The EURUSD pair stabilised around 1.1777 on Friday. Investors feel less nervous about the Fed’s future. Details – in our analysis for 4 July 2025.

EURUSD forecast: key trading points

- The EURUSD pair declined and is now consolidating after major news releases

- Next week will be eventful: with developments on trade tariffs and the US budget deficit

- EURUSD forecast for 4 July 2025: 1.1829

Fundamental analysis

EURUSD paused at around 1.1777 at the end of the week. The US dollar found support after the release of strong labour market statistics, which eased concerns about an economic slowdown and reduced pressure on the Fed regarding an imminent rate cut.

According to data, the US economy created 147K jobs in June – higher than May’s 144K and significantly above market expectations of 110K. Meanwhile, the unemployment rate unexpectedly fell to 4.1%, against forecasts for an increase to 4.3%.

On the trade front, markets await new statements from President Donald Trump. According to media reports, the White House is preparing either to announce new tariff rates or extend the current deadline (9 July) for several countries. This also supports the USD and general market sentiment.

Meanwhile, the House of Representatives approved Trump’s large tax and budget package, which now heads to the White House for signing. The document implies an expansion of the federal budget deficit by more than 3 trillion USD.

The EURUSD forecast remains neutral.

EURUSD technical analysis

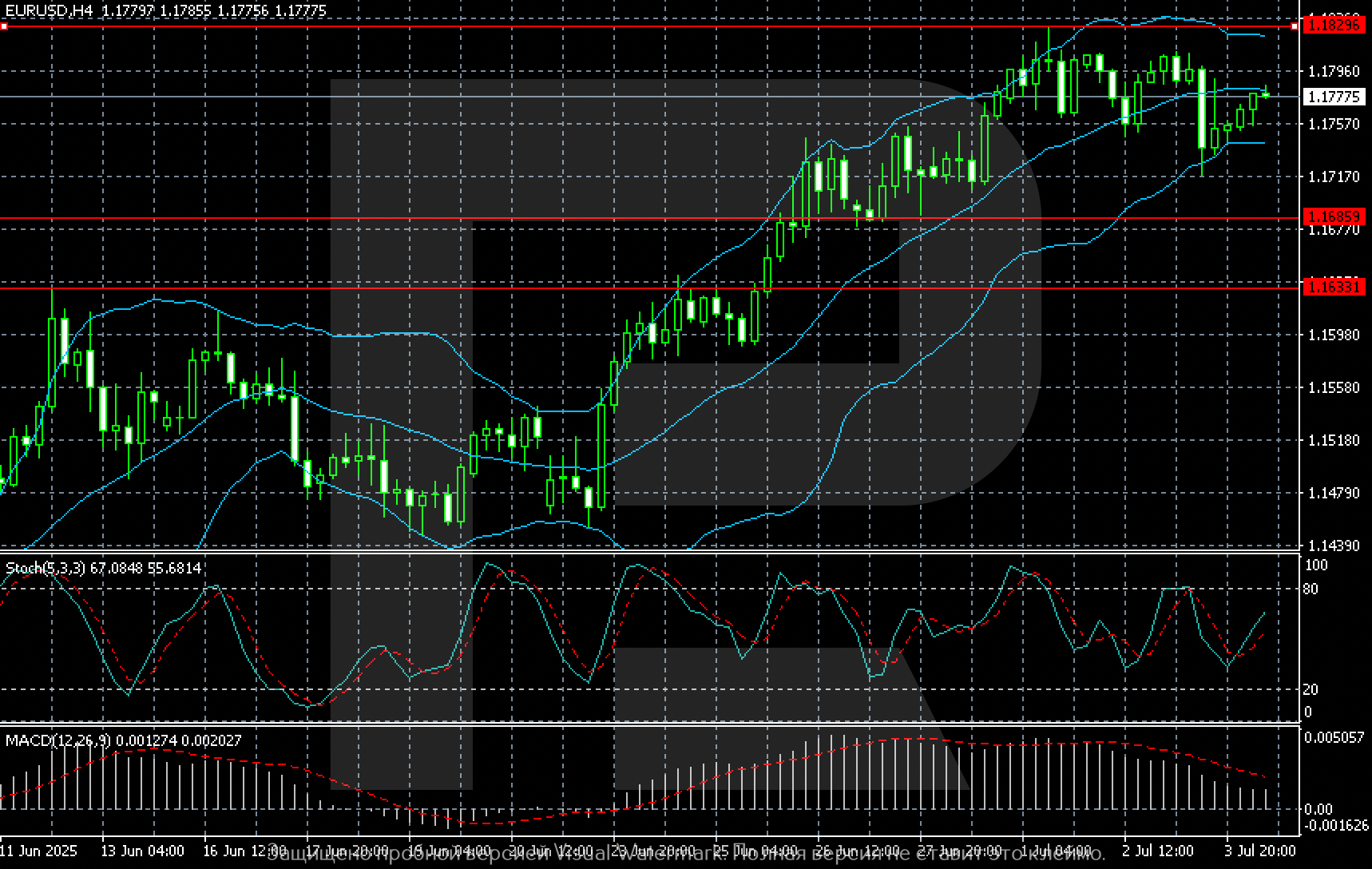

On the H4 chart, EURUSD is holding near 1.1777 after a slight correction from the local high of 1.1829 reached earlier this week. Despite the decline, the price remains above key support at 1.1685, maintaining the overall upward trend in the market.

The Bollinger Bands are widened, and quotes are in the upper part of the channel. This indicates that the balance of power remains with the buyers. However, the Stochastic indicator shows a decline from the overbought zone – which may signal a short-term correction or consolidation.

MACD remains positive, although the histogram shows a decrease in amplitude, which may also indicate weakening bullish momentum.

Support levels are at 1.1685 and 1.1633. Resistance is located at 1.1829. A confident breakout upwards will open the way to new highs. Holding above 1.1685 will be seen as a signal of the continuation of the uptrend.

Summary

The EURUSD pair saw a slight correction in response to the release of key US data. The EURUSD forecast for today, 4 July 2025, expects consolidation and a soon return of the price towards 1.1829.