The EURUSD rate is strengthening but remains at a strong resistance level of 1.1200. Read more in our analysis for 30 September 2024.

EURUSD forecast: key trading points

- The Personal Consumption Expenditure (PCE) index rose by 0.1% in August, while the annual growth was 2.2%

- The Core PCE index increased by 0.1% month-on-month and 2.7% year-on-year in August

- Initial jobless claims fell to 218k, a 4-month low

- The likelihood of the Fed rate cut by 50 basis points decreased to 54%, and a cut by 25 basis points increased to 46%

- EURUSD forecast for 30 September 2024: 1.1222

Fundamental analysis

EURUSD is slightly higher on Monday as the US dollar remained under pressure amid poor economic data reinforcing expectations of further Federal Reserve rate cuts.

The US Personal Consumption Expenditures (PCE) price index increased 0.1% in August compared to July, while the annualised growth rate was the lowest since February 2021, at 2.2%, versus the forecasted 2.3%.

The Core PCE (Core Personal Consumption Expenditures) price index, which does not include food and energy prices, also rose 0.1% in August from the previous month and increased by 2.7% annually. The Core PCE index is the Fed’s key indicator to assess inflation risks.

At the same time, data on jobless claims demonstrated the labour market’s resilience. The number of initial applications for benefits decreased by 4,000 to 218,800, the lowest level for the last four months. Analysts had forecasted an increase to 223,400.

Investors await the September US employment report for further signals about the Fed’s policy. The probability of a 50-basis-point interest rate cut at the next meeting fell to 54.0% from 60.3%, while the odds of a 25-point cut rose to 46.0% from 39.7%. Given the weakness of the US dollar and the regulator’s subsequent actions, today’s EURUSD forecast still holds potential for a breakthrough of the 1.1200 level.

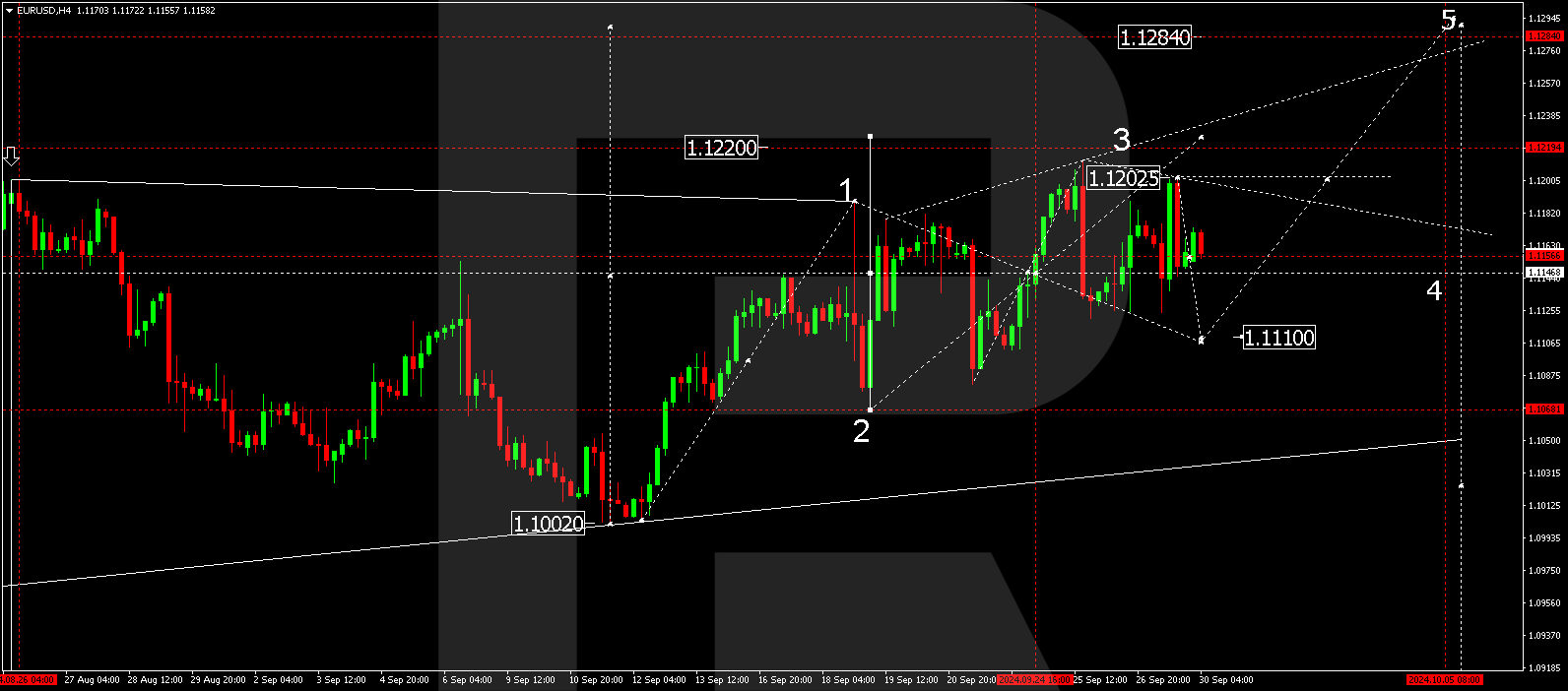

EURUSD technical analysis

In the H4 chart, EURUSD technical analysis shows that the market is forming a growth structure toward 1.1222. This is a local target. Today, on 30 September 2024, a decline to 1.1133 cannot be ruled out. In the future, we expect the EURUSD rate to rise to 1.1222. Once this level is reached, a correction towards 1.1144 (test from above) is possible. Technical indicators suggest the continuation of a broad consolidation range around the 1.1144 level, with potential breakout signals.

Summary

The US dollar remains under pressure due to weaker economic data, reinforcing expectations for a Fed rate cut. Investors await the September US jobs report to get more precise signals on the regulator’s actions. Technical indicators for today’s EURUSD forecast suggest considering the likelihood of the growth wave continuing towards 1.1222.