The EURUSD pair soared to 1.1772, with markets expecting the Fed to cut rates at least twice by the end of the year. Find more details in our analysis for 16 September 2025.

EURUSD forecast: key trading points

- The EURUSD pair rallied strongly ahead of the Federal Reserve meeting

- Before the rate decision, investors will assess US retail sales data

- EURUSD forecast for 16 September 2025: 1.1780 and 1.1830

Fundamental analysis

The EURUSD pair climbed to a two-month high ahead of the start of the Federal Reserve’s two-day monetary policy meeting.

The market is almost fully pricing in a 25-basis-point rate cut this week and expects a total of 67 basis points of easing by the end of the year. These expectations are backed by fresh data pointing to labour market cooling and moderate inflation despite tariff pressures.

US President Donald Trump once again urged Federal Reserve Chairman Jerome Powell to take a bolder step, citing weakness in the housing market.

Today, investors will also focus on retail sales, import prices, housing sector indicators and business inventories. Trump also remains active on the external front. He previously noted that the US-China talks in Spain are progressing well. A call with Chinese President Xi Jinping is scheduled for Friday to agree on terms.

The EURUSD forecast is positive.

EURUSD technical analysis

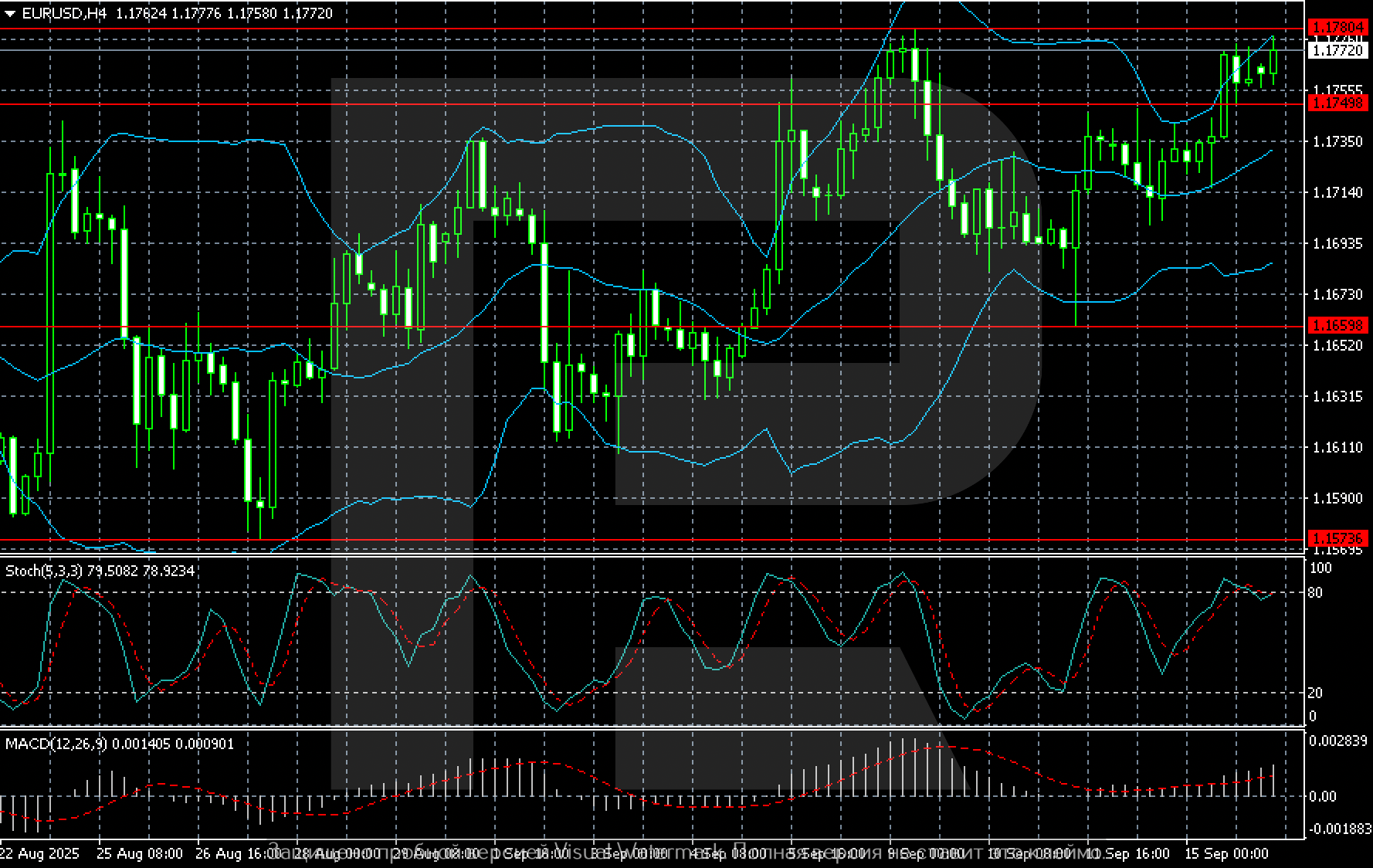

On the H4 chart, EURUSD quotes have consolidated around 1.1770. The pair is showing attempts to extend growth after consolidation earlier in September, with the main resistance level at 1.1780. The market has tested this level several times but has not yet managed to break above it. Support is located at 1.1749 and further at 1.1660.

Bollinger Bands are widening, and the price is moving in the upper part of the range – all pointing to continued bullish momentum. MACD remains above the zero line, confirming upward pressure. The Stochastic is approaching overbought territory (around 80), which may signal the likelihood of a short-term correction before another attempt to break above the resistance level.

Thus, the 1.1749–1.1780 range becomes the key zone for the near-term trading outlook. A confident breakout above 1.1780 would open the way to new targets around 1.1830, while a return below 1.1749 would increase the risk of a decline towards 1.1660.

Summary

The EURUSD pair may test a crucial level in the near term. The EURUSD forecast for today, 16 September 2025, does not rule out an attack on 1.1780 followed by a move towards 1.1830.

Open Account