Neutral US economic indicators may trigger a decline in the EURUSD rate to 1.0440. Find out more in our analysis for 11 December 2024.

EURUSD forecast: key trading points

- The US core CPI (m/m): previously at 0.3%, projected at 0.3%

- The US CPI (y/y): previously at 2.6%, projected at 2.7%

- EURUSD forecast for 11 December 2024: 1.0440

Fundamental analysis

The core CPI reflects the dynamics of the cost of goods and services from the consumer’s perspective. It is a key tool for evaluating changes in consumer preferences and inflation. Due to seasonal fluctuations in these categories, the core CPI excludes energy and food prices.

The impact of the CPI on currency rates can vary. While increasing CPI may prompt interest rate hikes and strengthen the national currency, it may also exacerbate conditions during an economic crisis, potentially weakening it. According to the forecast for 11 December 2024, the core CPI could remain flat at 0.3%. If actual data matches the previous reading, this may point to the country’s economic stagnation.

The CPI reflects changes in consumer prices of goods and services, helping assess changes in buying trends and economic stagnation. A weaker-than-forecast reading typically has a negative effect on the national currency.

The forecast for 11 December 2024 suggests that the index could exceed the previous 2.6%, coming in at 2.7%. According to fundamental analysis for 11 December 2024, an uptick in the CPI may positively impact the US dollar.

Volatility in the EURUSD pair has decreased today as market participants are likely awaiting the ECB interest rate release.

EURUSD technical analysis

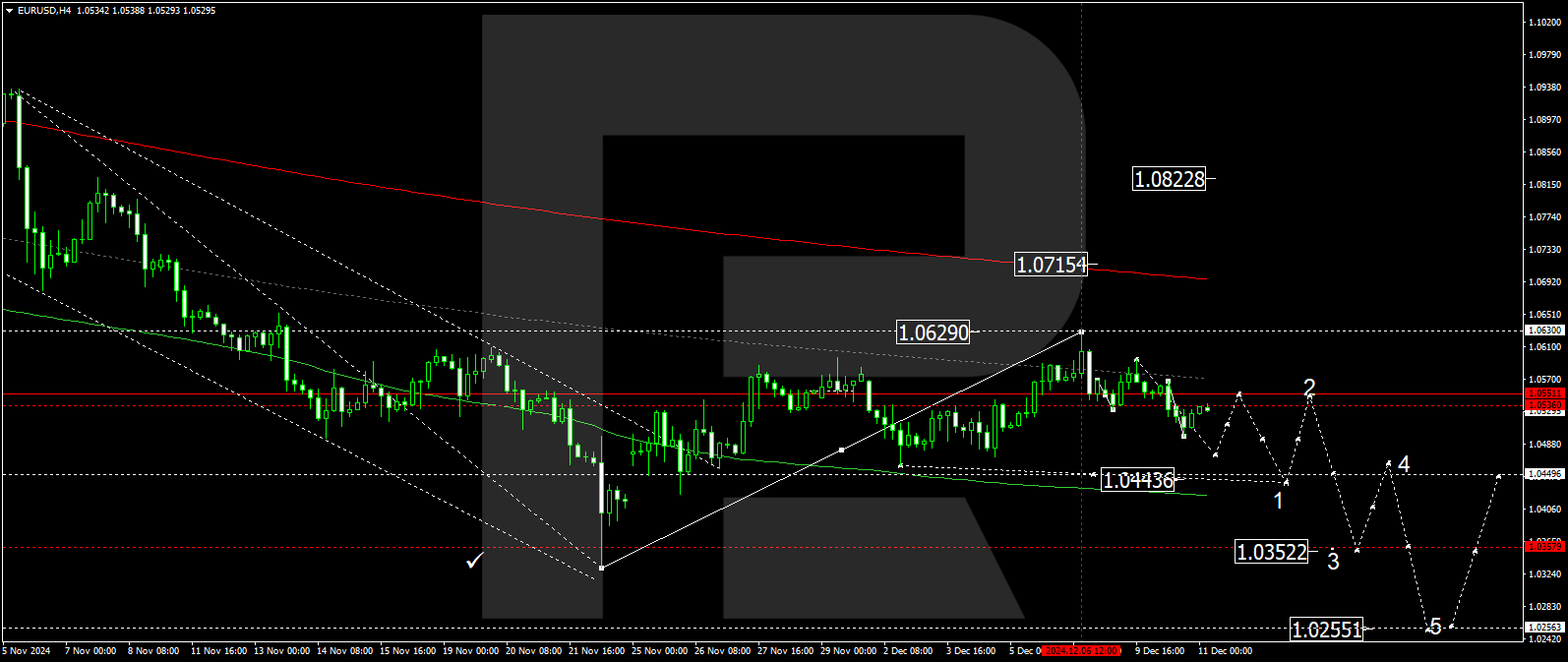

The EURUSD H4 chart shows that the market has completed a downward wave towards 1.0498 and a correction towards 1.0538. Another downward impulse could follow today, 11 December 2024, aiming for 1.0474. Subsequently, the price may rise to 1.0550, with a consolidation range forming around this level. The price is expected to break below the range, extending the wave towards 1.0440, the first estimated target.

The Elliott Wave structure and downward wave matrix, with a pivot point at 1.0550, technically support this scenario. This level is considered crucial for the EURUSD rate. The market is forming another downward wave below the central line of a price envelope, which could target its lower boundary at 1.0440.

Summary

Alongside technical analysis for today’s EURUSD forecast, expectations of the ECB interest rate decision suggest a potential downward wave towards the 1.0440 level.