A rise in US jobless claims may trigger growth in the EURUSD rate towards 1.1565. Find more details in our analysis for 24 April 2025.

EURUSD forecast: key trading points

- US initial jobless claims: previously at 215 thousand, projected at 222 thousand

- US continuing jobless claims: previously at 1,885 thousand, projected at 1,880 thousand

- EURUSD forecast for 24 April 2025: 1.1565 and 1.1280

Fundamental analysis

US initial jobless claims represent the number of people who claimed unemployment benefits for the first time during the previous week. This indicator measures the labour market climate, with an increase in initial jobless claims indicating rising unemployment. The previous reading stood at 215 thousand, while the forecast for 23 April 2025 anticipates an uptick to 222 thousand. Although not a sharp rise, it could still impact the EURUSD rate.

Fundamental analysis for 23 April 2025 also considers US continuing jobless claims, which are forecast to decline to 1,880 thousand. However, it is worth noting that actual data may deviate significantly from expectations.

Overall, the EURUSD outlook is favourable for the euro, with the US dollar likely to lose ground amid US fundamentals.

EURUSD technical analysis

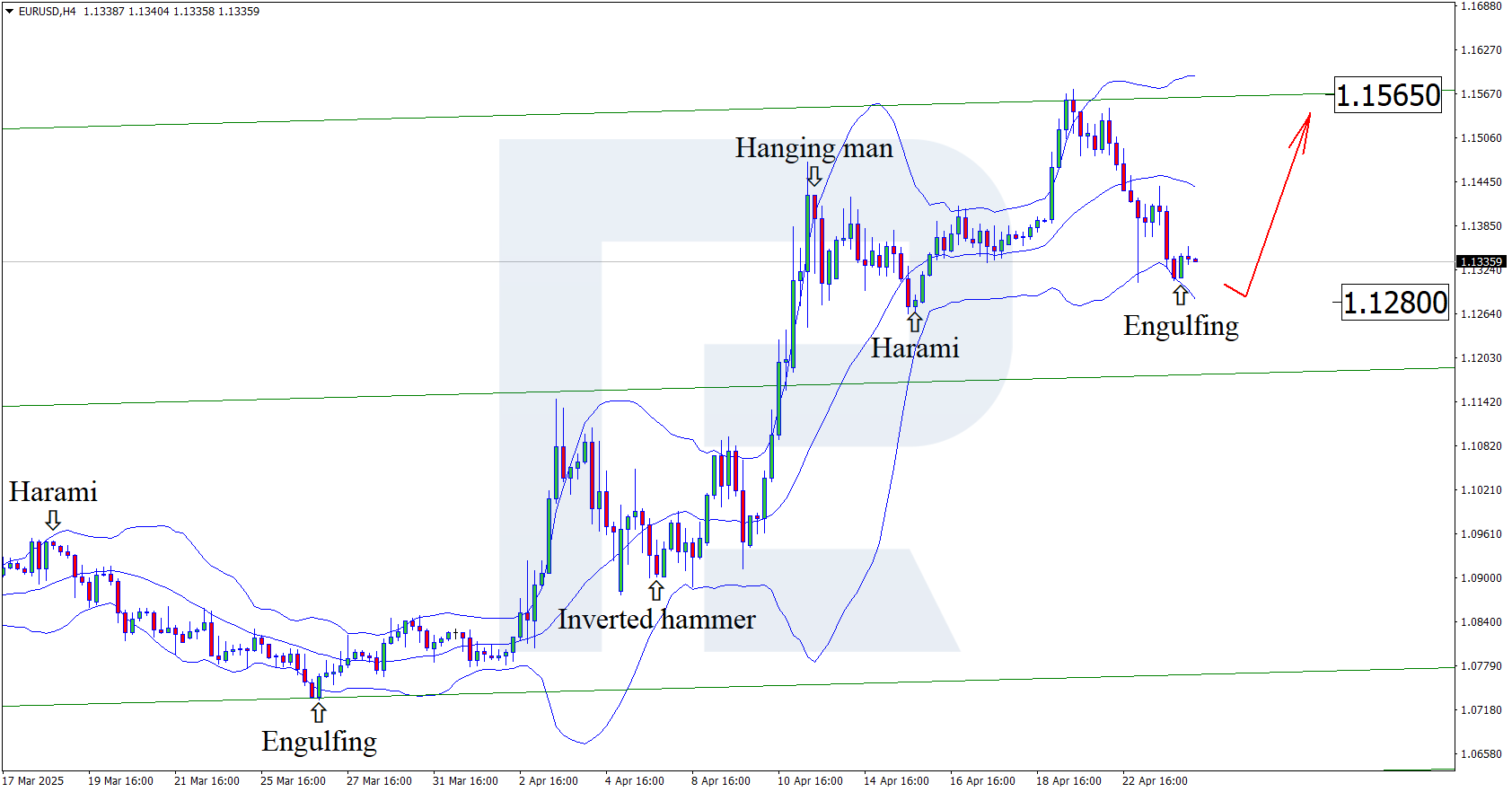

The EURUSD pair has formed an Engulfing reversal pattern near the lower Bollinger band on the H4 chart. It is currently forming an upward wave following the received signal. Since the price remains within an ascending channel, it could rise to the nearest resistance at 1.1565. A breakout above this level will open the way for a further upward movement.

However, the EURUSD rate could correct towards 1.1280 and gain upward momentum after testing the support level.

Summary

Rising US initial jobless claims and a possible decline in continuing claims create a conflicting backdrop for the US dollar. At the same time, the euro could benefit, especially if the data confirms the weakening of the US labour market. The EURUSD technical analysis suggests a move towards 1.1565 once the correction phase ends.