The EURUSD pair remains stable around 1.1195. The market has a plethora of crucial statistics ahead. Find out more in our analysis for 15 May 2025.

EURUSD forecast: key trading points

- The market believes the White House may be intentionally weakening the US dollar

- Focus shifts to a large batch of key data releases due tonight, including retail sales and industrial production

- EURUSD forecast for 15 May 2025: 1.1163

Fundamental analysis

The EURUSD pair is hovering around 1.1195 on Thursday. Trade uncertainty continues to pressure the market despite a recent easing in tensions.

Investors actively debate whether Washington may be deliberately pursuing a weaker dollar as part of ongoing trade negotiations. The Trump administration previously argued that a strong dollar and weak regional currencies create unfavourable conditions for US exporters.

The dollar’s recent strength, driven by optimism over tariff reductions in US-China talks, has started to fade. The market’s attention has now returned to the broader economic impact of Washington’s trade policy.

Thursday brings a heavy load of crucial US dollar data, including retail sales, producer inflation figures, and the March industrial production report.

The EURUSD forecast is moderately negative.

EURUSD technical analysis

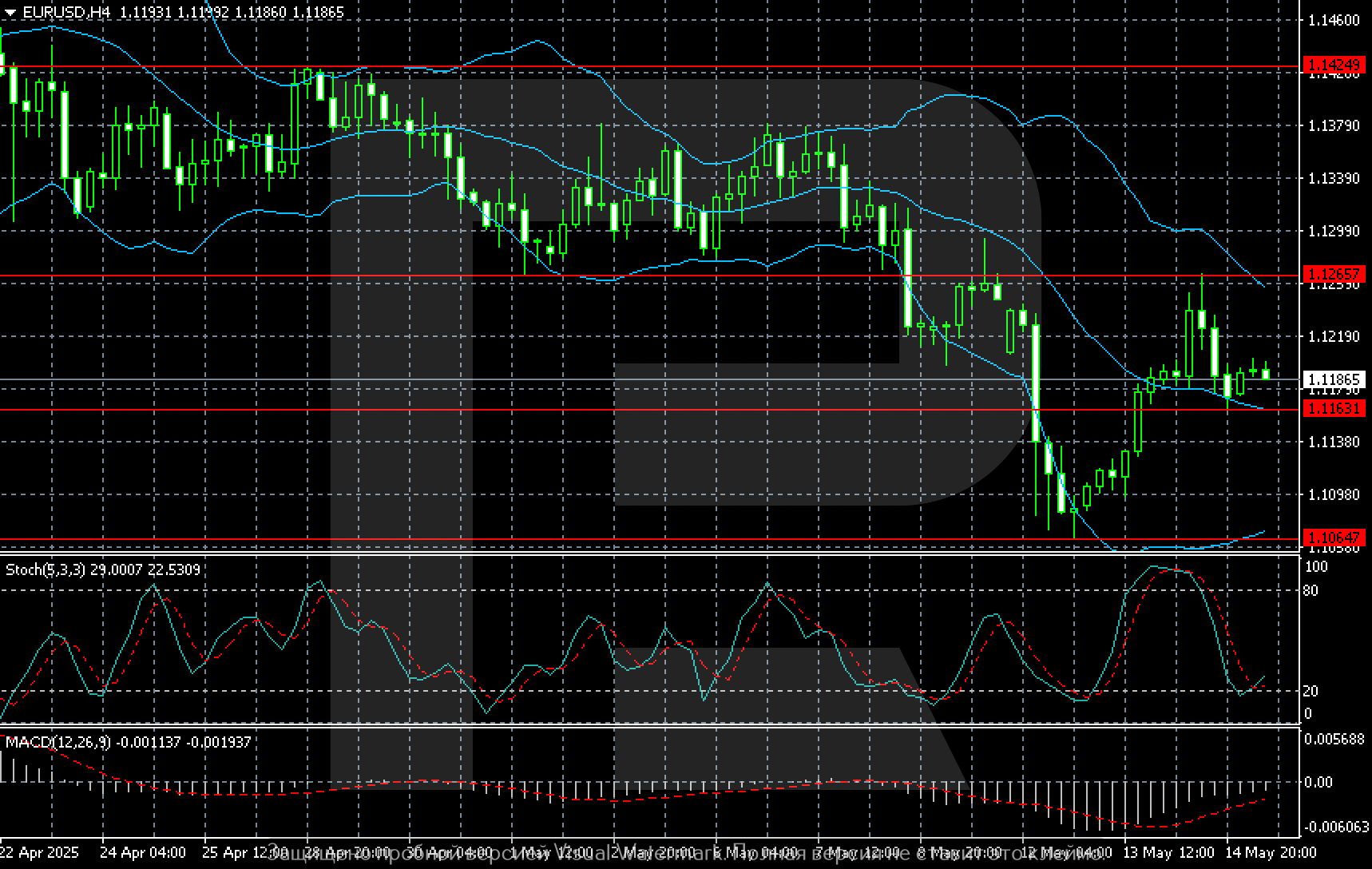

On the H4 chart, the EURUSD pair has room for a local pullback towards 1.1163. If the market goes lower, the path to 1.1064 could open, although not immediately.

On a larger timeframe, the main currency pair hovers in a sideways channel between 1.1163 and 1.1265.

Summary

The EURUSD pair enters another consolidation phase due to a mix of opposing factors. The market must weigh the White House’s intentions, US trade policy implications, and the upcoming data releases. The EURUSD outlook for today, 15 May 2025, anticipates a wave of selling towards 1.1163.