The DE 40 stock index has partially rebounded from its recent losses, but the overall trend remains bearish. The DE 40 forecast for today is negative.

DE 40 forecast: key trading points

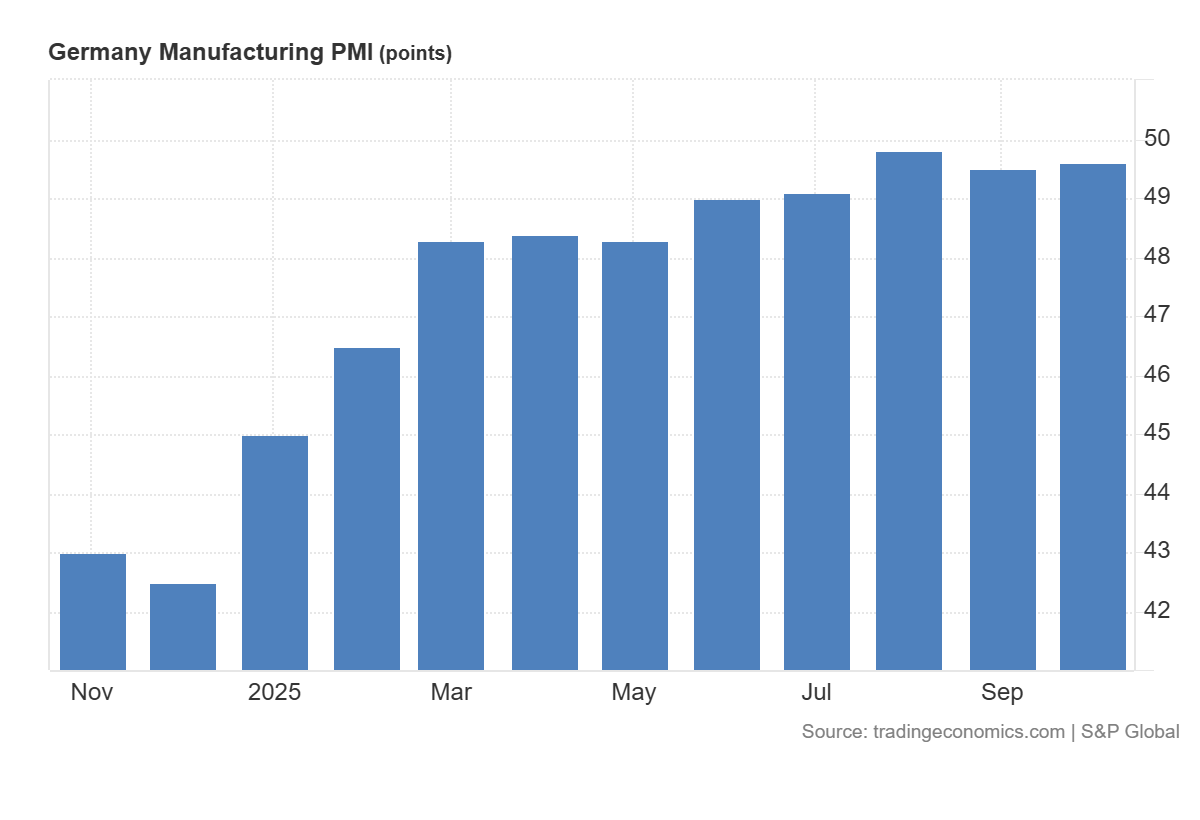

- Recent data: Germany’s preliminary manufacturing PMI came in at 49.5 in October 2025

- Market impact: the data creates a mixed backdrop for the German equity market

DE 40 fundamental analysis

Germany’s manufacturing PMI for October came in at 49.6 points, slightly above both the consensus forecast of 49.5 and the previous reading of 49.5. The figure indicates that the industrial sector remains in contraction, but with signs of gradual stabilisation near the neutral threshold. For the equity market, this is a moderately positive signal in terms of expectations: the slower pace of decline in manufacturing supports the valuation of future cash flows in cyclical sectors, reduces the risk of margin erosion from underutilised capacity, and may help narrow discounts on industrial assets. However, since the indicator remains below 50, it continues to reflect weakness in domestic and external demand, limiting the upside potential and making it dependent on confirmation of improvement in subsequent data releases.

For the DE 40 index, the likely response is neutral to positive. Key beneficiaries include automakers, industrial equipment manufacturers, and chemical producers, which may gain support from expectations of stabilising output levels, especially if German bond yields remain flat and the euro strengthens. If yields stay contained, valuation multiples for long-duration and export-oriented companies could expand slightly due to a reduced recession-risk premium.

Germany’s manufacturing PMI: https://tradingeconomics.com/germany/manufacturing-pmiDE 40 technical analysis

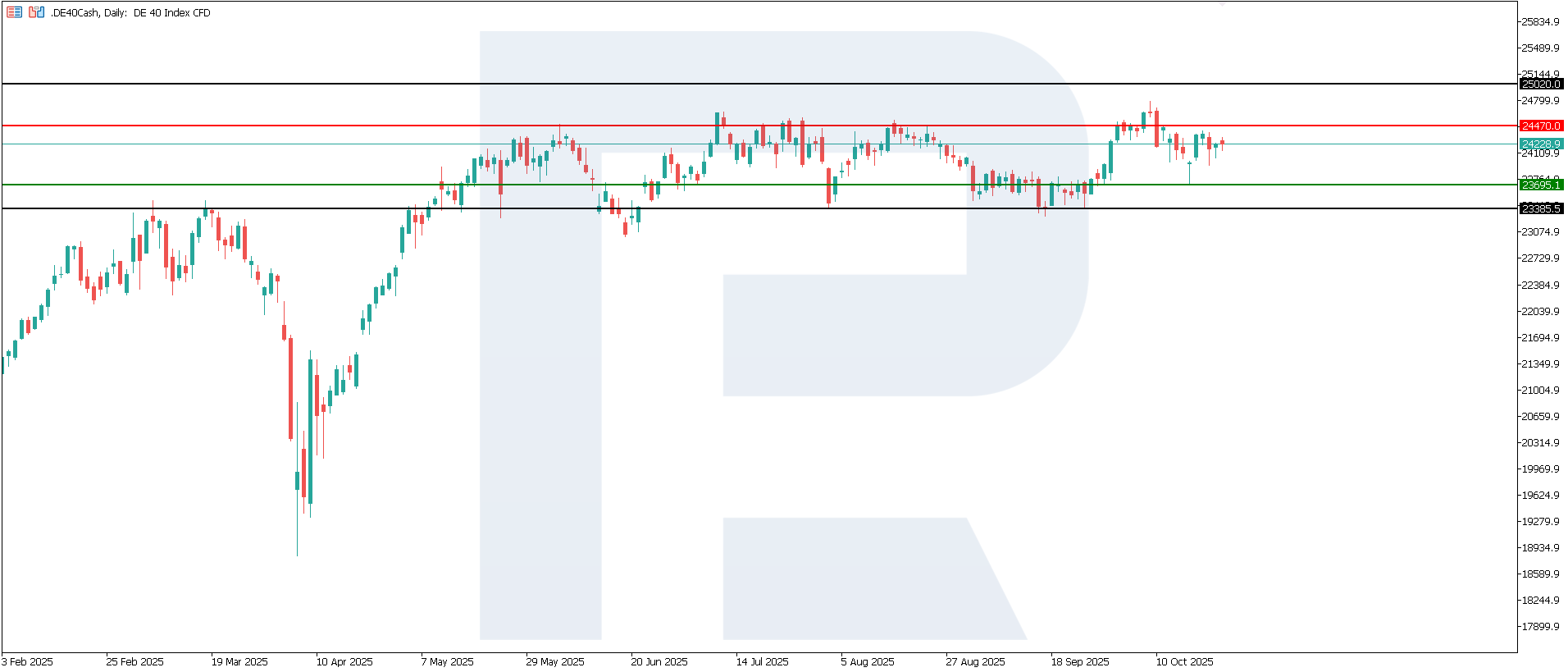

For the DE 40 index, the key resistance level is located near 24,470.0, while the support around 24,160.0 has been broken. The downward movement persists, and it remains difficult to assess its duration. The next potential downside target lies near 23,385.0.

The DE 40 price forecast considers the following scenarios:

- Pessimistic DE 40 scenario: if the price consolidates below the previously breached support level at 24,160.0, the index could slip to 23,385.0

- Optimistic DE 40 scenario: a breakout above the 24,470.0 resistance level could drive the index to 25,020.0

DE 40 technical analysis for 27 October 2025Summary

The PMI reading below 50 will continue to limit revaluation potential: the market is likely to remain selective, favouring issuers with strong operational efficiency, diversified export portfolios, and solid order backlogs, while companies dependent on domestic capital demand may underperform. The next downside target for the DE 40 index could be at 23,385.0.

Open Account