The EURUSD rate is gradually recovering after this morning's drop to the 1.1450 area following the US strike on Iranian nuclear facilities. Discover more in our analysis for 23 June 2025.

EURUSD forecast: key trading points

- Market focus: the US launched airstrikes on Iranian nuclear facilities

- Current trend: correcting downwards

- EURUSD forecast for 23 June 2025: 1.1450 and 1.1540

Fundamental analysis

The US dollar sharply strengthened during the morning session on Monday after the US struck three Iranian nuclear sites over the weekend. Investors now brace for potential retaliation from Tehran, including risks of attacks on US personnel in the region or disruptions to global oil flows through the Strait of Hormuz.

During the European session, market focus will shift to preliminary eurozone manufacturing and services PMI data for June, which will provide fresh insights into the region's economic outlook.

EURUSD technical analysis

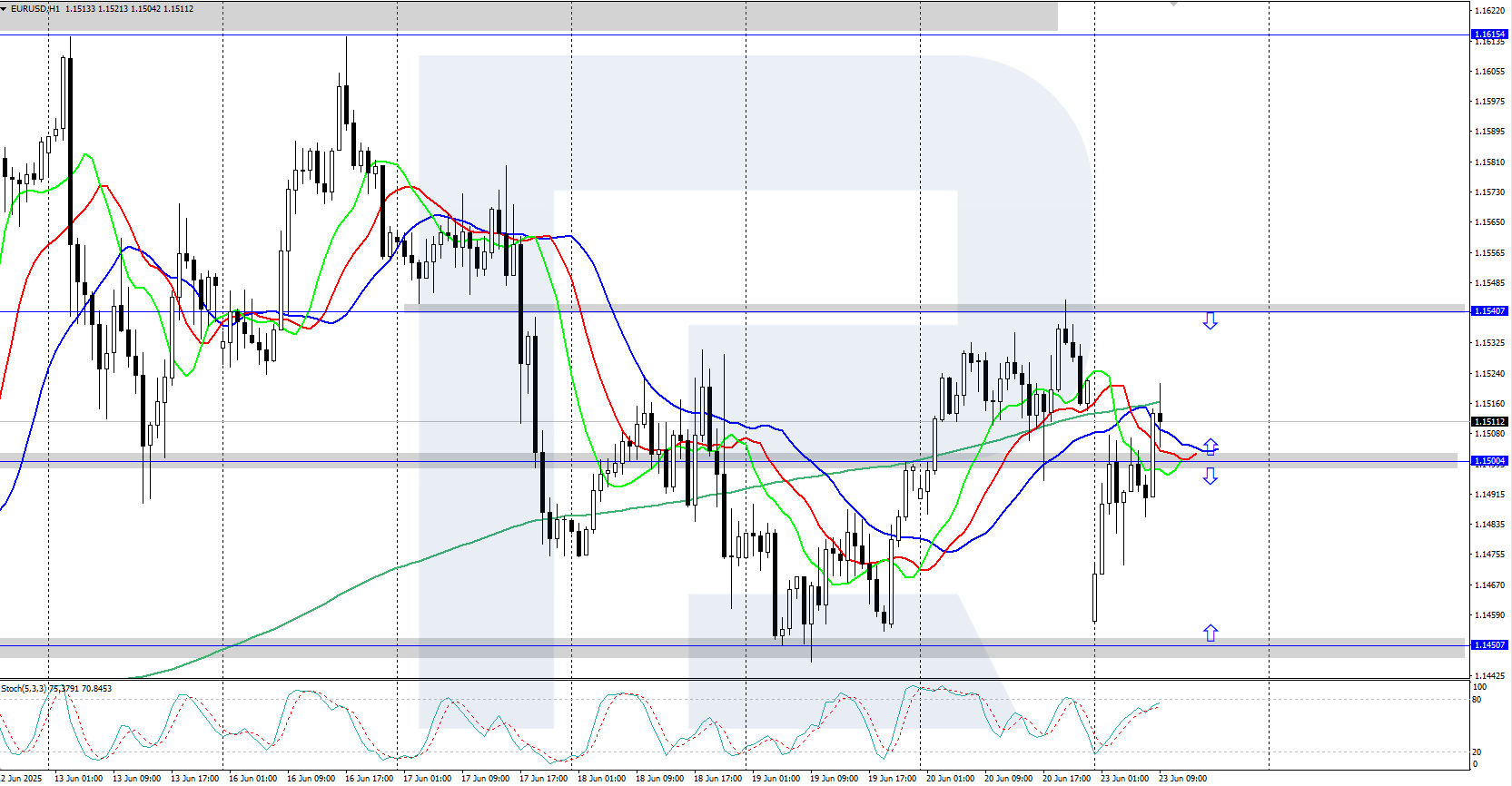

On the H4 chart, the EURUSD pair undergoes a downward correction, having dropped earlier this morning to the support area around 1.1450. Bulls are now attempting to regain control and push prices back above 1.1500. The daily trend remains upward, with the rally likely to resume after the correction.

The short-term EURUSD forecast suggests growth towards 1.1540 and higher in the short term if bulls hold above 1.1500. Conversely, if bears push prices below 1.1450, the downward correction may extend towards the 1.1400 support level.

Summary

The EURUSD pair returned above 1.1500 after falling to 1.1450 this morning following the US attack on Iranian nuclear sites. Today, the market awaits the eurozone PMI data.