The ECB meeting and the actual US GDP reading may support the euro. Find out more in our analysis for 27 November 2024.

EURUSD forecast: key trading points

- The European Central Bank meeting on non-monetary policy issues

- US Q3 core PCE price index: previously at 2.2%, projected at 2.2%

- US Q3 GDP: previously at 2.8%, projected at 2.8%

- EURUSD forecast for 27 November 2024: 1.0580

Fundamental analysis

The European Central Bank will meet today, 27 November 2024, to discuss non-monetary policy issues. The topics typically focus on various matters related to the financial system and economic stability but exclude interest rates or money supply management.

The main topics are:

- Banking regulation: discussing capital, liquidity, and risk management requirements for banks in the eurozone

- Innovation and fintech: analysing the impact of digital technologies, cryptocurrencies, and electronic payments on financial infrastructure

- Climate risks: integrating sustainable finance and considering environmental factors in supervisory policies

- Macrofinancial stability: measures to prevent systemic crises, including analysis of debt burden and market stability

- Legal and institutional issues: harmonising laws and developing the ECB’s internal structure

Non-monetary policy meetings generally have less impact on prices compared to interest rate or monetary policy decisions. However, in some cases, the final resolutions may significantly affect the euro.

The US Q3 core PCE price index is a crucial economic indicator. It shows changes in the cost of goods and services, excluding food and energy, and is used to estimate the net inflation rate.

The index is based on consumer spending data and reflects price movements faced by American households. The Q3 indicator is analysed within the context of economic activity during this period and provides the Federal Reserve with data for shaping monetary policy. This reading signals fundamental inflation trends affecting purchasing power and the country’s economic state.

The fundamental analysis for 27 November 2024 takes into account that the reading may remain flat at 2.2%, which is a neutral factor for the US dollar in the current situation.

GDP represents the total value of all goods and services produced in a country. It applies only to final products and does not include the cost of raw materials.

The forecast for 27 November 2024 appears somewhat optimistic, suggesting that the US GDP may remain steady at 2.8%. However, the actual reading may differ significantly from expectations, potentially causing the US dollar to lose ground against the euro.

EURUSD technical analysis

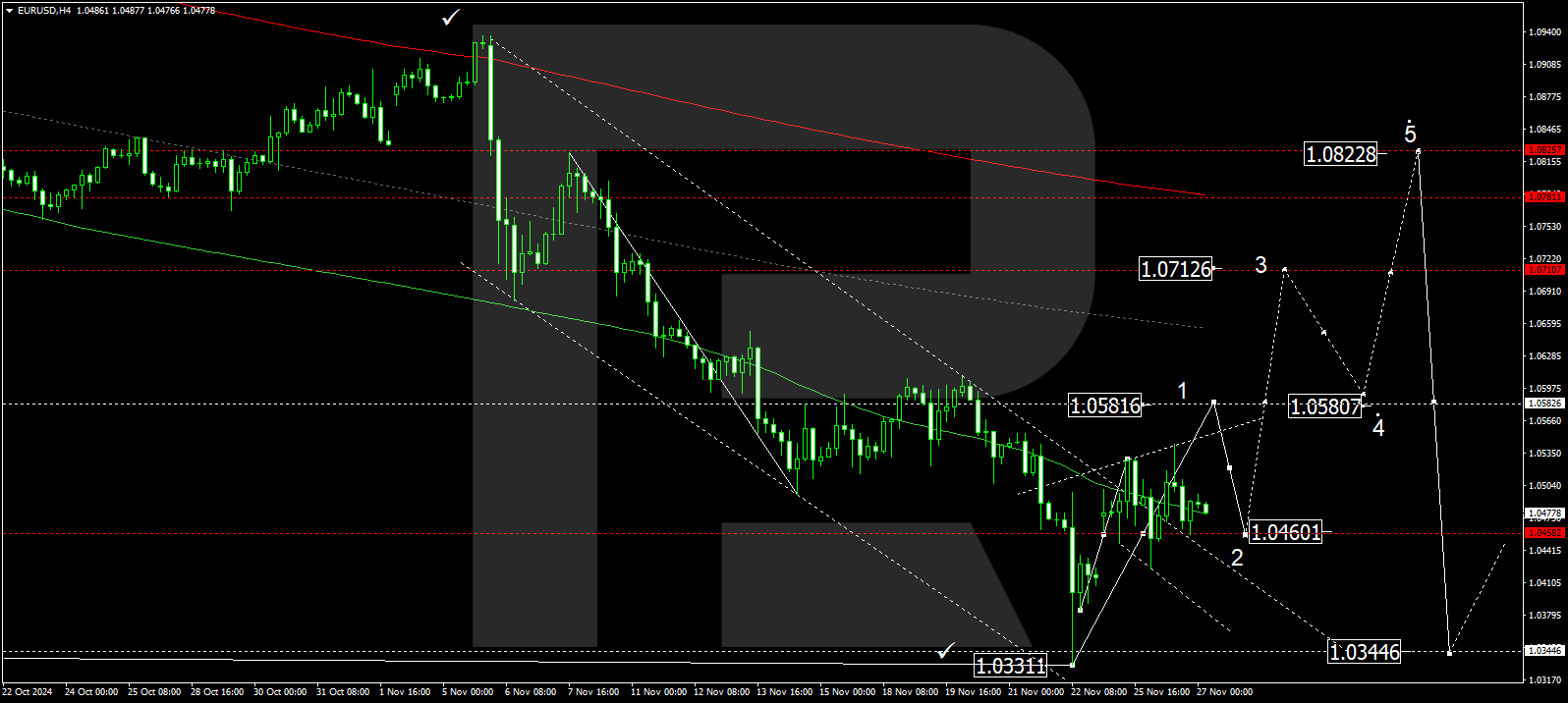

The EURUSD H4 chart shows that the market has completed a growth wave towards 1.0544, followed by a correction towards 1.0458. The growth structure is expected to develop today, 27 November 2024, with the first target at 1.0580. After reaching this level, the price could plunge to 1.0460, and a new growth wave could follow, aiming for 1.0580 again and potentially reaching the local target at 1.0700.

The Elliott Wave structure and growth wave matrix, with a pivot point at 1.0580, technically support this scenario. This level is considered crucial for the EURUSD rate. Another growth wave is possible, targeting the central line of a price envelope at 1.0580. Once this level is reached, a consolidation range is expected to form. An upward breakout would open the potential for a growth wave towards the envelope’s upper boundary at 1.0700.

Summary

Alongside technical analysis for today’s EURUSD forecast, stabilising PCE and US GDP suggest a potential growth wave towards the 1.0580 level.