The EURUSD pair is showing signs of recovery, trading around 1.1611. With the Fed decision behind, political developments now take centre stage. Find out more in our analysis for 30 October 2025.

EURUSD forecast: key trading points

- The EURUSD pair may recover as the market adjusts expectations for Federal Reserve rate cuts

- Focus shifts to the upcoming Trump – Xi meeting

- EURUSD forecast for 30 October 2025: 1.1576–1.1668

Fundamental analysis

The EURUSD pair is attempting to rebound, rising towards 1.1611 on Thursday. Market participants have scaled back expectations of another Federal Reserve rate cut in December after Fed Chair Jerome Powell’s hawkish remarks.

As expected, the Federal Reserve lowered interest rates by 25 basis points on Wednesday and announced it would end balance-sheet reduction starting 1 December. However, Powell emphasised that further cuts are not a done deal, citing internal disagreements within the committee and limited data availability due to the ongoing government shutdown.

The market now estimates the likelihood of another rate cut at less than 70%, while this scenario was almost fully priced in before the meeting.

Attention now turns to the upcoming Trump–Xi meeting, where investors expect both leaders to formalise a trade truce after months of tension.

The EURUSD forecast is moderate.

EURUSD technical analysis

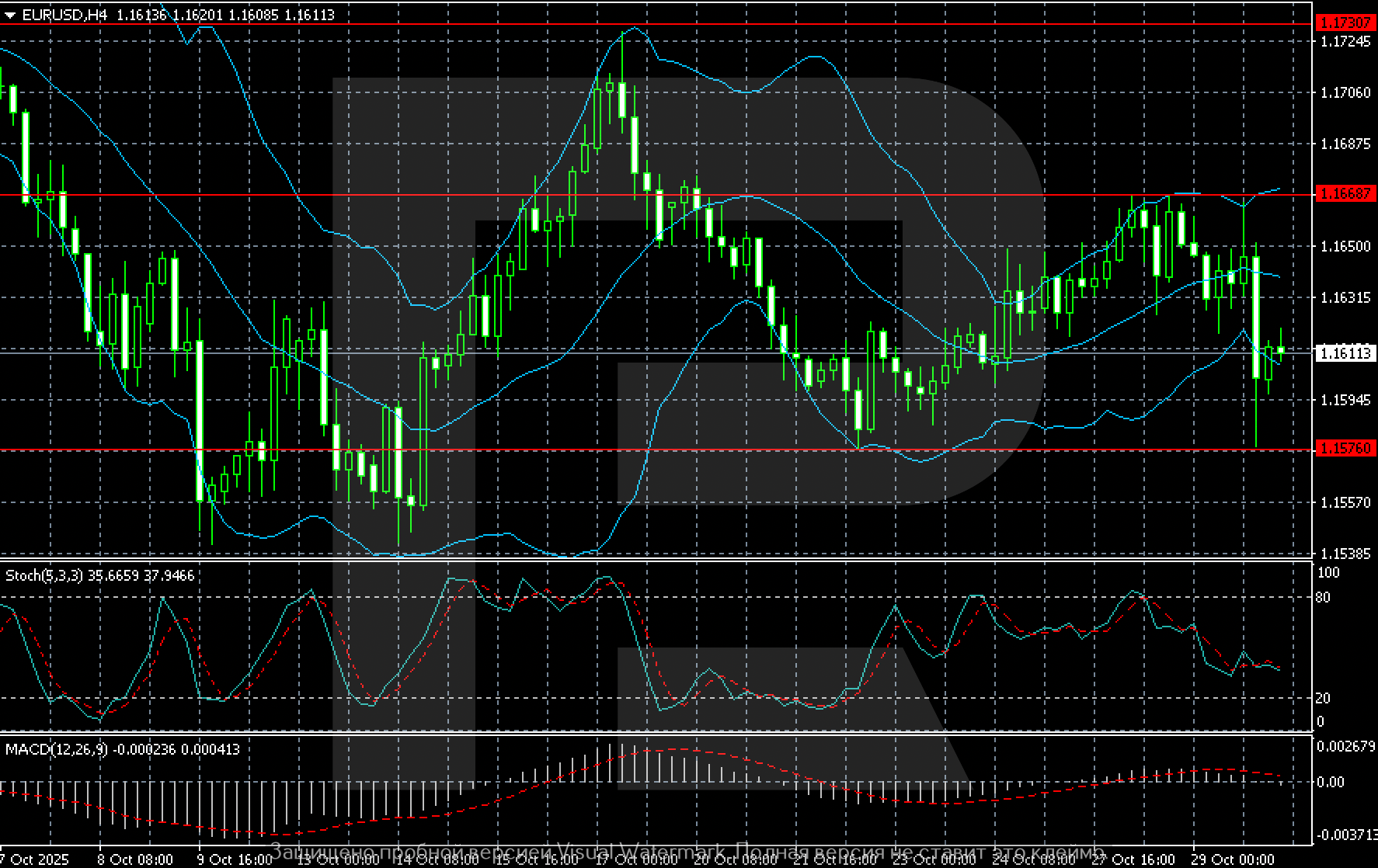

On the H4 chart, the EURUSD pair continues to trade within a sideways range, reflecting market uncertainty. After declining in early October, the pair bounced off the 1.1576 support level and repeatedly tested resistance near 1.1668, but failed to break higher. The price is now hovering around 1.1610, consolidating after recent fluctuations.

Bollinger Bands are gradually narrowing, signalling reduced volatility and potential buildup for a breakout. The Stochastic Oscillator remains neutral, while MACD shows weak downward momentum, indicating no clear trend.

The nearest resistance level remains at 1.1668, with key support standing at 1.1576. A breakout of either boundary will determine the direction of the move. A rise above 1.1670 would open the path to 1.1730, while a downward breakout could add to pressure and trigger a decline towards 1.1520–1.1500. Despite ongoing dollar strength, the euro retains a chance for a corrective rise.

Summary

The EURUSD pair is beginning to recover as part of a correction phase. The EURUSD forecast for today, 30 October 2025, suggests sideways trading between 1.1576 and 1.1668.

Open Account