The EURUSD pair declined to 1.1378. The White House made efforts to calm investors. Find more details in our analysis for 23 April 2025.

EURUSD forecast: key trading points

- The EURUSD pair has fallen as part of a correction but could quickly resume its upward movement

- The tone from the White House has shifted again – this time towards a more constructive stance

- EURUSD forecast for 23 April 2025: 1.1303

Fundamental analysis

The EURUSD rate dropped to 1.1378 on Wednesday. Stability in the US dollar began to take shape the day before and continues today, supported by hopes of easing tensions in the US-China trade war. In addition, the White House has stopped attacking Federal Reserve Chairman Jerome Powell and no longer appears intent on removing him. This also works in favour of the USD.

US Treasury Secretary Scott Bessent said yesterday that the current conflict between the US and China is not of a lasting nature. He also emphasised that the American administration does not intend to sever economic ties between the two countries.

In other words, the White House is making efforts to calm capital markets, which has helped reduce volatility.

The EURUSD forecast is positive.

EURUSD technical analysis

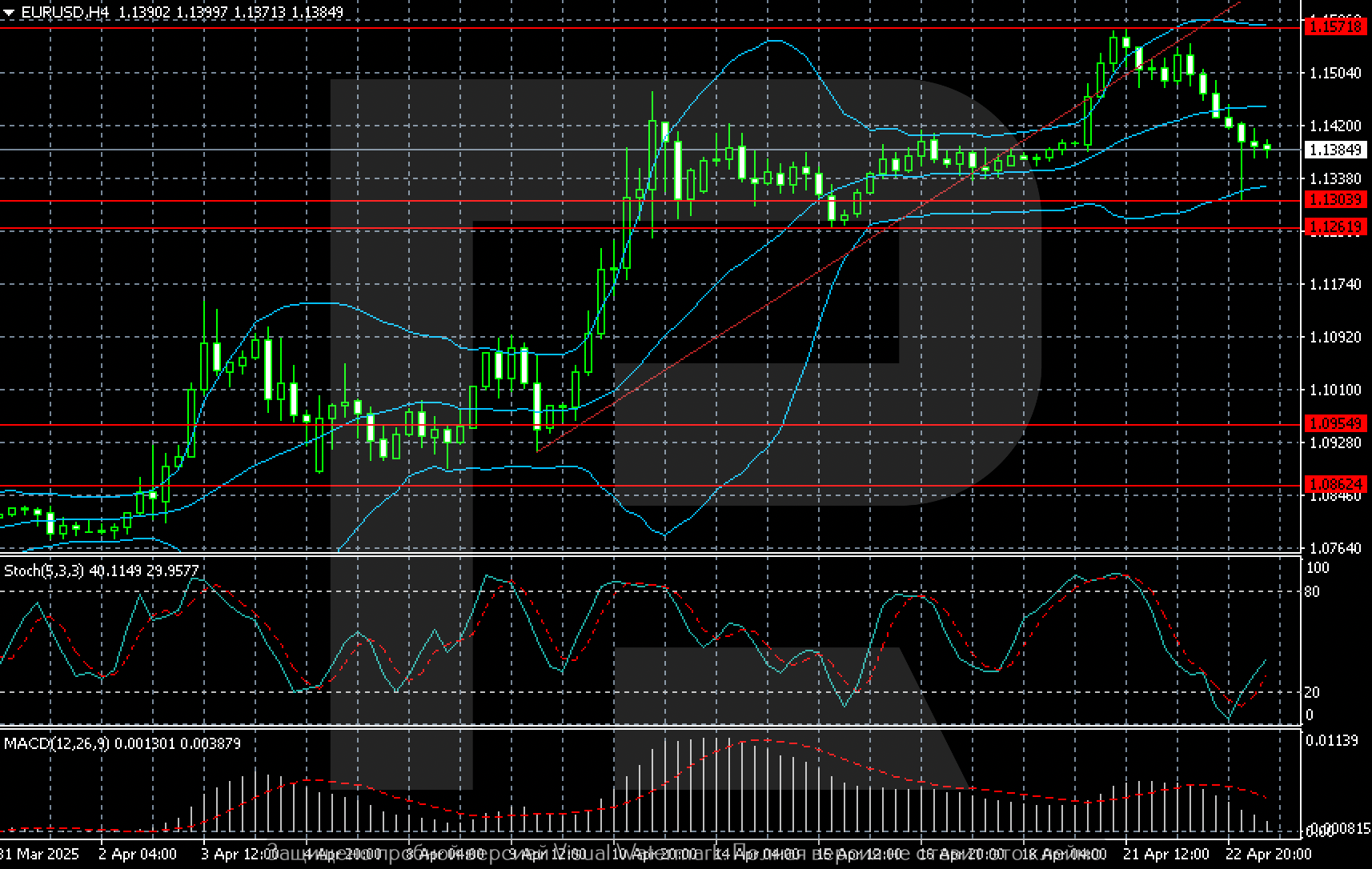

The EURUSD H4 chart shows a possible corrective wave developing towards 1.1303. After this decline, the market is expected to resume growth, aiming for 1.1425 and then 1.1504.

On a broader scale, a sideways trading channel is forming, with boundaries at 1.1261 and 1.1571.

Summary

The EURUSD pair has reached another three-year high before entering a correction. The pullback was driven not only by overbought conditions but also by the changing rhetoric from the US White House. The EURUSD forecast for today, 23 April 2025, suggests a brief correction towards 1.1303, followed by resumed growth.