The EURUSD rate is experiencing an upward correction within a downtrend. The bulls failed to overcome the 1.0350 resistance level on their first attempt. More details in our analysis for 17 January 2025.

EURUSD forecast: key trading points

- The EURUSD pair undergoes a correction within a downtrend

- Today, the eurozone’s inflation statistics are scheduled for release – specifically, the Core Harmonized Index of Consumer Prices (HICP)

- EURUSD forecast for 17 January 2025: 1.0350 and 1.0200

Fundamental analysis

This week, the EURUSD quotes formed a local upward reversal, supported by demand from buyers in the 1.0177-1.0200 USD area. The euro found support due to weaker-than-expected US inflation data, which opens the possibility of further key rate cuts from the Federal Reserve this year.

Today, market participants are awaiting the eurozone’s inflation statistics. The HICP is expected to rise by 2.8% year-on-year. Weaker-than-forecast readings would exert pressure on the euro and drive the pair lower. Conversely, more substantial figures would bolster the European currency, potentially helping the EURUSD rate strengthen.

EURUSD technical analysis

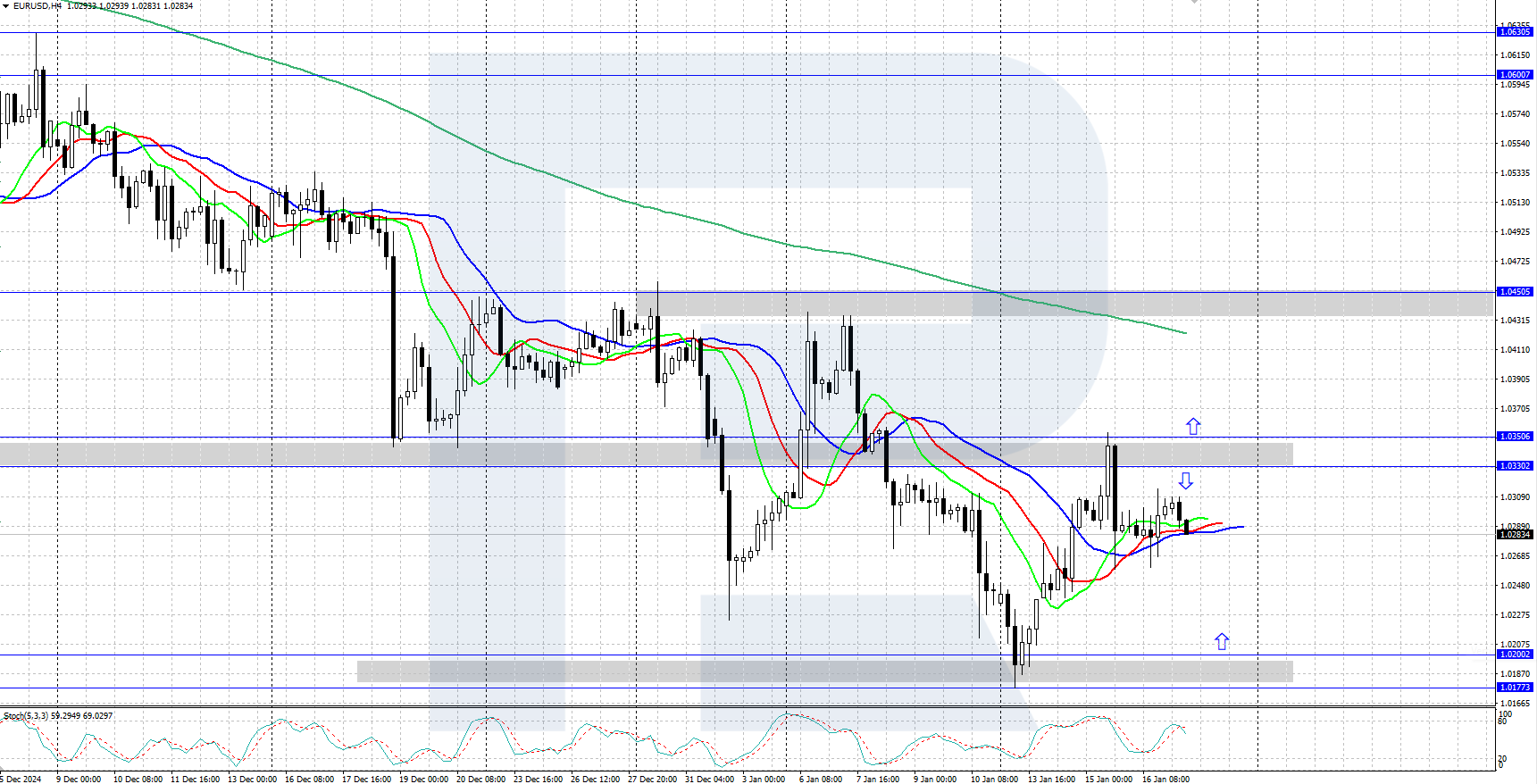

On the H4 chart, the EURUSD pair is experiencing an upward correction after forming a local trough in the 1.0177-1.0200 support area. On Wednesday, the bulls attempted to overcome resistance at 1.0350 but encountered significant selling pressure and retraced, with the price currently consolidating slightly below 1.0300.

Today’s EURUSD forecast suggests that if the bulls manage to break through the 1.0350 resistance level, the pair could continue its upward correction and rise to the 1.0450 resistance level. If the bears hold the 1.0350 level, the price could decline back to the 1.0177-1.0200 USD support area.

Summary

The EURUSD pair failed to surpass the 1.0350 resistance level within its upward correction. The eurozone’s inflation statistics will be released today, which could add to volatility in the asset’s price movements.