The EURUSD rate strengthens, with buyers targeting 1.0605. Discover more in our analysis for 10 December 2024.

EURUSD forecast: key trading points

- The market anticipates a 25-basis-point ECB rate cut

- Political instability in France and Germany adds to the eurozone’s economic challenges

- US data shows sustained job growth

- EURUSD forecast for 10 December 2024: 1.0500 and 1.0470

Fundamental analysis

The EURUSD rate rises after two days of declines, supported by buyers holding the 1.0535 support level. The market is currently focused on the upcoming ECB monetary policy decision. The regulator is expected to reduce the interest rate by 25 basis points. The market has already priced in the reduction, and according to today’s EURUSD forecast, it will not exert significant pressure on the European currency

Meanwhile, the eurozone’s economy continues to show signs of weakness. Political instability in Germany and France and geopolitical risks after Donald Trump’s election victory aggravate the situation. Against this backdrop, the ECB head has warned of a potential economic slowdown in the coming months, emphasising that downside risks dominate the medium-term outlook

At the same time, US data reveals steady job growth, exceeding forecasts despite an increase in the unemployment rate to 4.2%. Inflation expectations rose to 3.0% in November from 2.9% in October, indicating persisting price pressures. Despite mixed economic signals, markets expect a 25-basis-point Federal Reserve interest rate cut this month with an 89.5% likelihood.

EURUSD technical analysis

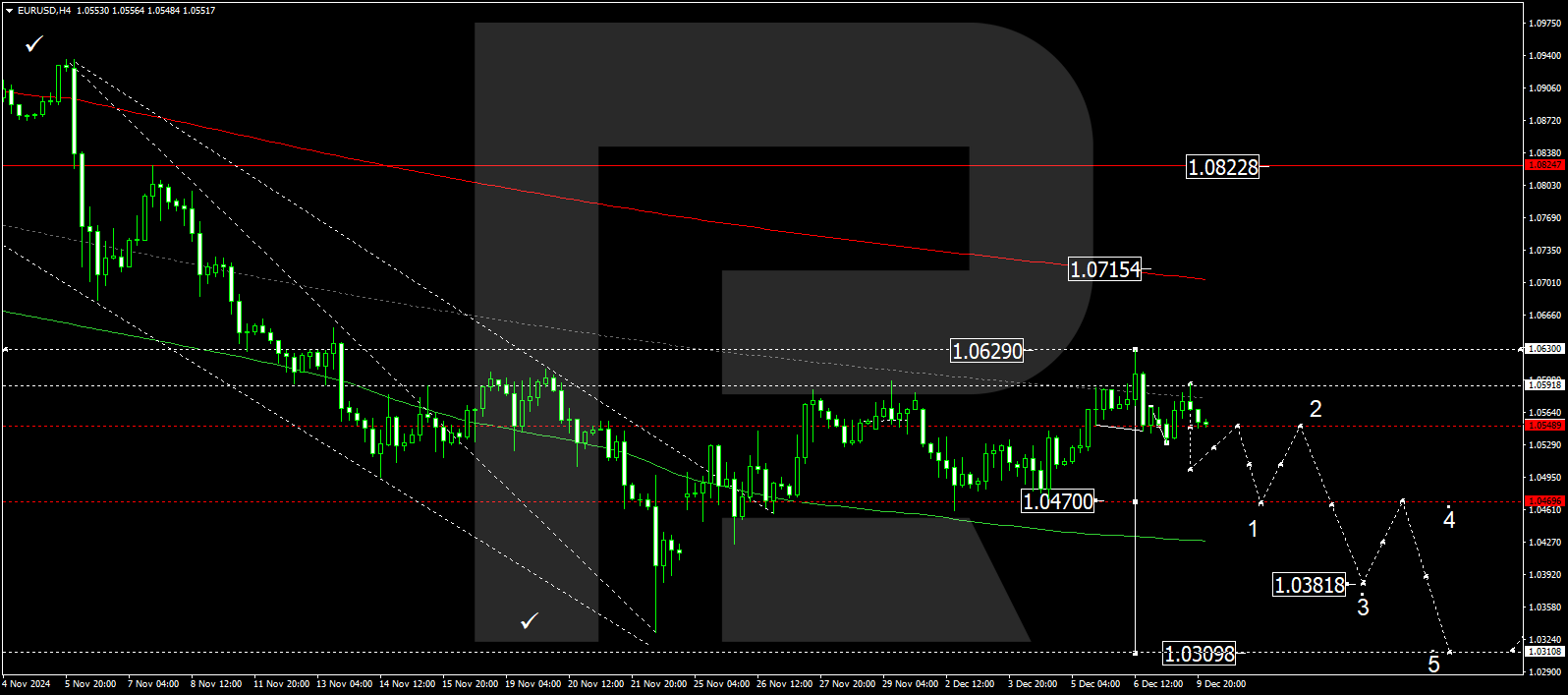

The EURUSD H4 chart shows that the market has completed a downward wave towards 1.0532 and a correction towards 1.0590. Another downward impulse could follow today, 10 December 2024, aiming for 1.0500. Subsequently, the price may rise to 1.0550, with a consolidation range forming around this level. The price is expected to break below the range and continue moving towards 1.0470, the first target.

The Elliott Wave structure and downward wave matrix, with a pivot point at 1.0550, technically support this scenario. This level is considered crucial for the EURUSD rate. The market has reached the central line of a price envelope. The downward wave could continue, targeting the envelope’s lower boundary at 1.0470.

Summary

The EURUSD rate rises, and traders expect an ECB rate cut, which is likely already priced in and should not significantly impact the European currency. However, the eurozone’s economic issues and political instability remain substantial risks. Technical indicators for today’s EURUSD forecast suggest a potential downward wave towards the 1.0500 and 1.0470 levels.