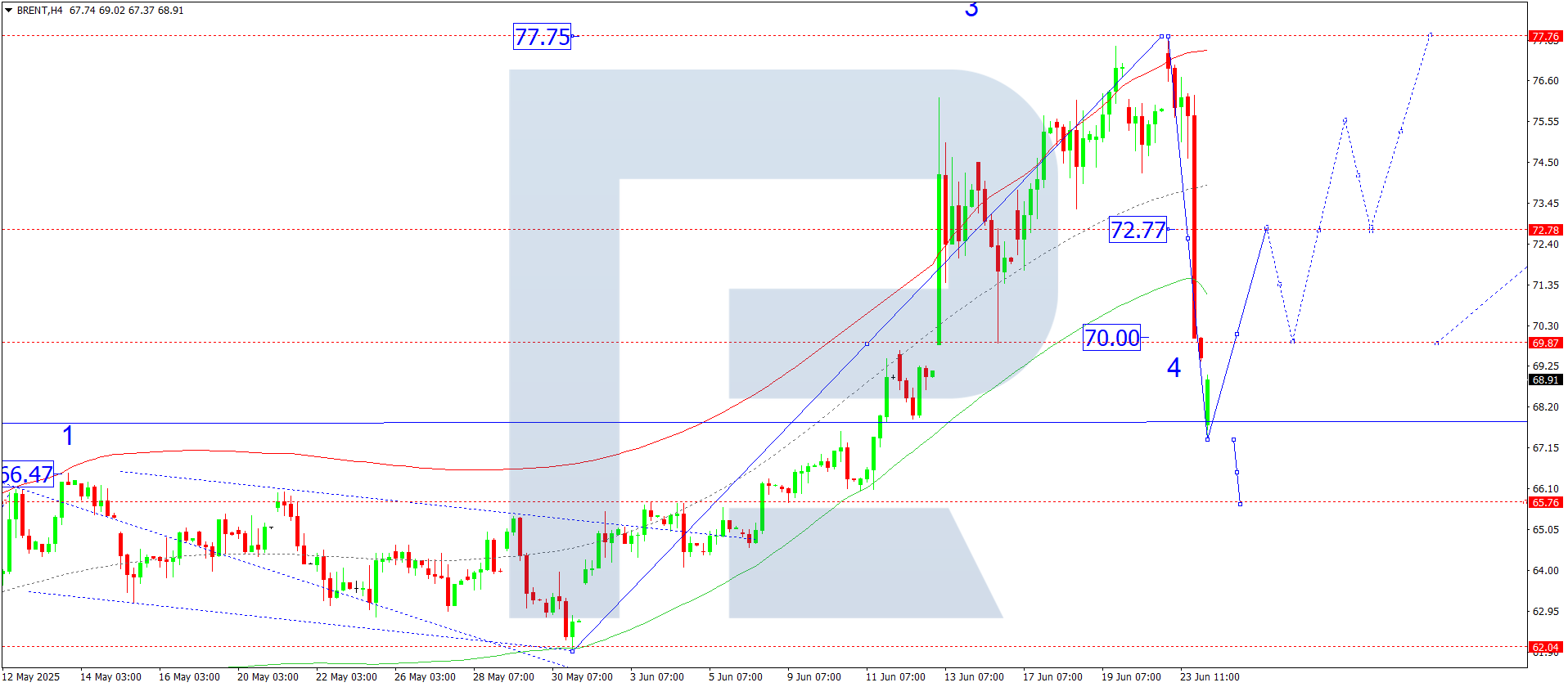

Brent forecast

On the H4 chart of Brent crude, the market completed a correction wave to 67.50. Today, 24 June 2025, a rise towards 72.77 is expected. A consolidation range may form around this level. If the market breaks upwards, the trend could continue to 81.11 with the potential to stretch to 82.00. A break downwards may lead to a further correction to 65.80. Afterwards, a growth wave to 82.00 is likely as the first target.

The Elliott wave structure and growth matrix with a pivot at 70.00 confirm this scenario and mark it as key in the Brent wave structure. The market is currently forming a correction structure towards the lower boundary of the price Envelope at 65.780. A rise towards the central line at 72.77 is possible. Later, a move to the upper boundary at 81.11 remains relevant.

Technical indicators in today’s Brent forecast suggest a potential upward wave to 72.77.