Daily technical analysis and forecast for 28 August 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 28 August 2025.

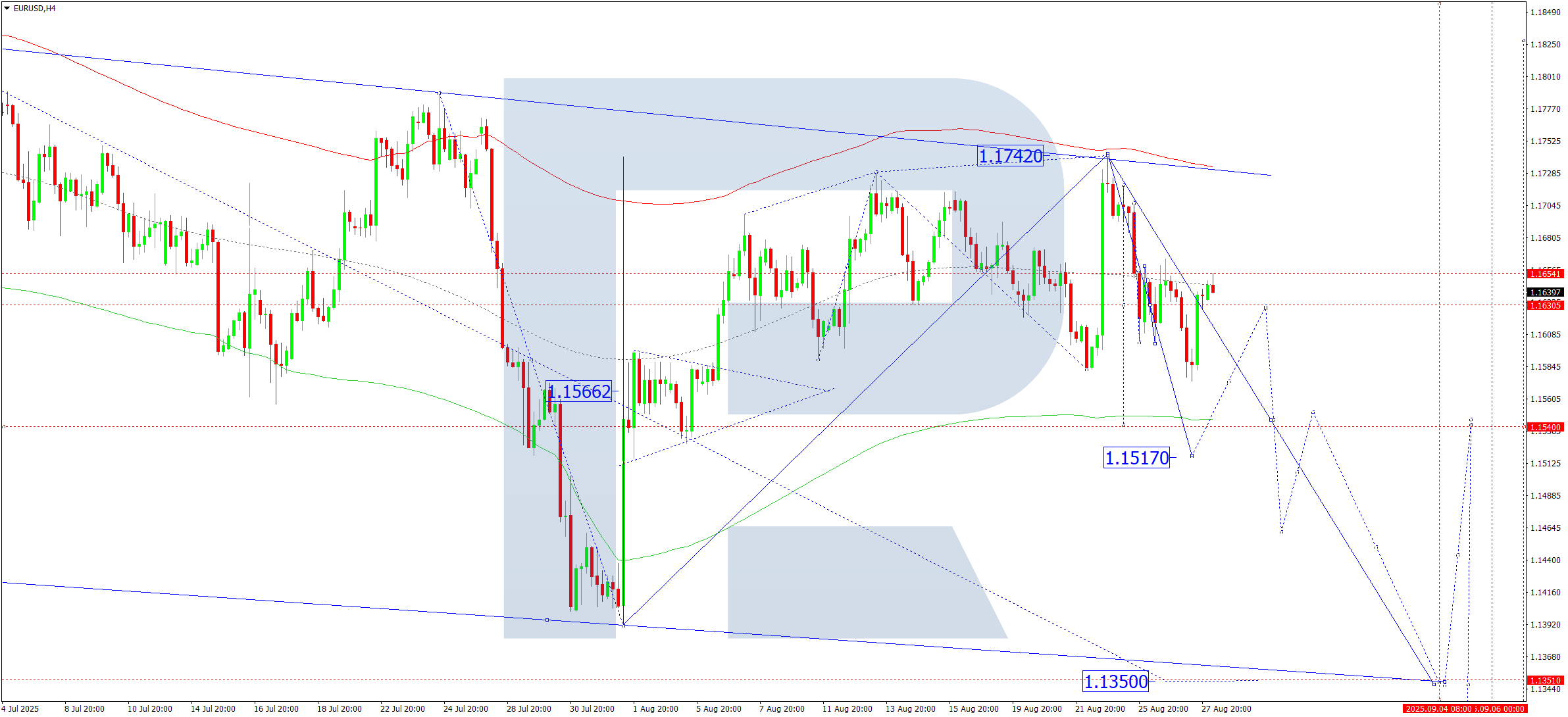

EURUSD forecast

On the H4 chart of EURUSD, the market completed a downward wave to 1.1573 and a correction to 1.1654. The consolidation range continues to form around 1.1630. Today, 28 August 2025, a downward breakout is expected with a local target at 1.1540. Later, a correction to 1.1630 (testing from below) is possible, followed by a continued decline to 1.1517 as the first target.

Technically, the Elliott wave structure and the downward wave matrix with a pivot at 1.1630 confirm this scenario for EURUSD. At the moment, the market continues to develop a downward wave to the lower boundary of the Price Envelope at 1.1540.

Technical indicators for today’s EURUSD forecast suggest the downward wave could continue to 1.1540.

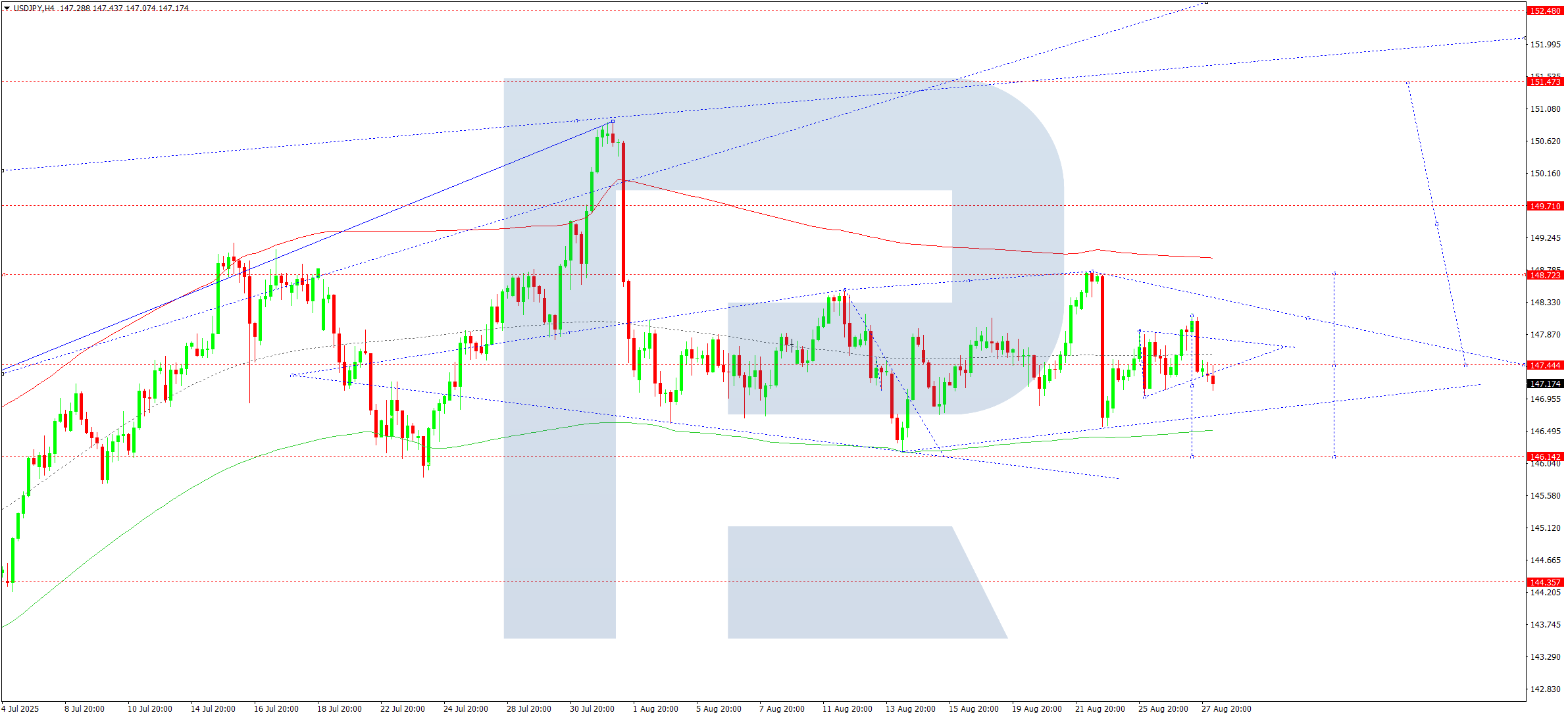

USDJPY forecast

On the H4 chart of USDJPY, the market continues to consolidate around 147.44, with the range extending up to 148.10. Today, 28 August 2025, the market returned to 147.44 and is forming a narrow consolidation range around this level. A downward breakout may extend the wave to 146.15, while an upward breakout may push the wave to 148.77.

Technically, the Elliott wave structure and the upward wave matrix with a pivot at 147.44 confirm this as the key scenario for USDJPY. At the moment, the market is consolidating around the central line of the Price Envelope at 147.44. A breakout downwards may open the potential for a move to its lower boundary at 146.15, while a breakout upwards may extend the wave to its upper boundary at 148.77.

Technical indicators for today’s USDJPY forecast suggest a decline to 146.15.

GBPUSD forecast

On the H4 chart of GBPUSD, the market completed a downward wave to 1.3414 and a correction to 1.3515. Today, 28 August 2025, a breakout below 1.3440 may trigger a move to 1.3395, with further development towards 1.3360 as the first target.

Technically, the Elliott wave structure and the downward wave matrix with a pivot at 1.3492 confirm this as the key scenario for GBPUSD. At the moment, the market is consolidating around the central line of the Price Envelope at 1.3492, with expectations of a decline to its lower boundary at 1.3360.

Technical indicators for today’s GBPUSD forecast suggest a continuation of the downward wave to 1.3360.

AUDUSD forecast

On the H4 chart of AUDUSD, the market remains in a consolidation phase around 0.6486, with no clear trend evident. Today, 28 August 2025, a downward breakout is expected with the wave continuing to 0.6400. After reaching this level, a correction to 0.6480 may follow.

Technically, the Elliott wave structure and the downward wave matrix with a pivot at 0.6515 confirm this as the key scenario for AUDUSD. At the moment, the market is forming the fifth downward wave to the lower boundary of the Price Envelope at 0.6400.

Technical indicators for today’s AUDUSD forecast suggest a downward move to 0.6400.

USDCAD forecast

On the H4 chart of USDCAD, the market broke below 1.3822 and continues to develop a wave to 1.3755. Today, 28 August 2025, the pair could reach this target before undergoing a correction to 1.3800. After this correction, another downward wave towards 1.3700 may follow.

Technically, the Elliott wave structure and the downward wave matrix with a pivot at 1.3800 confirm this scenario for USDCAD. At the moment, the market is developing a downward wave to the lower boundary of the Price Envelope at 1.3755. Later, growth to its central line at 1.3800 (testing from below) is possible, followed by another decline to its lower boundary at 1.3700.

Technical indicators for today’s USDCAD forecast suggest a decline to 1.3755.

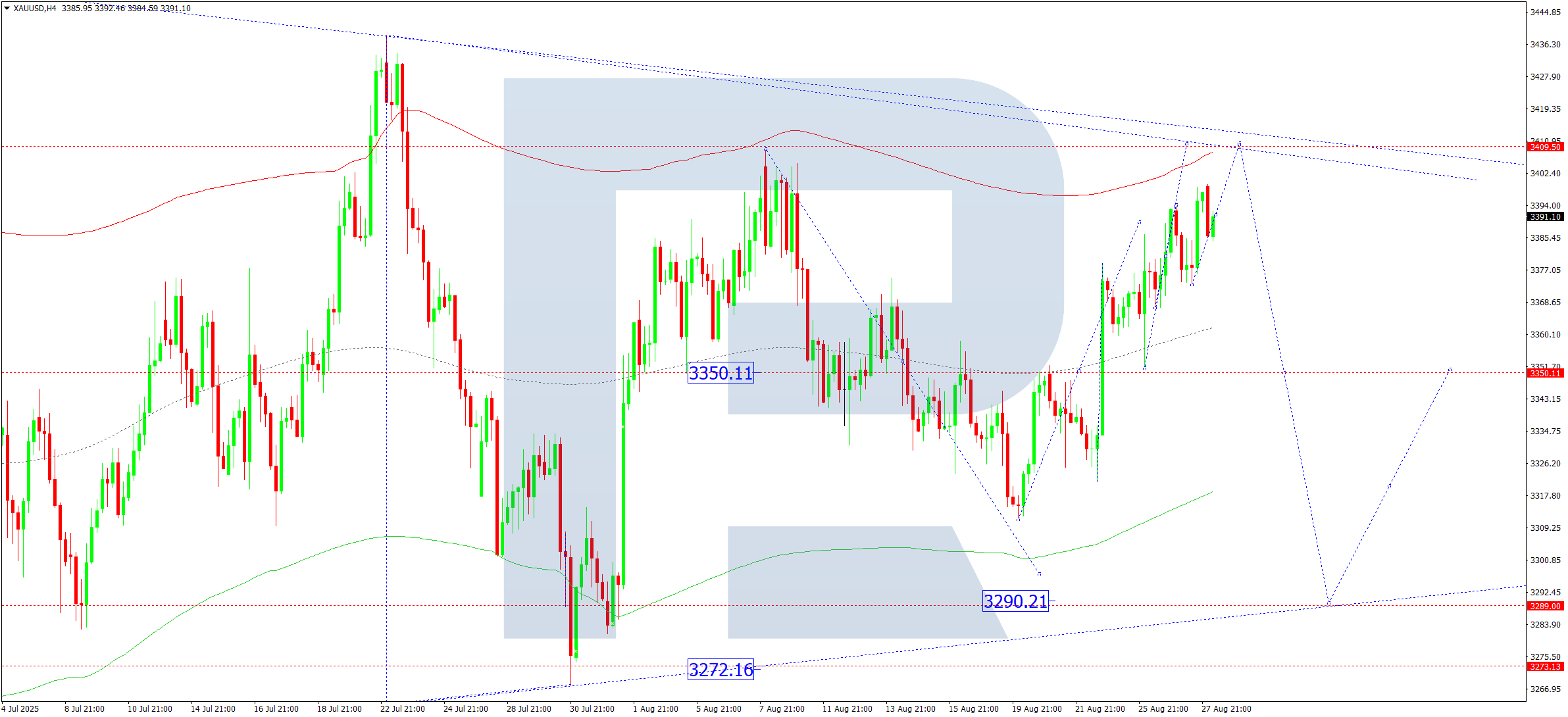

XAUUSD forecast

On the H4 chart of XAUUSD, the market is forming a consolidation range at the top of the growth wave around 3,380. Today, 28 August 2025, an expansion upwards to 3,409 is possible. Later, a decline to 3,350 is expected, and if this level breaks, the wave may continue to 3,290.

Technically, the Elliott wave structure and the downward wave matrix with a pivot at 3,350 confirm this as the key scenario for XAUUSD. At the moment, the market is forming a consolidation range around the central line of the Price Envelope at 3,350, with growth to its upper boundary at 3,409 followed by a decline to its central line at 3,350. If this level breaks, the wave may extend to its lower boundary at 3,290.

Technical indicators for today’s XAUUSD forecast suggest a continued decline to 3,350.

Brent forecast

On the H4 chart of Brent, the market completed a growth wave to 67.45, followed by a correction to 66.77. Today, 28 August 2025, growth to 68.66 is expected, with the trend continuing to 68.88 as the first target.

Technically, the Elliott wave structure and the upward wave matrix with a pivot at 67.70 confirm this as the key scenario for Brent. At the moment, the market is continuing a wave to the upper boundary of the Price Envelope at 68.88. Later, a correction to its central line at 66.60 may follow.

Technical indicators for today’s Brent forecast suggest an upward wave to 68.88.