Daily technical analysis and forecast for 7 August 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 7 August 2025.

EURUSD forecast

On the H4 chart of EURUSD, the market broke out of the consolidation range upwards. Today, 7 August 2025, the correction is expected to continue towards 1.1680. After this correction is complete, a new downward wave could follow, aiming for 1.1343 as the first target. Subsequently, the pair could return to the 1.1550 level, the second target.

This scenario receives technical confirmation from the specified Elliott wave structure and the downward wave matrix centred at 1.1550, which acts as the key level in this wave structure for EURUSD. At present, the market is developing a correction wave towards the upper boundary of the price Envelope at 1.1680. Once this level is reached, the pair could dip to the lower boundary at 1.1343.

Technical indicators for today's EURUSD forecast suggest that the correction could complete at 1.1680, followed by a downward wave towards 1.1343.

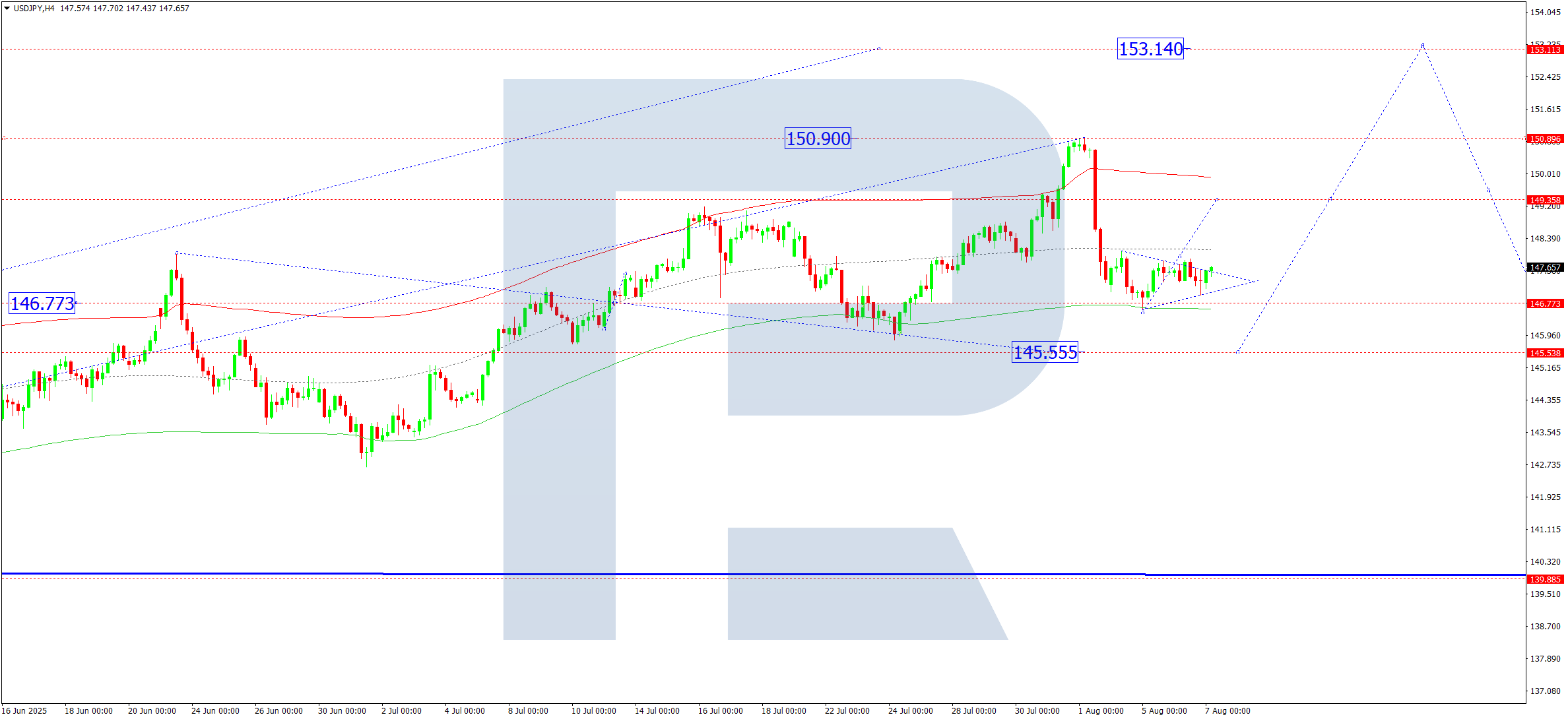

USDJPY forecast

On the H4 chart of USDJPY, the market completed a correction to 146.70. Today, 7 August 2025, a compact consolidation range may form above this level. A downward breakout would signal a decline towards 145.55. An upward breakout would open the path towards 149.33, and a breakout of this level would lead to an extended wave towards 153.14.

This scenario finds technical confirmation in the Elliott wave structure and the growth wave matrix with its pivot point at 146.77, considered key to this wave. Currently, the market has formed a growth structure up to the upper boundary of the price Envelope at 150.90 and corrected to 147.00 (tested from above). A downward extension to the lower boundary at 145.55 remains possible. Later, the pair is expected to rise towards the upper boundary at 153.14.

Technical indicators for today's USDJPY forecast suggest the start of a growth wave towards 153.14.

GBPUSD forecast

On the H4 chart of GBPUSD, the market is forming a compact consolidation range below 1.3366. Today, 7 August 2025, if the market breaks upwards, the range may expand towards 1.3400. The entire growth structure is viewed as a correction. Upon its completion, the fifth downward wave is expected to start, aiming for 1.3155. If this level is broken, the wave may continue towards 1.2942 as the first target in the downward trend.

The scenario is technically confirmed by the Elliott wave structure and the downward wave matrix with its pivot point at 1.3366, considered the key level. At present, the market has completed a downward wave towards the lower boundary of the price Envelope at 1.3141. The correction could now continue towards its central line at 1.3366 before the price declines to the lower boundary at 1.2942.

Technical indicators for today's GBPUSD forecast suggest the correction may complete at 1.3366, followed by a downward wave towards 1.2942.

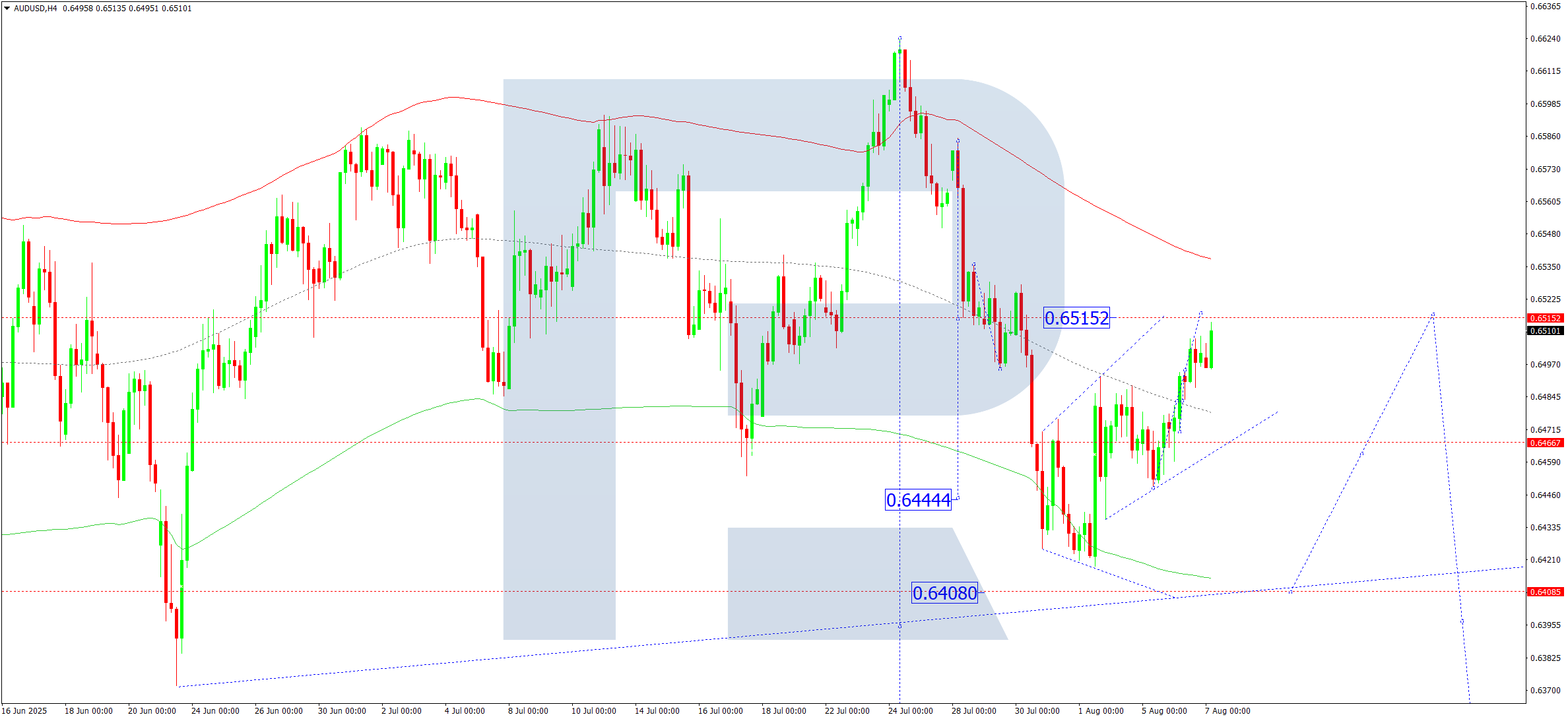

AUDUSD forecast

On the H4 chart of AUDUSD, the market continues forming a consolidation range around 0.6466 with no clear trend. Today, 7 August 2025, an upward move towards 0.6515 is expected. After that, we may see a decline towards 0.6460. A breakout below this level could signal a continued downward trend towards 0.6408 as the first target.

This scenario is technically confirmed by the Elliott wave structure and the AUDUSD downward wave matrix, with a pivot point at 0.6515 – considered the key level in this wave. Currently, the market completed a downward wave towards the lower boundary of the price Envelope at 0.6417. Today, a correction wave towards the central line at 0.6515 is possible, followed by a move further down to the lower boundary at 0.6408.

Technical indicators for today's AUDUSD forecast suggest the start of a downward wave towards 0.6408.

USDCAD forecast

On the H4 chart of USDCAD, the market continues its correction towards 1.3715. Today, 7 August 2025, the price is expected to reach this target level. Once the correction is complete, a new upward wave could begin, targeting 1.3890.

This scenario is supported by the Elliott wave structure and the growth wave matrix with its pivot point at 1.3715, which acts as the key level for USDCAD in this structure. The market formed a consolidation range around the central line of the price Envelope at 1.3800 and broke out downwards. Today, the pair could drop to the lower boundary at 1.3715. The entire decline structure is seen as a correction of the previous growth wave. After this correction, an upward wave towards the upper boundary at 1.3890 may follow.

Technical indicators for today's USDCAD forecast suggest the start of a growth wave towards 1.3890.

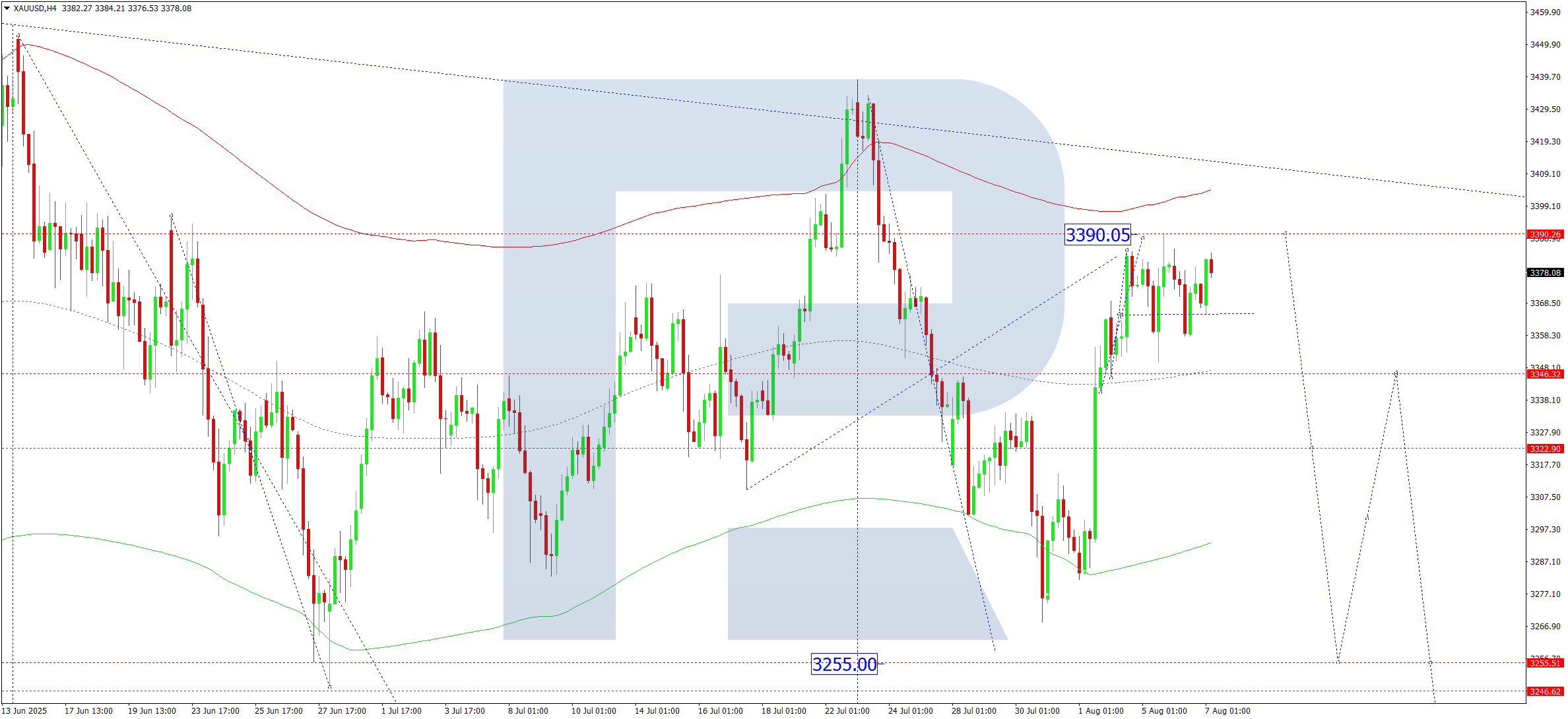

XAUUSD forecast

On the H4 chart of XAUUSD, the market completed a correction to 3,390. Today, 7 August 2025, the pair could continue to form a consolidation range below this level. The price is expected to break below the range and continue its movement towards 3,255 as the local target.

This scenario is technically confirmed by the Elliott wave structure and the downward wave matrix with its pivot point at 3,345, seen as the key level for XAUUSD in this wave. Currently, the market has completed a correction towards the upper boundary of the price Envelope at 3,390. Next, the pair could tumble to the central line at 3,333 and continue the wave towards the lower boundary at 3,255.

Technical indicators for today's XAUUSD forecast suggest the start of a downward wave towards 3,255.

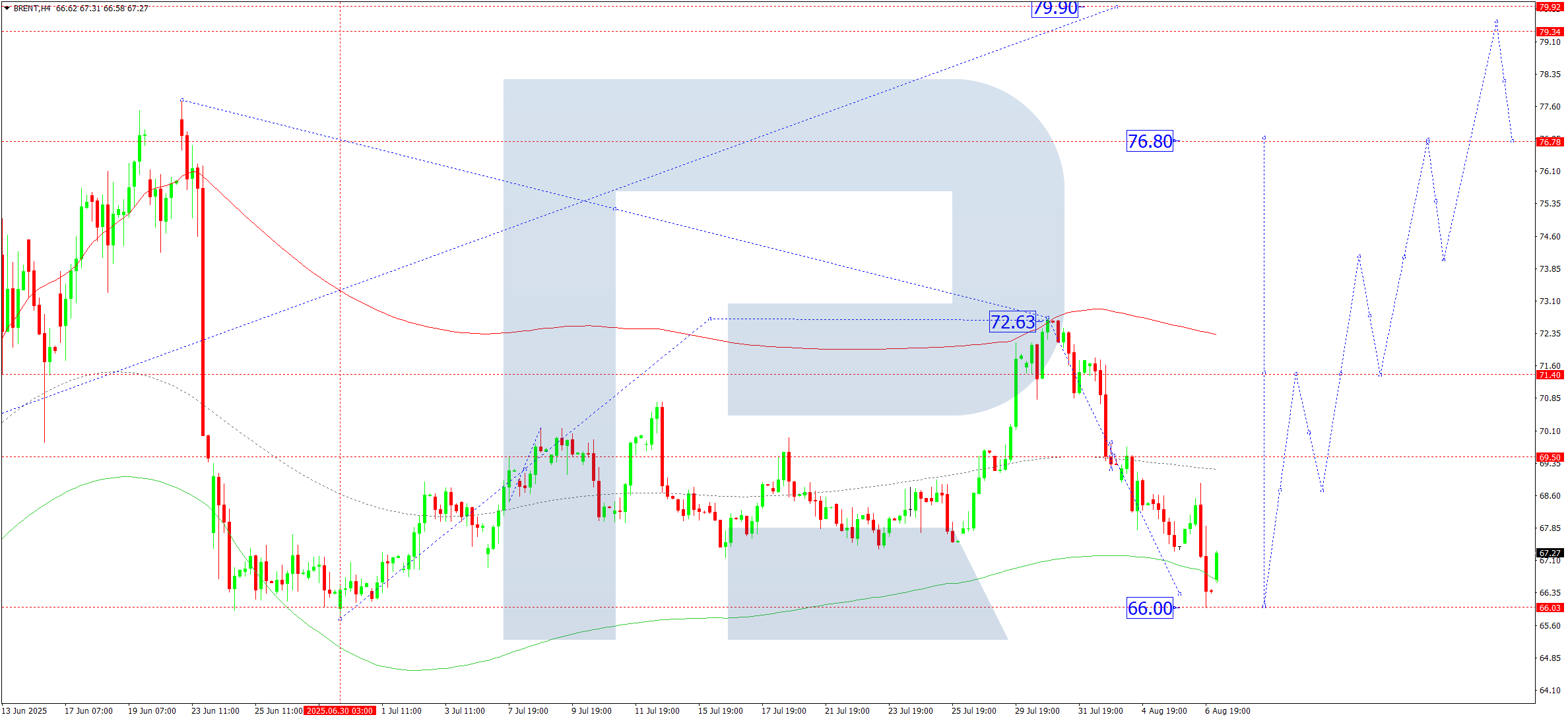

Brent forecast

On the Brent H4 chart, the market formed a consolidation range around 69.50 and continued the correction downwards to 66.00. Today, 7 August 2025, a growth wave is expected to start, aiming for 71.40. After that, we may see a pullback to 68.77, followed by growth to 74.30 and a possible continuation of the trend to 76.80.

This scenario is technically supported by the Elliott wave structure and the growth wave matrix with its pivot point at 69.50, considered the key level for Brent in this wave. The market completed a correction towards the lower boundary of the price Envelope at 66.00. The pair may now climb to the upper boundary at 71.40, with the trend potentially continuing to 76.80.

Technical indicators in today's Brent forecast suggest the start of a growth wave towards 71.40.