The ECB’s financial stability report and the ECB president’s speech could further weaken the euro. Discover more in our analysis for 20 November 2024.

EURUSD forecast: key trading points

- The ECB financial stability report

- A speech by ECB President Christine Lagarde

- US crude oil inventories: previously at 2.089 million barrels

- EURUSD forecast for 20 November 2024: 1.0625

Fundamental analysis

Twice a year, the European Central Bank releases a financial stability review, which analyses potential threats to the eurozone’s economic resilience. The document’s primary purpose is to inform the professional community and the general public about key aspects and risks affecting the region’s financial stability.

Fundamental analysis for 20 November 2024 considers today’s speech by European Central Bank President Christine Lagarde. Her speeches typically strongly impact financial markets, particularly when related to monetary policy. Expectations surrounding today’s speech may depend on current economic conditions and key topics under discussion.

The following topics are of primary interest:

- Interest rates and inflation

- The health of the eurozone economy

- Financial stability

- Geopolitical and global factors

- Signals for currency markets

Key points to watch for in Lagarde’s speech:

- Firm tones and phrases about the determination to control inflation will be interpreted as a signal for tightening monetary policy

- The market reaction, including movements in EURUSD, European bonds, and stock indices

- Any reference to a pause or a peak interest rate could trigger further ECB actions, potentially increasing volatility in the EURUSD rate

US crude oil stock data will be released today. The previous reading stood at 2,089 million barrels. The forecast for 20 November 2024 suggests reserves may decrease to 766 million barrels. The decline in reserves could negatively impact both the US economy and inflation.

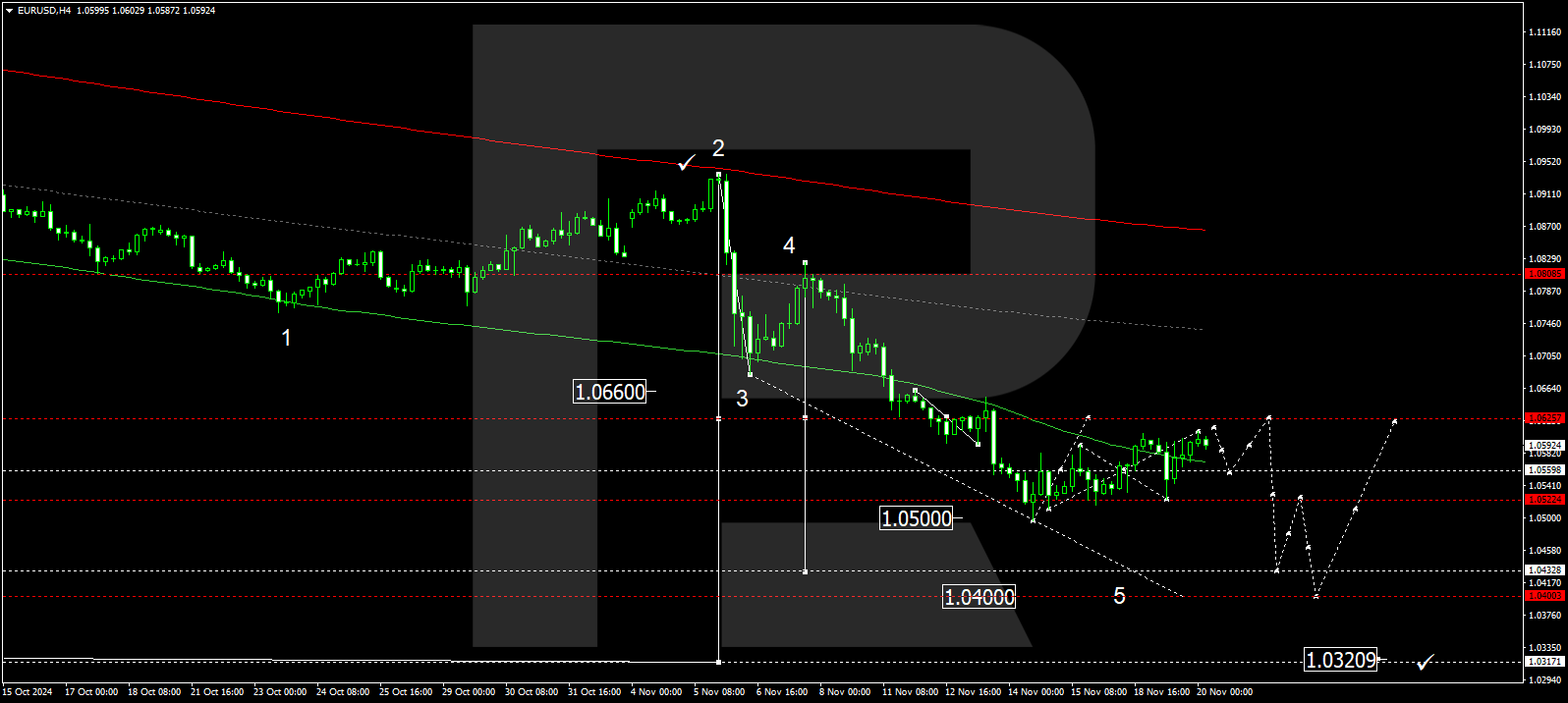

EURUSD technical analysis

The EURUSD H4 chart indicates that the market has received support at the 1.0523 level and has continued its upward movement. The price is expected to reach 1.0610 today, 20 November 2024. The structure formed around the 1.0560 can be viewed as correcting the previous downward wave. After reaching 1.0610, the price could fall back to 1.0560. Subsequently, another upward move might develop, targeting 1.0625 (testing from below). Once this correction is completed, a new downward wave could emerge, aiming for 1.0450, potentially extending to 1.0400, the local target.

The Elliott Wave structure and matrix for the second half of the downward wave, with a pivot point at 1.0660, technically support this scenario. This level is crucial for the EURUSD’s downward wave structure. The market is forming a correction around the lower boundary of a price envelope, which could end at 1.0625. Subsequently, the downward wave is expected to continue to the envelope’s lower boundary at 1.0400.

Summary

The ECB president’s speech and other fundamental factors continue to weaken the euro. Technical analysis for today’s EURUSD forecast suggests that a corrective wave could extend to the 1.0625 level. A downward wave could begin once the correction is complete, targeting 1.0400.